1/ What is @0xAcidDAO?

0xACID aims to maximize the return on LSD assets (such as stETH, rETH, frxETH, etc.) and provide a much higher return than ordinary LSD assets (which typically only have 4-5% APR).

But how?

0xACID aims to maximize the return on LSD assets (such as stETH, rETH, frxETH, etc.) and provide a much higher return than ordinary LSD assets (which typically only have 4-5% APR).

But how?

2/ Since everyone is in the same conditions (Lido or Frax are not paying an extra % to Acid), there should be a way how Acid would pay higher returns.

Here come the ponzinomics.

Here come the ponzinomics.

3/ All profits generated by the 0xACID protocol are distributed to the holders of locked-up $ACID in the form of $wstETH.

When $ACID locked-up TVL is lower than the treasury value, users will always be getting higher staking rewards.

When $ACID locked-up TVL is lower than the treasury value, users will always be getting higher staking rewards.

4/ More than that, $ACID yield is $wstETH also depends on the length of locking (up to 1 year) and the ratio of supply locked. The lower the locking ratio - the higher the rewards.

Currently, locked $acid is earning 10-27% APR in $wstETH.

Currently, locked $acid is earning 10-27% APR in $wstETH.

5/ There are 3 ways how $acid is entering the market:

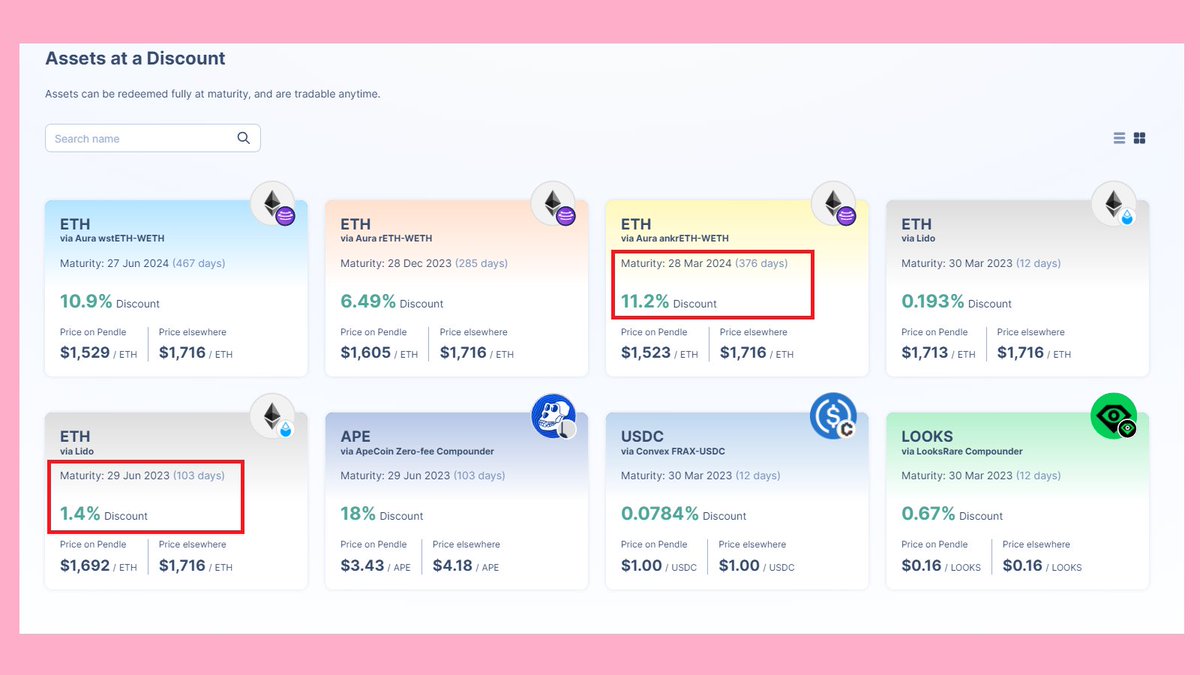

• Bonding

Users can bond $eth and get acid at a discount which is vested for 36 hours.

• Bonding

Users can bond $eth and get acid at a discount which is vested for 36 hours.

7/ Or

• esACID vesting

$ACID stakers are receiving esACID rewards.

To initiate esACID vesting user has to stake a 200% amount of $ACID first and then esACID tokens will vest linearly into $ACID over a 30-day period.

• esACID vesting

$ACID stakers are receiving esACID rewards.

To initiate esACID vesting user has to stake a 200% amount of $ACID first and then esACID tokens will vest linearly into $ACID over a 30-day period.

8/ With the current emissions (500% APR into the acid-eth pool), esACID rewards (3000-9000% APR), and bond discount 5-12% vested for 36 hours we can expect that the price of $ACID might go to zero.

But is it the case?

But is it the case?

9/ I don't think so, but I would not also rush to buy/bond $acid right now either. Instead, we can calculate what would be an attractive price to buy $acid.

Acid treasury is 4670 $ETH ~ $8.3M, while the $ACID market cap is $11.8m. So $acid is traded at a 42% premium now, but...

Acid treasury is 4670 $ETH ~ $8.3M, while the $ACID market cap is $11.8m. So $acid is traded at a 42% premium now, but...

10/ But you can bond $ETH to get $ACID at a discount. Discounts are varying and while I was writing this thread I saw they were in the range of 5% to 12%.

Even at the highest 12% discount $ACID will is at a 25% premium which is still expensive, except...

Even at the highest 12% discount $ACID will is at a 25% premium which is still expensive, except...

11/ Except locked $ACID has boosted staking rewards (paid in $ETH).

However, I am still expecting that the $acid price will go lower due to high emissions and bonding, but will not go to zero for 2 simple reasons.

However, I am still expecting that the $acid price will go lower due to high emissions and bonding, but will not go to zero for 2 simple reasons.

12/

• When the $acid market cap is lower than the treasury, users will be simply buying "discounted ETH exposure" (buying $acid is nothing else than getting exposure to ETH+yield) with boosted yield (even if 100% supply is locked $acid yield will be higher than $eth yield).

• When the $acid market cap is lower than the treasury, users will be simply buying "discounted ETH exposure" (buying $acid is nothing else than getting exposure to ETH+yield) with boosted yield (even if 100% supply is locked $acid yield will be higher than $eth yield).

13/

• And the protocol will be exposed to treasury hunters.

$ACID market cap is way lower than the treasury value?

No problem, @dcfgod will buy your governance tokens and liquidate the treasury (governance is not yet introduced at Acid).

• And the protocol will be exposed to treasury hunters.

$ACID market cap is way lower than the treasury value?

No problem, @dcfgod will buy your governance tokens and liquidate the treasury (governance is not yet introduced at Acid).

https://twitter.com/DeFi_Made_Here/status/1554473664120250371?s=20

14/ For me $ACID might be attractive if

• I want to have exposure to $eth

• $acid market cap is ~= $eth in the treasury

• Governance is live

But anyways it would be interesting to monitor how investors and the price behave over time.

• I want to have exposure to $eth

• $acid market cap is ~= $eth in the treasury

• Governance is live

But anyways it would be interesting to monitor how investors and the price behave over time.

15/ I think that Acid has great ponzinomics, very similar to ohm forks. Some investors will lose again because they do not really understand what/why they are buying.

But that's their problem.

But that's their problem.

16/ Imo, Acid can survive long term if not rugged / exploited, or in the worst case treasury might be liquidated (and distributed to $acid holders).

What do you think?

What do you think?

17/ Oh, when writing this thread I found out there is a thread competition, so I'll try to participate, but I expect that this thread will be marked as FUD by the @0xAcidDAO team)) #acidthreadchallenge

https://twitter.com/0xAcidDAO/status/1635652290744053760?s=20

18/ That’s a wrap.

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

Thank You and stay safe!

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

https://twitter.com/DeFi_Made_Here/status/1637890740192673792?s=20

Thank You and stay safe!

19/ If you like my content you would also like my newsletter where I go beyond DeFi space.

Several times a week I share alpha projects, market overviews, and more things to come!

Join Alpha Newsletter here:

alphamadehere.substack.com

Several times a week I share alpha projects, market overviews, and more things to come!

Join Alpha Newsletter here:

alphamadehere.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh