@0xfluid / @Instadapp | COO new tg: @iam_dmh The approach is not to limit the choice, but to provide a broader choice.

7 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/1464724421411749891/status/1783820539162706334

2/ Net APY is the percentage that a position would earn on its Net assets (Total Supplied - Total Borrowed) after one year at current supply and borrow rates.

2/ Net APY is the percentage that a position would earn on its Net assets (Total Supplied - Total Borrowed) after one year at current supply and borrow rates.

https://twitter.com/1508458204866486283/status/1762124704373190999

2/ The end goal for Ethereum is to become the financial layer for global coordination by utilizing rollups

2/ The end goal for Ethereum is to become the financial layer for global coordination by utilizing rollups

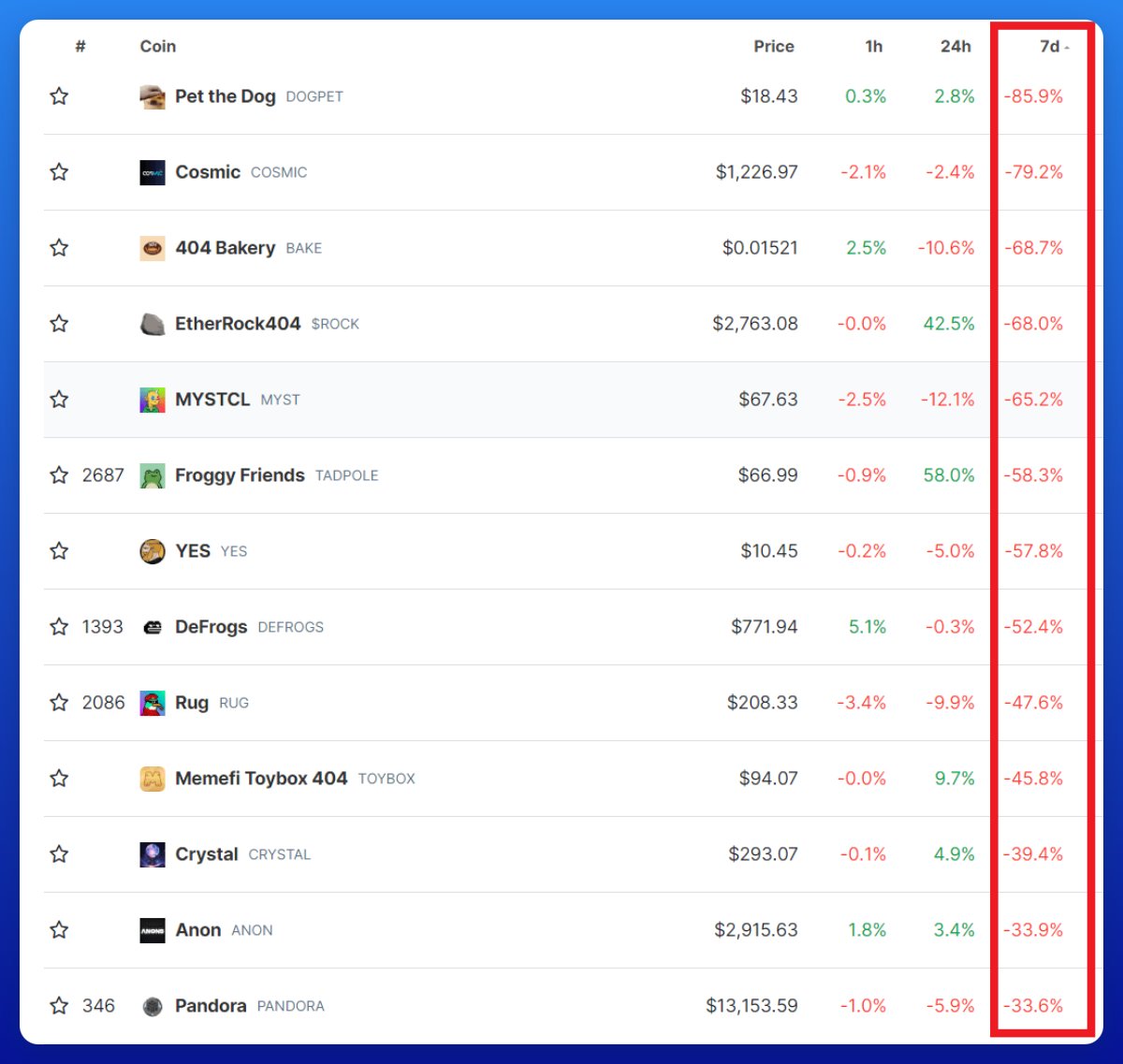

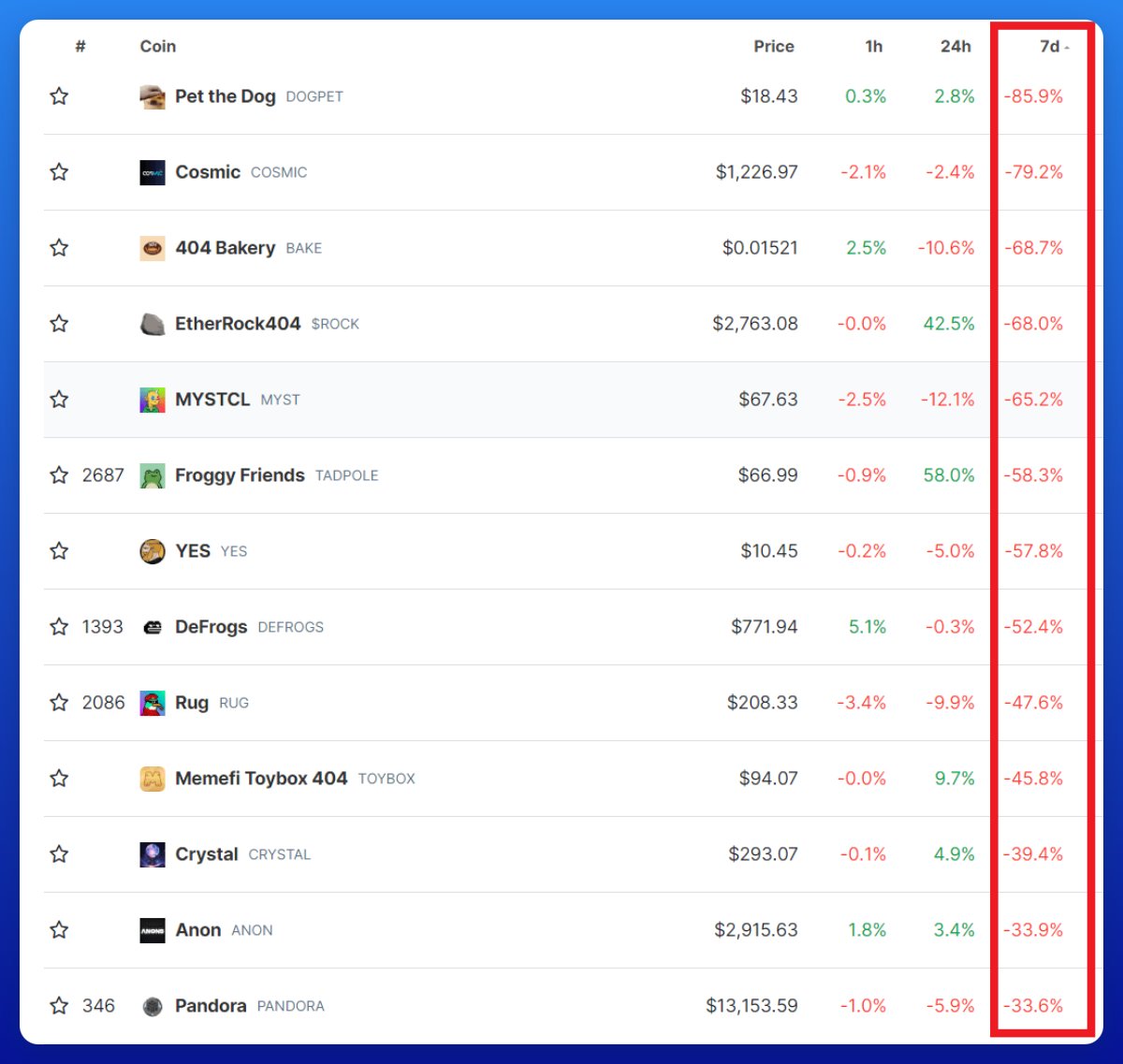

2/ First, let's talk about what ERC-404 has changed and what it hasn't.

2/ First, let's talk about what ERC-404 has changed and what it hasn't.

2/ I raised the liquidity pricing issue a while ago.

2/ I raised the liquidity pricing issue a while ago.https://twitter.com/1464724421411749891/status/1718671387810816344

https://twitter.com/1464724421411749891/status/1684233479607705601

2/ I have deposited into 10 different vaults to compare actual returns instead of relying on the APR numbers on the UI.

2/ I have deposited into 10 different vaults to compare actual returns instead of relying on the APR numbers on the UI.https://twitter.com/1464724421411749891/status/1747691392338715034

2/ Multi-asset LPs such as GLP and later GM pools were introduced by GMX (and then forked by everyone)

2/ Multi-asset LPs such as GLP and later GM pools were introduced by GMX (and then forked by everyone)

2/ Back in August Mich had ~50% of the $crv circulating supply which he could not sell (no liquidity, bad image, etc)

2/ Back in August Mich had ~50% of the $crv circulating supply which he could not sell (no liquidity, bad image, etc)https://twitter.com/1464724421411749891/status/1685971381547147264

@official_CVI 2/ What does the Crypto Volatility Index tell us?

@official_CVI 2/ What does the Crypto Volatility Index tell us?

2/ DeFi has thousands of projects with hundreds of them in each category, how to choose the right one to invest in?

2/ DeFi has thousands of projects with hundreds of them in each category, how to choose the right one to invest in?

2/ LPing and running yield farming strategies on top of Ipor became much more attractive with the launch of v2.

2/ LPing and running yield farming strategies on top of Ipor became much more attractive with the launch of v2.

2/ First of all. I want to mention that my thoughts are based on the public information shared by the protocol and it is not live yet

2/ First of all. I want to mention that my thoughts are based on the public information shared by the protocol and it is not live yet

2/ First, and the most important that I haven't realized until today is:

2/ First, and the most important that I haven't realized until today is:

2/ According to @DefiLlama RWA category has $2.4B ($1.8B is in $stUSDT though)

2/ According to @DefiLlama RWA category has $2.4B ($1.8B is in $stUSDT though)https://twitter.com/DeFi_Made_Here/status/1698681369969205594

@BankofAmerica @avax 2/ First, why Subnets and not L2?

@BankofAmerica @avax 2/ First, why Subnets and not L2?

2/ While perp DEX volume is only 2% of CEX trading volume, decentralized exchanges are making billions in daily volume combined.

2/ While perp DEX volume is only 2% of CEX trading volume, decentralized exchanges are making billions in daily volume combined.

@Uniswap @Instadapp 2/ Instadapp is one of the biggest projects in DeFi but many (including myself until recently) don't know what is it about.

@Uniswap @Instadapp 2/ Instadapp is one of the biggest projects in DeFi but many (including myself until recently) don't know what is it about.https://twitter.com/DeFi_Made_Here/status/1676897798363512832?s=20

@reserveprotocol @CurveFinance 1/ In this thread I will cover:

@reserveprotocol @CurveFinance 1/ In this thread I will cover:

1/ First, let's clarify what I mean by the Ethereum bonds market.

1/ First, let's clarify what I mean by the Ethereum bonds market.

@gauntletnetwork @AaveAave @CurveFinance 2/ Borrowing against own token is the best way of taking the profit:

@gauntletnetwork @AaveAave @CurveFinance 2/ Borrowing against own token is the best way of taking the profit:

@CurveFinance @SiloFinance 1/ First of all how Silo is different from traditional lending protocols?

@CurveFinance @SiloFinance 1/ First of all how Silo is different from traditional lending protocols?

2/ Projects included:

2/ Projects included: