About -

Titagarh Wagons Limited, incorporated in 1997, started out with an annual production capacity of 180 wagons.

In 2015, Titagarh acquired a 90% stake in Italian🇮🇹 rail equipment firm Firema Trasporti for an estimated €25 Mill.

Titagarh Firema designs metro rail coaches.

Titagarh Wagons Limited, incorporated in 1997, started out with an annual production capacity of 180 wagons.

In 2015, Titagarh acquired a 90% stake in Italian🇮🇹 rail equipment firm Firema Trasporti for an estimated €25 Mill.

Titagarh Firema designs metro rail coaches.

Today, they're the largest manufacturer of wagons in 🇮🇳 with a capacity of 8400 wagons P.A.

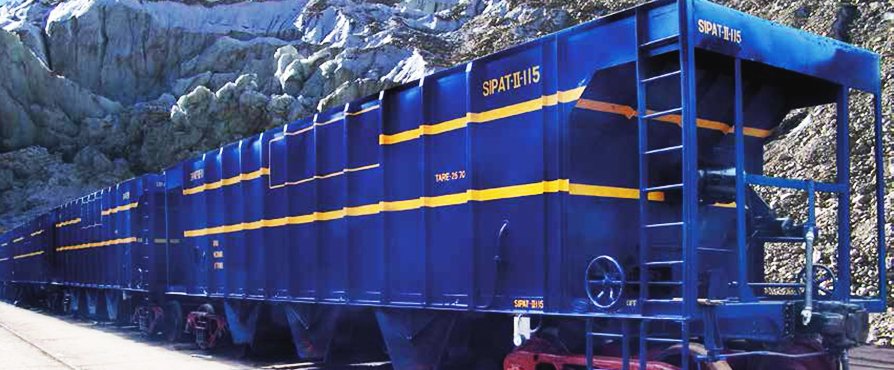

Co is mainly engaged in the mfg & selling of Freight Wagons, Passenger Coaches, Metro Trains, Train Electricals, Steel Castings, Specialised Equipments & Bridges, Ships, etc.

Co is mainly engaged in the mfg & selling of Freight Wagons, Passenger Coaches, Metro Trains, Train Electricals, Steel Castings, Specialised Equipments & Bridges, Ships, etc.

Manufacturing Facilities -

Company has four manufacturing facilities, 2 in Titagarh, 1 in Uttarpara, (West Bengal) and 1 in Bharatpur, (Rajasthan).

Company has four manufacturing facilities, 2 in Titagarh, 1 in Uttarpara, (West Bengal) and 1 in Bharatpur, (Rajasthan).

Financials -

Q3 FY22 (YoY)

Revenue were at Rs.777 Cr.⬆️101%

PAT at Rs.39 Cr.⬆️112%

EBITDA at Rs.83 Cr.⬆️75.3%

EPS at Rs. 3.3 ⬆️112%

Q3 FY22 (YoY)

Revenue were at Rs.777 Cr.⬆️101%

PAT at Rs.39 Cr.⬆️112%

EBITDA at Rs.83 Cr.⬆️75.3%

EPS at Rs. 3.3 ⬆️112%

Revenue Breakup -

Titagarh Wagon earns 63% of it's revenue form Freight Rolling Stock, 34% from Passenger Rolling Stock & 3% from Shipbuilding & Others.

Titagarh Wagon earns 63% of it's revenue form Freight Rolling Stock, 34% from Passenger Rolling Stock & 3% from Shipbuilding & Others.

◾Freight Rolling Stock - Consists of mfg of Wagons, Loco Shells, Bogies,Couplers & its components.

◾Passenger Rolling Stock - Consists of designing & mfg of Metro, Passenger Coaches, EMUs, Train Sets, Mono Rail, Propulsion equipment, Traction Motors & its components.

◾Passenger Rolling Stock - Consists of designing & mfg of Metro, Passenger Coaches, EMUs, Train Sets, Mono Rail, Propulsion equipment, Traction Motors & its components.

◾Shipbuilding & Others - Consists of Shipbuilding which includes Designing & Construction of Warships, Passenger Vessels, Tugs & other specialised self-propelled vessels, & specialised equipment for Defence Sector & Modular Bridging Solutions for several remote locations in 🇮🇳

Order Book -

TWL has a standing order book of Rs. 10,130 Cr with good subsequent visibility.

◾Freight Rolling Stock: Rs 8613 Cr

◾Passenger Rolling Stock: Rs 1176 Cr

◾Ship Building, Bridges & Defence: Rs 341 Cr

TWL has a standing order book of Rs. 10,130 Cr with good subsequent visibility.

◾Freight Rolling Stock: Rs 8613 Cr

◾Passenger Rolling Stock: Rs 1176 Cr

◾Ship Building, Bridges & Defence: Rs 341 Cr

Key Highlights -

❖ Highest ever budget allocation towards Railways:

Govt has made its highest ever budgetary allocation in the recent budget towards the Railways to the tune of Rs. 2.40 lakh Cr.

❖ Highest ever budget allocation towards Railways:

Govt has made its highest ever budgetary allocation in the recent budget towards the Railways to the tune of Rs. 2.40 lakh Cr.

❖ Participation in Vande Bharat Tender:

TWL participated in the Vande Bharat tender in Nov 2022. The tender is for supply of 200 trains along with maintenance for 35 yrs. The estimated value of the tender is roughly 72,000 cr.

TWL participated in the Vande Bharat tender in Nov 2022. The tender is for supply of 200 trains along with maintenance for 35 yrs. The estimated value of the tender is roughly 72,000 cr.

❖ Participation in Forged Wheels Tender:

TWL with Ramkrishna Forgings Ltd submitted a joint bid in response

to Indian Railways' expression of interest for companies to set up a steel forged wheel manufacturing unit.

TWL with Ramkrishna Forgings Ltd submitted a joint bid in response

to Indian Railways' expression of interest for companies to set up a steel forged wheel manufacturing unit.

Purpose of this initiative is to produce forged wheelsets in India & to reduce dependence on imported wheels from China & other nations.

❖ Existing capacity utilization in freight wagons:

As against the stated target of 700 wagons p.m., co achieved production of 630-650 p.m.

❖ Existing capacity utilization in freight wagons:

As against the stated target of 700 wagons p.m., co achieved production of 630-650 p.m.

Industry Outlook -

• Indian Railways plans to expand Vande Bharat train network & the National Rail Plan predicts a 2.5x increase in passenger demand by 2051, requiring significant capacity expansion & technological advancements in passenger handling & coach improvement.

• Indian Railways plans to expand Vande Bharat train network & the National Rail Plan predicts a 2.5x increase in passenger demand by 2051, requiring significant capacity expansion & technological advancements in passenger handling & coach improvement.

• Indian Railways have prepared a National Rail Plan for 2030, a future ready railway system by 2030 bringing down the logistic cost for industry is at the core of the strategy to enable the country to integrate its rail network with other modes of transport.

• As per the National Rail Plan, 2020 and

the government’s aim to increase the

railway freight traffic, the railways will

need 30,000 wagons per year over the

next decade.

the government’s aim to increase the

railway freight traffic, the railways will

need 30,000 wagons per year over the

next decade.

Capital Expenditures -

Company plans to spend Rs. 1,000 Cr on CAPEX over the next 4.5 to 5 years, including the Rs. 300 Cr spent in the last 3 years.

CAPEX will be split between the passenger, transit & propulsion, freight & SBD divisions.

Company plans to spend Rs. 1,000 Cr on CAPEX over the next 4.5 to 5 years, including the Rs. 300 Cr spent in the last 3 years.

CAPEX will be split between the passenger, transit & propulsion, freight & SBD divisions.

Risks -

• Major chunk of TWL's revenue comes from Wagon orders placed by Indian Railways, & non-receipt of steady order could pressure the topline.

• Persistent requirements for high Inventory & Debtor days can have a significant impact on their Working Capital requirements.

• Major chunk of TWL's revenue comes from Wagon orders placed by Indian Railways, & non-receipt of steady order could pressure the topline.

• Persistent requirements for high Inventory & Debtor days can have a significant impact on their Working Capital requirements.

Fundamentals -

Market Cap : ₹ 2,877 Cr

P/E (Stock): 41.3

P/E (Industry): 22.3

P/B : 3.27

Debt to equity : 0.39

ROE : -0.05%

ROCE : 7.67%

EV/EBITDA : 13.4

Market Cap : ₹ 2,877 Cr

P/E (Stock): 41.3

P/E (Industry): 22.3

P/B : 3.27

Debt to equity : 0.39

ROE : -0.05%

ROCE : 7.67%

EV/EBITDA : 13.4

Conclusion -

Long term growth prospects seems positive of Titagarh Wagons driven by new growth opportunities getting created for the Indian Railway industry as a whole.

Long term growth prospects seems positive of Titagarh Wagons driven by new growth opportunities getting created for the Indian Railway industry as a whole.

https://twitter.com/LnprCapital/status/1638115294630785025?t=KnFdvy29Y1kxPGPR9rzUWQ&s=19

Please 🙏 like 👍,comment, retweet ♻️ if you find this 🧵 useful.

And follow us on @LnprCapital for more information like this.

@VVVStockAnalyst

• • •

Missing some Tweet in this thread? You can try to

force a refresh