Today, we are introducing 10 impressive Swedish Serial Acquirers in varying sizes and niches 🧵

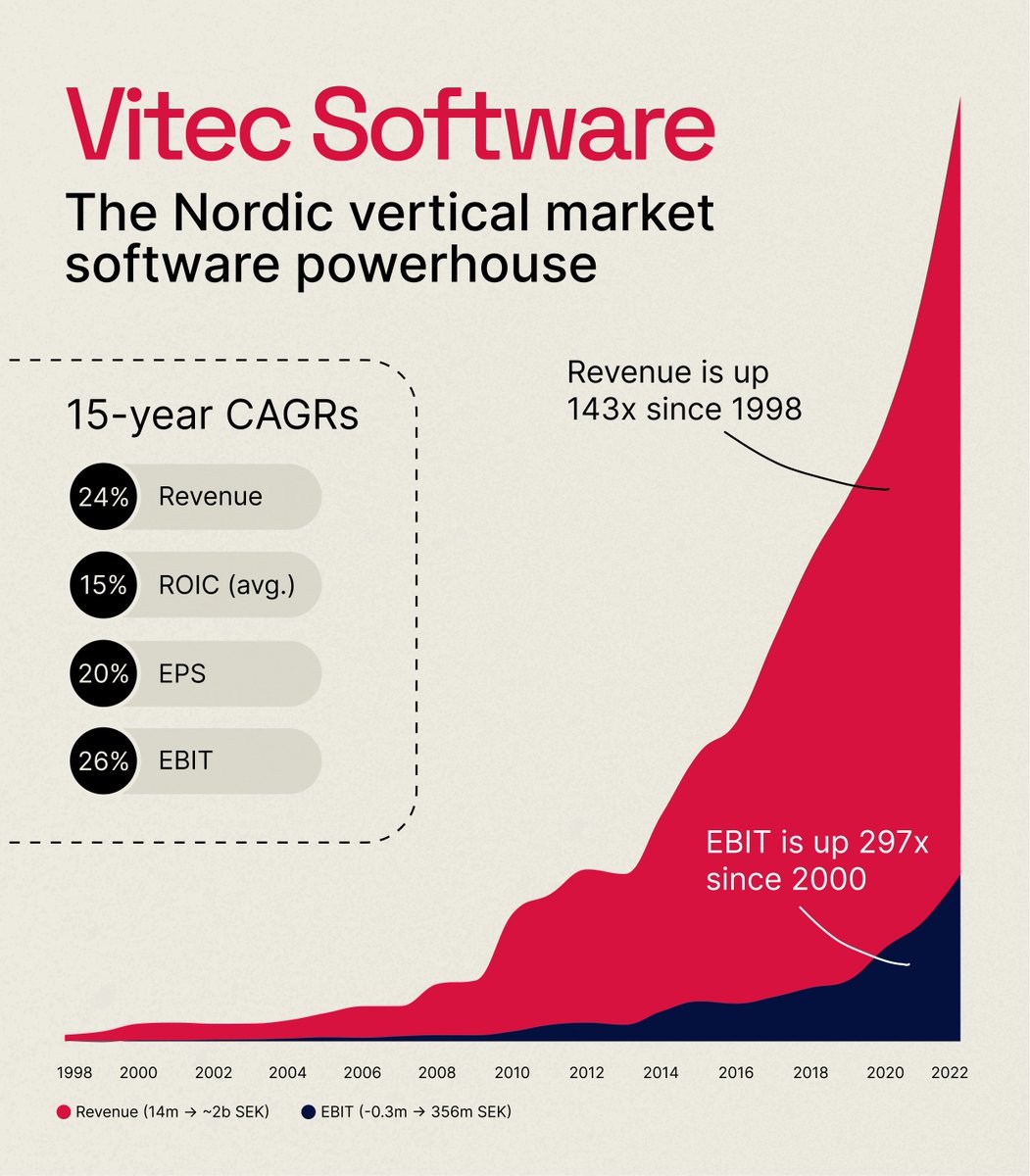

1. $VIT.B ($1.8B market cap) has, just like $CSU.TO and $TOI.V, a pure vertical market software focus. Vitec has been a 250-bagger(!) over the last two decades.

1. $VIT.B ($1.8B market cap) has, just like $CSU.TO and $TOI.V, a pure vertical market software focus. Vitec has been a 250-bagger(!) over the last two decades.

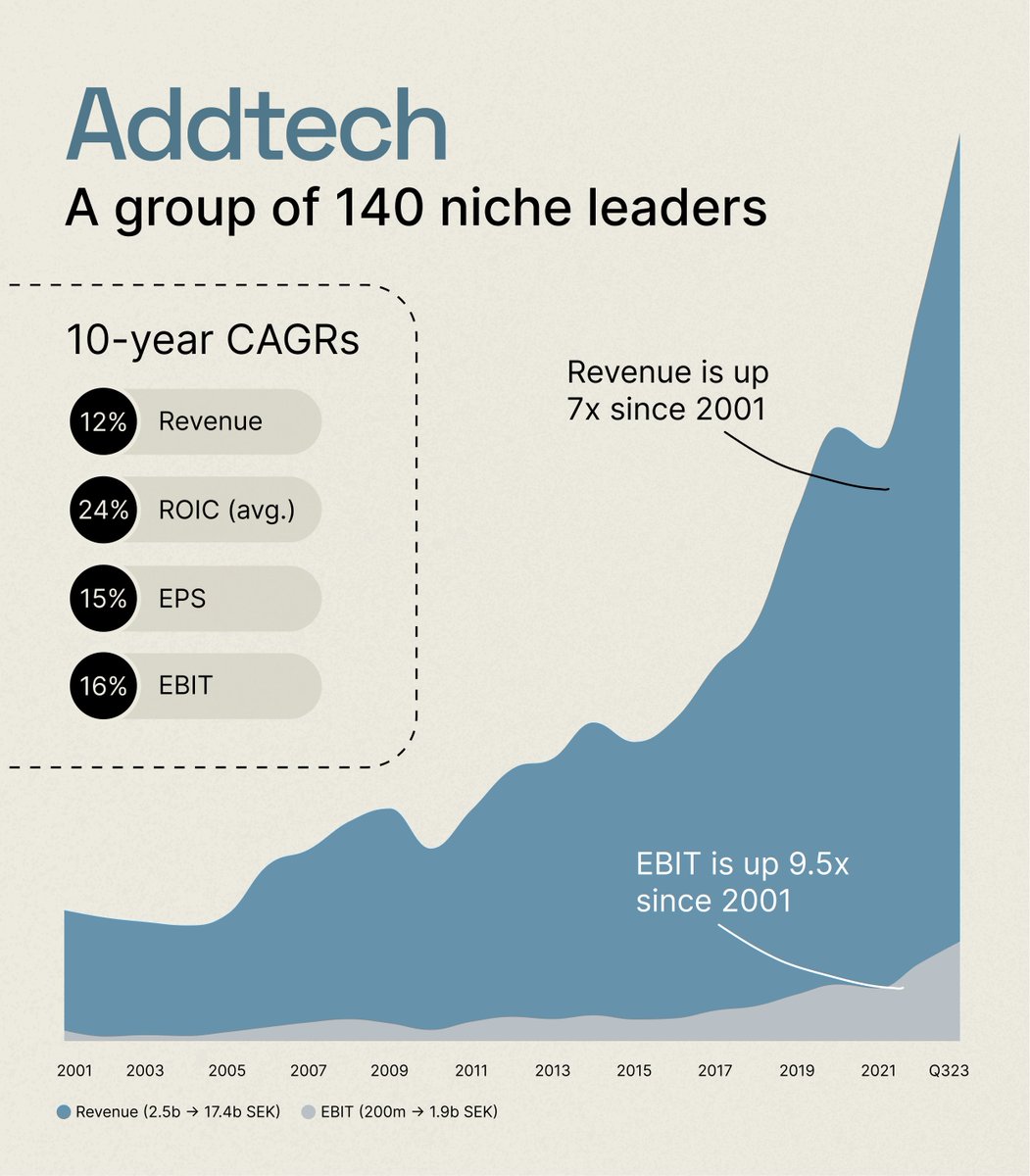

2. $ADDT ($4.5B) is a decentralized acquirer focused on niche high-tech businesses. Since 2004, Addtech has returned 45x *excluding spin-offs (more on that later!) and dividends*.

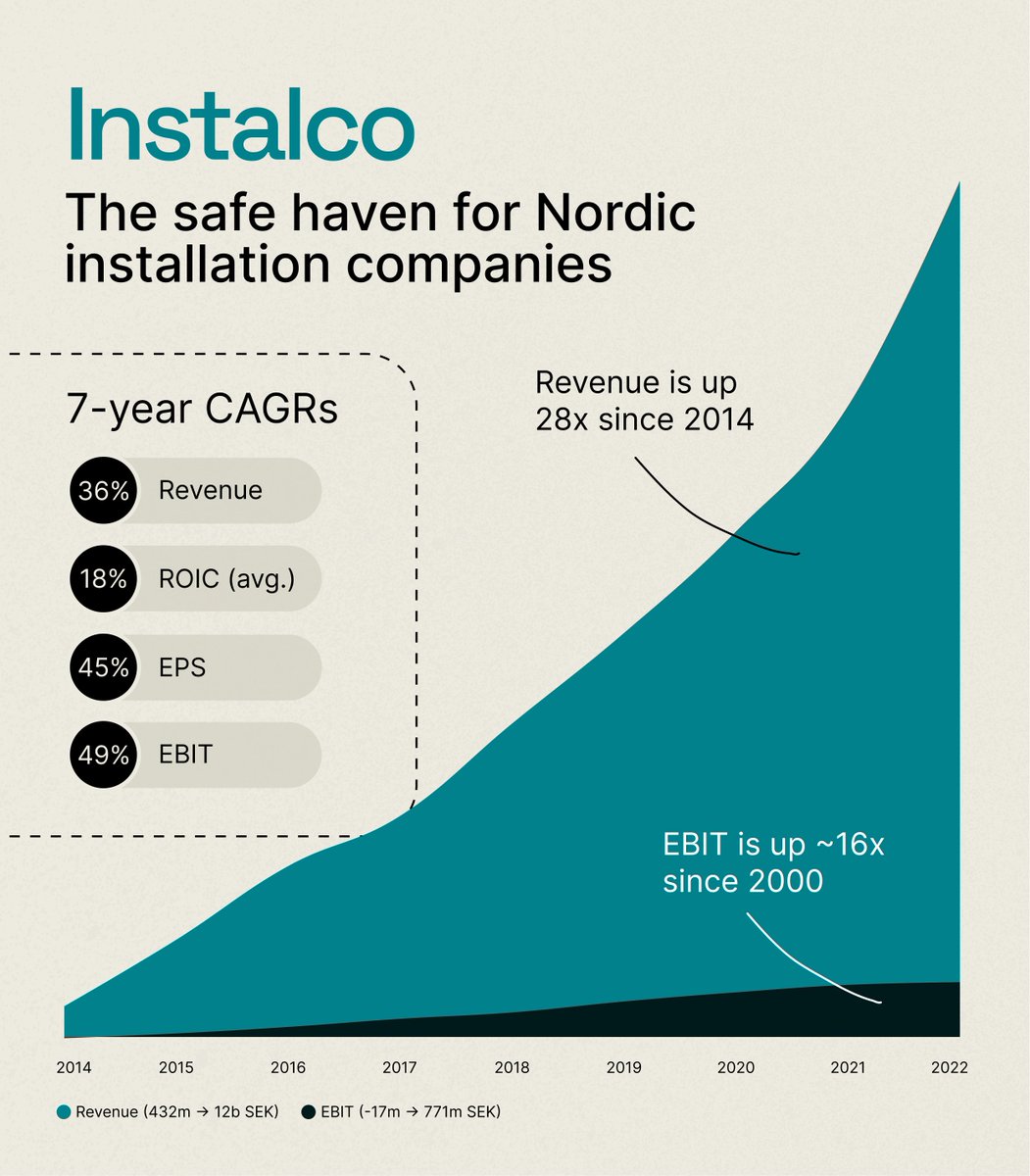

3. $INSTAL ($1.2B) is one of the youngsters on this list, but their consolidation of installation companies in the Nordics has so far been very successful. Since going public in 2017, the stock is up 4x.

4. $LIFCO (~$9B) is one of the most famous Swedish serial acquirers on FinTwit, and we can see why with this track record. Lifco consists of three business areas; Dental, Demolition & Tools, and Systems Solutions.

5. $LAGR ($2.2B) is one of the legendary Bergman & Beving companies – an OG serial acquirer. Much like Addtech, Lagercrantz is focused on companies in a wide range of high-tech niches.

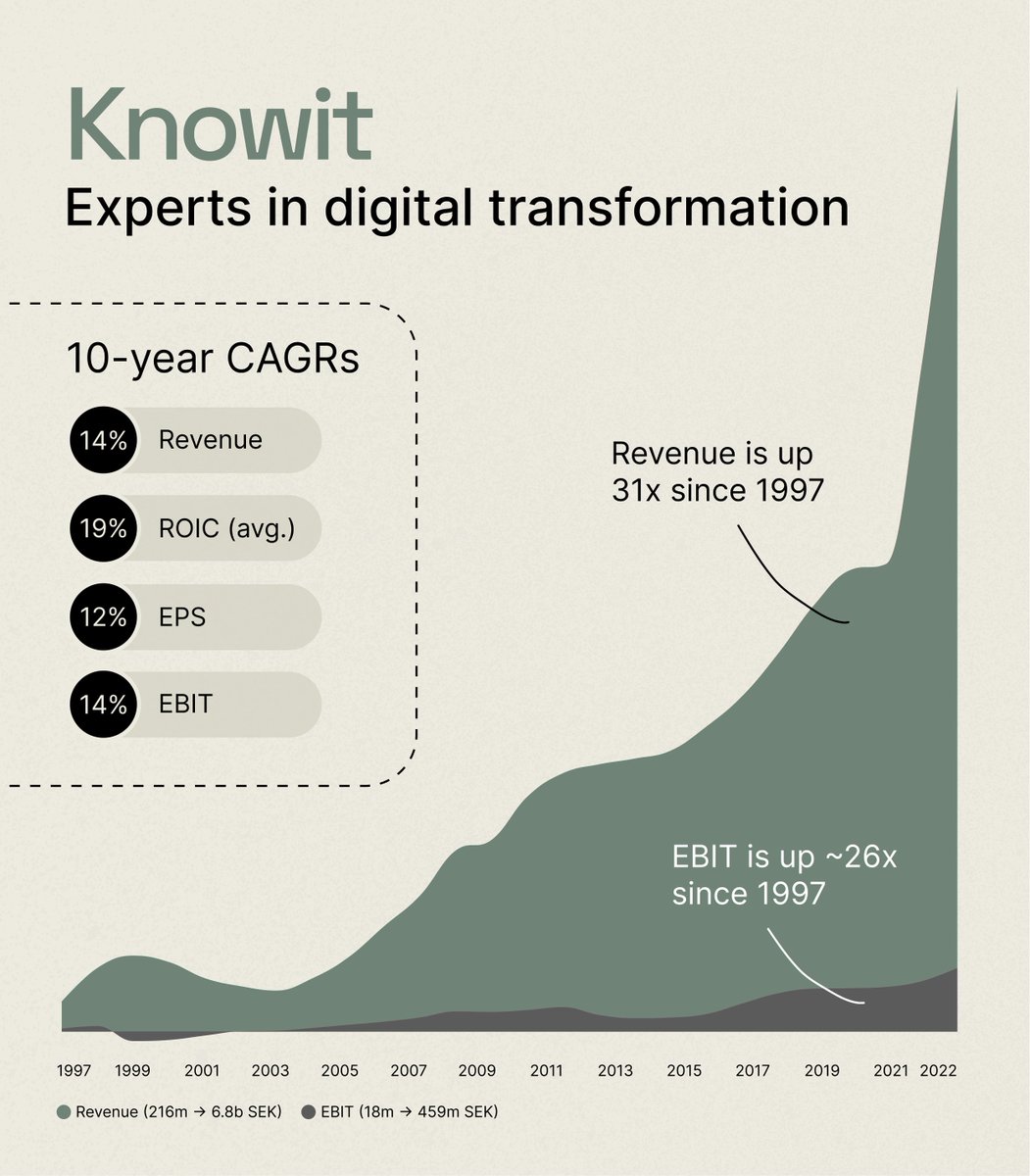

6. $KNOW ($550M) is a consolidator of IT consultancy firms with a long track record of value creation. Over the last two decades, Knowit has been a ~10-bagger excluding dividends.

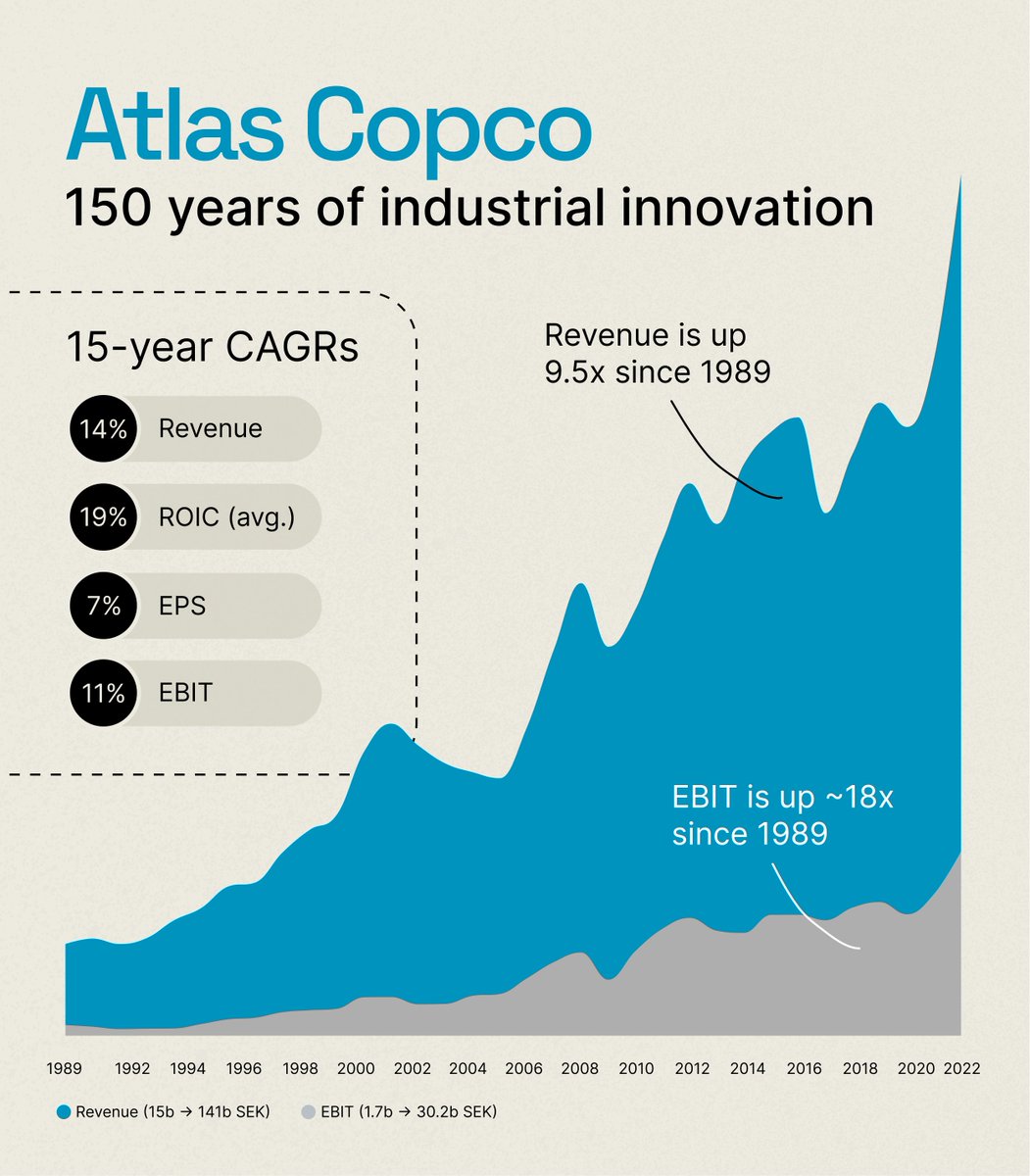

7. $ATCO.ST ($55B) is one of the global leaders in vacuum and compressor technology, used in basically every production process imaginable. Atlas Copco is turning 150 years old in 2023, and is the largest publicly traded company in Sweden.

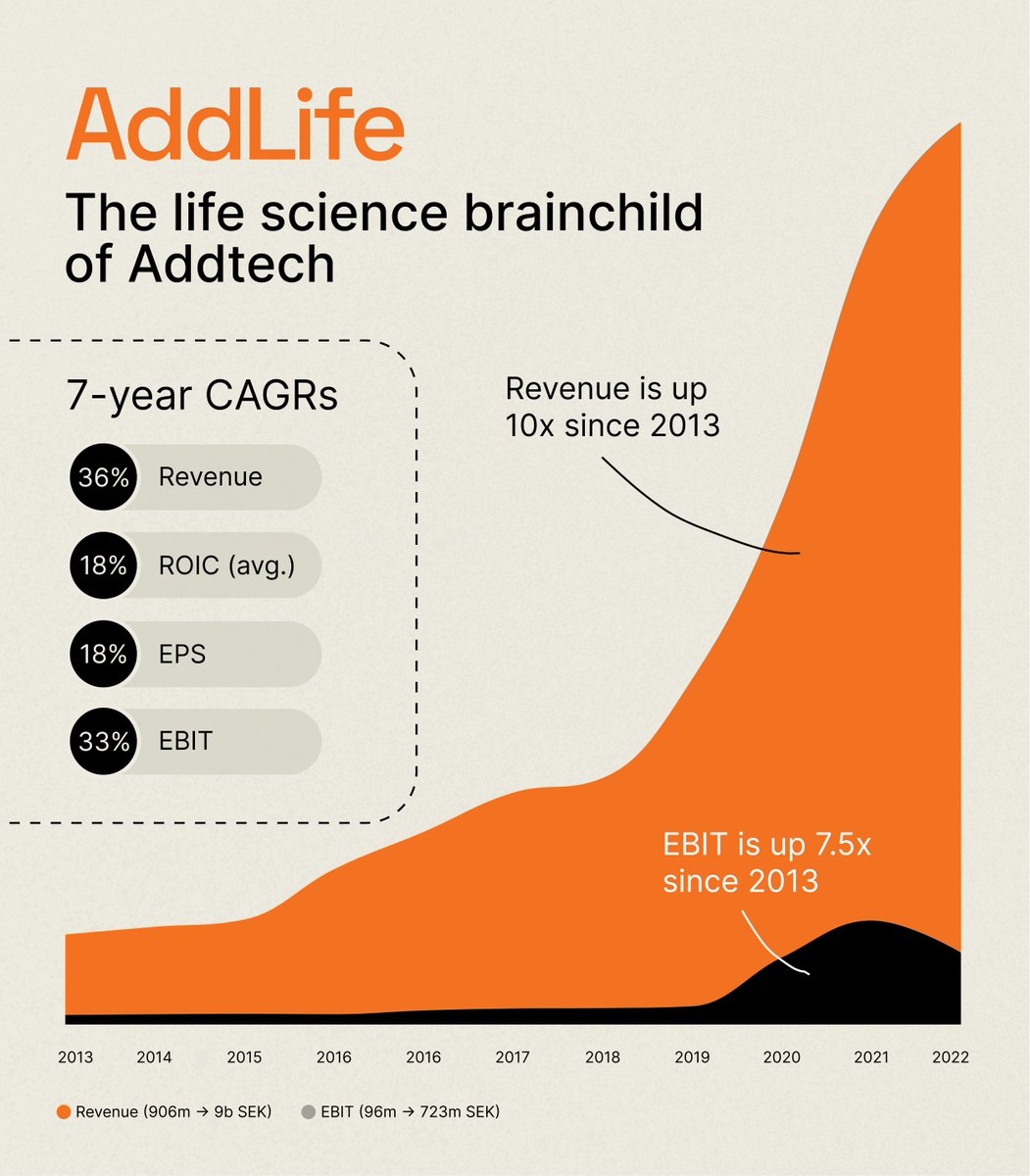

8. $ALIF ($1.2B) was spun off from $ADDT in 2016, and is a group of 85 businesses that offers products, services, and consulting to both the life science industry. Since the spin-off, AddLife has returned ~300% excl. dividends.

9. $VOLO ($800M) acquirers companies with proven business models, leading market positions and strong cash flows at reasonable valuations and develops them with a focus on long-term value creation. Insider ownership amounts to >70%.

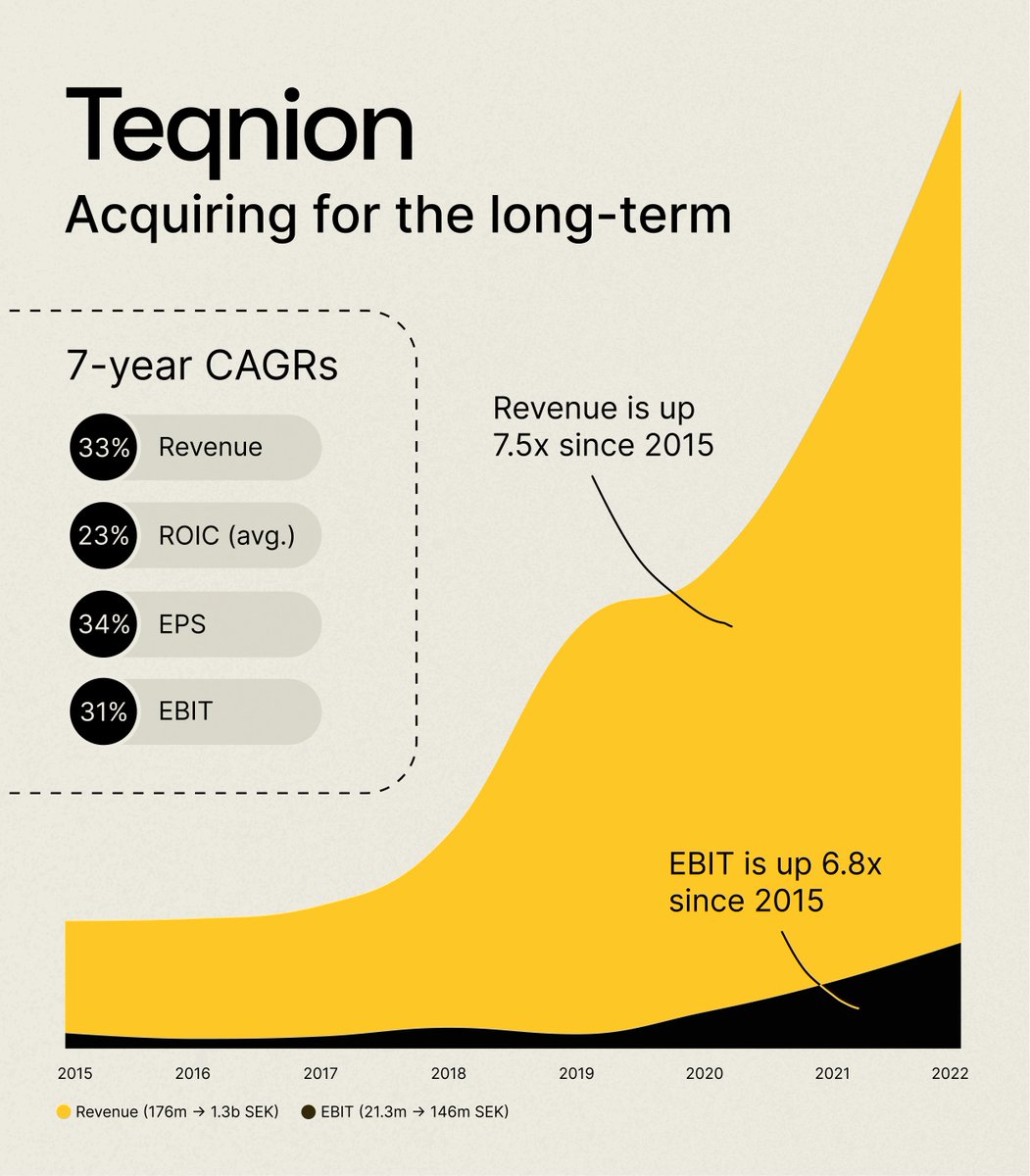

10. $TEQ.ST ($300M) has also become somewhat of a FinTwit favorite, and looking at the their track record and corporate culture, we can understand why. Since its IPO in 2019, Teqnion is a 5-bagger.

• • •

Missing some Tweet in this thread? You can try to

force a refresh