This piece proves Premier and UCP don’t have a clue about oil & gas law or facts:

“Smith acknowledged Alberta first needs to figure out how to get orphan wells reclaimed before requiring renewables companies to do the same”

Nothing to figure out! 1/n

edmonton.ctvnews.ca/we-are-a-natur…

“Smith acknowledged Alberta first needs to figure out how to get orphan wells reclaimed before requiring renewables companies to do the same”

Nothing to figure out! 1/n

edmonton.ctvnews.ca/we-are-a-natur…

Either:

a) Ensure the Regulator charges a levy on industry each year to be sufficient to retire all orphans as required by law; or

b) Cabinet can name another body to do the job in accordance with law if the Regulator can’t or won’t, as also contemplated by law.

2/n

a) Ensure the Regulator charges a levy on industry each year to be sufficient to retire all orphans as required by law; or

b) Cabinet can name another body to do the job in accordance with law if the Regulator can’t or won’t, as also contemplated by law.

2/n

The law is Part 11 of the Oil & Gas Conservation Act. We just need to ensure it’s enforced or make the changes the law provides for when enforcement is an issue. No need to reinvent the wheel on the world’s best orphan law!

<canlii.ca/t/55xvl#sec68>

3/n

<canlii.ca/t/55xvl#sec68>

3/n

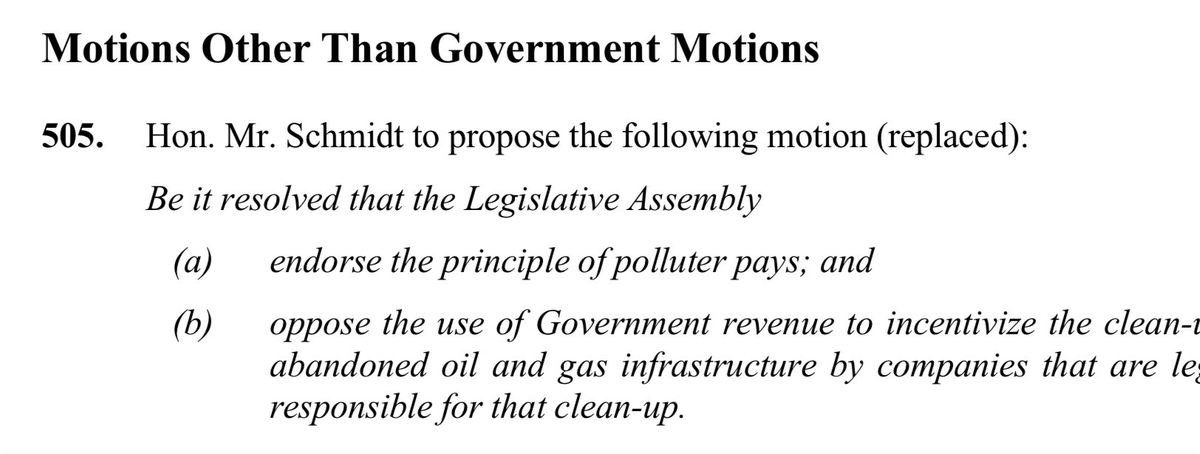

The clear problem is the Premier’s industry taskmasters and buddies, who put her up to the #RStarScam also referenced in the piece, have to pay for closure of orphans via the Orphan Fund levy. #RStar is a circumvention of orphan fund legislation:

4/n

m.youtube.com/results?sp=mAE…

4/n

m.youtube.com/results?sp=mAE…

In a province where oil & gas is everywhere and there are related liability, land use, public safety issues etc., we can’t afford an unbalanced, industry-captured approach. Management of resources has to be principled, fair, and in accordance with law, not a Smith free-for-all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh