Starting at 14:00 London time today:

@gverdian will be appearing on @FutureofFinanc3's panel discussing how CBDCs will happen in the major global currencies.

Register here: futureoffinance.biz/is-this-how-cb…

Or follow us for live highlights.

#CBDC #CBDCs #DigitalCurrency

@gverdian will be appearing on @FutureofFinanc3's panel discussing how CBDCs will happen in the major global currencies.

Register here: futureoffinance.biz/is-this-how-cb…

Or follow us for live highlights.

#CBDC #CBDCs #DigitalCurrency

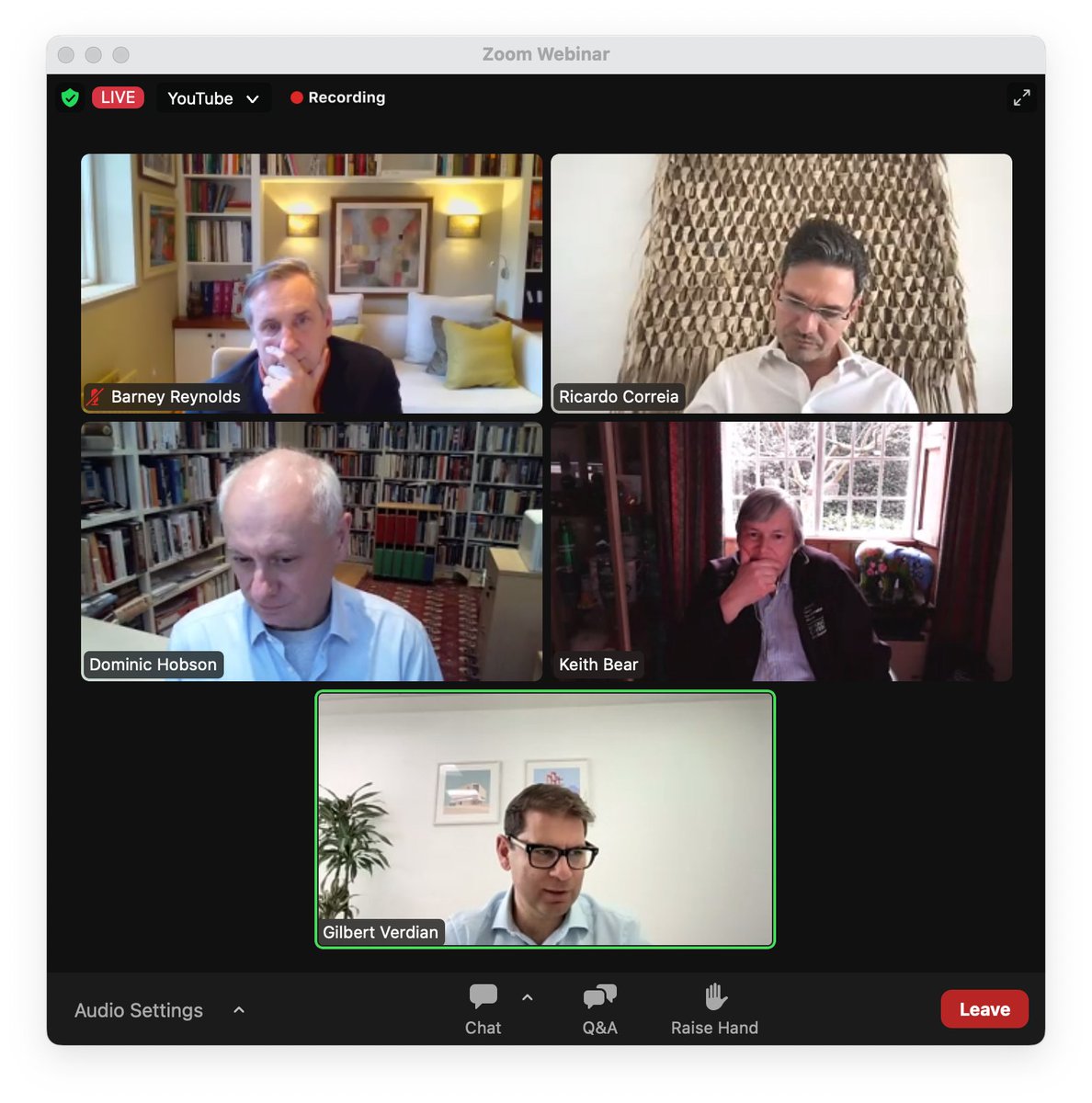

@gverdian @FutureofFinanc3 Joining @gverdian will be:

Todd Ricardo Correia, from @inside_r3;

Barney Reynolds, Partner, Global Head Financial Institutions, at @ShearmanLaw; and

Keith Bear, Fellow at the Centre for Alternative Finance, @CambridgeJBS.

The panel will be moderated by @Dominic_Hobson.

Todd Ricardo Correia, from @inside_r3;

Barney Reynolds, Partner, Global Head Financial Institutions, at @ShearmanLaw; and

Keith Bear, Fellow at the Centre for Alternative Finance, @CambridgeJBS.

The panel will be moderated by @Dominic_Hobson.

"Governance and operations are really important. Ecosystem collaboration and integration are also key," says Ricardo Correia.

#CBDC #CBDCs

#CBDC #CBDCs

"There are three key factors," says Keith Bear. "1) You need access; 2) You need trust (you need privacy, the @bankofengland, for example, is committed to this); and 3) There has to be utility."

#CBDC #CBDCs

#CBDC #CBDCs

"This is a new form of money that will be treated like a critical national infrastructure," says @gverdian. "Central banks demand resilience."

#CBDC #CBDCs

#CBDC #CBDCs

"Central banks are not interested in controlling how people spend their money. That's not their mission. They're there to manage the macro." says @gverdian. "The onus is on the commercial banks to make sure they comply with the relevant policies."

#CBDC #CBDCs

#CBDC #CBDCs

"On the commercial bank side, the risk is that their sources of funding become more precarious." says Barney Reynolds. "Maturity transformation is necessary. DLT causes us to revisit some basic propositions but we should't tear up the basics."

#CBDC #CBDCs

#CBDC #CBDCs

"The governance rules needs to be written very carefully." says Barney Reynolds. "It's not as simple as saying the Bank will never see personal details."

#CBDC #CBDCs

#CBDC #CBDCs

"We've seen some economies move a lot quicker recently," says Ricardo Correia. "The speed is different for wholesale vs retail CBDC implementation. "

#CBDC #CBDCs

#CBDC #CBDCs

"The @bankofengland paper suggests a CBDC by 2030," says Ricardo Correia. "I predict we'll see, within the next five years, the roll out of some CBDCs in lesser economies."

#CBDC #CBDCs

#CBDC #CBDCs

@bankofengland "The @ecb and digital euro have a bit of a lead. It could be as early as 2026," says Keith Bear.

#CBDC #CBDCs

#CBDC #CBDCs

"Regulators around the world are looking at stablecoins," says Barney Reynolds. "Regulation needs to follow what the market does."

#CBDC #CBDCs

#CBDC #CBDCs

"CBDC is a very safe asset, and not just because of the issuer," says Barney Reynolds. "You have the simplest legal structure. The fewer moving parts, the better from that perspective."

#CBDC #CBDCs

#CBDC #CBDCs

"We have all inherited very fragmented payment systems in every country," says @gverdian. "So how to integrate them? What needs solving is the gateway to gateway integration between networks."

#CBDC #CBDCs

#CBDC #CBDCs

"One of the key purposes of a CBDC is to support the future state of the digital economy," says Keith Bear. "We'd expect atomic settlement between tokenised cash and assets."

#CBDC #CBDCs

#CBDC #CBDCs

"We are becoming a more digital society. We need a new form of money, a new instrument to cater for the new way we live," says @gverdian. "A CBDC is a natural fit. It's trusted and backed by the central bank. Non-CBDC assets are simply less reliable."

#CBDC #CBDCs

#CBDC #CBDCs

• • •

Missing some Tweet in this thread? You can try to

force a refresh