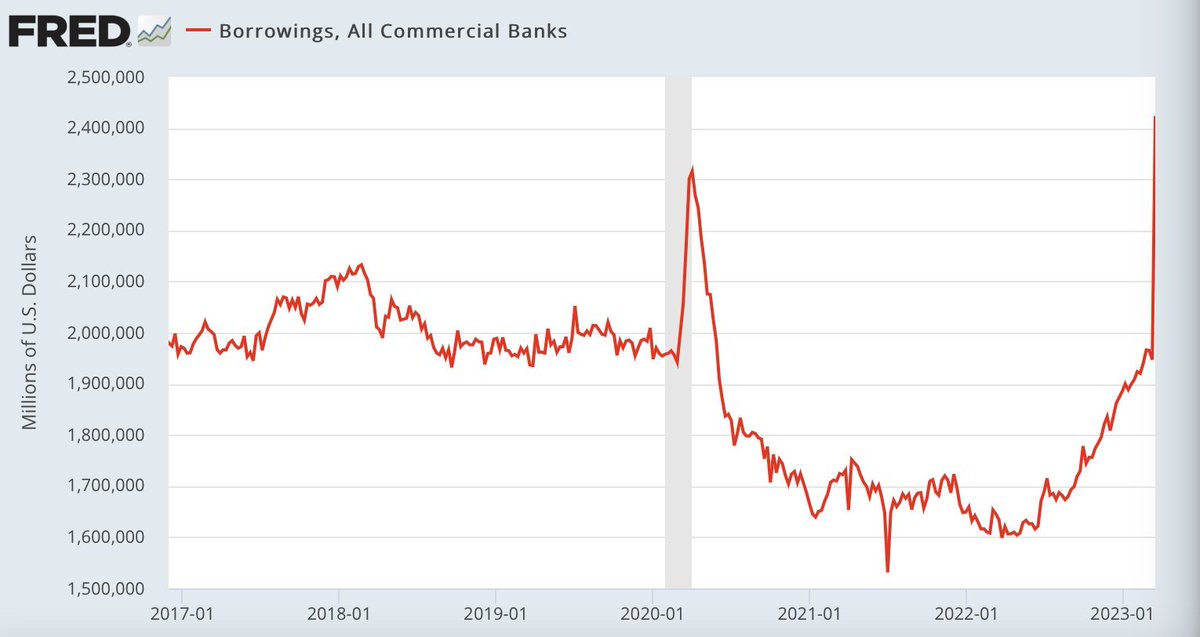

The Fed just reported that U.S. banks borrowed $475 billion last week as the banking crisis continued.

Meanwhile, over $500 billion has been withdrawn from small banks in the TWO WEEKS since SVB collapsed.

We did some research and the numbers are alarming (a short thread):

1/7

Meanwhile, over $500 billion has been withdrawn from small banks in the TWO WEEKS since SVB collapsed.

We did some research and the numbers are alarming (a short thread):

1/7

U.S. banks borrowed $475 billion last week, but look at the breakdown:

- Large Banks: +$250B

- Small Banks: +$250B

- Foreign-Related Banks: +$25B

Small banks borrowed the same amount as large banks.

Relative to their size small banks borrowed TWICE as much as large banks.

2/7

- Large Banks: +$250B

- Small Banks: +$250B

- Foreign-Related Banks: +$25B

Small banks borrowed the same amount as large banks.

Relative to their size small banks borrowed TWICE as much as large banks.

2/7

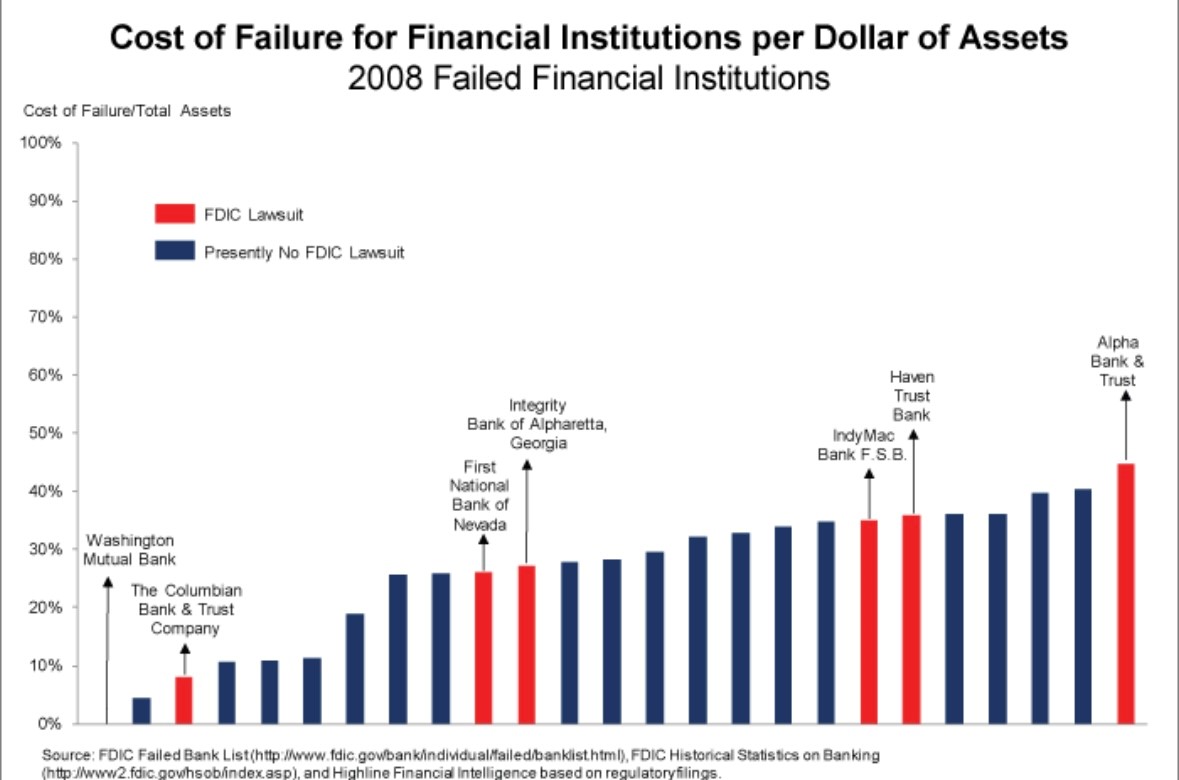

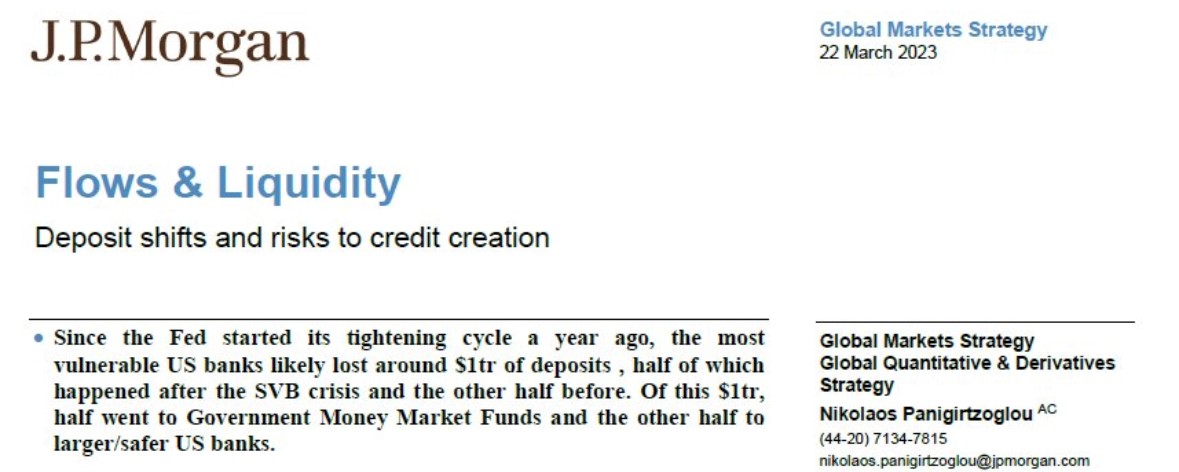

Furthermore, according to JP Morgan $1 trillion has been withdrawn from "the most vulnerable" banks over the last 2 years, when the Fed started raising rates.

However, $500 billion of this has been withdrawn since the collapse of SVB on March 10th.

This is BY FAR a record.

3/7

However, $500 billion of this has been withdrawn since the collapse of SVB on March 10th.

This is BY FAR a record.

3/7

New Fed data shows banks lost ~$100 billion in deposits JUST last week.

Here’s the breakdown:

1. Large US Banks: +$67B

2. Small US Banks: -$120B

3. Foreign-Related Banks: -$45B

The worst part is that SVB is a "large bank" in their model, and large banks still added $67B.

4/7

Here’s the breakdown:

1. Large US Banks: +$67B

2. Small US Banks: -$120B

3. Foreign-Related Banks: -$45B

The worst part is that SVB is a "large bank" in their model, and large banks still added $67B.

4/7

Where are all of the withdrawals going?

JP Morgan research shows half of this money going to Government Money Market Funds and the other half to larger/safer banks.

Small banks continue to feel the pain while large banks are (ironically) winning the banking crisis.

5/7

JP Morgan research shows half of this money going to Government Money Market Funds and the other half to larger/safer banks.

Small banks continue to feel the pain while large banks are (ironically) winning the banking crisis.

5/7

According to the Wall Street Journal, nearly 200 banks are still facing the same issues as SVB.

The crisis has spread to Europe with the collapse of Credit Suisse, $CS, and Deutsche Bank credit default swaps hitting a 4-year high.

Meanwhile, there still is not a solution.

6/7

The crisis has spread to Europe with the collapse of Credit Suisse, $CS, and Deutsche Bank credit default swaps hitting a 4-year high.

Meanwhile, there still is not a solution.

6/7

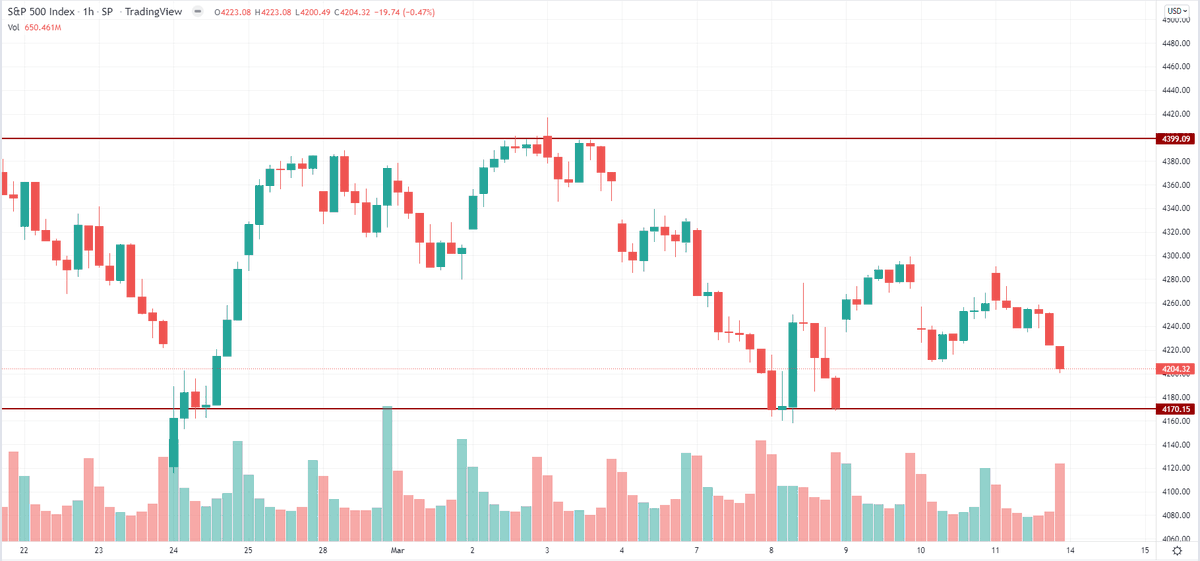

Last week, Treasury Sec. Yellen said the US was considering backing ALL deposits.

1 day later, she said the US is no longer considering this.

Banks stocks fell with regional bank ETF $KRE making a new low.

Follow us @KobeissiLetter for real time analysis as this develops.

7/7

1 day later, she said the US is no longer considering this.

Banks stocks fell with regional bank ETF $KRE making a new low.

Follow us @KobeissiLetter for real time analysis as this develops.

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh