Official X account for The Kobeissi Letter, an industry leading commentary on the global capital markets. Email us: support@thekobeissiletter.com

101 subscribers

How to get URL link on X (Twitter) App

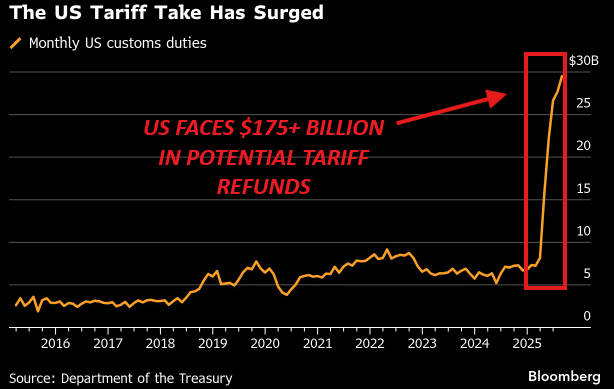

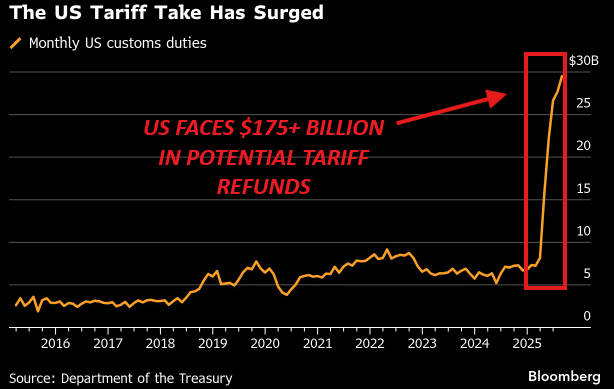

After 5+ months, the Supreme Court's ruling was released.

After 5+ months, the Supreme Court's ruling was released.

As of 8:00 AM ET today, Bitcoin has officially erased its post-election rally.

As of 8:00 AM ET today, Bitcoin has officially erased its post-election rally.

It was an incredibly busy weekend.

It was an incredibly busy weekend.

For years, investors have been upping purchases of single-family homes in the US.

For years, investors have been upping purchases of single-family homes in the US.

In the early 2000s, Venezuela was a MUCH larger oil producer than the US.

In the early 2000s, Venezuela was a MUCH larger oil producer than the US.

As you may know, our view for 2025 has been "own assets or be left behind."

As you may know, our view for 2025 has been "own assets or be left behind."

At first glance, this looks like one of the best inflation reports in years.

At first glance, this looks like one of the best inflation reports in years.

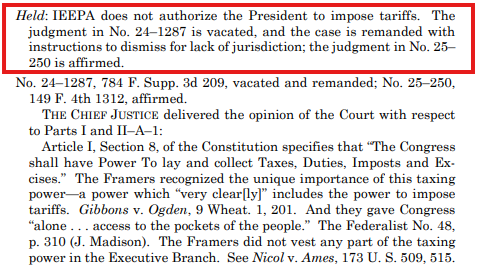

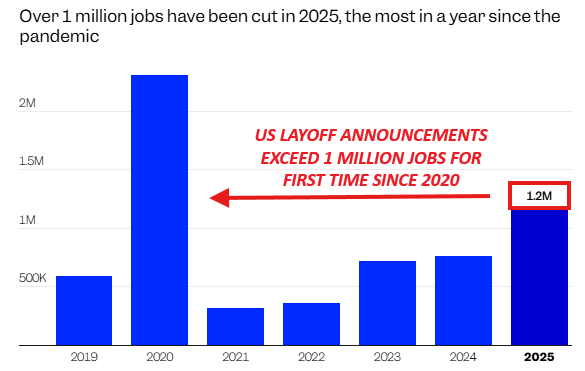

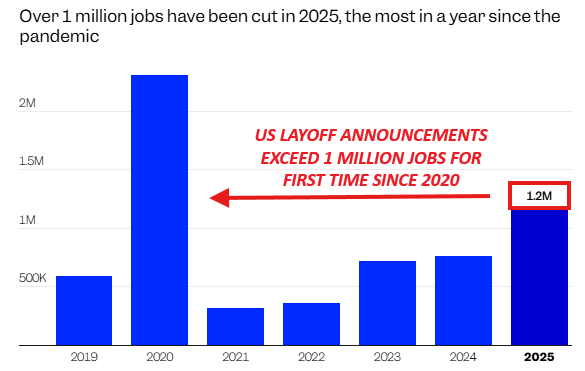

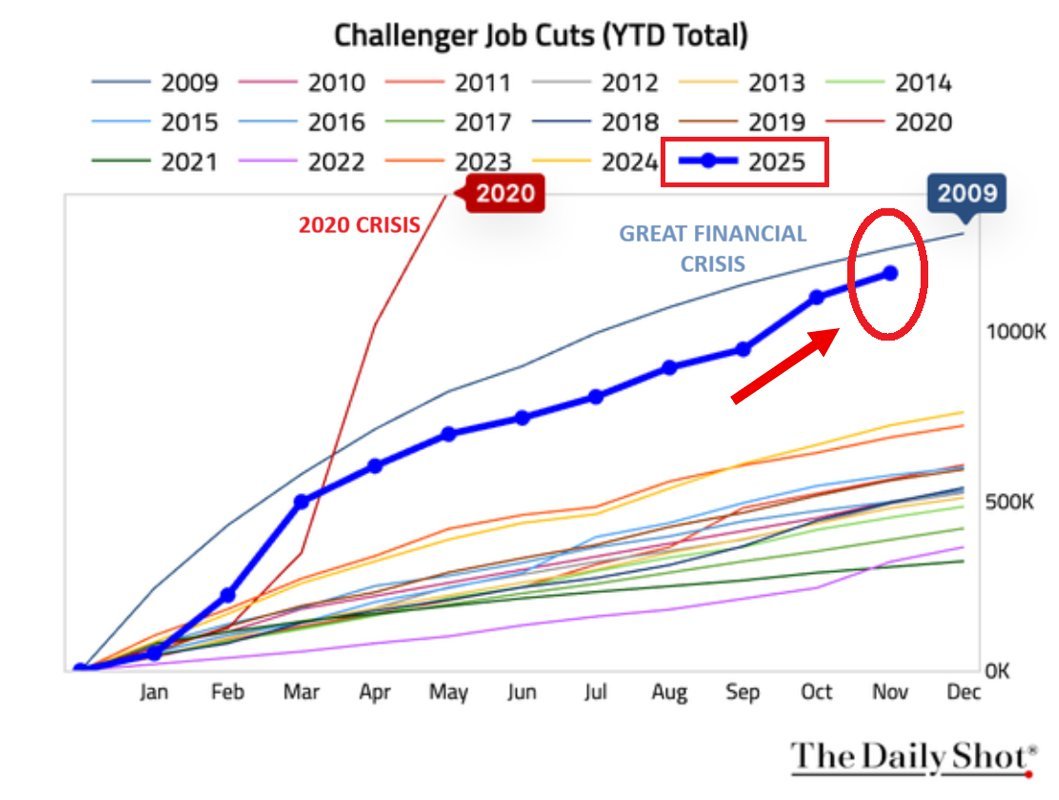

US layoffs currently set to match levels seen in the 2008 Financial Crisis.

US layoffs currently set to match levels seen in the 2008 Financial Crisis.

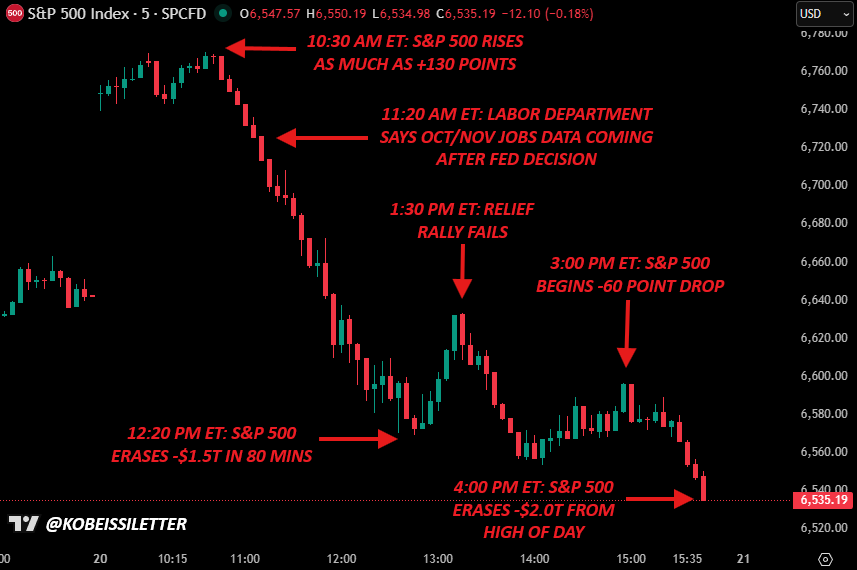

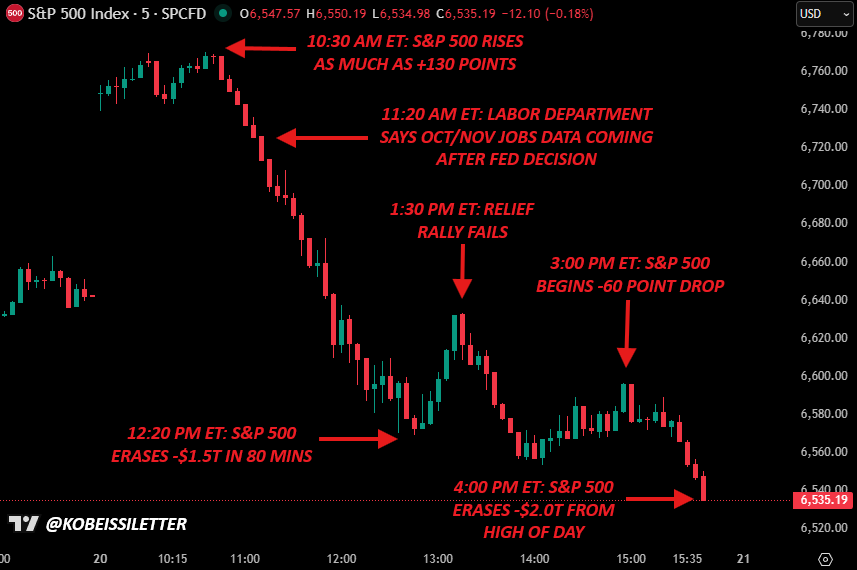

Here was the S&P 500's heat map at the open today.

Here was the S&P 500's heat map at the open today.

This decline has been strange for one key reason:

This decline has been strange for one key reason:

This morning, President Trump made the below announcement:

This morning, President Trump made the below announcement:

Today, the US government shutdown officially enters day 38.

Today, the US government shutdown officially enters day 38.

Today marks day 35 of the 2025 US government shutdown.

Today marks day 35 of the 2025 US government shutdown.

For the first time in history, the Magnificent 7 stocks are now worth over a combined $20 TRILLION.

For the first time in history, the Magnificent 7 stocks are now worth over a combined $20 TRILLION.

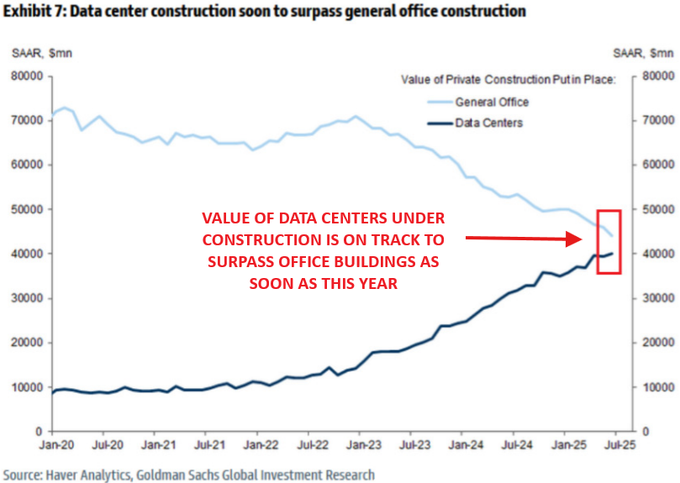

The magnitude of the data center boom became apparent in early-2024.

The magnitude of the data center boom became apparent in early-2024.

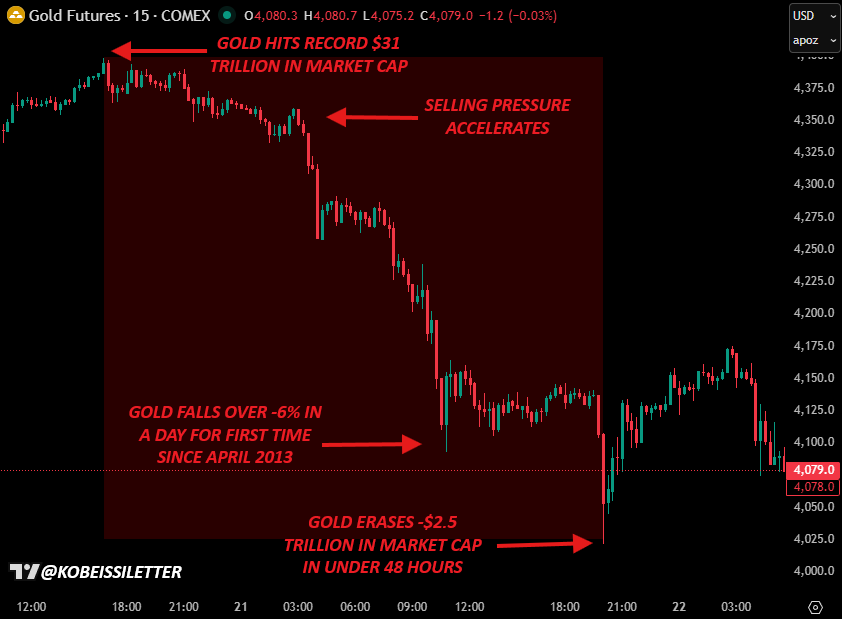

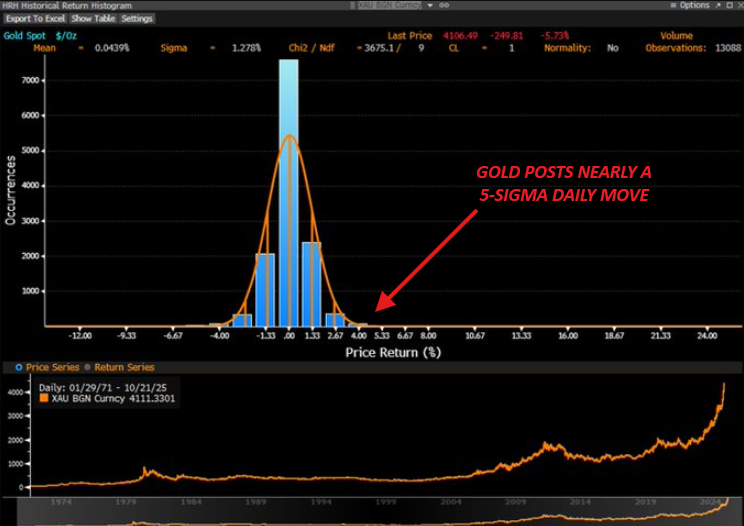

Statistically speaking, gold's move was a near 5-sigma event.

Statistically speaking, gold's move was a near 5-sigma event.

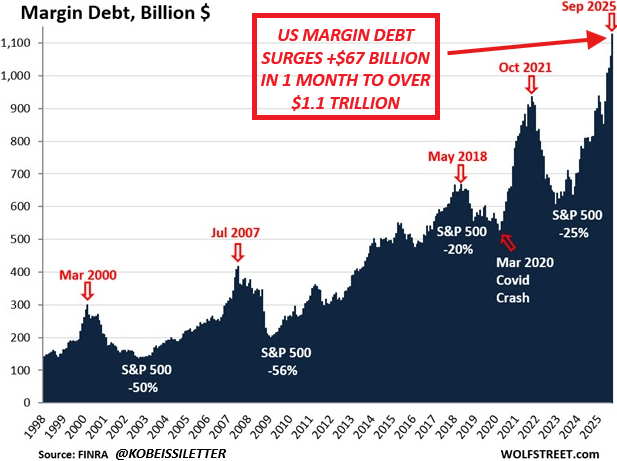

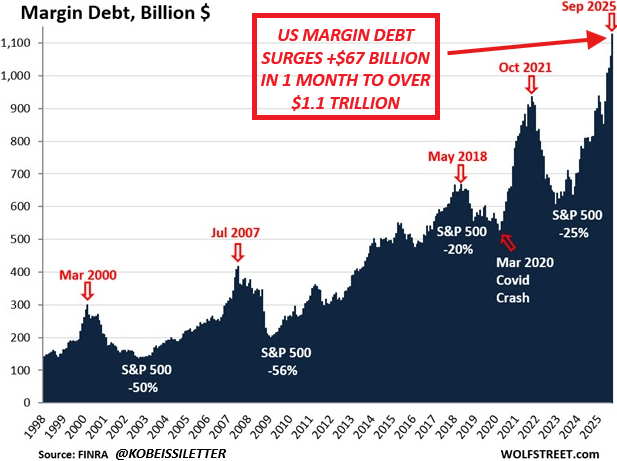

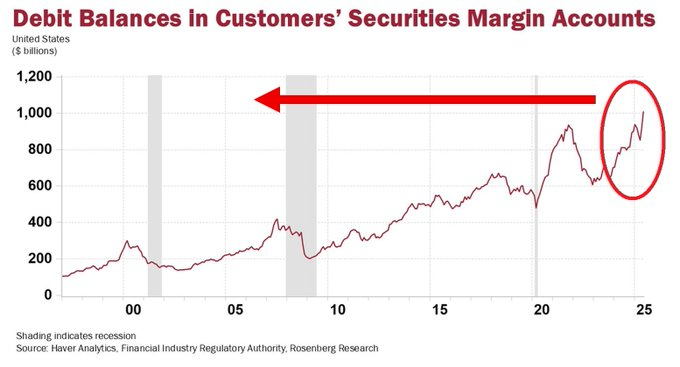

Investor leverage has nearly DOUBLED over the last 2 years.

Investor leverage has nearly DOUBLED over the last 2 years.

Gold has reached a point where the technicals seem to be irrelevant.

Gold has reached a point where the technicals seem to be irrelevant.

To put this into perspective:

To put this into perspective:

Here is the statement that President Trump posted today.

Here is the statement that President Trump posted today.

For decades, Moore’s Law was the gold standard measure of technological progress.

For decades, Moore’s Law was the gold standard measure of technological progress.