Banking fragility has worried

@BillAckman for decades.

A 28-year old Ackman “from New York City” once asked Buffett about Salomon Bros’ 30:1 leverage at $BRK 1994 AGM.

That risk profile catalyzed the GFC in 2007-09.

Now he’s worried about systemic risk again.

A short 🧵👇.

@BillAckman for decades.

A 28-year old Ackman “from New York City” once asked Buffett about Salomon Bros’ 30:1 leverage at $BRK 1994 AGM.

That risk profile catalyzed the GFC in 2007-09.

Now he’s worried about systemic risk again.

A short 🧵👇.

1. Perhaps this line of investigation contributed to Bill’s famously successful short of $MBIA and its GFC implosion…

Or his observation that CDS spreads might blow out during early days of COVID…

And who knows how he’s positioned now?

But we know he’s worried…

Read on.👇

Or his observation that CDS spreads might blow out during early days of COVID…

And who knows how he’s positioned now?

But we know he’s worried…

Read on.👇

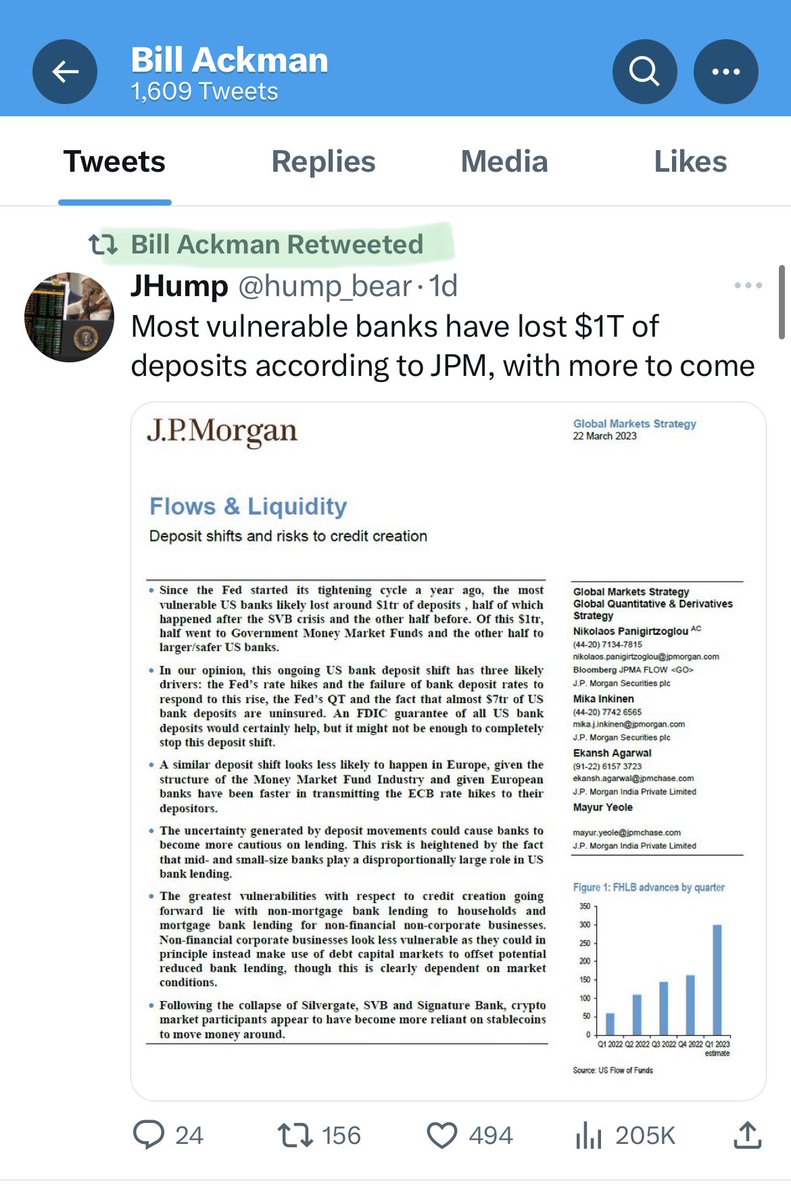

2. Bill is on an absolute heater, tweeting every day about his worries.

At core, he seems to make 4 KEY CLAIMS:

Claim 1:

Depositors can’t be expected to analyze bank balance sheet risks more effectively than full-time banking regulators.

Deposits should be guaranteed.

At core, he seems to make 4 KEY CLAIMS:

Claim 1:

Depositors can’t be expected to analyze bank balance sheet risks more effectively than full-time banking regulators.

Deposits should be guaranteed.

3. CRE

Claim 2:

While rising rates, via declining security prices, initially smashed a MTM dent in bank balance sheets (eg $SIVB)…

…high rates ultimately cause credit performance issues (ie, loan defaults).

This will be most acute in CRE loans, like NYC office buildings.

Claim 2:

While rising rates, via declining security prices, initially smashed a MTM dent in bank balance sheets (eg $SIVB)…

…high rates ultimately cause credit performance issues (ie, loan defaults).

This will be most acute in CRE loans, like NYC office buildings.

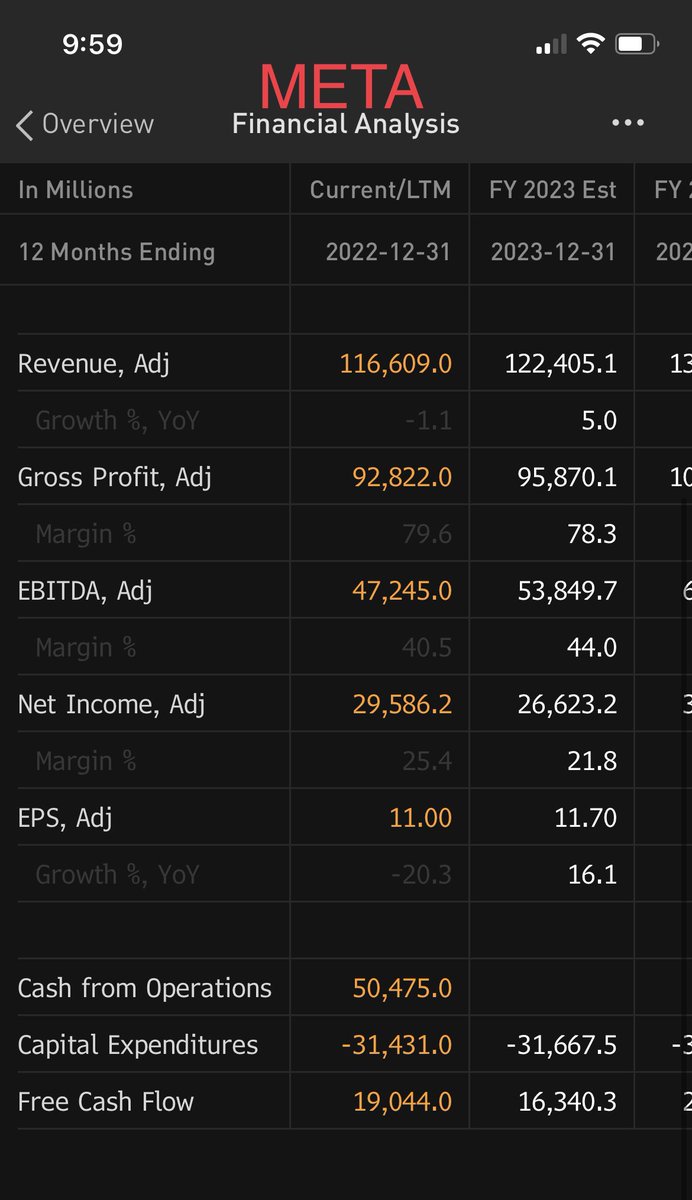

4. Bank Costs

Claim 3:

Cash depositors, especially uninsureds, are waking up to the new rate environment - they won’t accept 0% interest checking going forward.

This is forcing banks to compete by paying rate, hurting banks’ ability to heal via profits.

🏦 💰

Claim 3:

Cash depositors, especially uninsureds, are waking up to the new rate environment - they won’t accept 0% interest checking going forward.

This is forcing banks to compete by paying rate, hurting banks’ ability to heal via profits.

🏦 💰

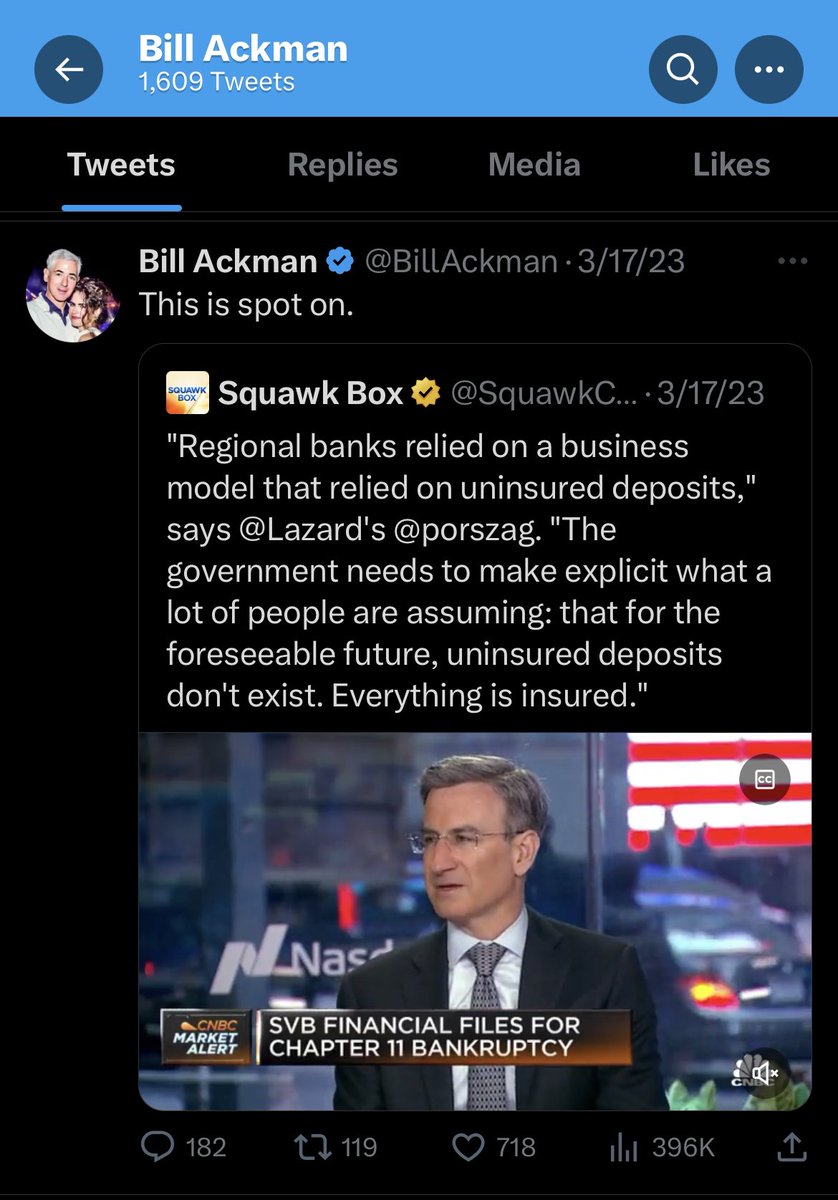

5. Too Big To Fail

Claim 4:

Regional Banks facilitate local business growth and our unique US economic outperformance.

The current system of a few TBTF banks creates a 2-tier system, where large depositors will naturally migrate to the TBTFs (or brokerages), hurting regionals.

Claim 4:

Regional Banks facilitate local business growth and our unique US economic outperformance.

The current system of a few TBTF banks creates a 2-tier system, where large depositors will naturally migrate to the TBTFs (or brokerages), hurting regionals.

6. Collectively, these risks are driving Bill’s repeated calls for regulators to:

A) Guarantee all deposits (reducing incentives to move and the risk of abrupt funding cost pressure on regionals);

B) Pause further rate increases while monitoring funding and credit performance.

A) Guarantee all deposits (reducing incentives to move and the risk of abrupt funding cost pressure on regionals);

B) Pause further rate increases while monitoring funding and credit performance.

I don’t always agree with Bill, but I always listen.

He’s thought deeply about these issues for 30+ yrs, with a track record of repeatedly profiting from danger.

Tease, question, challenge? Sure.

But don’t ignore.

-End

Like, RT & Follow for more knowledge bombs like this👇

He’s thought deeply about these issues for 30+ yrs, with a track record of repeatedly profiting from danger.

Tease, question, challenge? Sure.

But don’t ignore.

-End

Like, RT & Follow for more knowledge bombs like this👇

https://twitter.com/compound248/status/1634105371198644224

• • •

Missing some Tweet in this thread? You can try to

force a refresh