Crunching Numbers with @FootnotesFirst

Thread 🧵1/22

In 2020 @SachemCove presented a "confidential - not-for-distribution" deck on the @MacroVoices podcast. This document has been prepared by Lloyd Harbor Capital Management.

Let's dive in & go back to basics: Math is the Math.

Thread 🧵1/22

In 2020 @SachemCove presented a "confidential - not-for-distribution" deck on the @MacroVoices podcast. This document has been prepared by Lloyd Harbor Capital Management.

Let's dive in & go back to basics: Math is the Math.

2/22

The document starts off with the prejudiced fear narratives common investors absorb or generate when it comes to investing in this sector.

Please take note of how some of those points are similar to the ones used by @ItsWarrenIrwin in his current #Uranium bear thesis.

The document starts off with the prejudiced fear narratives common investors absorb or generate when it comes to investing in this sector.

Please take note of how some of those points are similar to the ones used by @ItsWarrenIrwin in his current #Uranium bear thesis.

3/22

If we pierce through the fear narratives we start seeing the first signs of the #Uranium bull case.

@ItsWarrenIrwin still uses the 2% PA demand growth model. But @FootnotesFirst explains that his models are very conservative & don't include restarts, life extensions, etc.

If we pierce through the fear narratives we start seeing the first signs of the #Uranium bull case.

@ItsWarrenIrwin still uses the 2% PA demand growth model. But @FootnotesFirst explains that his models are very conservative & don't include restarts, life extensions, etc.

4/22

The #Uranium Investment Case is based on an exceptional asymmetric risk/reward thesis.

A major dislocation between the math and the narrative in a butchered sector that saw massive investor fatigue from a multi-year downturn.

Most of the companies are not investable...

The #Uranium Investment Case is based on an exceptional asymmetric risk/reward thesis.

A major dislocation between the math and the narrative in a butchered sector that saw massive investor fatigue from a multi-year downturn.

Most of the companies are not investable...

5/22

Back in 2020, and with @FootnotesFirst's very conservative models, the bull case was already better set up vs the prior bottom.

These models did not include all the new demand increases coming from Japanese restarts, life extensions & massive new global build programs.

Back in 2020, and with @FootnotesFirst's very conservative models, the bull case was already better set up vs the prior bottom.

These models did not include all the new demand increases coming from Japanese restarts, life extensions & massive new global build programs.

6/22

The March 2011 Fukushima disaster was the main cause of demand destruction in the previous cycle.

But other factors, like Kazakhstan ramping up production, and Cameco bringing on significant supply in 2014 into an oversupplied market, also contributed to aggravating it.

The March 2011 Fukushima disaster was the main cause of demand destruction in the previous cycle.

But other factors, like Kazakhstan ramping up production, and Cameco bringing on significant supply in 2014 into an oversupplied market, also contributed to aggravating it.

7/22

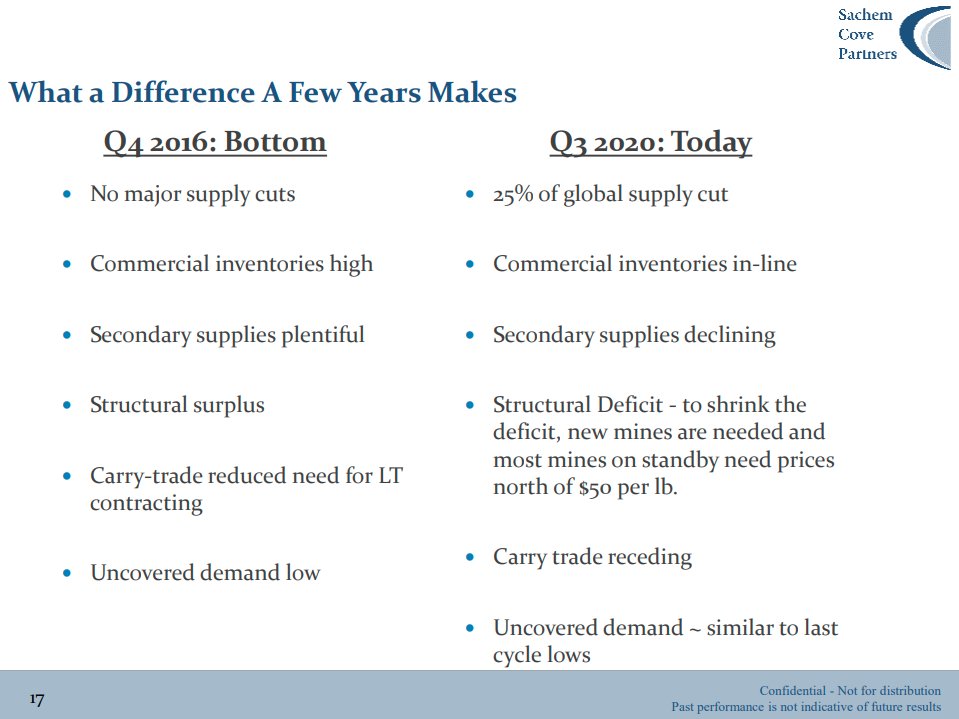

Since Q4 2016 bottom up to Q3 2020 when this deck was presented @SachemCove already viewed how a few years made a huge difference in the supply vs demand model.

At this point in time in 2023 we could basically say we have now completely swung 180 degrees.

Since Q4 2016 bottom up to Q3 2020 when this deck was presented @SachemCove already viewed how a few years made a huge difference in the supply vs demand model.

At this point in time in 2023 we could basically say we have now completely swung 180 degrees.

8/22

Narrative vs the Math. Mike Alkin hammers on this a lot. The narratives are stories not always supported by maths.

His advice: Ignore the narrative, mine the arithmetic gap.

We, as shareholders, should mine that arithmetic gap without getting "mined" by the companies 😉

Narrative vs the Math. Mike Alkin hammers on this a lot. The narratives are stories not always supported by maths.

His advice: Ignore the narrative, mine the arithmetic gap.

We, as shareholders, should mine that arithmetic gap without getting "mined" by the companies 😉

9/22

Back in 2020, @SachemCove's models predicted that $KAP production would peak in 2023. They were not that far off as it seems it might even have peaked in 2022. Their revised forward guidance shows they will not be able to ramp up and are decreasing production expectations.

Back in 2020, @SachemCove's models predicted that $KAP production would peak in 2023. They were not that far off as it seems it might even have peaked in 2022. Their revised forward guidance shows they will not be able to ramp up and are decreasing production expectations.

10/22

And the $KAP production peak squares with its capital spending plans.

@ItsWarrenIrwin keeps repeating that $KAP will be able to ramp up production whenever they like, but the forward-looking expectations & capital spending plans disagree with him. The Math is the math.

And the $KAP production peak squares with its capital spending plans.

@ItsWarrenIrwin keeps repeating that $KAP will be able to ramp up production whenever they like, but the forward-looking expectations & capital spending plans disagree with him. The Math is the math.

11/22

If you don't believe Mike Alkin's data models regarding $KAP's #Uranium production, read the words from Kazatamprom themselves...

Remember, this was well before Japanese restarts, multiple life extensions, SMRs & enormous new build programs recently announced by the DOE.

If you don't believe Mike Alkin's data models regarding $KAP's #Uranium production, read the words from Kazatamprom themselves...

Remember, this was well before Japanese restarts, multiple life extensions, SMRs & enormous new build programs recently announced by the DOE.

12/22

This used to be the future deficit outlook of the supply/demand if LT #U3O8 prices stay below $45. It included Cigar Lake online in 2020 & $KAP at FULL production.

It did not include higher inflation = higher incentive price + increased demand.

Extremely conservative 👀

This used to be the future deficit outlook of the supply/demand if LT #U3O8 prices stay below $45. It included Cigar Lake online in 2020 & $KAP at FULL production.

It did not include higher inflation = higher incentive price + increased demand.

Extremely conservative 👀

13/22

Let's crunch some more numbers with @FootnotesFirst.

An even more conservative model:

1. $KAP FULL production

2. Cigar Lake online since 2020

3. McArthur Rive back online in 2023

4. Olympic Dam expansion added

Again, this does not include the increased demand outlook.

Let's crunch some more numbers with @FootnotesFirst.

An even more conservative model:

1. $KAP FULL production

2. Cigar Lake online since 2020

3. McArthur Rive back online in 2023

4. Olympic Dam expansion added

Again, this does not include the increased demand outlook.

14/22

@sachemcove:

#Uranium price is EVERYTHING, don't confuse costs with required selling prices.

"Oh yeah, of that ~140Mlbs with AISC below $50, 23Mlbs are on care & maintenance, and another 3Mlbs depletes within a couple of years."

@sachemcove:

#Uranium price is EVERYTHING, don't confuse costs with required selling prices.

"Oh yeah, of that ~140Mlbs with AISC below $50, 23Mlbs are on care & maintenance, and another 3Mlbs depletes within a couple of years."

15/22

Many proponents of the bear thesis only cite new mine builds, but #Uranium mines don't last forever. And the further along they are in time the higher the costs to mine the ore. In their deck, @SachemCove covers the production cuts & planned closures of current producers.

Many proponents of the bear thesis only cite new mine builds, but #Uranium mines don't last forever. And the further along they are in time the higher the costs to mine the ore. In their deck, @SachemCove covers the production cuts & planned closures of current producers.

16/22

Many bear thesis proponents point towards $NXE's production start as a catalyst that might saturate the supply side, but none of them mention the Lbs that permanently go offline due to depletion.

If $NXE goes online in 2029/2030.

Cigar Lake goes offline at the same time.

Many bear thesis proponents point towards $NXE's production start as a catalyst that might saturate the supply side, but none of them mention the Lbs that permanently go offline due to depletion.

If $NXE goes online in 2029/2030.

Cigar Lake goes offline at the same time.

17/22

Only higher LT prices can solve the staggering deficits caused by contracting apathy. The risk has transferred from suppliers to nuclear utilities.

Remember, this was before the Ukraine war, the Energy Crisis, the Nuclear Renaissance, restarts, life extensions, SMRs, etc.

Only higher LT prices can solve the staggering deficits caused by contracting apathy. The risk has transferred from suppliers to nuclear utilities.

Remember, this was before the Ukraine war, the Energy Crisis, the Nuclear Renaissance, restarts, life extensions, SMRs, etc.

18/22

@SachemCove & @FootnotesFirst models showed that LT contracting had to start soon again as it had fallen below consumption in 2013 and never got above again.

In 2022 we started a new LT contracting cycle which started at the highest #Uranium price starting point ever...

@SachemCove & @FootnotesFirst models showed that LT contracting had to start soon again as it had fallen below consumption in 2013 and never got above again.

In 2022 we started a new LT contracting cycle which started at the highest #Uranium price starting point ever...

19/22

All of this while Global #Uranium deliveries were declining precipitously & incentive prices have gone well above $50lbs due to higher inflation since 2020 QE & low rates environment. Let alone the Ukraine war bifurcation which will keep playing a role in #U308 deliveries.

All of this while Global #Uranium deliveries were declining precipitously & incentive prices have gone well above $50lbs due to higher inflation since 2020 QE & low rates environment. Let alone the Ukraine war bifurcation which will keep playing a role in #U308 deliveries.

20/22

In 2020, pre-Ukraine war & Energy Crisis, this @sachemcove deck stated that Utility security of supply was low. It is way lower now.

Mike Alkin & Co thought that history will at least rhyme with the previous cycle. Remember, this was in 2020...

Rhyme, repeat, or beat?

In 2020, pre-Ukraine war & Energy Crisis, this @sachemcove deck stated that Utility security of supply was low. It is way lower now.

Mike Alkin & Co thought that history will at least rhyme with the previous cycle. Remember, this was in 2020...

Rhyme, repeat, or beat?

21/22

Remember, 2.3 years #Uranium inventories won't bail utilities out this time. Not in a high supply risk phase.

@Sachemcove:

"Utilities can pay producers more now or pay them more later – but one way or another, they’re going to pay them more."

Remember, 2.3 years #Uranium inventories won't bail utilities out this time. Not in a high supply risk phase.

@Sachemcove:

"Utilities can pay producers more now or pay them more later – but one way or another, they’re going to pay them more."

22/22

Here is the link to the @MacroVoices podcast transcript: macrovoices.com/podcast-transc…

And the LINK to the @SachemCove deck PDF: macrovoices.com/guest-content/…

Here is the link to the @MacroVoices podcast transcript: macrovoices.com/podcast-transc…

And the LINK to the @SachemCove deck PDF: macrovoices.com/guest-content/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh