#NEW Ed Pinto at AEI reaffirms his national home price outlook:

“We project a cumulative [U.S. home price] decline from the Jun 2022 peak of -10% to 0%, and -5% to +5% by year end 2023 and 2024 respectively.”

“We project a cumulative [U.S. home price] decline from the Jun 2022 peak of -10% to 0%, and -5% to +5% by year end 2023 and 2024 respectively.”

Heading into the year, AEI was more bearish. But that changed as their outlook for mortgage rates got less bearish.

https://twitter.com/NewsLambert/status/1610811834587561986

AEI has national prices up 1.2% MoM in Feb.

I don’t closely follow the AEI HPI readings. On their website, they call it “a quasi repeat sales index with a hedonic element.”

I don’t closely follow the AEI HPI readings. On their website, they call it “a quasi repeat sales index with a hedonic element.”

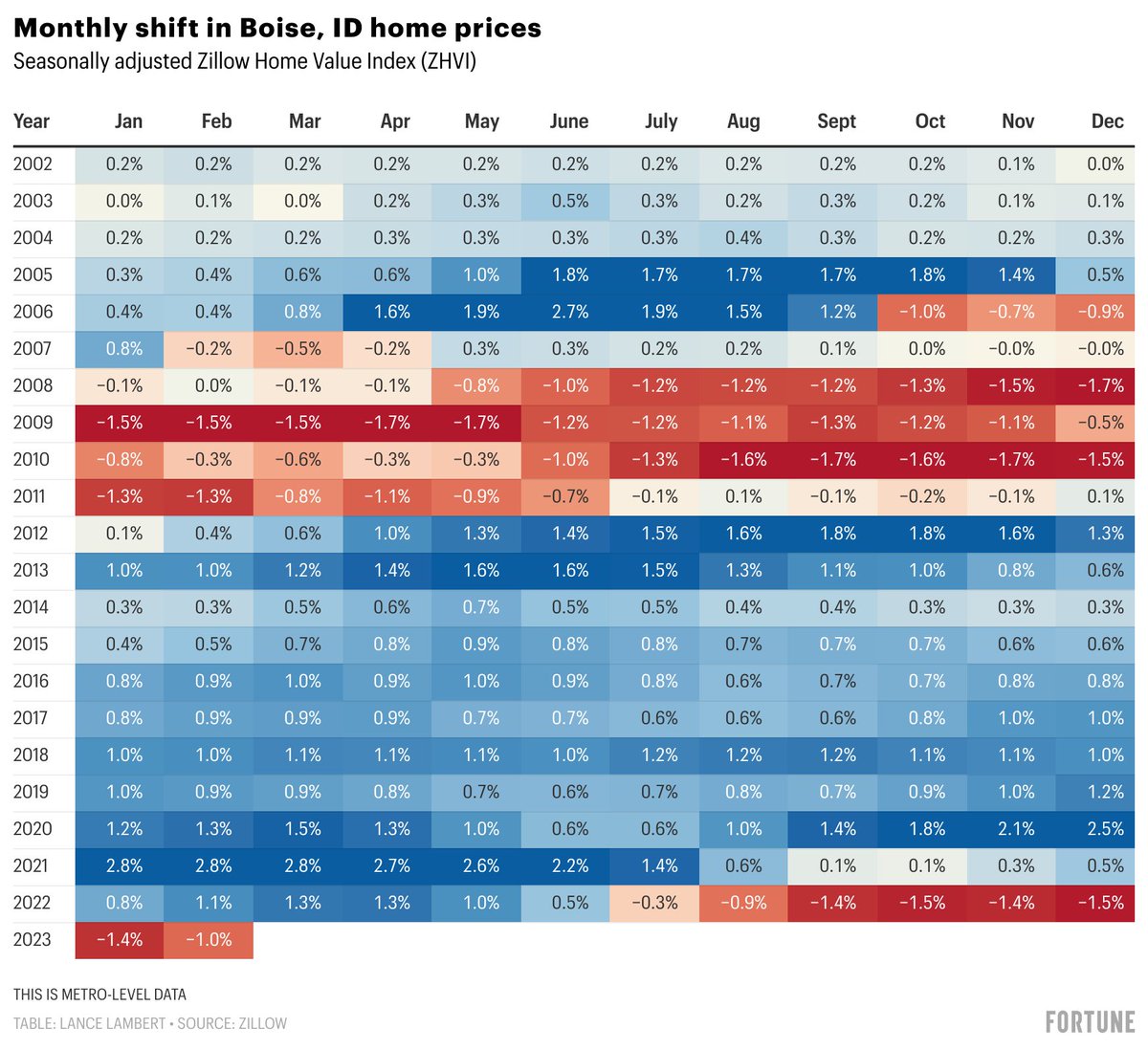

Unlike the Case-Shiller and ZHVI data I share frequently, the AEI HPA doesn’t appear to be seasonally adjusted.

• • •

Missing some Tweet in this thread? You can try to

force a refresh