@FINRA in relations to your modified Q&A regarding $MMTLP, can you provide:

1. Proof of the "coding issues"(screenshot);

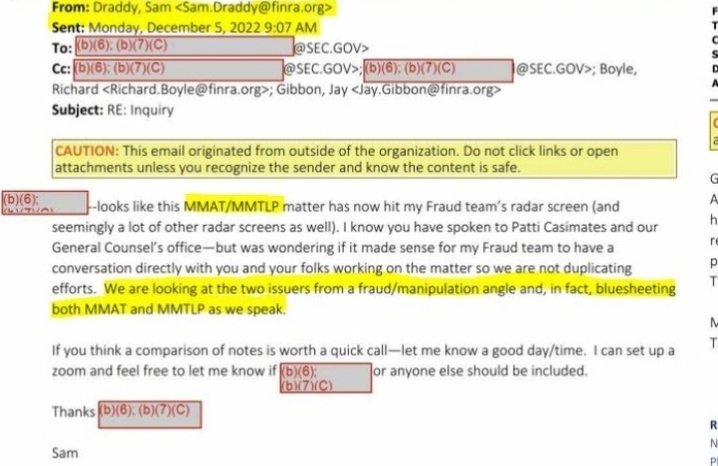

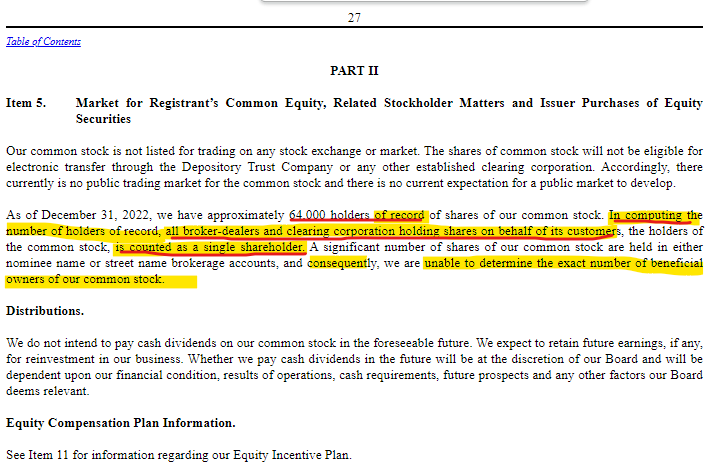

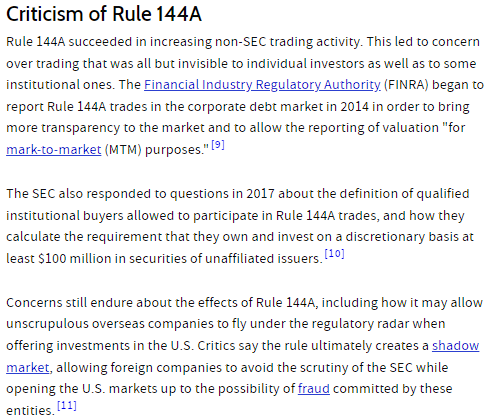

2. The names of the broker-dealer(s) that relied on an exception to SEC Rule 15c2-11 to get $mmtlp to trade contrary to the instructions of the company CEOs;

1. Proof of the "coding issues"(screenshot);

2. The names of the broker-dealer(s) that relied on an exception to SEC Rule 15c2-11 to get $mmtlp to trade contrary to the instructions of the company CEOs;

@FINRA 3. The CEO's & Retail alerted @finra of $mmtlp illegally trading, why didn't @finra issue a halt to explain the situation as you did in this Q&A to "protect" investors?

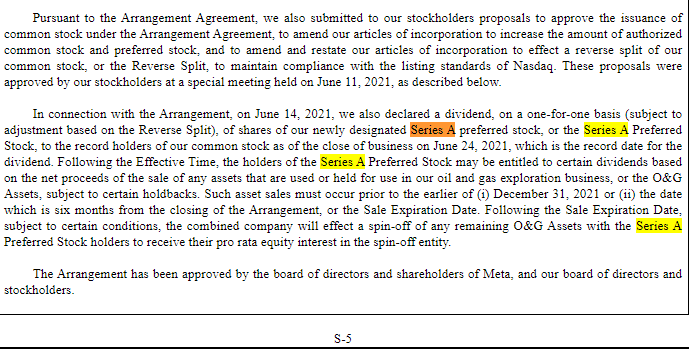

4. MMTLP given to TRCH holders prior to merger with MMAT. Original S1 states MMTLP wud get divi from sale of… twitter.com/i/web/status/1…

4. MMTLP given to TRCH holders prior to merger with MMAT. Original S1 states MMTLP wud get divi from sale of… twitter.com/i/web/status/1…

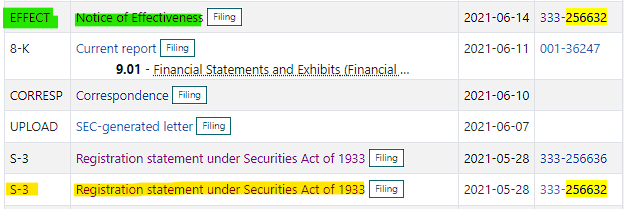

@FINRA 5. Who issued $MMTLP a cusip?

@OptionsClearing

memo# 48884 - June 21, 2021

memo# 48904 - June 25, 2021

No Cusip or Ticker: "TBA".

memo# 49379 - Oct 8, 2021

memo# 49380 - Oct 12, 2021

had Ticker MMTLP with cusip#: 59134N203

- CNS NOT eligible & must clear Broker to Broker

@OptionsClearing

memo# 48884 - June 21, 2021

memo# 48904 - June 25, 2021

No Cusip or Ticker: "TBA".

memo# 49379 - Oct 8, 2021

memo# 49380 - Oct 12, 2021

had Ticker MMTLP with cusip#: 59134N203

- CNS NOT eligible & must clear Broker to Broker

Oct 6, 2021 --> $mmtlp starts trading

Oct 8 @OptionsClearing Memo# 49379 - stating mmtlp is NOT CNS eligible & must settle B2B.

Did members notify OCC they are unable to settle?

Oct 12 @OptionsClearing Memo# 49388 -"MMTLP component of MMAT1 options will settle through NSCC"

Oct 8 @OptionsClearing Memo# 49379 - stating mmtlp is NOT CNS eligible & must settle B2B.

Did members notify OCC they are unable to settle?

Oct 12 @OptionsClearing Memo# 49388 -"MMTLP component of MMAT1 options will settle through NSCC"

@OptionsClearing Oct 12, 2021 Memo# 49388 states that "MMTLP component of MMAT1 options will settle through NSCC."

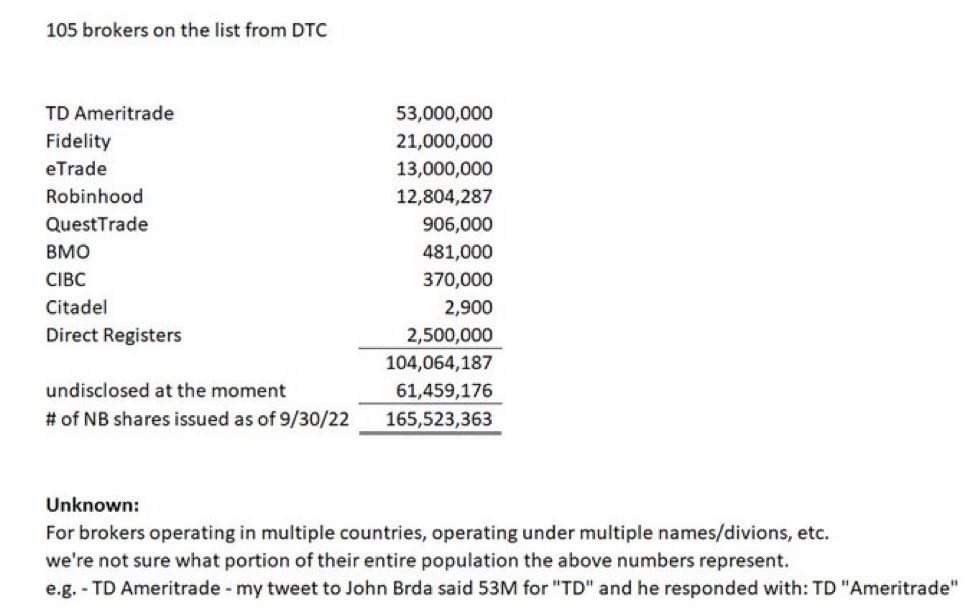

6. Why wud Broker Dealers need $MMTLP to settle through NSCC if settlement sud have occurred with the Merger of $TRCH & $MMAT?

7. @The_DTCC is NSCC implicated in short $mmtlp?

6. Why wud Broker Dealers need $MMTLP to settle through NSCC if settlement sud have occurred with the Merger of $TRCH & $MMAT?

7. @The_DTCC is NSCC implicated in short $mmtlp?

@OptionsClearing @The_DTCC 8. Why did @finra issue the U3 halt on $MMTLP on December 9, 2022, if December 8 was the last day for it to trade?

Finra notices dated Dec 6 & 8 INSTRUCTED investors that purchases can be made after Dec 8, but in doing so, the investor will NOT receive the distribution of NBH

Finra notices dated Dec 6 & 8 INSTRUCTED investors that purchases can be made after Dec 8, but in doing so, the investor will NOT receive the distribution of NBH

@OptionsClearing @The_DTCC @FINRA Now, @finra is claiming, that it issued the U3 halt to protect investors from @finra's own Instructions INSTRUCTING investors that they can purchase $MMTLP after December 8.

9. Did @finra revisions of the Dec 6 notice to the Dec 8 notice, protect the shorters @cromwellc ?

9. Did @finra revisions of the Dec 6 notice to the Dec 8 notice, protect the shorters @cromwellc ?

• • •

Missing some Tweet in this thread? You can try to

force a refresh