STRICTLY ENTERTAINMENT

NOT FINANCIAL OR LEGAL ADVICE

NFT Work : https://t.co/Gtz98RJIXb…

YouTube: https://t.co/pfnGk7qTrz

http://truth

How to get URL link on X (Twitter) App

$mmtlp "The deposit losses at JPMorgan Chase, Bank of America and Wells Fargo ($464.7 billion) are more than twice of 4,000 small banks lost in total during the same period. Their combined loss in deposits was just $210 billion."

$mmtlp "The deposit losses at JPMorgan Chase, Bank of America and Wells Fargo ($464.7 billion) are more than twice of 4,000 small banks lost in total during the same period. Their combined loss in deposits was just $210 billion."

https://twitter.com/ModyMarc/status/1638342382914502657?t=eIfF8ofDZq0LOHT4ESG9jg&s=19

$mmtlp

$mmtlphttps://twitter.com/ModyMarc/status/1638345772457422848?t=y9kyclwNwM-TJof07wnYSw&s=19

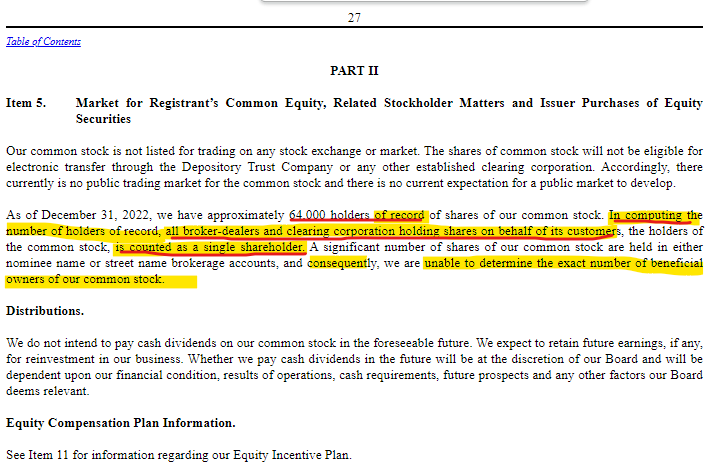

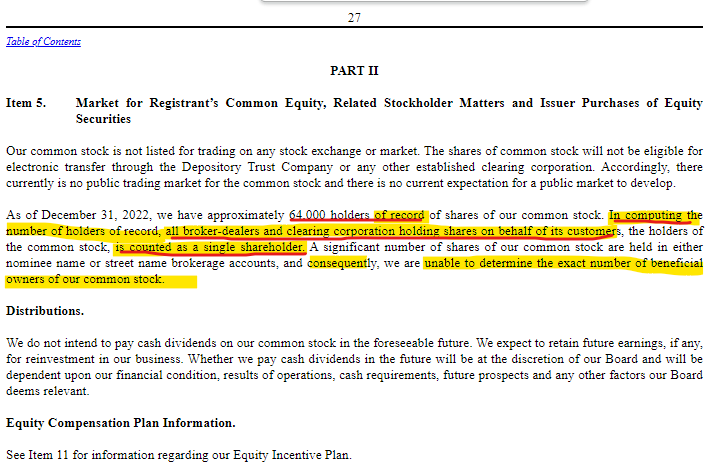

64,000 NBH common stock holders, "INCLUDES" broker-dealers & clearing corporations as "SINGLE SHAREHOLDERS"

64,000 NBH common stock holders, "INCLUDES" broker-dealers & clearing corporations as "SINGLE SHAREHOLDERS"

https://twitter.com/ModyMarc/status/1640477498163994626?s=20

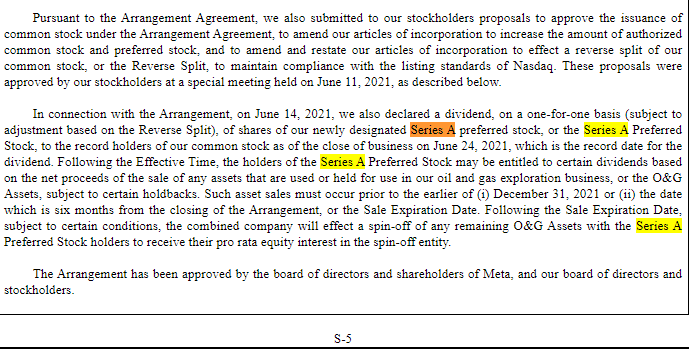

@FINRA Exceptions for SEC RULE 15c2-11 do NOT apply to non-tradable Series A preferred Dividend shares, dividend shares which were specifically made & approved by the @SECGov for investors to receive a dividend from the sale of Oil & Gas assets which were then spun off into NBH; $mmtlp

@FINRA Exceptions for SEC RULE 15c2-11 do NOT apply to non-tradable Series A preferred Dividend shares, dividend shares which were specifically made & approved by the @SECGov for investors to receive a dividend from the sale of Oil & Gas assets which were then spun off into NBH; $mmtlp

@FINRA 3. The CEO's & Retail alerted @finra of $mmtlp illegally trading, why didn't @finra issue a halt to explain the situation as you did in this Q&A to "protect" investors?

@FINRA 3. The CEO's & Retail alerted @finra of $mmtlp illegally trading, why didn't @finra issue a halt to explain the situation as you did in this Q&A to "protect" investors?