Thread 🧵 1/22

Recently @CathieDWood and @balajis both made claims that Bitcoin could reach $1mm in the relatively near future.

I wanted to ascertain how realistic these may be based on some modeling.

Let's begin 👇

Recently @CathieDWood and @balajis both made claims that Bitcoin could reach $1mm in the relatively near future.

I wanted to ascertain how realistic these may be based on some modeling.

Let's begin 👇

2/22

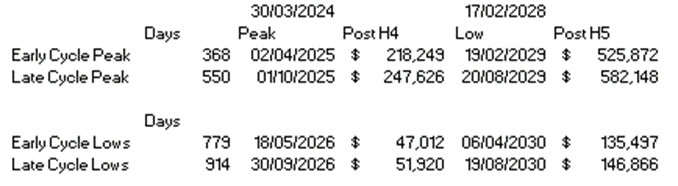

When using Days from the Bitcoin Halving (where the inflation rate of new Bitcoins is halves); we can see that Bitcoin peaks around 368-550 days post halving and then bottoms 779-914 days post cycle.

decentrader.com/charts/bull-ma…

When using Days from the Bitcoin Halving (where the inflation rate of new Bitcoins is halves); we can see that Bitcoin peaks around 368-550 days post halving and then bottoms 779-914 days post cycle.

decentrader.com/charts/bull-ma…

3/22

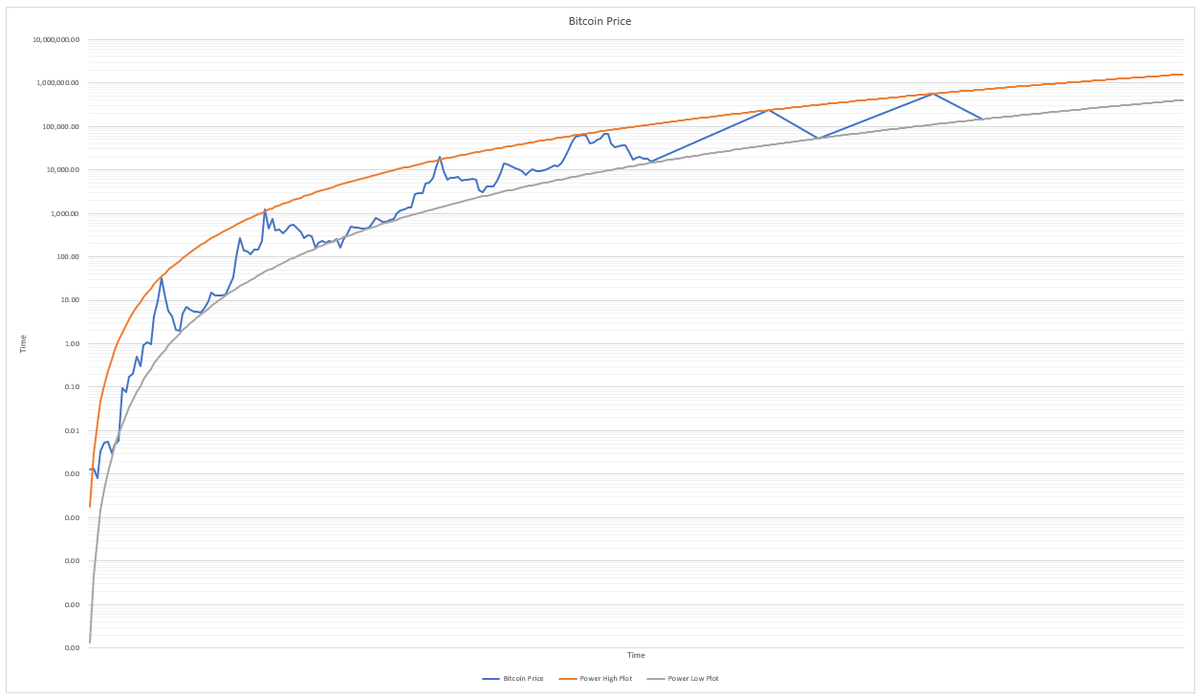

Using the Bitcoin cycle high and low prices we can derive the well-known Bitcoin “price curve”, with upper and lower values, both of which have a power line of best fit with an R2 or >99%

Using the Bitcoin cycle high and low prices we can derive the well-known Bitcoin “price curve”, with upper and lower values, both of which have a power line of best fit with an R2 or >99%

4/22

Let's make an assumption:

Bitcoin price behaves in a cyclical nature, largely defined in terms of time by the Bitcoin halving, which has a following period of price exuberance and subsequent decline, which happens on a timely basis, largely dictated by the halving itself.

Let's make an assumption:

Bitcoin price behaves in a cyclical nature, largely defined in terms of time by the Bitcoin halving, which has a following period of price exuberance and subsequent decline, which happens on a timely basis, largely dictated by the halving itself.

5/22

By combining expected halving dates and days to cycle tops and cycle bottoms alongside extrapolated regression of price data, it is possible to use this model in predicting where Bitcoin price may reside at the peak and trough of future cycles. It looks like this:

By combining expected halving dates and days to cycle tops and cycle bottoms alongside extrapolated regression of price data, it is possible to use this model in predicting where Bitcoin price may reside at the peak and trough of future cycles. It looks like this:

6/22

Assuming Bitcoin Peaks and troughs in a similar fashion to before; here is the key outcomes for the next two cycles based off this model.

>$200k 2025, and $500k in 2029.

Assuming Bitcoin Peaks and troughs in a similar fashion to before; here is the key outcomes for the next two cycles based off this model.

>$200k 2025, and $500k in 2029.

7/22

Just how reasonable are these prices? an obviously well-contested area of debate

let's look at recent developments; as we know, Bitcoin was created after ’08 as an answer to the banking crisis as a decentralized hard money asset with a fixed monetary policy.

Just how reasonable are these prices? an obviously well-contested area of debate

let's look at recent developments; as we know, Bitcoin was created after ’08 as an answer to the banking crisis as a decentralized hard money asset with a fixed monetary policy.

8/22

Recently, while recently Silvergate and SVB collapsed, Bitcoin saw price appreciation as a flight to safety.

Recently, while recently Silvergate and SVB collapsed, Bitcoin saw price appreciation as a flight to safety.

9/22

Why is this important?

Wealth is mid-transfer from the Boomer generation to the Millennials, who will look to protect their assets like all other generations.

They are likely to do this via means they are familiar with – i.e. digital means.

Why is this important?

Wealth is mid-transfer from the Boomer generation to the Millennials, who will look to protect their assets like all other generations.

They are likely to do this via means they are familiar with – i.e. digital means.

10/22

Tom lee @fundstrat explains this brilliantly in 2018 and this video is still one of the best investment thesis examples which i still share to this day.

I urge you all to watch this (after finishing the thread ;P)

Tom lee @fundstrat explains this brilliantly in 2018 and this video is still one of the best investment thesis examples which i still share to this day.

I urge you all to watch this (after finishing the thread ;P)

11/22

Lets talk about Gold:

The Gold market cap is effectively unknown as the total quantity of Gold is unknown, but it is estimated to be around $13 Trillion.

For reference, to capture this entire market, Bitcoin would reside around $670k.

Lets talk about Gold:

The Gold market cap is effectively unknown as the total quantity of Gold is unknown, but it is estimated to be around $13 Trillion.

For reference, to capture this entire market, Bitcoin would reside around $670k.

12/22

If we assume Millennials adopted a digital store of value and Gold was dropped entirely, $670k would roughly be the value of a Bitcoin today.

If we assume Millennials adopted a digital store of value and Gold was dropped entirely, $670k would roughly be the value of a Bitcoin today.

13/22

So we know that Bitcoin has room to grow – will it replace gold entirely?

– Unlikely; gold has commercial properties which Bitcoin does not, however, Bitcoin also has properties Gold does not – e.g. it's easily transferable and difficult to confiscate.

So we know that Bitcoin has room to grow – will it replace gold entirely?

– Unlikely; gold has commercial properties which Bitcoin does not, however, Bitcoin also has properties Gold does not – e.g. it's easily transferable and difficult to confiscate.

14/22

Gold as a flight to safety is a bit of an enigma – it has not meaningfully broken higher since 2011, yet the money supply has increased by 132% over the same period.

tradingview.com/x/BhJjfEd1/

Gold as a flight to safety is a bit of an enigma – it has not meaningfully broken higher since 2011, yet the money supply has increased by 132% over the same period.

tradingview.com/x/BhJjfEd1/

15/22

This means that there is a detachment between the inflation of money and the value of the risk assets backing up that money (debt).

This means that there is a detachment between the inflation of money and the value of the risk assets backing up that money (debt).

16/22

Therefore, if we assume that the risk off assets are under-priced, it’s reasonable to assume that a correction may occur, particularly in times of heightened risk, which is arguably why gold looks set to break out higher towards $3k.

tradingview.com/x/1ZPAgZZE/

Therefore, if we assume that the risk off assets are under-priced, it’s reasonable to assume that a correction may occur, particularly in times of heightened risk, which is arguably why gold looks set to break out higher towards $3k.

tradingview.com/x/1ZPAgZZE/

17/22

Over time, I suspect that two things will happen; a repricing of risk (and therefore the assets which represent risk-off) and a shift from physical to digital, in the same way, we have seen with everything else.

Over time, I suspect that two things will happen; a repricing of risk (and therefore the assets which represent risk-off) and a shift from physical to digital, in the same way, we have seen with everything else.

18/22

Put the two together and it would suggest increasing the market share of Bitcoin in an increasing value pool undergoing repricing.

Put the two together and it would suggest increasing the market share of Bitcoin in an increasing value pool undergoing repricing.

19/22

So let's address the questions around $1mm Bitcoin!

According to this Model, Bitcoin would Hit $1m no sooner than 2032.

@CathieDWood is probably making similar assumptions as this model.

They are not unreasonable and it is effectively within the realms of possibility

So let's address the questions around $1mm Bitcoin!

According to this Model, Bitcoin would Hit $1m no sooner than 2032.

@CathieDWood is probably making similar assumptions as this model.

They are not unreasonable and it is effectively within the realms of possibility

20/22

Personal thoughts:

Bitcoin is likely to see a tapering effect with its price over time, which is only natural and to be expected as there is a ceiling.

I do not think that we have yet seen a seismic shift toward digitally stored value, despite being on course to do so

Personal thoughts:

Bitcoin is likely to see a tapering effect with its price over time, which is only natural and to be expected as there is a ceiling.

I do not think that we have yet seen a seismic shift toward digitally stored value, despite being on course to do so

21/22

My gut feel is that the bottom of the curve is more reliable and a better assessment of value and would be a better place for most long-view investors to be placing their focus – the rising tide.

My gut feel is that the bottom of the curve is more reliable and a better assessment of value and would be a better place for most long-view investors to be placing their focus – the rising tide.

22/22

I recently stated $180k is the target next cycle; I will stick to that for now.

I hope you found this interesting. If you want to know the highs and lows for whatever reason ill respond in the comments.

I recently stated $180k is the target next cycle; I will stick to that for now.

I hope you found this interesting. If you want to know the highs and lows for whatever reason ill respond in the comments.

What should go without saying here is the following:

- This is a model

- This does not guarantee anything in the future

- Do your own research

- Stuff goes up and down this is ultimately a guess and not gospel.

- This is a model

- This does not guarantee anything in the future

- Do your own research

- Stuff goes up and down this is ultimately a guess and not gospel.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter