A bipartisan bill called the #RestrictAct has been proposed by Mark Warner of Virginia & John Thune of South Dakota, to protect national security and ending foreign adversaries. Apps like TikTok to be banned from misusing American consumer data or … twitter.com/i/web/status/1…

Are you a VPN user in USA… too bad #RestrictAct could get you decades in jail for using VPN 🤷♂️

The #RestrictAct gives sweeping powers to the secretary of commerce and the president (the executive branch) to take appropriate measures against people/products/services they deem threaten national security.

The powers that #RestrictAct gives over citizens and foreign nationals are unprecedented.

Civil violations can result in penalties up to $250,000 or twice the amount of transaction committed, whichever is greater.

Criminal penalties can get you fines up to $1,000,000 and up to… twitter.com/i/web/status/1…

Civil violations can result in penalties up to $250,000 or twice the amount of transaction committed, whichever is greater.

Criminal penalties can get you fines up to $1,000,000 and up to… twitter.com/i/web/status/1…

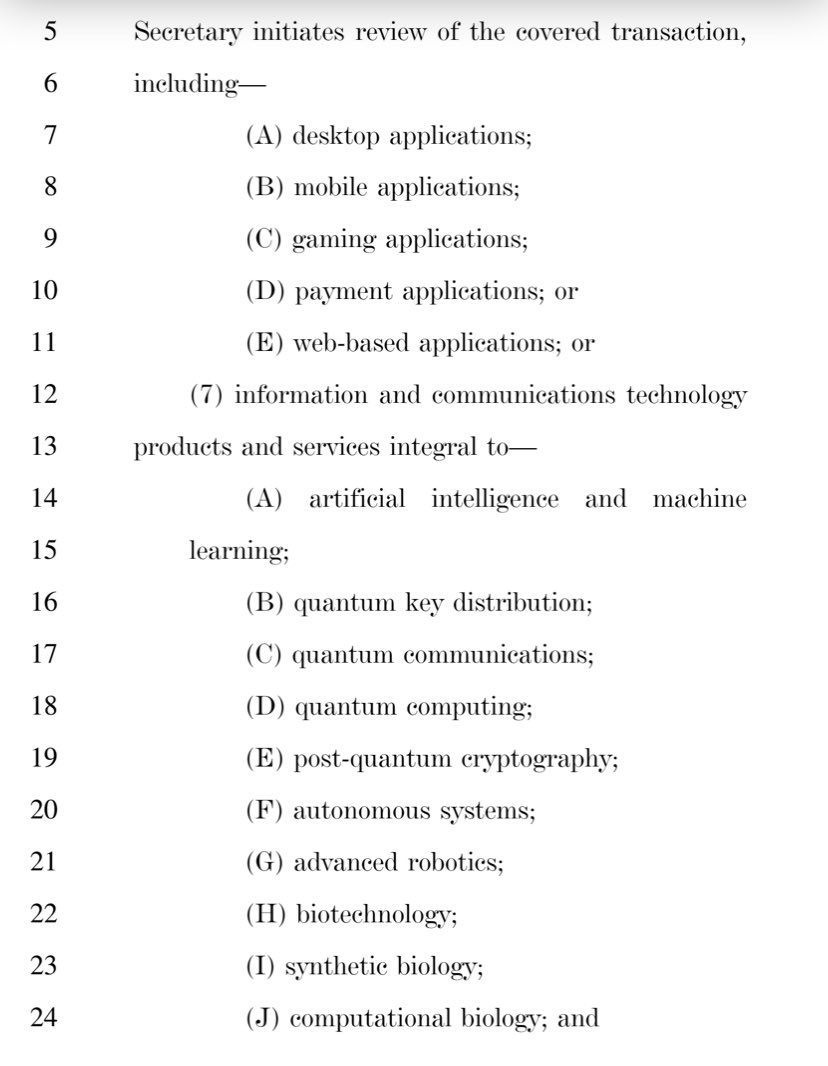

The adversary elements in this bill are so vast, you might as well kiss your innovation goodbye in the USA. This might apply AI, ML, Quantum computing and even cryptography.

Blockchain & Crypto projects would be under the purview of this bill 😱

Blockchain & Crypto projects would be under the purview of this bill 😱

The #RestrictAct aids the American #Government in restricting citizens rights & liberties, turn itself into a totalitarian surveillance state just like China, which it’s trying to stop.

The #RestrictAct will morph America into China a totalitarian state.

The #RestrictAct is the #PatriotAct on steroids and you all know what powers and rights you lost with patriot act 🤷♂️

The #RestrictAct is not just limited to TikTok it’s much more than that

https://twitter.com/lpmisescaucus/status/1639934790026555394

If #RestrictAct gets passed you might as well leave America, it’s that bad

#RestrictAct isn’t about banning TikTok, it’s controlling the entirety of your internet & digital presence

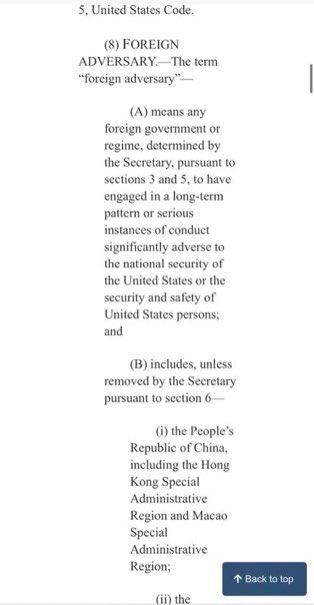

And who are the foreign adversaries. BTW this list isn’t complete, your executive branch can deem any individual or country or an entity an adversary at anytime 🤷♂️

You’ll be a complete clown puppet in the hands of your master & controller the #BigBrother after the #RestrictAct gets passed into law 🤷♂️

🚨🚨🚨🚨🚨🚨🚨🚨🚨🚨🚨🚨

The RESTRICT ACT S 686 is a massive violation of our 4th Amendment Rights and a complete Nationalization of the internet.

@SenateGOP if you attempt to pass this Bill, you will be sealing the nail in the coffin of Freedom and … twitter.com/i/web/status/1…

The RESTRICT ACT S 686 is a massive violation of our 4th Amendment Rights and a complete Nationalization of the internet.

@SenateGOP if you attempt to pass this Bill, you will be sealing the nail in the coffin of Freedom and … twitter.com/i/web/status/1…

Google Trends for #RESTRICTAct is at the highest levels. What does this mean -- lots of people of scared to see their freedoms erode away with this act.

The #RESTRICTAct isn’t about TikTok

The #RESTRICTAct is about your freedom & privacy on the internet

The #RESTRICTAct is #PatriotAct on steroids.

The #RESTRICTAct is about your freedom & privacy on the internet

The #RESTRICTAct is #PatriotAct on steroids.

#RESTRICTAct isn’t about TikTok

• • •

Missing some Tweet in this thread? You can try to

force a refresh