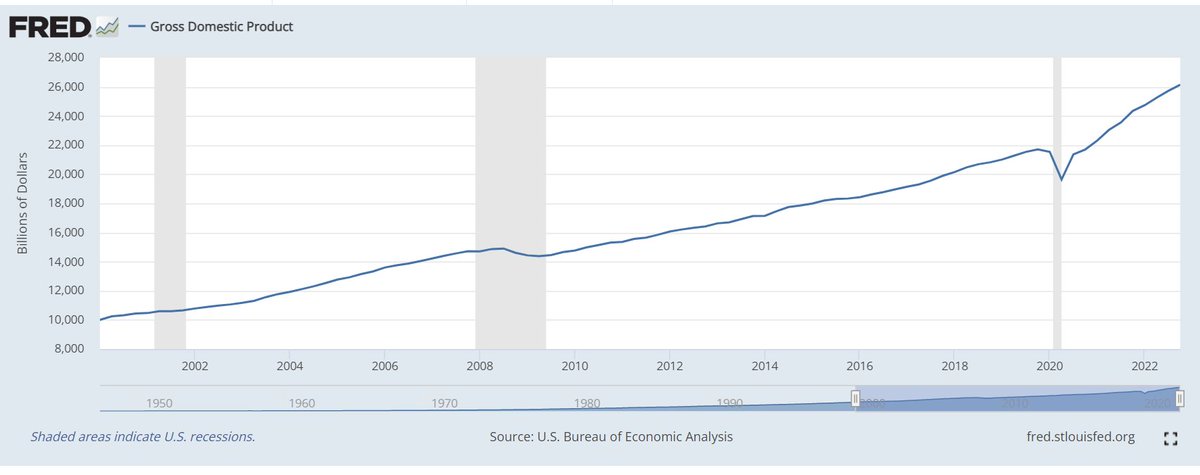

The US economy is increasingly de-coupled from fossil fuels and the FF industry increasingly depends on exports. Which means propping up the FF sector - as the #PollutersOverPeople Act does - is increasingly at odds with with the interests of American energy consumers.

https://twitter.com/RepCasten/status/1641093918300205060

(I'm only going to 2021 because the energy reporting data lags a bit, but bear with me)

2. US Natural gas consumption over the same 2010 - 2021 period is up just slightly over 25%. Only growing half as fast as GDP.

3. US Petroleum consumption is flat over the period. Was rising slowly, collapsed during COVID and hasn't recovered.

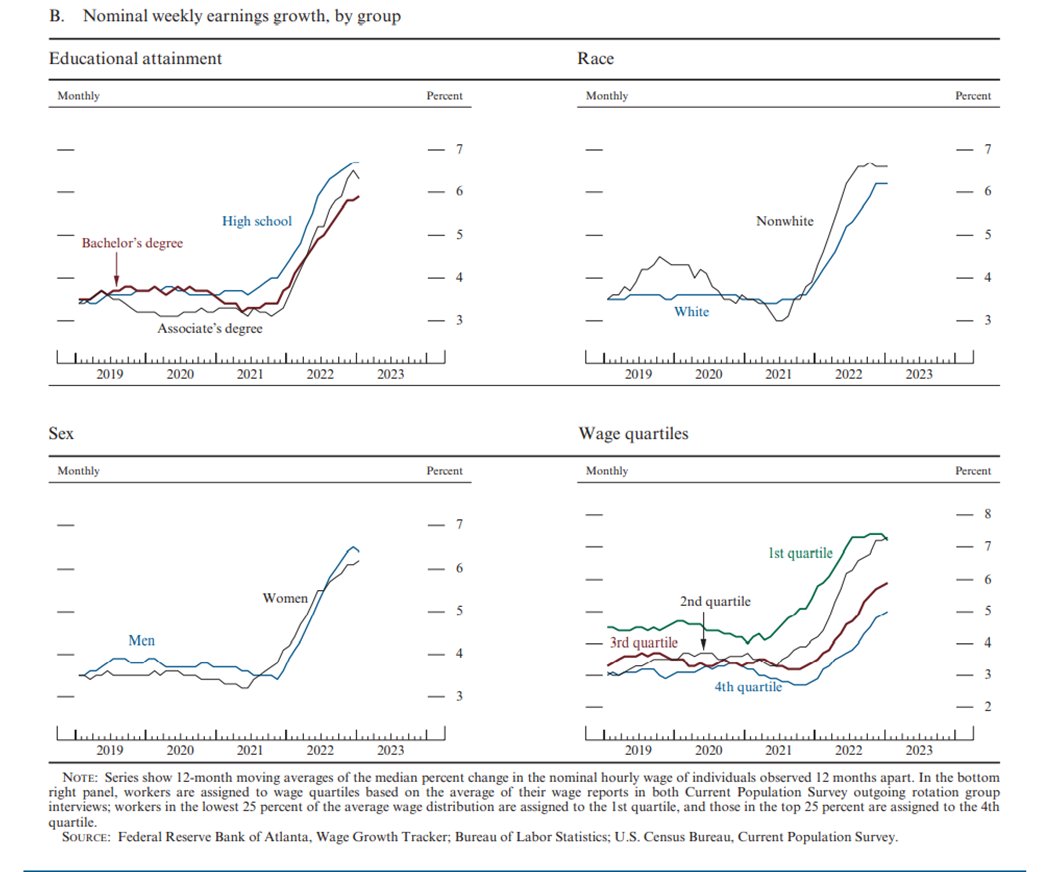

4. A big part of the reason for the flat oil sales in the United States is because people have figured out how to drive without buying gasoline. It's pretty awesome.

6. As I noted in my speech, this is really great news. There was a debate for a long time about whether rising GDP = rising fossil fuel use = rising pollution. We are proving that we can decouple the two. Not fast enough, but it's happening.

7. And it is NOT because we're using less energy. It's because we've figured out how to meet our needs for light, warmth and mobility without fossil fuels. That is a BFD.

https://twitter.com/SeanCasten/status/1627703062604161027?s=20

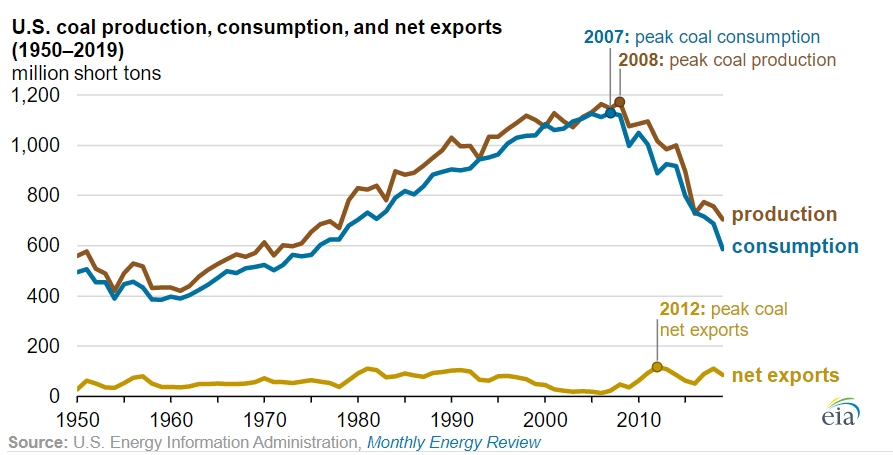

8. So why is the fossil fuel industry making so much money, even as they lose domestic market share? Because they're now strip mining the US for export. Look at the surge in US petroleum exports.

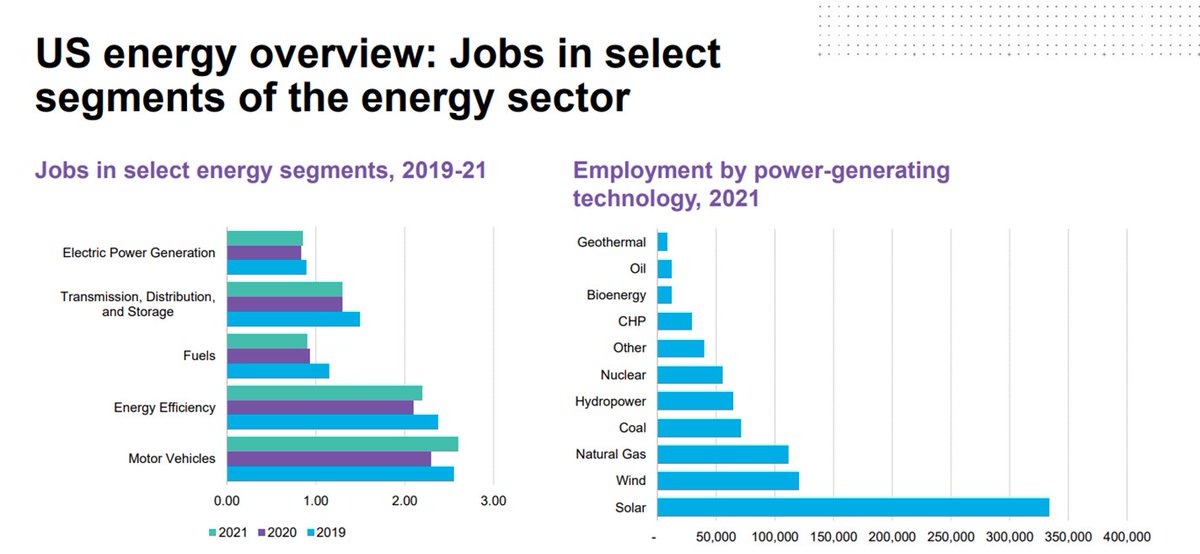

10. IOW: the interests of the US fossil fuel industry are increasingly at odds with the interests of American energy consumers. The latter want cheap energy and are voting with their wallets to invest in solar, wind, efficiency, EVs, etc. The former want to export.

11. Moreover, since we are now net exporters of oil and gas, on the margin any additional Btu exported RAISES American energy prices. Because less domestic supply, all else equal = higher oil and gas price.

12. What the @HouseGOP has done then is to prioritize the interest of US energy exporters. Make it easier to permit wells, mines and export terminals so that we can ship more US fossil energy overseas and prop up an industry that can't otherwise compete domestically.

13. Look, there are very good reasons to oppose their bill purely on environmental grounds. I'd rather not live next to a strip mine after all. But the heck of it is, this is a pile of foolishness also on purely economic grounds. In every way, it puts #PollutersOverPeople.

14. Anyway, that's the data to support my floor speech. But if you'd rather just watch my soaring oratory without footnotes, do that here. Meantime, I'm getting ready to vote HELL no. /fin

https://twitter.com/RepCasten/status/1641093918300205060?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter