We finally got its name: ICT Silver Bullet Model

Video timestamps: [49:24 - 1:08:00]

ICT introduced this everyday trading model that always takes place between 10am & 11am EST last week on the "Until the Brakes Fall Off..."

In todays ICT Livestream we got a lot more info!

Video timestamps: [49:24 - 1:08:00]

ICT introduced this everyday trading model that always takes place between 10am & 11am EST last week on the "Until the Brakes Fall Off..."

In todays ICT Livestream we got a lot more info!

March 30, 2023 Live Tape Reading - AM Session

Video timestamps: [49:24 - 1:08:00]

Video timestamps: [49:24 - 1:08:00]

- Everyday between 10am & 11am EST

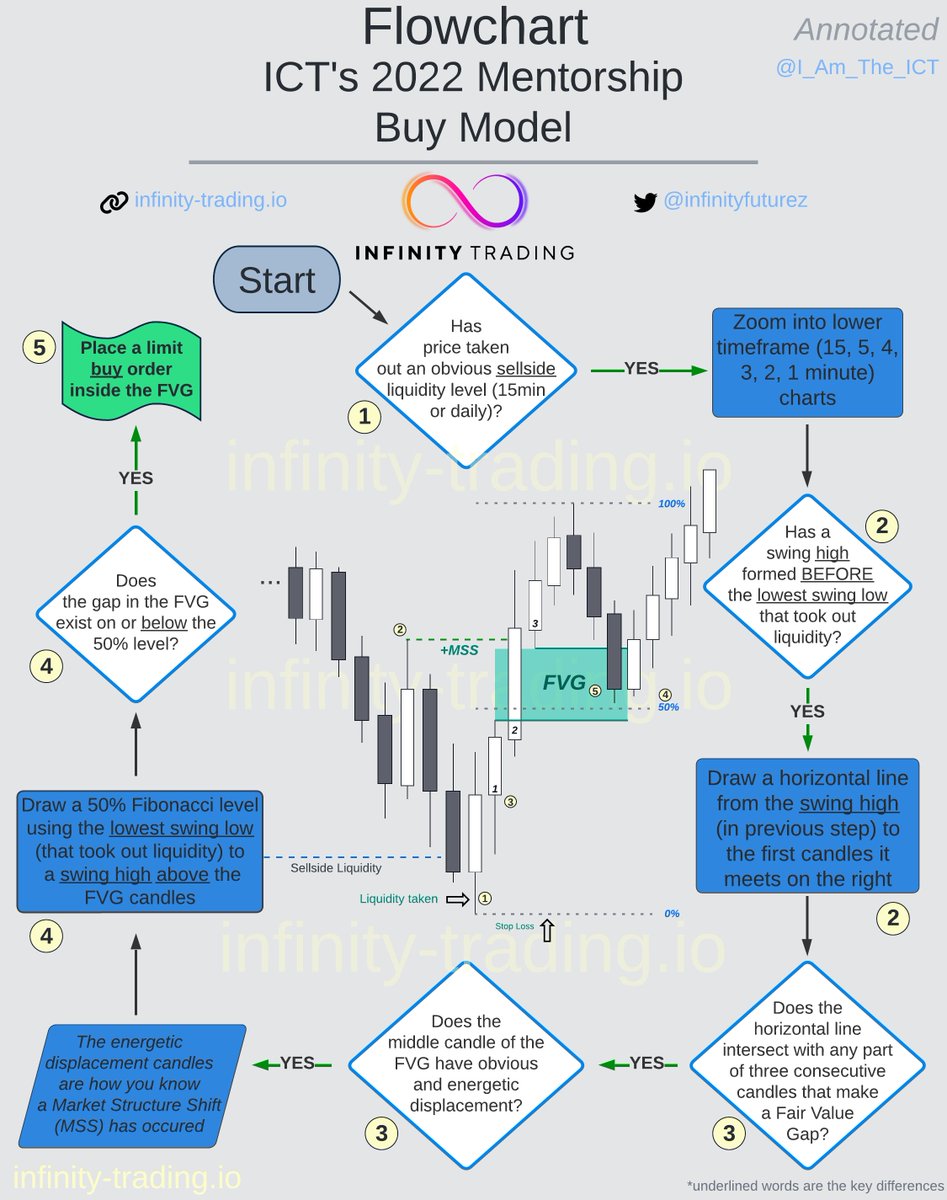

- Identify an obvious pool of liquidity that has not been tapped into or engaged

- Wait for displacement towards liquidity pool between 10am & 11am

- Find a FVG (FVG has to be opposite the targeted liquidity pool)

- Identify an obvious pool of liquidity that has not been tapped into or engaged

- Wait for displacement towards liquidity pool between 10am & 11am

- Find a FVG (FVG has to be opposite the targeted liquidity pool)

- Wait for price to trade back into FVG and then reprice out of the FVG towards the targeted pool of liquidity

- Then drop down to the 1-min, 30-sec, 15-sec chart and start looking for a second FVG

- Then drop down to the 1-min, 30-sec, 15-sec chart and start looking for a second FVG

- The next FVG you see on the 1-min, 30-sec, 15-sec chart (after price has traded back into the higher timeframe FVG) instantly enter the trade in the direction of the targeted liquidity pool

- Trader needs to validate whether the range from their potential FVG entry and Liquidity Pool is greater than 5 handles

- Take profit after 5 handles of profit (or liquidity pool reached)

- Take profit after 5 handles of profit (or liquidity pool reached)

Here is the link to the original Twitter Space where ICT introduced the ICT Silver Bullet

https://twitter.com/infinitytradeIO/status/1639828427162234881?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter