Futures Trader - ES, NQ, RTY, YM

Website @ https://t.co/MnSeSwuKCD

Not Financial Advice

4 subscribers

How to get URL link on X (Twitter) App

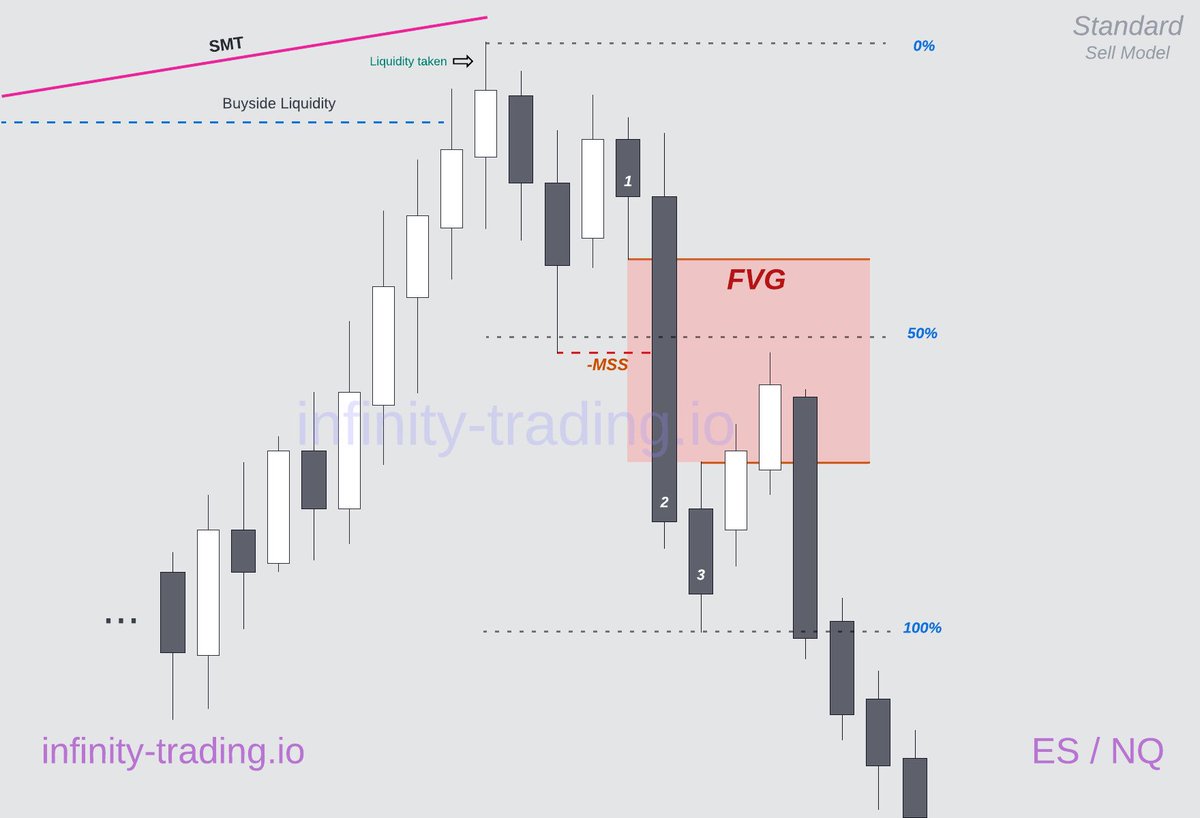

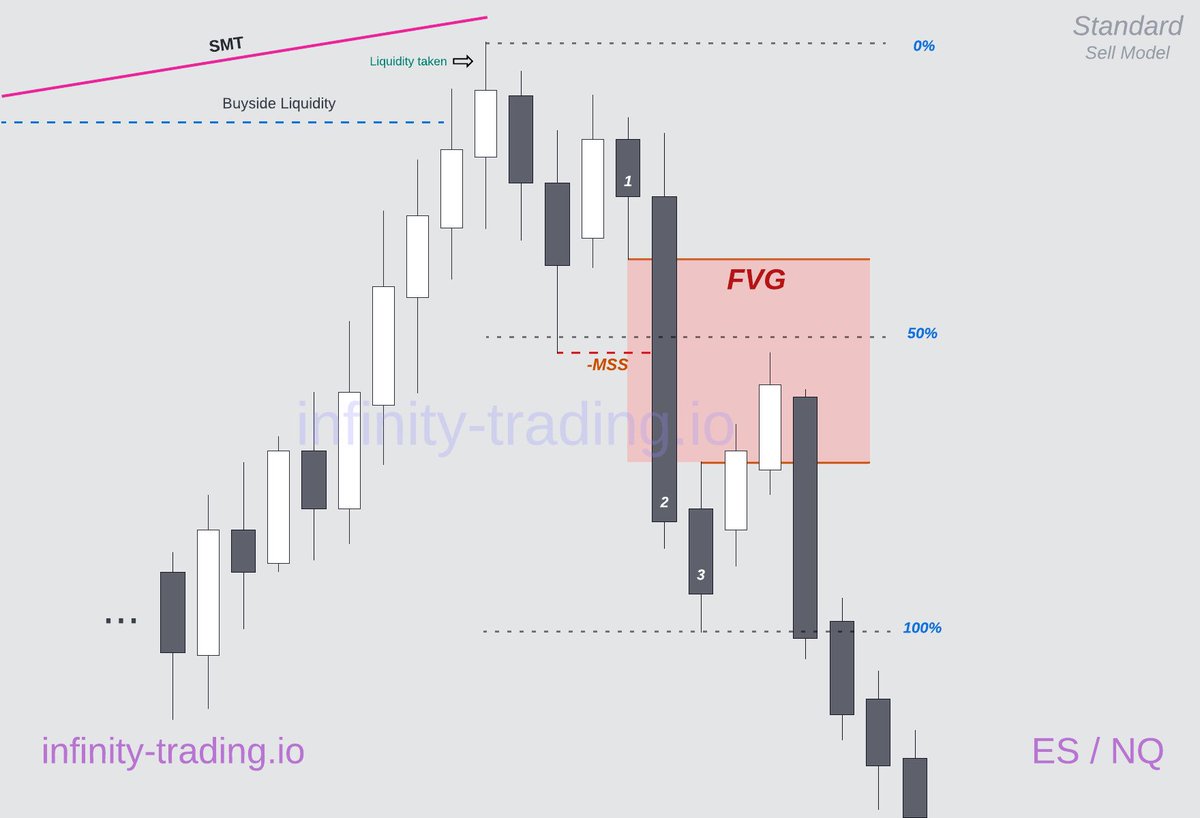

NQ was running up and it appeared that it would take out London Session Highs. Since I had a Bearish Bias (Weekly FVG below) I would start looking for an ICT 2022 Sell Model reversal

NQ was running up and it appeared that it would take out London Session Highs. Since I had a Bearish Bias (Weekly FVG below) I would start looking for an ICT 2022 Sell Model reversal

ICT said in the 2/21/2023 Livestream the following in the Implied FVG section:

ICT said in the 2/21/2023 Livestream the following in the Implied FVG section:

March 30, 2023 Live Tape Reading - AM Session

March 30, 2023 Live Tape Reading - AM Session

Turtle Soup is ICT's term for a false breakout of a Liquidity Pool. Price crosses the Liquidity Pool level and then quickly reverses back the other direction

Turtle Soup is ICT's term for a false breakout of a Liquidity Pool. Price crosses the Liquidity Pool level and then quickly reverses back the other direction

Example #1 A: 2/9/2023 (today)

Example #1 A: 2/9/2023 (today)

First off I had (what turned out to be) the correct Bias (which is the direction you think price is going to go) and even correct Narrative (which is how price is going to get to a location)

First off I had (what turned out to be) the correct Bias (which is the direction you think price is going to go) and even correct Narrative (which is how price is going to get to a location)

Option 1: Volume Imbalances

Option 1: Volume Imbalances

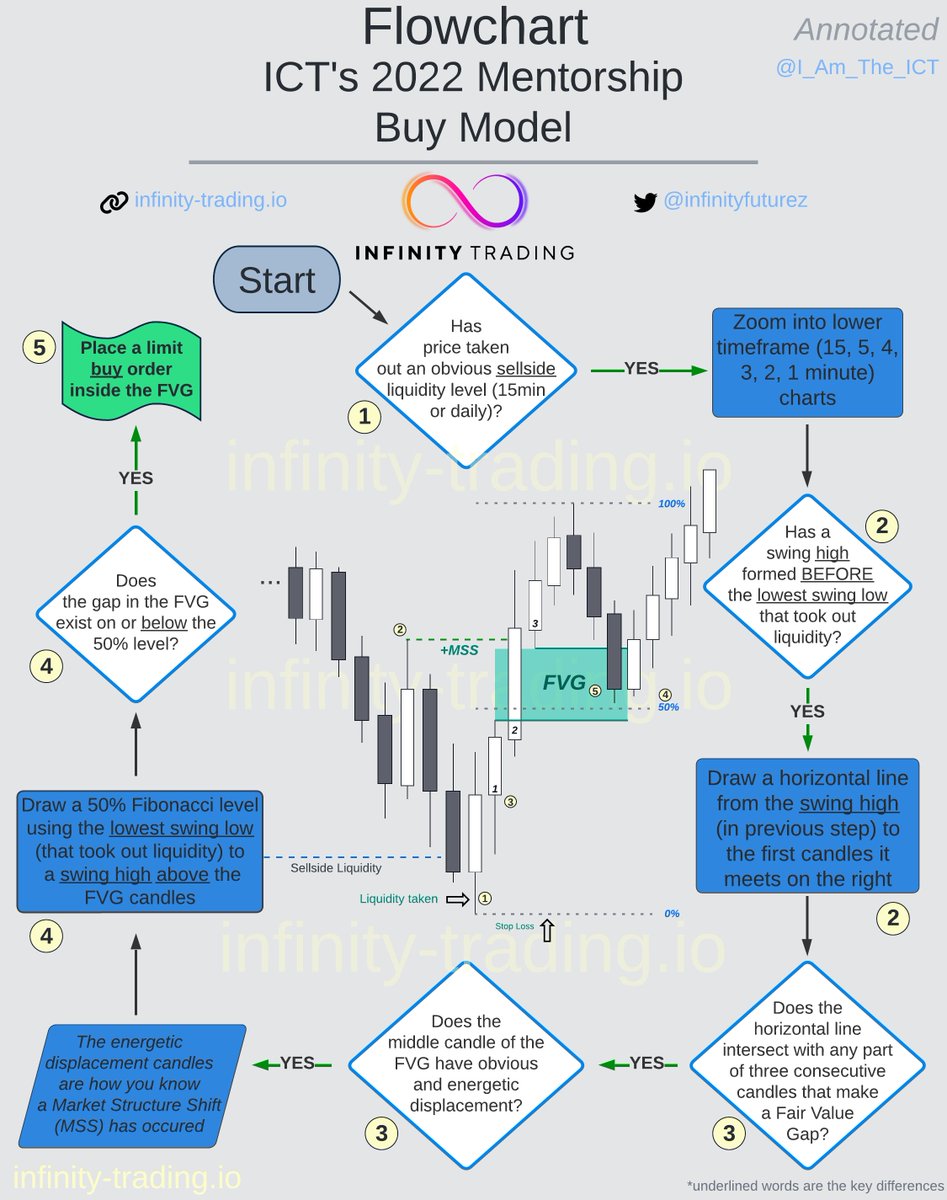

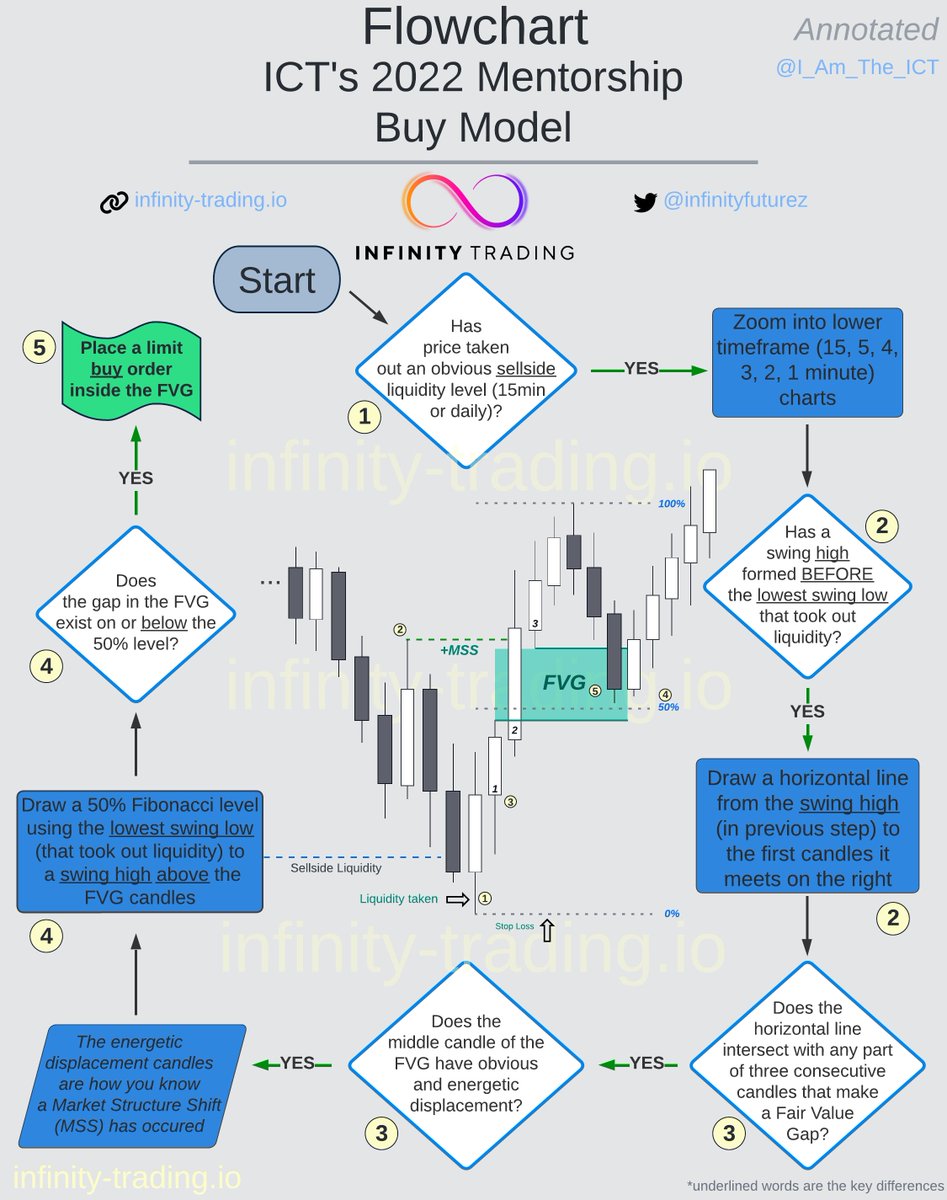

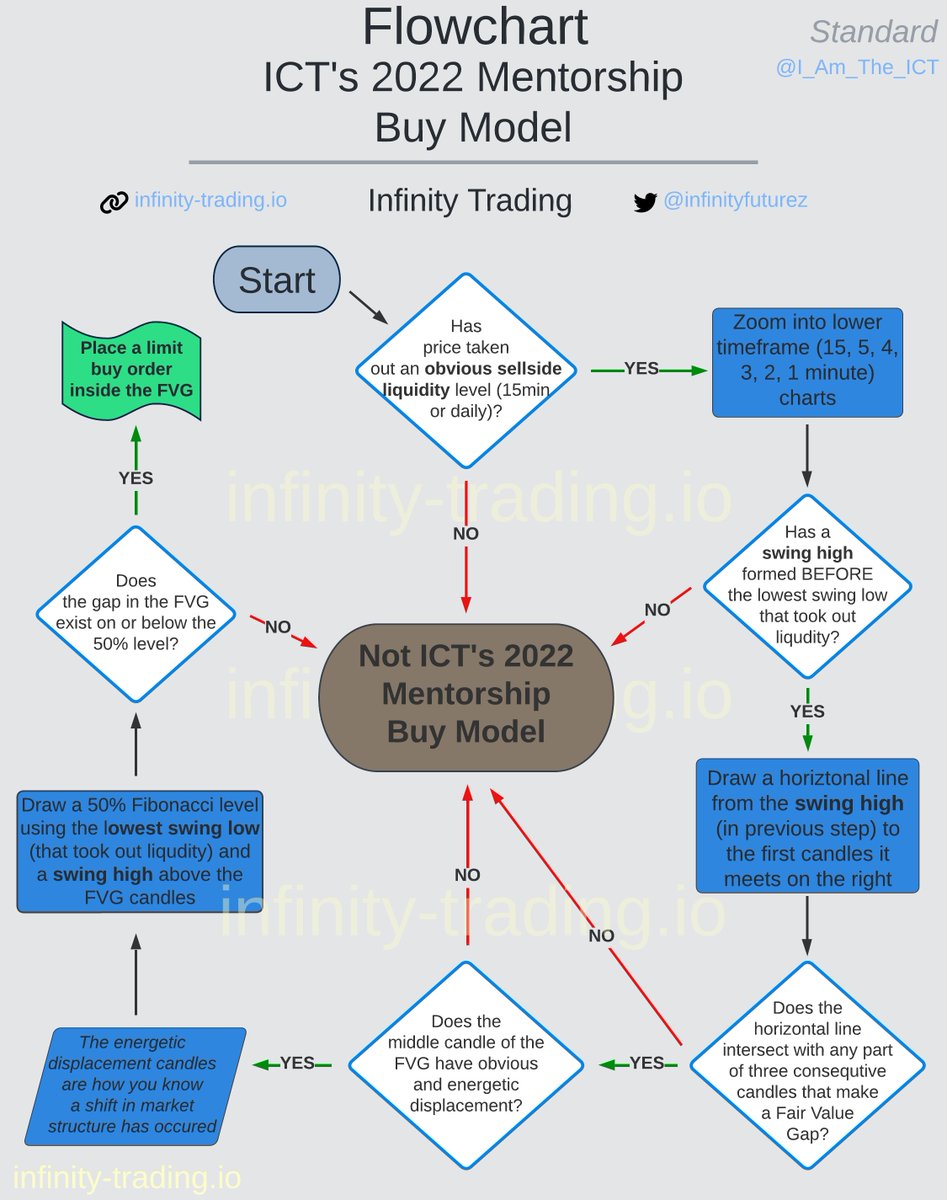

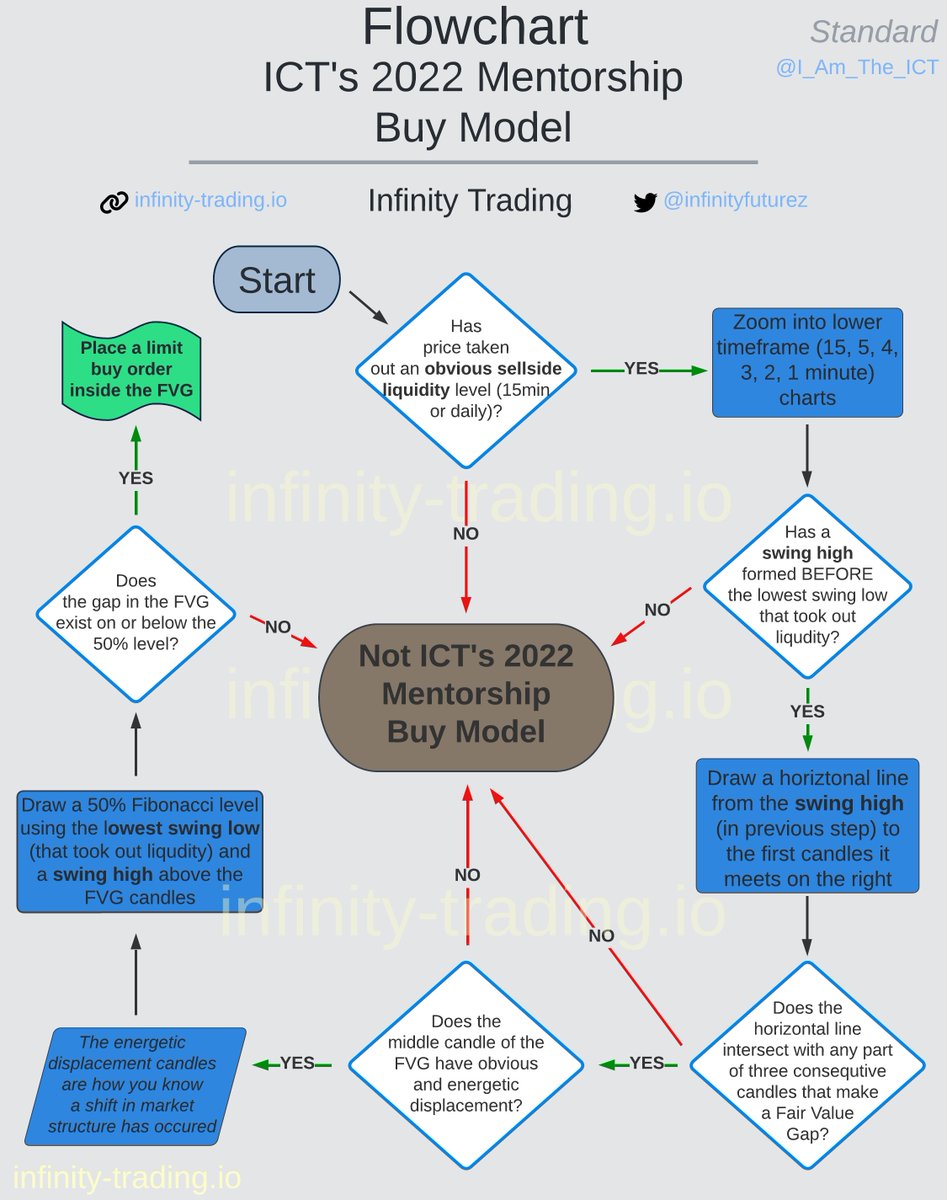

Here is an example from $ES today of the Buy Model

Here is an example from $ES today of the Buy Model

@CandyCabin75 You asked about why the Buy model has a MSS before and the Sell model has the MSS after

@CandyCabin75 You asked about why the Buy model has a MSS before and the Sell model has the MSS after

See this article on my website that contains all these diagrams and examples on one easy-to-read page

See this article on my website that contains all these diagrams and examples on one easy-to-read page

If you would like high res PNG images of the candle chart examples see my website article below:

If you would like high res PNG images of the candle chart examples see my website article below: