DJ - Shaken, not stirred—4Q22 review

-pullback a buying opportunity 1/x 🧵

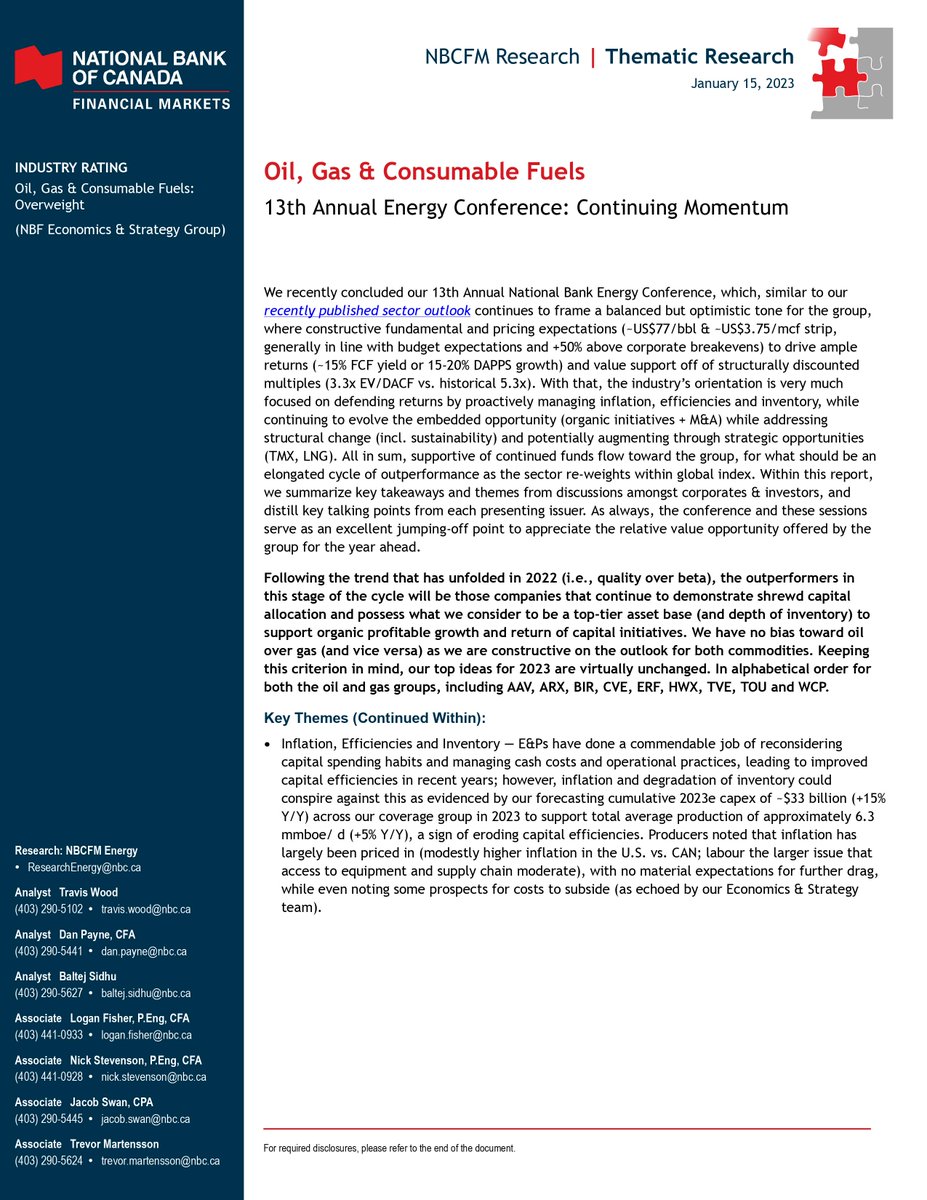

Top picks:

$SU integrated

$TOU large cap gas

$ERF mid cap oil

$AAV mid cap gas

$SDE wet gas

$FRU royalty

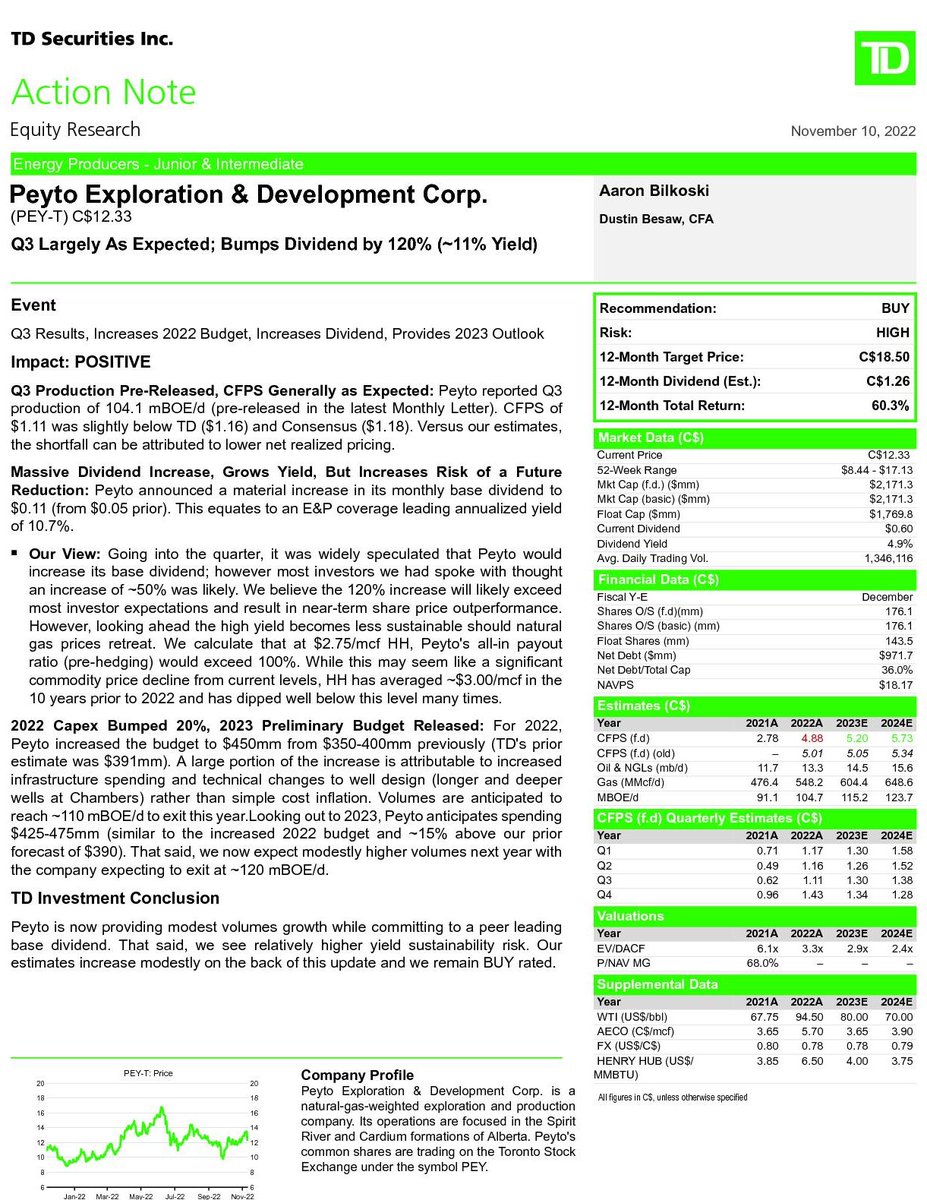

$ARX.TO $CNQ $CVE $CPG $PEY.TO $PNE $TPZ $TVE $VET.TO $WCP $ATH $CR $HWX $NVA $IMO $MEG

#OOTT #COM

-pullback a buying opportunity 1/x 🧵

Top picks:

$SU integrated

$TOU large cap gas

$ERF mid cap oil

$AAV mid cap gas

$SDE wet gas

$FRU royalty

$ARX.TO $CNQ $CVE $CPG $PEY.TO $PNE $TPZ $TVE $VET.TO $WCP $ATH $CR $HWX $NVA $IMO $MEG

#OOTT #COM

https://twitter.com/emmpeethree1/status/1617896498578223105

2/x

1. Cash flow continues to moderate but still provides robust returns

2. Staying on budget in 2023

3. Unbridled growth no more

4. Balance sheets are no longer a major issue for most companies

5. Is returning 100% of FCF the right number, or is it overkill?

1. Cash flow continues to moderate but still provides robust returns

2. Staying on budget in 2023

3. Unbridled growth no more

4. Balance sheets are no longer a major issue for most companies

5. Is returning 100% of FCF the right number, or is it overkill?

3/x

6. Base dividends have mostly reached a ceiling

7. The lion’s share of discretionary FCF will continue being deployed through share buybacks

8. Recycle ratios remain healthy on the back of strong commodity prices amid rising FD&A costs

6. Base dividends have mostly reached a ceiling

7. The lion’s share of discretionary FCF will continue being deployed through share buybacks

8. Recycle ratios remain healthy on the back of strong commodity prices amid rising FD&A costs

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter