The @HouseGOP #PollutersOverPeople act was an easy bill to say "no" to. But we still need to deploy massive amounts of clean energy at unprecedented scale. That's why @MikeLevin and I have introduced a consumer- and climate focused alternative: eenews.net/articles/house…

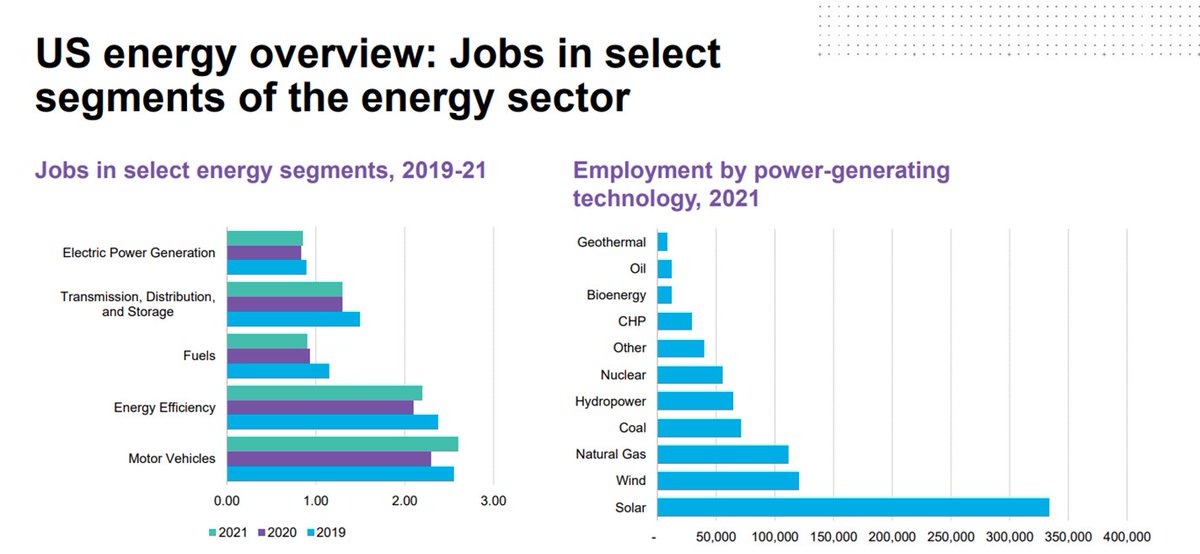

1. The GOP bill was focused solely on accelerating the export of US oil & gas. Other than the (misleading) title, it did nothing to help energy consumers. It would have raised prices, raised the deficit and accelerated global warming. Details here:

https://twitter.com/SeanCasten/status/1641128424931573766?s=20

2. But as @JesseJenkins (and others) have pointed out, we aren't going to be able to meet our climate goals without building a lot more electric transmission. So we have to find ways to make permitting easier... for the RIGHT assets.

3. At it's core, there are 3 things a consumer- and climate-focused permitting reform bill must do. (a) reform energy markets to remove the economic conflicts of interest that bedevil our electric sector so that they will stop standing in the way of permitting reform...

4. ... (b) provide a single point of authority for permitting, with firm time lines for go/no-go decisions while ensuring that all affected parties' voices are heard, and...

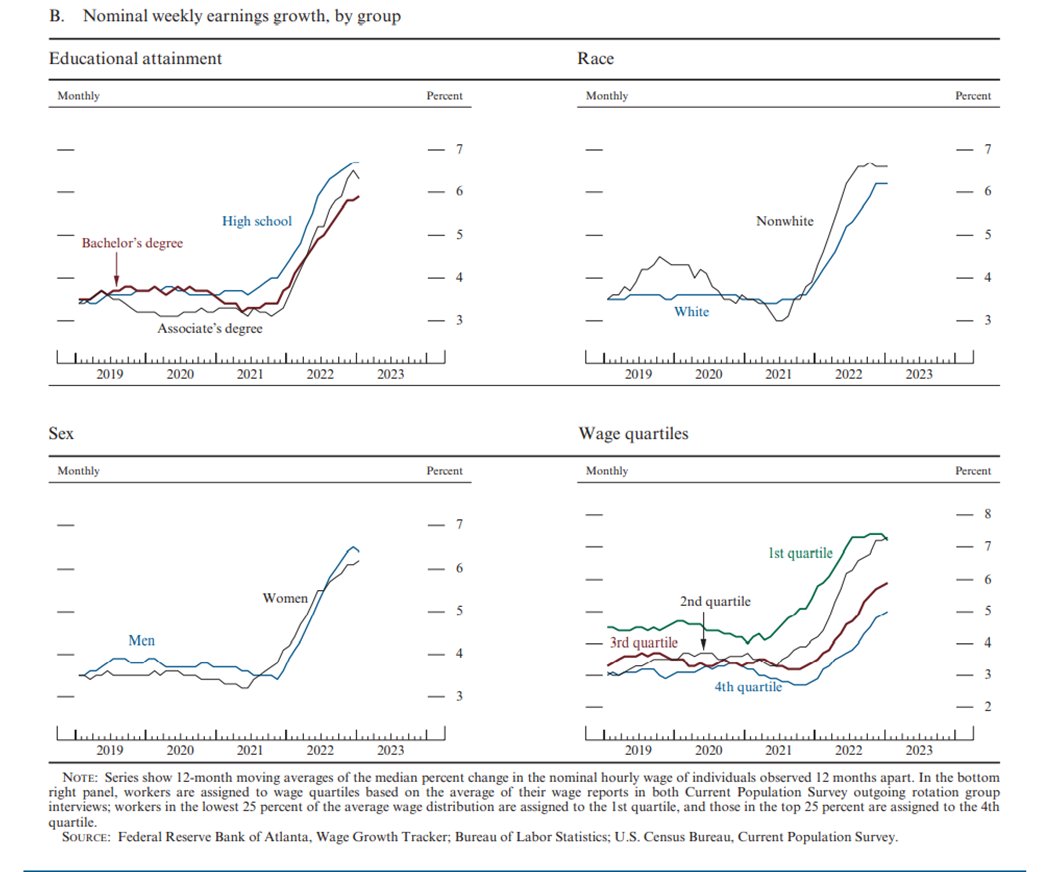

5. ...(c) equitably allocate not only the COSTS but also the BENEFITS of clean energy deployment. And ideally, ensure that those who bear costs earn their pro rata share of the benefits. Environmental justice / economic justice / efficient markets are synonyms, after all.

6. The good news is that there are a lot of bills that have been introduced and worked up by our colleagues that have done most of those things. @mikelevin and I have worked to pull those together and are finalizing / cleaning up text to address the missing bits.

7. So (and correcting my mis-statement at the start of this thread) watch this space for full legislation soon. But in the meantime, as we say in the E&E piece, we need to stop doing energy politics and calling it energy policy. It's past time to do the policy right.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter