Starting a DAO on @terra_money using @enterprise_dao DAY #3! 🧵

We're about 60 hours into the DAO's life. Will do a few tweets in this thread with a summary of some of the key activities so far & will update as the day progresses.

Link to the DAO: enterprise.money/dao/terra17c6t…

$ROAR

We're about 60 hours into the DAO's life. Will do a few tweets in this thread with a summary of some of the key activities so far & will update as the day progresses.

Link to the DAO: enterprise.money/dao/terra17c6t…

$ROAR

https://twitter.com/TheRyanLion/status/1641718741212733440

Community:

Twitter: @TheLionDAO 265 followers

Discord: discord.gg/hZpqVkT3v9 89 members - shout out to @MrMohawk for helping build some features in there.

Telegram: t.me/Lion_DAO 65 members

$ROAR token holders - 729 list here: terrasco.pe/mainnet/addres…

Twitter: @TheLionDAO 265 followers

Discord: discord.gg/hZpqVkT3v9 89 members - shout out to @MrMohawk for helping build some features in there.

Telegram: t.me/Lion_DAO 65 members

$ROAR token holders - 729 list here: terrasco.pe/mainnet/addres…

DAO:

178.5Bn $ROAR staked in the DAO. 100B is my original stake to prevent early governance attacks.

78.5B $ROAR of the 167B which has been airdropped is staked. Giving a staking ratio of 47%.

$ROAR staking has a 24 hour unbond period, which can be adjusted by governance

178.5Bn $ROAR staked in the DAO. 100B is my original stake to prevent early governance attacks.

78.5B $ROAR of the 167B which has been airdropped is staked. Giving a staking ratio of 47%.

$ROAR staking has a 24 hour unbond period, which can be adjusted by governance

Governance:

Governance proposals 6 & 7 are due to pass, whitelisting all available assets for the treasury & the distributor contract.

THere's currently some $ASTRO, $TPT. $dUST & $DOCS (another DAO token) waiting to be distributed to $ROAR stakers.

Governance proposals 6 & 7 are due to pass, whitelisting all available assets for the treasury & the distributor contract.

THere's currently some $ASTRO, $TPT. $dUST & $DOCS (another DAO token) waiting to be distributed to $ROAR stakers.

Collabs:

We've already had some great collabs with other @terra_money tools and protocols.

Firstly huge shoutout to @genie_coinhall & @coinhall_org who dropped everything to help us run a successful $ROAR airdrop campaign to $LUNA holders yesterday.

We've already had some great collabs with other @terra_money tools and protocols.

Firstly huge shoutout to @genie_coinhall & @coinhall_org who dropped everything to help us run a successful $ROAR airdrop campaign to $LUNA holders yesterday.

https://twitter.com/TheRyanLion/status/1641857955325771777?s=20

Thank you to @tfm_com who added the ability for you to use their DEX aggregator to buy $ROAR which will give you the best swap rate by routing through multiple $ROAR liquidity pools! (DO NOT BUY!)

You can also see full token/LP analytics & charts here: tfm.com/terra2/trade/a…

You can also see full token/LP analytics & charts here: tfm.com/terra2/trade/a…

Thank you to @astroport_fi for also whitelisting our token and adding our token symbol into their DEX!

I want to add LP incentives to the $ROAR / $LUNA LP but that requires some technical work & a governance proposal! If anyone is able to help me with this, please reach out! 🙏

I want to add LP incentives to the $ROAR / $LUNA LP but that requires some technical work & a governance proposal! If anyone is able to help me with this, please reach out! 🙏

Thank you to terrasco.pe the @terra_money block explorer for whitelisting $ROAR & also collating the @TheLionDAO contract under their Projects page here: terrasco.pe/mainnet/projec…

There's a little bit of work to do, I would like people to be able to see $ROAR balances

There's a little bit of work to do, I would like people to be able to see $ROAR balances

@terra_money @TheLionDAO I'm reaching out to @PulsarFinance so that $ROAR token holders can see their balances in Pulsar's wallet tracking app. If anyone has any connections to them, or knows what I need to do to get listed, please give me a shout!

Some other things I'm exploring partnership wise:

- Using $ROAR on @TP_TerraPoker

- Some sort of campaign on @valkyrie_money

- Going interchain on @TeamKujira's FIN limit order book 👀🉐

- treasury swaps with @galactic_punks, @Skeleton_Punks, @redacted_money

- Using $ROAR on @TP_TerraPoker

- Some sort of campaign on @valkyrie_money

- Going interchain on @TeamKujira's FIN limit order book 👀🉐

- treasury swaps with @galactic_punks, @Skeleton_Punks, @redacted_money

@TP_TerraPoker @valkyrie_money @TeamKujira @galactic_punks @Skeleton_Punks @redacted_money Friend of @TheLionDAO @cryptrus is also running a meme competition today. The best 10 meme submissions get 100m $ROAR - go and get involved:

https://twitter.com/cryptrus/status/1642056532425580546?s=20

Absolutely incredible PFP creations by @SPEERBOT in the Discord. Thank you ser 🙏🏻

Community stepping up and just building stuff on their own at this point is crazy! 🦁

Get yours here ➡️ discord.com/channels/10911…

Community stepping up and just building stuff on their own at this point is crazy! 🦁

Get yours here ➡️ discord.com/channels/10911…

Updated on terraso.pe so $ROAR balances show and we can also now see all the assets waiting in the funds distributor and in the main @TheLionDAO treasury!

@TheLionDAO Proposal 6 to whitelist assts other than $LUNA & $ROAR in the DAO has passed, this means that any token can be distributed to $ROAR stakers & all assets sent to the treasury are viewable.

Proposal 7 for the $DOCS airdrop will also pass in about half an hour.

Proposal 7 for the $DOCS airdrop will also pass in about half an hour.

87.75Bn $ROAR of the 167Bn that has been airdropped is now staked in @TheLionDAO giving a staking ratio of 52.5% 🫶🏻🦁

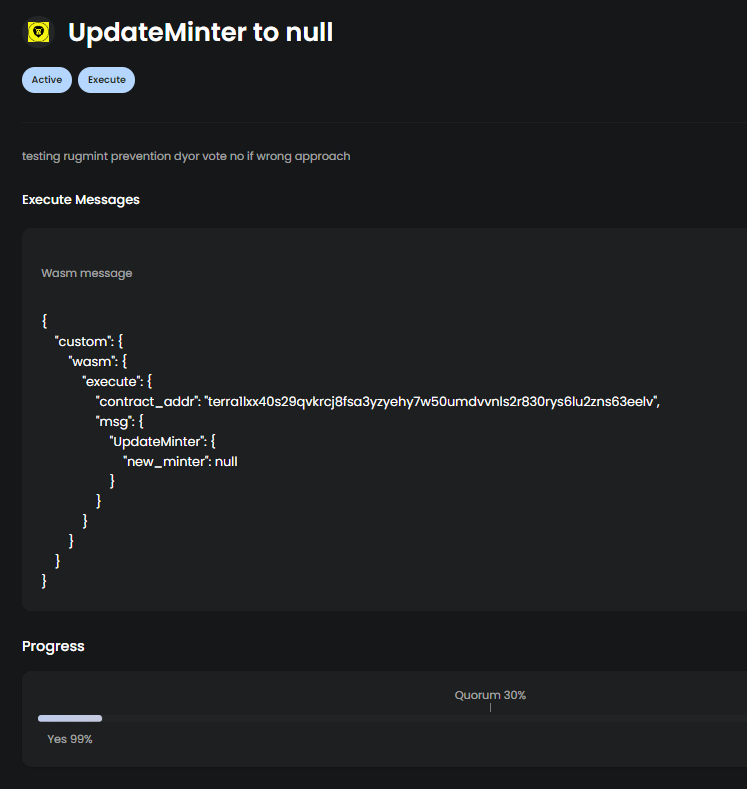

@TheLionDAO One DAO member raised a proposal to turn off minting function on the token contract so that no further $ROAR tokens can be minted (the only way they could be is through governance) - I am supportive of the idea, but waiting on @enterprise_dao devs to confirm if code is correct.

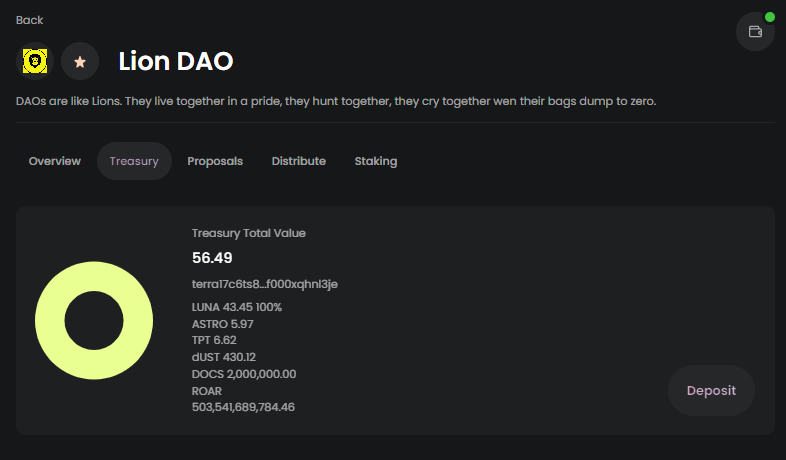

@TheLionDAO @enterprise_dao Following the passing of proposal 6, all tokens in the DAO treasury can be viewed.

All treasury value (apart from the 500B $ROAR) has been donated by the community. Currently:

43.5 $LUNA

6 $ASTRO

6.5 $TPT

430 $dUST

2M $DOCS

& 500 #ampWHALE (currently not a whitelisted asset)

All treasury value (apart from the 500B $ROAR) has been donated by the community. Currently:

43.5 $LUNA

6 $ASTRO

6.5 $TPT

430 $dUST

2M $DOCS

& 500 #ampWHALE (currently not a whitelisted asset)

We just had a 3 hour Lion DAO twitter spaces where we spitballed a whole bunch of ideas, was great fun and so happy to see so many people getting involved. You can listen back to the recoded space here 👇twitter.com/i/spaces/1BdxY…

Final (I think) update of the day...

Spotted on @TeamKujira IBCed $ROAR...

Could we see a $ROAR pair on Kujira's Fin orderbook soon?! Maybe an airdrop to $KUJI stakers?!

finder.kujira.app/kaiyo-1/token/…

Spotted on @TeamKujira IBCed $ROAR...

Could we see a $ROAR pair on Kujira's Fin orderbook soon?! Maybe an airdrop to $KUJI stakers?!

finder.kujira.app/kaiyo-1/token/…

@TeamKujira Oh just for clarification - I voted down gov proposal 9 to kill the token minting contract because I had it confirmed the code submitted wouldn't work. Will work with devs over next couple of days to get the correct wasm message & then we will resubmit the proposal & execute.

@TeamKujira OK one last thing LOL

Proposal 11 is up to whitelist a bunch of NFT contracts for the DAO treasury. It just means that under the NFT Treasury section, if we get sent any of the NFTs we're whitelisting, the NFT would show there.

enterprise.money/dao/terra17c6t…

Gn!

Proposal 11 is up to whitelist a bunch of NFT contracts for the DAO treasury. It just means that under the NFT Treasury section, if we get sent any of the NFTs we're whitelisting, the NFT would show there.

enterprise.money/dao/terra17c6t…

Gn!

• • •

Missing some Tweet in this thread? You can try to

force a refresh