DJ - Shaken, not stirred - 4Q22 review, and 2023/2024 estimates

Charts/tables edition 1/10 🧵

First up: 4Q22 Quarterly CFPS comparison

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

#COM #OOTT

Charts/tables edition 1/10 🧵

First up: 4Q22 Quarterly CFPS comparison

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

#COM #OOTT

https://twitter.com/emmpeethree1/status/1641642307073216517

2/x

2023-2024 capex

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

2023-2024 capex

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

3/x

EV/DACF (2024E) vs FCF yield (2024E) at strip prices (March 17)

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

EV/DACF (2024E) vs FCF yield (2024E) at strip prices (March 17)

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

4/x

EV/DACF (2024E) vs two-year compounded dividend yield plus PPS growth (2024E/22) at strip prices (March 17)

and

D/CF at strip prices (March 17)

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

EV/DACF (2024E) vs two-year compounded dividend yield plus PPS growth (2024E/22) at strip prices (March 17)

and

D/CF at strip prices (March 17)

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

5/x

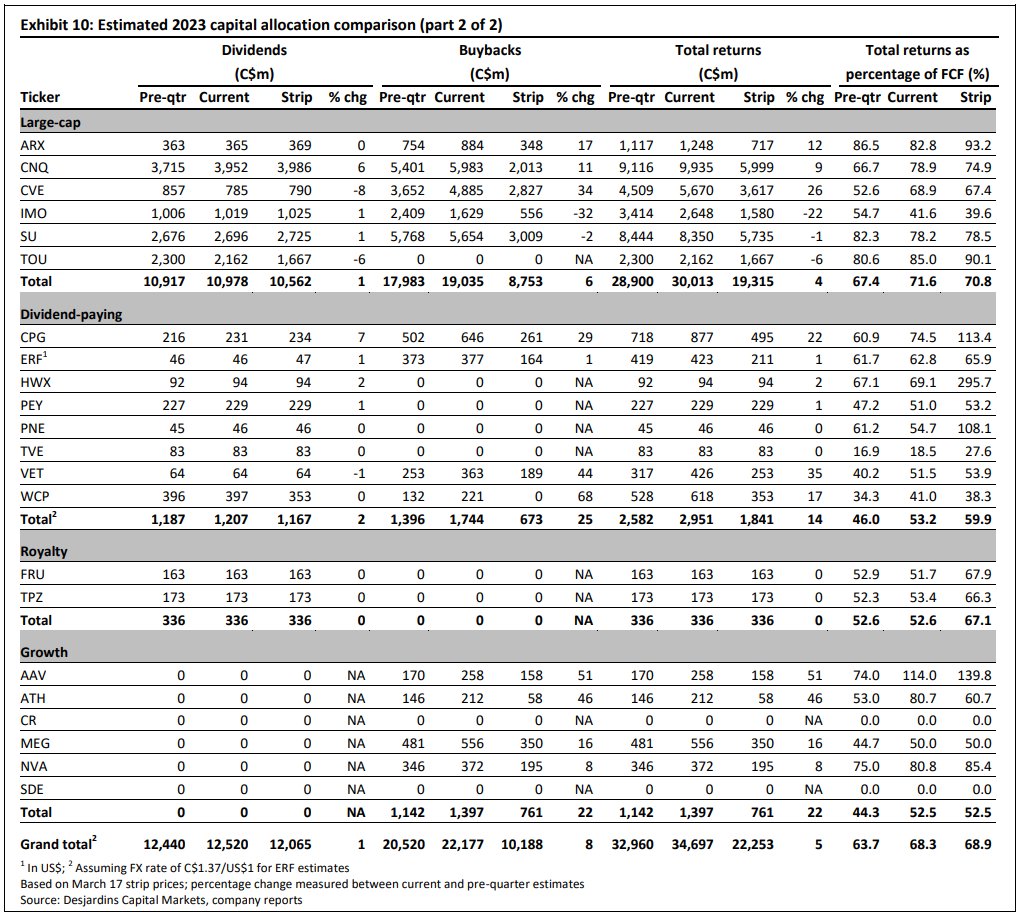

Estimated 2023 capital allocation comparison:

cashflow, capex, FCF, dividends, buybacks, total returns, total returns as % of FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

Estimated 2023 capital allocation comparison:

cashflow, capex, FCF, dividends, buybacks, total returns, total returns as % of FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

6/x

Estimated 2024 capital allocation comparison:

cashflow, capex, FCF, dividends, buybacks, total returns, total returns as % of FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

Estimated 2024 capital allocation comparison:

cashflow, capex, FCF, dividends, buybacks, total returns, total returns as % of FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

7/x

2023-2024E capital allocation for Desjardins E&P coverage universe:

capex, dividends, buybacks and residual FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

2023-2024E capital allocation for Desjardins E&P coverage universe:

capex, dividends, buybacks and residual FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

8/x

2023-2024E capital allocation (part 1):

capex, dividends, buybacks and residual FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

2023-2024E capital allocation (part 1):

capex, dividends, buybacks and residual FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

9/x

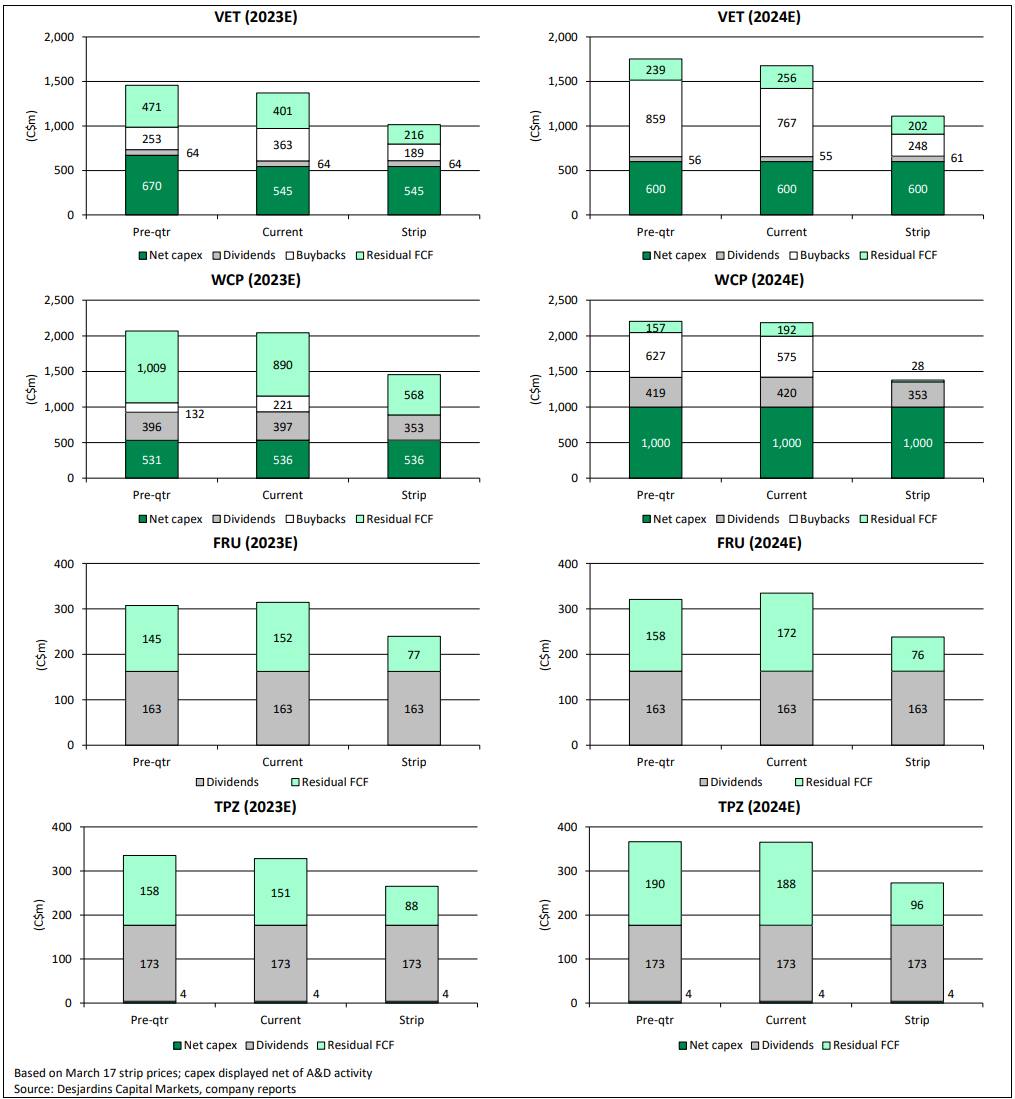

2023-2024E capital allocation (part 2):

capex, dividends, buybacks and residual FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

2023-2024E capital allocation (part 2):

capex, dividends, buybacks and residual FCF

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

10/10

Full price assumptions 2023/2024:

Brent 95/105

WTI 90/100

WCS Diff 20/15

HH 4/4

AECO 3.75/3.75

LNG (TTF/JKM/NBP) 20/25 USD/MCF

FX 0.75/0.8

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

Full price assumptions 2023/2024:

Brent 95/105

WTI 90/100

WCS Diff 20/15

HH 4/4

AECO 3.75/3.75

LNG (TTF/JKM/NBP) 20/25 USD/MCF

FX 0.75/0.8

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter