This thread goes over the majority for PD arrays that I suggest you master (most important ones first)

A PD array is a type of ICT entry. There are lots. First I will show them and say how to use them, then show how to put them all together.

Study💎🧵

A PD array is a type of ICT entry. There are lots. First I will show them and say how to use them, then show how to put them all together.

Study💎🧵

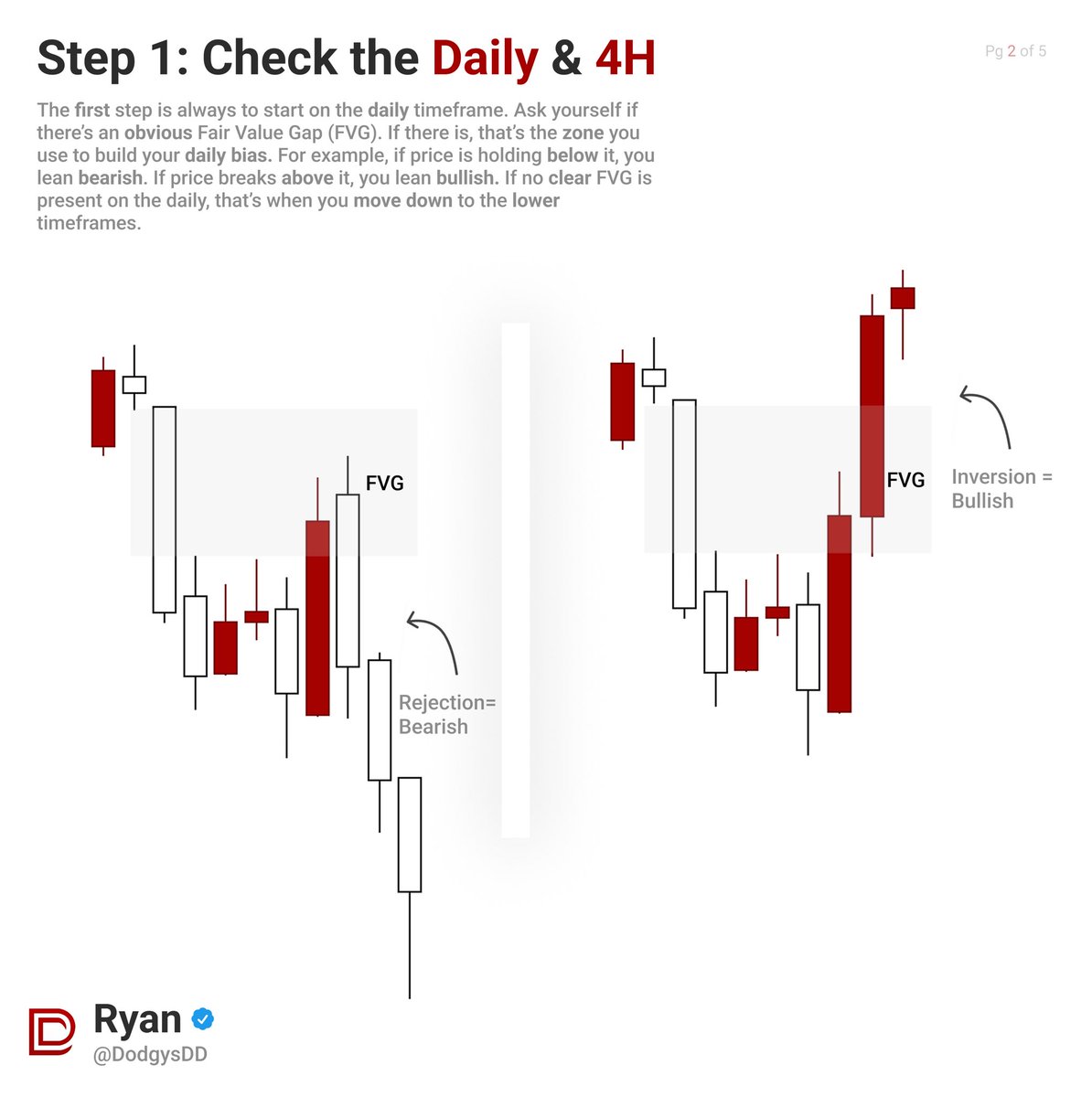

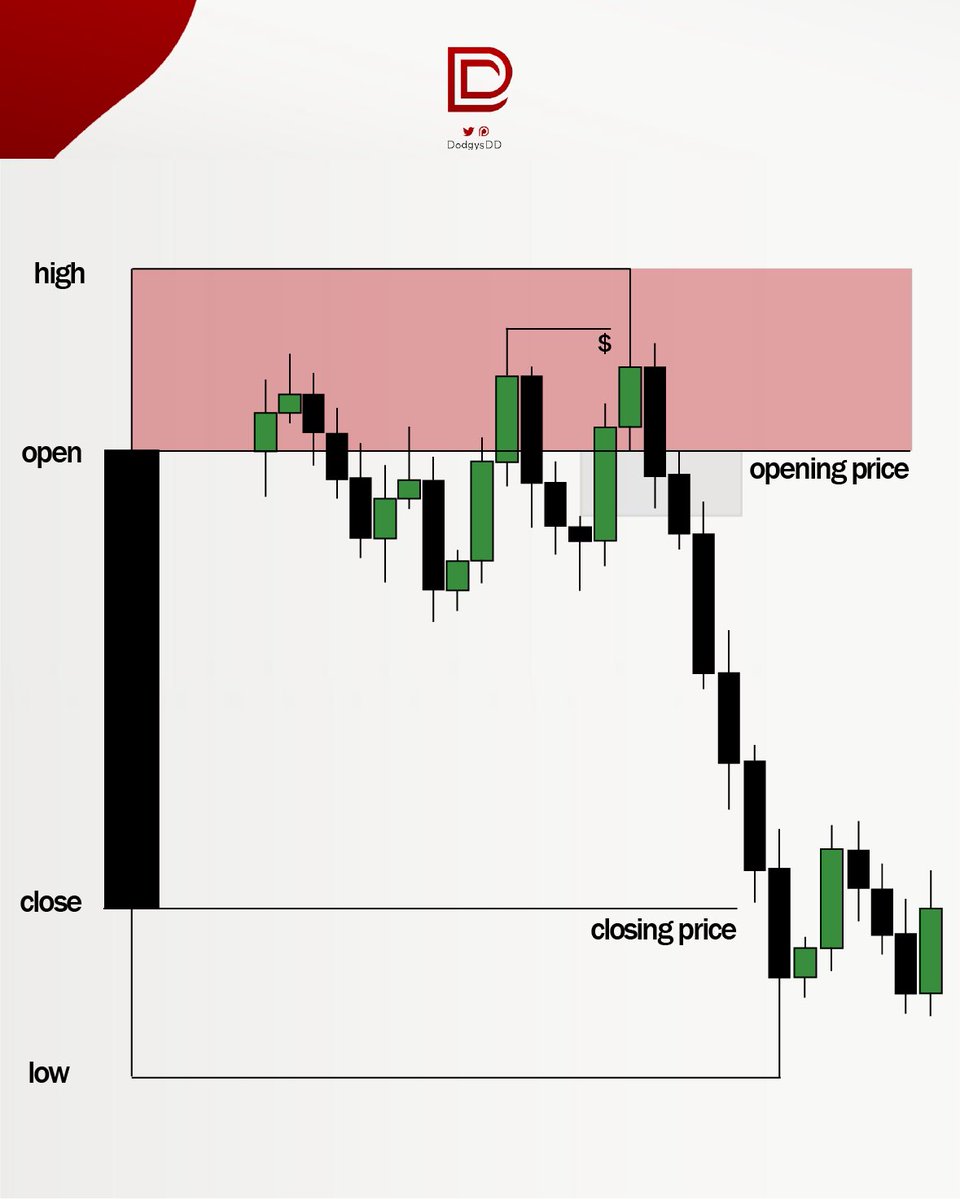

1. Fair Value Gap (anytime when a low of first candle does not overlap high of a third candle in a sequence)

Best way to use a fair value gap is…

Longing a FVG if it is in discount (under 0.5) on a market structure shift to the upside

OR

Shorting a besrish fair value gap in premium (above 0.5) if we break structure to downside)

All other FVGs are irrelevant (for now)

Longing a FVG if it is in discount (under 0.5) on a market structure shift to the upside

OR

Shorting a besrish fair value gap in premium (above 0.5) if we break structure to downside)

All other FVGs are irrelevant (for now)

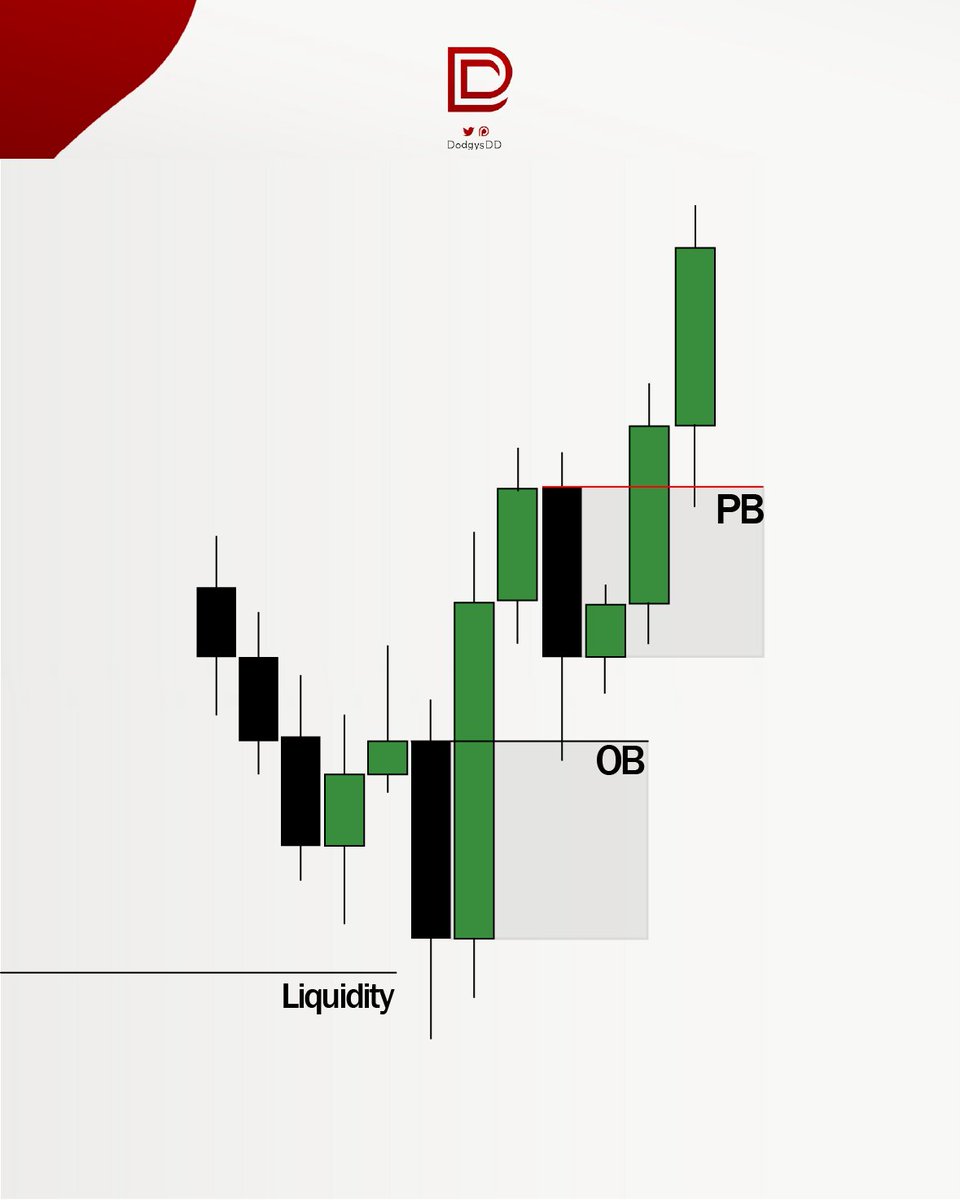

2. Orderblock (OB)

Bullish OB is a set of green candles before up move in an UPTREND

Bearish OB is a set of 1 red candle before down move in a DOWNTREND

Bullish OB is a set of green candles before up move in an UPTREND

Bearish OB is a set of 1 red candle before down move in a DOWNTREND

Everyone uses these differently.

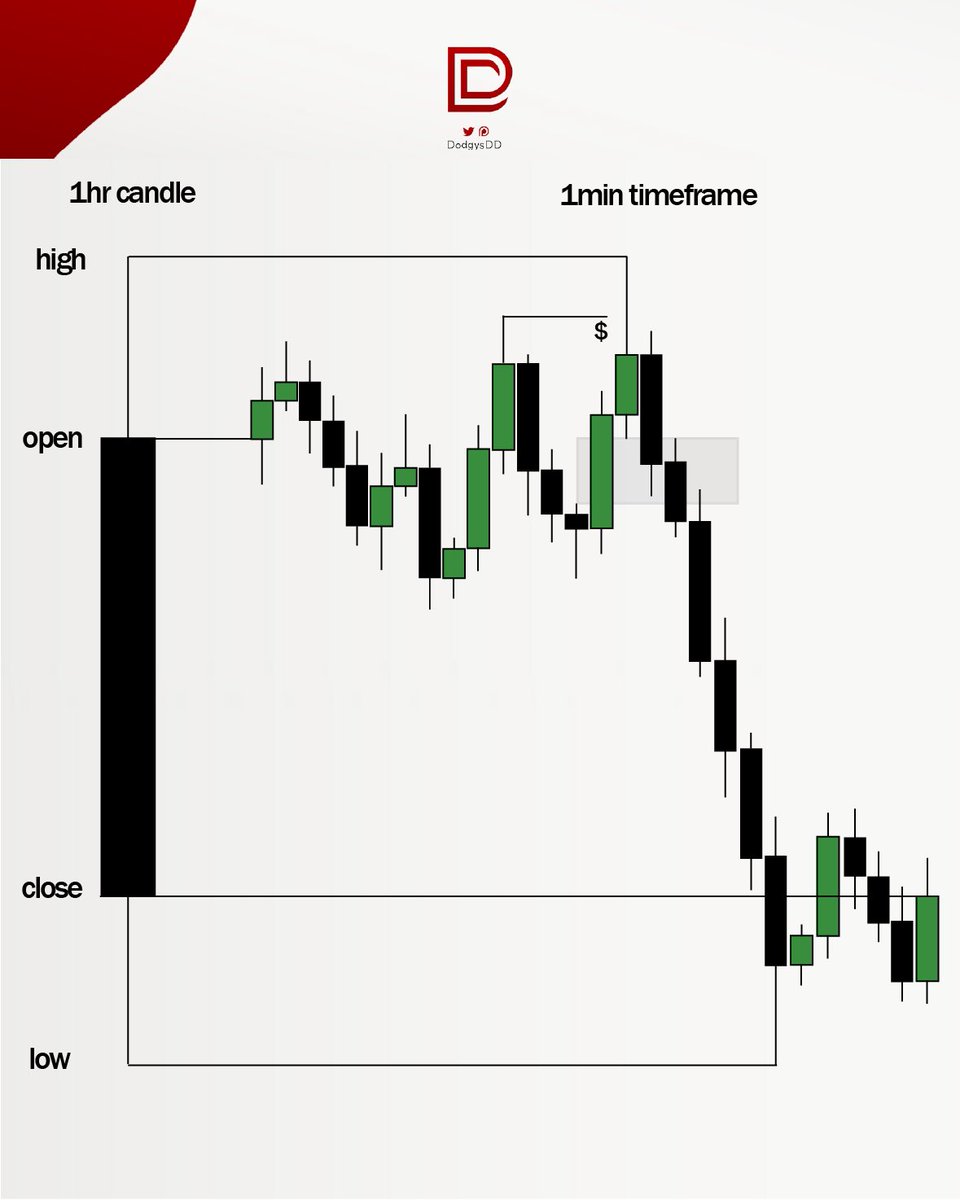

I suggest marking out order blocks on the higher timeframe such as 15M 1H or 4 hour, then once we arrive to one, go to the lower time frame like the 1m or 5m to see if we get a setup off of it

Like this:

I suggest marking out order blocks on the higher timeframe such as 15M 1H or 4 hour, then once we arrive to one, go to the lower time frame like the 1m or 5m to see if we get a setup off of it

Like this:

You can also use order blocks for stop loss placements like this:

Place stop above bearish order block if you are short and below bullish order block if you are long

Place stop above bearish order block if you are short and below bullish order block if you are long

3. Balanced Price Range

This is when a Bearish FVG and Bullish FVG line up, there’s more to this but don’t want to take the time to over explain in this thread

Here’s unbalanced versus a balanced price range:

This is when a Bearish FVG and Bullish FVG line up, there’s more to this but don’t want to take the time to over explain in this thread

Here’s unbalanced versus a balanced price range:

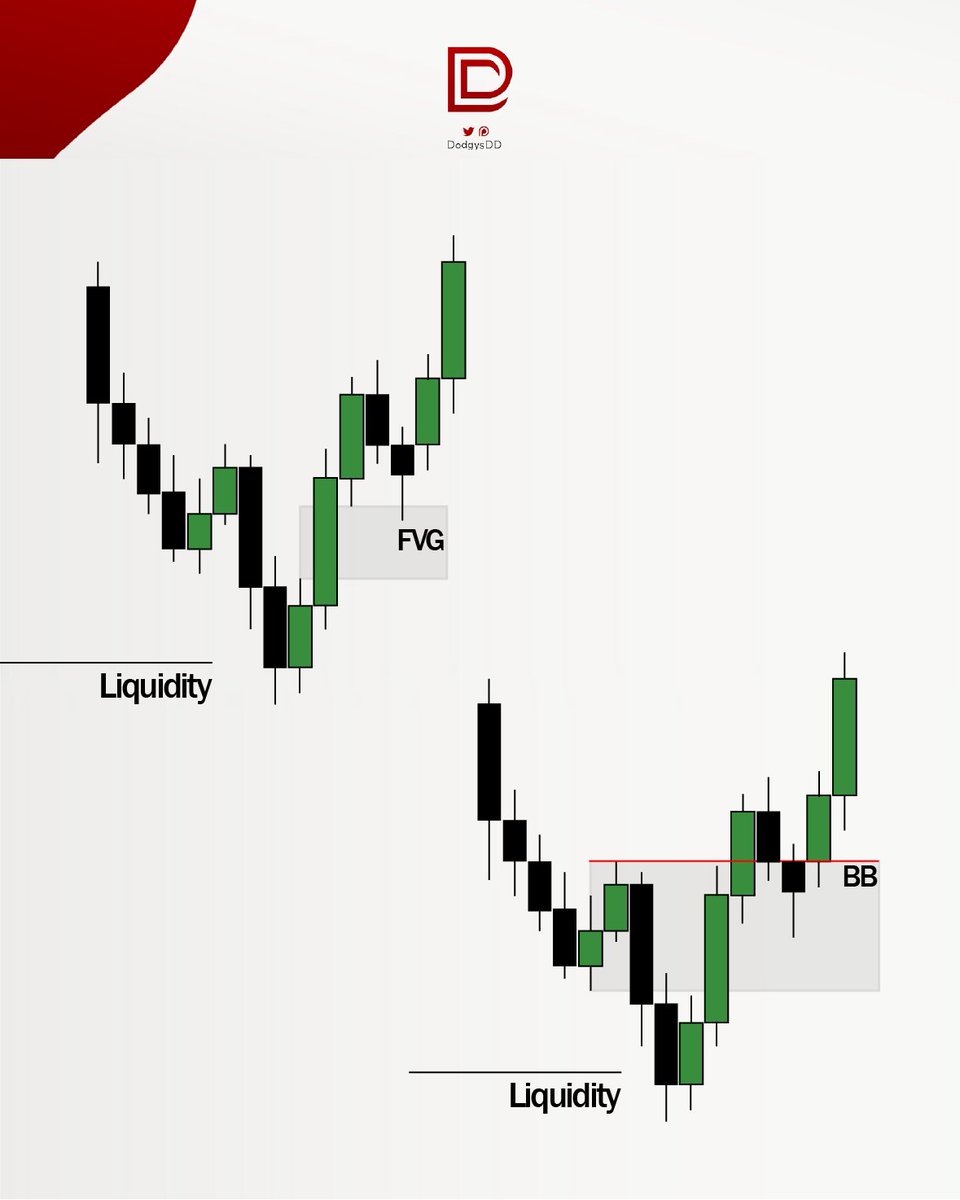

4. Breaker Block

To put this in the simplest terms as possible so you understand:

Look for an orderblock that was broken through after we purged liquidity.

*Breaker Blocks are not old OBs, because the OB should not be respected in the first place*

This is a breaker block.

To put this in the simplest terms as possible so you understand:

Look for an orderblock that was broken through after we purged liquidity.

*Breaker Blocks are not old OBs, because the OB should not be respected in the first place*

This is a breaker block.

5. Mitigation Block

This is the same thing as a breaker except we do not purge liquidity before.

Like this:

This is the same thing as a breaker except we do not purge liquidity before.

Like this:

I don’t use these a ton, but if you ever see giant wicks at bottom or tops of trend when taking liquidity, draw a fib with the 0.5 on the whole wick alone.

Then you look for a setup off of it.

Like this:

Then you look for a setup off of it.

Like this:

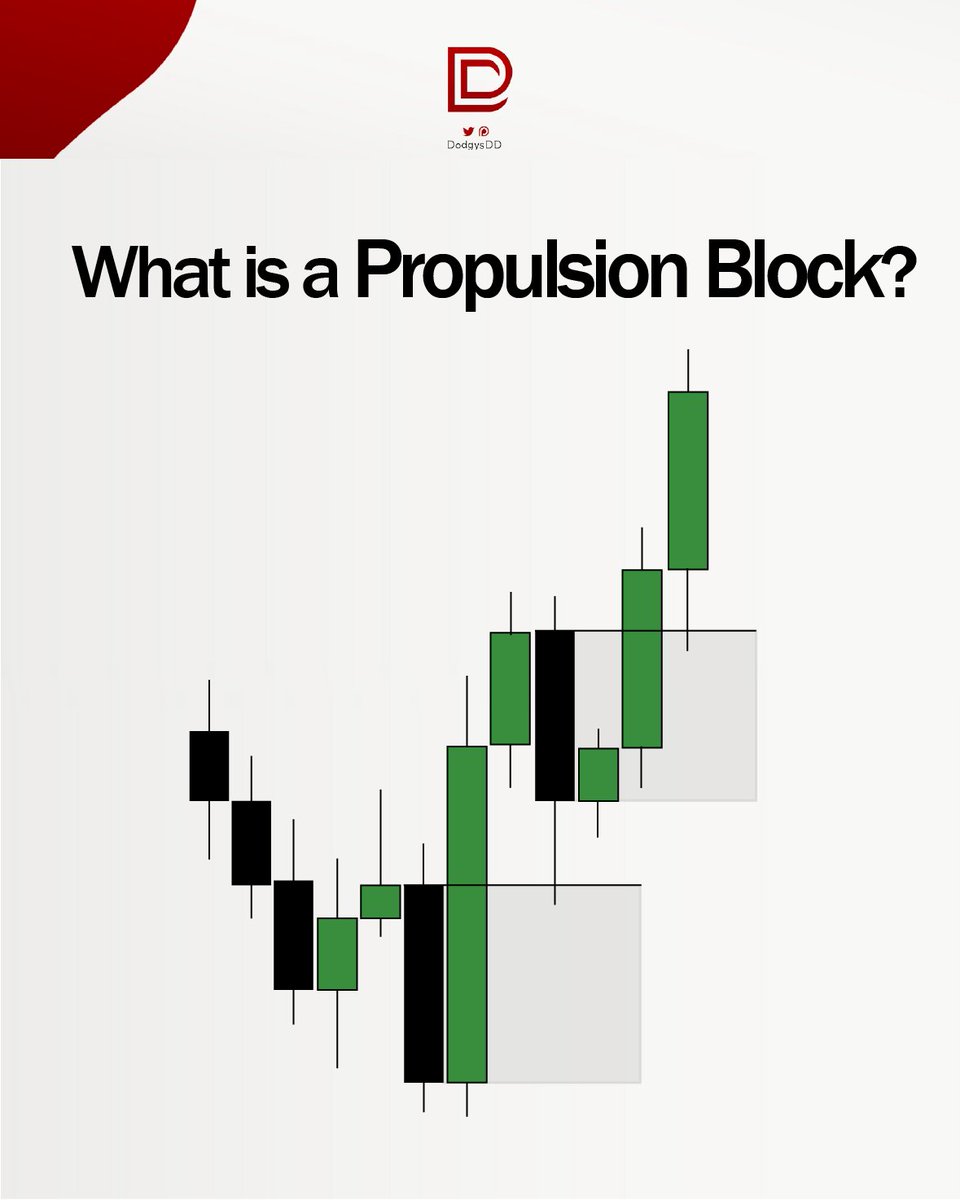

This is basically when we get an OB, then a second OB off the first OB. The second OB is a propulsion block and you do not want us to retrace below the mean threshold of it (50%)

Like this:

Like this:

These act as magnets. I always draw the 50% (CE) of NWOG and what I do is if I see we are in a sell model and there’s sellside below, I often look to see if there’s a NWOG under

If there is, that’s my target after sellside, then I look for potential reversal off of it.

Like so

If there is, that’s my target after sellside, then I look for potential reversal off of it.

Like so

Alright, now note all these PD arrays

You can also use all of these as inverses. (besides OB because that’s just a BB/MB)

So once we close above old bearish FVG you look for a long setup off it and want to see it used as support

This just doubled the PD arrays you can use:)

You can also use all of these as inverses. (besides OB because that’s just a BB/MB)

So once we close above old bearish FVG you look for a long setup off it and want to see it used as support

This just doubled the PD arrays you can use:)

HOW TO COMBINE THEM

ICT once said “If 3 PD Arrays fail, you’re fucked”

So if I see a FVG combined with an OB and VI, like this picture, and we break through all 3:

That likely means my bias will change for the time being

This is why you should know all PD arrays

ICT once said “If 3 PD Arrays fail, you’re fucked”

So if I see a FVG combined with an OB and VI, like this picture, and we break through all 3:

That likely means my bias will change for the time being

This is why you should know all PD arrays

That’s it. There are a few more but these are the most common ones you should use every single day and the only ones I really use.

Check out my discord if you have questions or want to talk with other good ICT trader during the day:)

Check out my discord if you have questions or want to talk with other good ICT trader during the day:)

Here is my discord if you have any questions I will answer: discord.gg/rBEHxWcN

I also live trade everyday for $15 a month if you’re interested but just ask me about that in discord

I also live trade everyday for $15 a month if you’re interested but just ask me about that in discord

For my BPR experts I know this is an inversion FVG lol

SORRY GUYS THE ANNOTATION IS CORRECT HERE

Read the picture. Green candle before down move = bearish OB in a downtrend while order flow is bearish

Red candle before up move = bullish OB in an uptrend while orderflow is bullish

Read the picture. Green candle before down move = bearish OB in a downtrend while order flow is bearish

Red candle before up move = bullish OB in an uptrend while orderflow is bullish

i typed this out earlier after a tough tennis match and should’ve rechecked everything when mindset was better but posted anyways

i will do a whole separate orderblock thread anyways so be prepared

i will do a whole separate orderblock thread anyways so be prepared

• • •

Missing some Tweet in this thread? You can try to

force a refresh