😡 “CoinMarketCap's dirty secret of manipulating rankings to benefit @binance!”

Once again, #CoinMarketCap surprises us with its transparency and honesty 🤣

Let's see how @HEXcrypto was affected by this manipulation and why you can be the next one.

🧵 ⬇️

Once again, #CoinMarketCap surprises us with its transparency and honesty 🤣

Let's see how @HEXcrypto was affected by this manipulation and why you can be the next one.

🧵 ⬇️

@CoinMarketCap has a history of manipulating its rankings to benefit Binance.

For example, in May 2020, they changed their methodology to rank exchanges based on web traffic by default, a metric that put Binance in the top spot.

Shocked? Read the rest ⬇️

For example, in May 2020, they changed their methodology to rank exchanges based on web traffic by default, a metric that put Binance in the top spot.

Shocked? Read the rest ⬇️

It's not just the exchanges that are affected by CMC's manipulation.

The same goes for crypto assets like #HEX. Indeed in September 2021, a group of HEX investors launched a class action against #CMC for ranking manipulation.

The same goes for crypto assets like #HEX. Indeed in September 2021, a group of HEX investors launched a class action against #CMC for ranking manipulation.

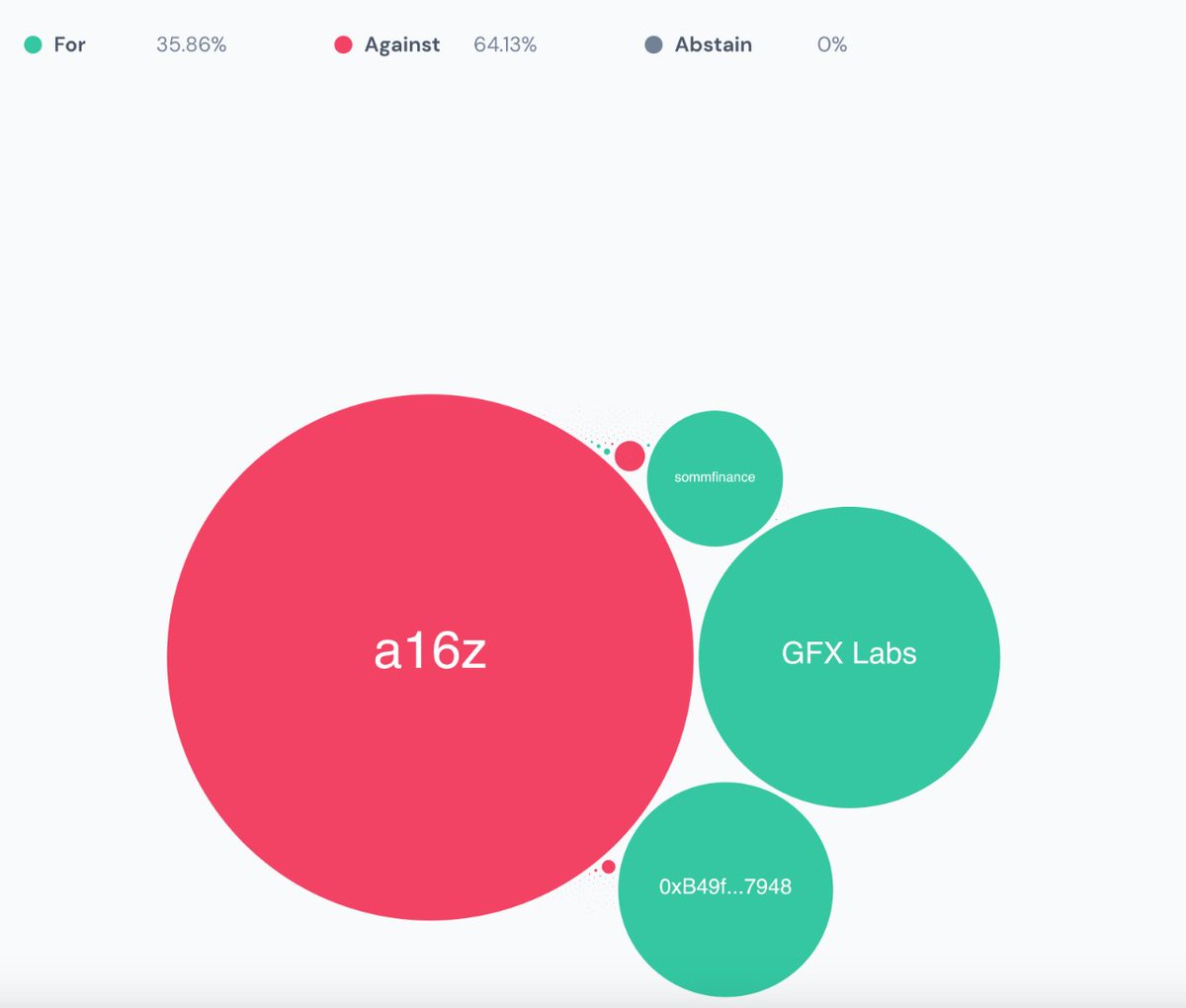

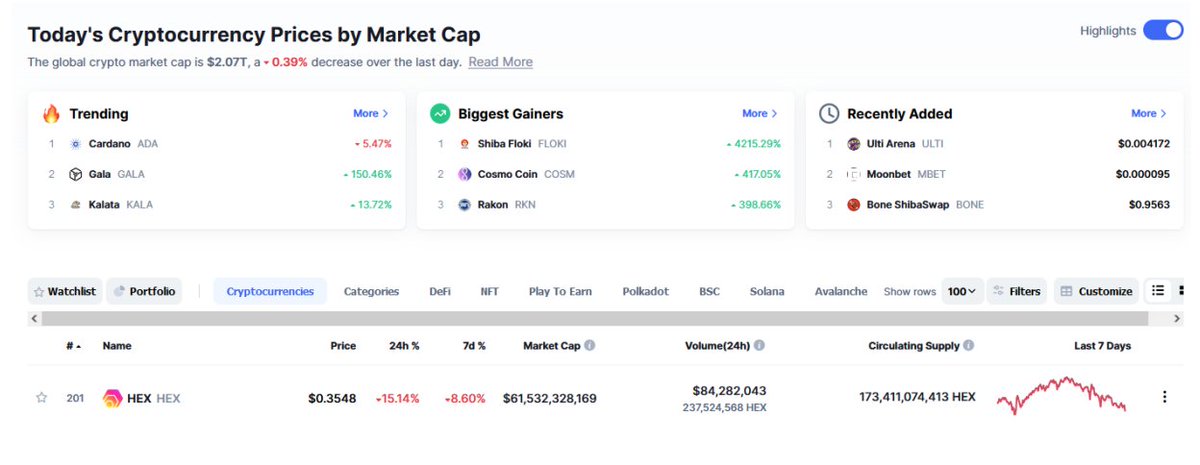

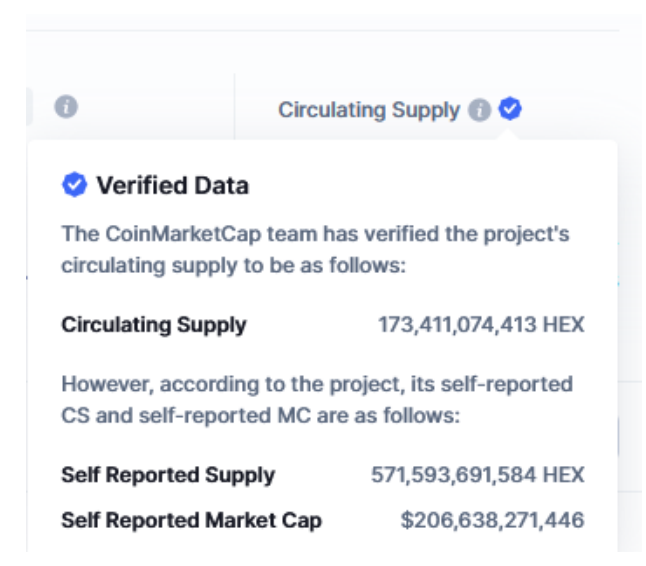

On September 13, 2021, CoinMarketCap verified HEX’s circulating supply to be 173,411,074,413 HEX and the market cap to be $62,295,479,825, which should have placed HEX at rank 6, right? However, it was ranked 201 on the third page of the results.

Even though @HEXcrypto was the best-performing crypto of 2020, CoinMarketCap locked HEX’s ranking at #201 and has refused to adjust it on the basis of HEX’s performance.

And on July 21, 2021, CoinMarketCap still ranked HEX at #201, despite its true market cap of $85.3 billion, which would have ranked it third in size.

This has caused HEX to trade at lower prices than it would have if its ranking had not been locked. The improper ranking of #HEX has artificially increased the value of cryptocurrencies ranked above it, including those issued by @binance👀 (according to the class action document)

But why? For HEX, the reason could be attributed to its staking system, which is viewed as a threat to Binance. Because the staking system does not promote active trading, which is at odds with Binance's business model. This may explain Binance's actions towards HEX through CMC.

CoinMarketCap's claims of being "open source" raises questions as there is no mechanism for users to vote to change the ranking methodology.

Additionally, as the leading data platform for crypto (not for much longer 😏) and as a propaganda weapon of Binance, it raises concerns about the level of transparency and trust.

In the meantime, at Mobula.fi, every new project that is listed on the platform goes through a verification process conducted by members of the DAO.

The data is sourced directly on-chain, and all the tools that Mobula provides for managing your crypto assets are transparent and built on the mutual trust between you and Mobula.

And yes, HEX is at the right place on Mobula.fi, ranked at fifth place 💁

Finally, a crypto aggregator you can trust. 👉 mobula.fi

Finally, a crypto aggregator you can trust. 👉 mobula.fi

• • •

Missing some Tweet in this thread? You can try to

force a refresh