My kind of afternoon chat when the feed talking about divs.

3D div discussion on $BTC.

The simple answer is use the Awesome Oscillator. It will do a far better job of tracking "longer" divs.

From my perspective, the 3D div has already played out, this is fresh price action.

3D div discussion on $BTC.

The simple answer is use the Awesome Oscillator. It will do a far better job of tracking "longer" divs.

From my perspective, the 3D div has already played out, this is fresh price action.

You can see the way the AO tracks both the original triple div on the highs and the single divergence on the ATH push.

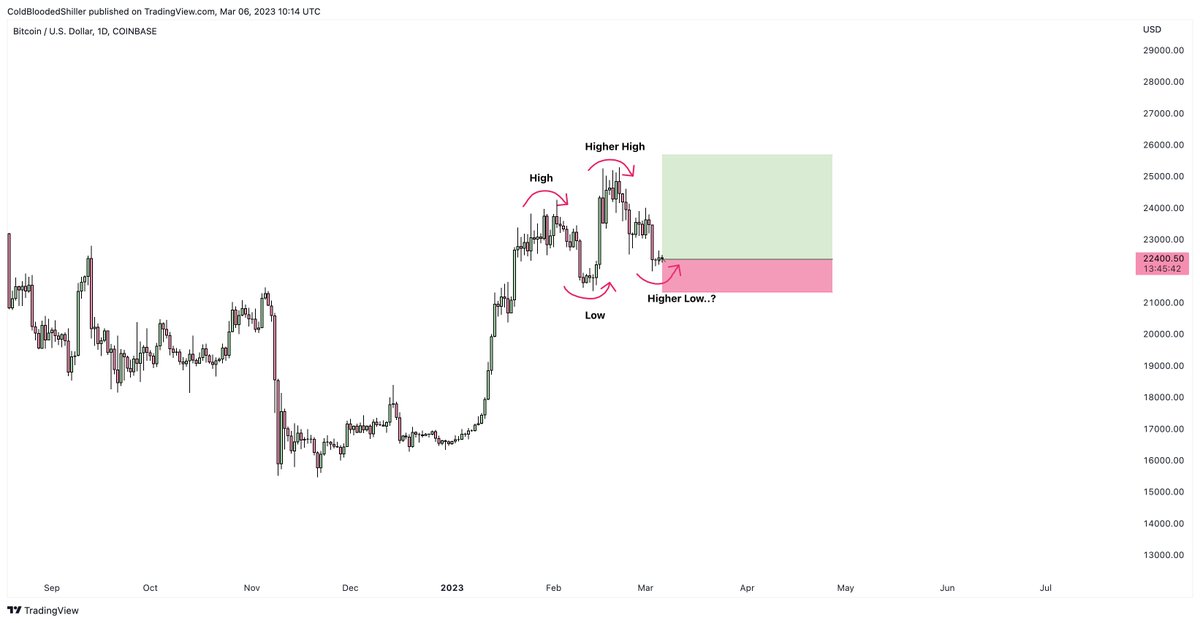

This run had a div, we corrected 21% and now we've just made a higher high (invalidating trying to connect all highs like the first triple div)

This run had a div, we corrected 21% and now we've just made a higher high (invalidating trying to connect all highs like the first triple div)

RSI also hit below 50 - which is typically a point you'd be satisfied a div has played out. Note the fact we never did this on the first triple div or the second ATH div.

So from my perspective and the way I interpret the charts.

This is div played out already on the last correction.

We're now in a fresh patch of price action.

We just broke resistance.

You cannot connect the highs to make a "div"

Well, you can, but it's not the same as before.

This is div played out already on the last correction.

We're now in a fresh patch of price action.

We just broke resistance.

You cannot connect the highs to make a "div"

Well, you can, but it's not the same as before.

The structure on $ETH is still way more attractive from a bearish perspective.

But as mentioned previously, we're finely poised here. Any impulse upwards and RSIs and AOs going to move hard into the upper extreme (and it's still my belief that they both do this)

But as mentioned previously, we're finely poised here. Any impulse upwards and RSIs and AOs going to move hard into the upper extreme (and it's still my belief that they both do this)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter