A 🧵 on the 🎲 game theory 🎲of airdrops and decentralization in light of the utterly embarrasing public fiasco with Arbitrum governance 🤦♀️

Some of you are very well aware of the meta, but I want to bring it to light for those who didn’t know

🕵️♀️

1/🧵

Some of you are very well aware of the meta, but I want to bring it to light for those who didn’t know

🕵️♀️

1/🧵

90% of the💰valuation💰of crypto networks come from promises of decentralization

To maximize valuation:

The network needs to appear very active

The distribution needs to appear decentralized

networks cooperate with airdrop farmers to maximize valuation 🤝

2/🧵

To maximize valuation:

The network needs to appear very active

The distribution needs to appear decentralized

networks cooperate with airdrop farmers to maximize valuation 🤝

2/🧵

Arbitrum insiders and airdrop farmers need to dump their tokens efficiently so they request the services of sophisticated actors in the financial markets space

These actors use their expertise in market plumbing to match token dumpers with buyers as efficiently as possible

3/🧵

These actors use their expertise in market plumbing to match token dumpers with buyers as efficiently as possible

3/🧵

How are these sophisticated actors compensated?

They get a loan of tokens and call options on those tokens

long call option have positive market exposure, or “delta”

In order to hedge, the holder sells tokens into the open market

This creates a timeless fractal

4/🧵

They get a loan of tokens and call options on those tokens

long call option have positive market exposure, or “delta”

In order to hedge, the holder sells tokens into the open market

This creates a timeless fractal

4/🧵

We have 3 actors who coordinate, so who is on the other side?

🛒 Retail🛒

There is a clear adversarial dynamic between the sellers and retail 🐑

Retail converts their fiat into tokens because they believe in the long term vision of the project

5/🧵

🛒 Retail🛒

There is a clear adversarial dynamic between the sellers and retail 🐑

Retail converts their fiat into tokens because they believe in the long term vision of the project

5/🧵

This is the game, this is how it works

Retail has a right to be upset when the other actors are colluding against them and not bending the rules of the game

The most heinous being that the promised “decentralization” is exposed to be a lie

6/🧵

coindesk.com/business/2023/…

Retail has a right to be upset when the other actors are colluding against them and not bending the rules of the game

The most heinous being that the promised “decentralization” is exposed to be a lie

6/🧵

coindesk.com/business/2023/…

Even worse is when retail learns that participants of the game are “cheating” by dumping more tokens than was initially disclosed

7/🧵

7/🧵

https://twitter.com/arbitrum/status/1642567580748595202?t=lacubB7apY5-02XdFQTkOw&s=19

Yes I know these dynamics are painfully obvious to anyone that’s been in the space for a while.

Arbitrum is very innocuous compared to some of its predecessors

8/🧵

Arbitrum is very innocuous compared to some of its predecessors

8/🧵

@arbitrum had the power to dump all 4.2B of the DAO allocation via direct sales and market maker deals immediately without any oversight or any need to communicate to the public

insider trading laws exist for a reason

9/🧵

sec.gov/Archives/edgar…

insider trading laws exist for a reason

9/🧵

sec.gov/Archives/edgar…

“projects have been doing this for ages”

(3, 3, 3, -9) works in bull markets. Look at Ohm

As markets mature, things should be expected to improve

Past cynicism is not a valid excuse

How can the space grow if the rules of the game aren’t fair?

10/🧵

(3, 3, 3, -9) works in bull markets. Look at Ohm

As markets mature, things should be expected to improve

Past cynicism is not a valid excuse

How can the space grow if the rules of the game aren’t fair?

10/🧵

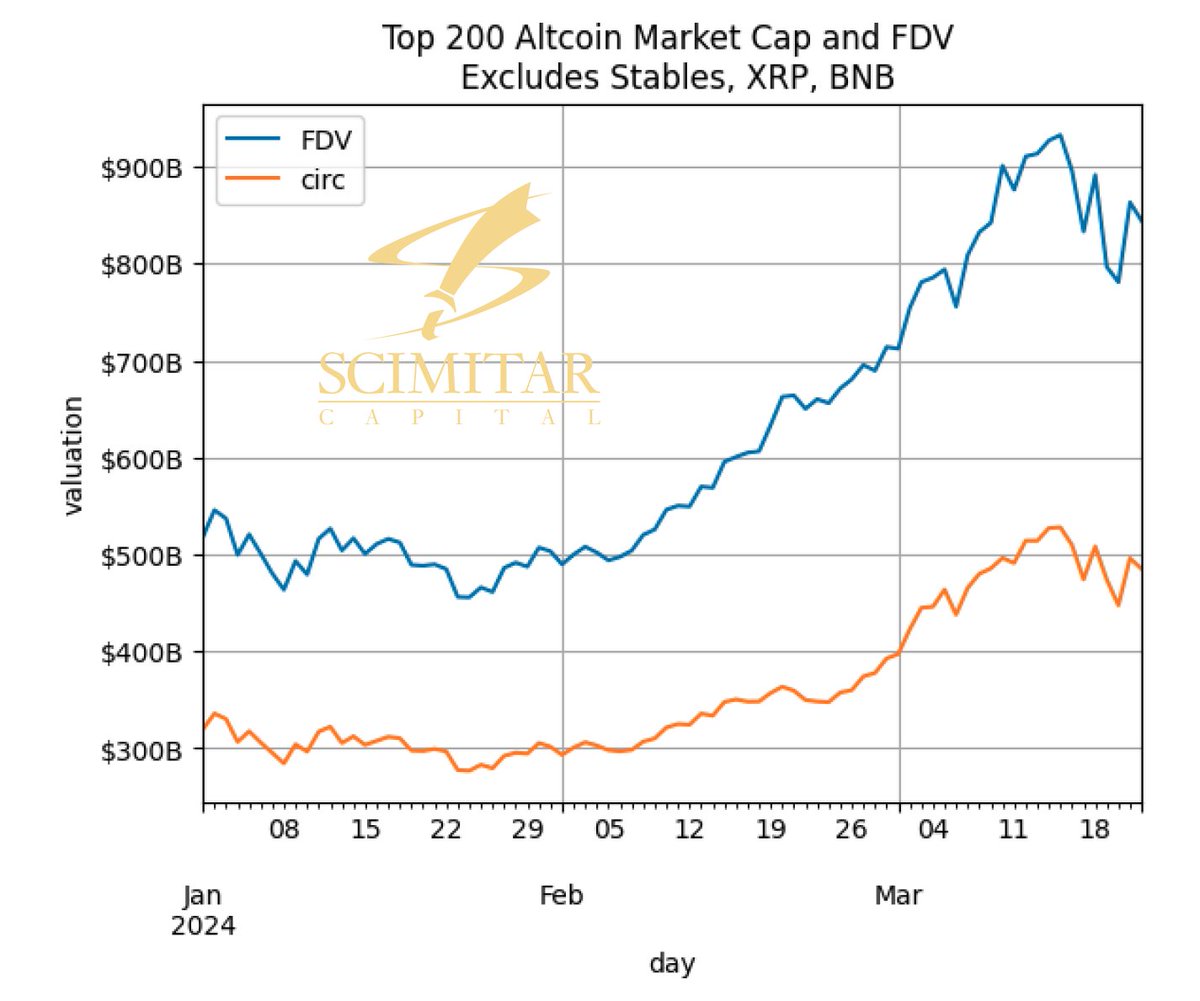

As a community, we should demand that the tirculating supply should reflect the amount of tokens that can hit the market without any public disclosure

This means for $ARB, the circ should be 1.2B + 4.2B DAO funds = 5.4B tokens or around $6B

11/🧵

This means for $ARB, the circ should be 1.2B + 4.2B DAO funds = 5.4B tokens or around $6B

11/🧵

Some people are saying that the community is “entitled” for receiving a “free money” from an airdrop

They don’t have the full understanding of of this game that we all play

To them I ask:

Where do you think this free money is coming from?

12/🧵

They don’t have the full understanding of of this game that we all play

To them I ask:

Where do you think this free money is coming from?

12/🧵

Sources:

[1]

arbitrumfoundation.medium.com/arbitrum-the-n…

[2]

[3]

coindesk.com/business/2023/…

[4]

snapshot.org/#/arbitrumfoun…

[5]

forum.arbitrum.foundation/t/clarity-arou…

13/🧵

[1]

arbitrumfoundation.medium.com/arbitrum-the-n…

[2]

https://twitter.com/arbitrum/status/1642567153067933697

[3]

coindesk.com/business/2023/…

[4]

snapshot.org/#/arbitrumfoun…

[5]

forum.arbitrum.foundation/t/clarity-arou…

13/🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh