How to get URL link on X (Twitter) App

maybe all that comes of it is a cohort of talent armed with capital filtered purely by the meritocracy of the markets

maybe all that comes of it is a cohort of talent armed with capital filtered purely by the meritocracy of the markets

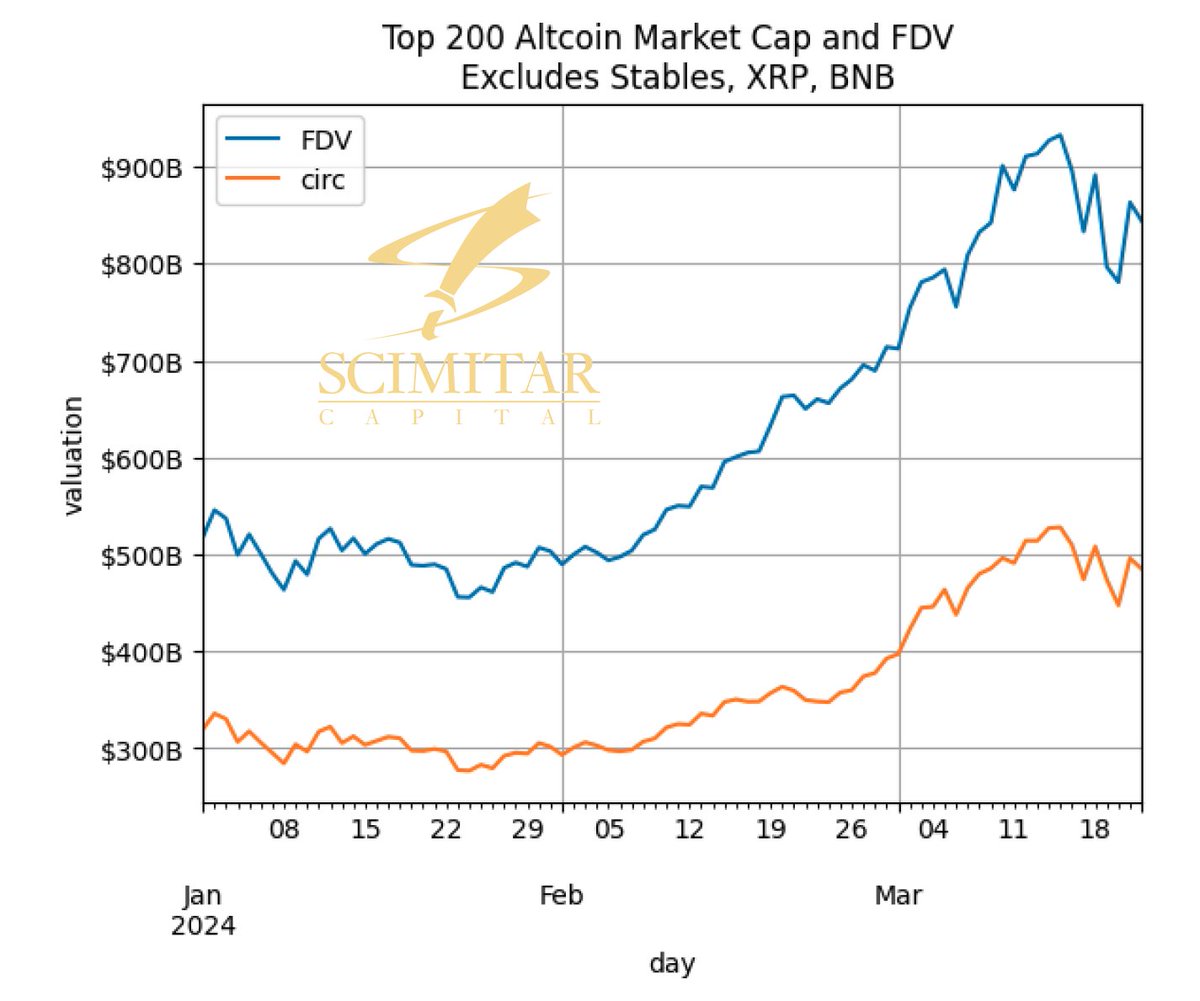

https://twitter.com/thiccyth0t/status/1771340322464751905Altcoin valuations pushed hard this year to a point where the altcoins were emitting over 250M of supply a day, more than the average daily inflow of the bitcoin ETFs

Altcoins have added roughly $200m of market cap or up 53% ytd

Altcoins have added roughly $200m of market cap or up 53% ytd

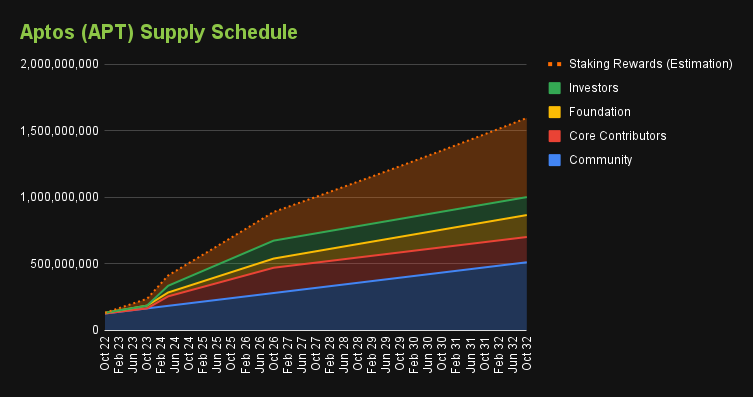

another thing to keep in mind is that SUI has more TVL than Aptos

another thing to keep in mind is that SUI has more TVL than Aptos

platform.arkhamintelligence.com/explorer/entit…

platform.arkhamintelligence.com/explorer/entit…

I analyzed all RLB trades in the Uniswap ETH, USDC, and USDT pools and grouped them by the biggest sellers since 8/01

I analyzed all RLB trades in the Uniswap ETH, USDC, and USDT pools and grouped them by the biggest sellers since 8/01

they received 11.70% APY for this 2y loan back in Oct '21

they received 11.70% APY for this 2y loan back in Oct '21

$BALD launched on July 30 on the Base chain, Coinbase's new Layer 2 built on Optimism

$BALD launched on July 30 on the Base chain, Coinbase's new Layer 2 built on Optimism

The SEC has approved quite a few Bitcoin futures ETFs that holds near dated Bitcoin futures contracts on the CME but no spot ETFs

The SEC has approved quite a few Bitcoin futures ETFs that holds near dated Bitcoin futures contracts on the CME but no spot ETFs

[DEFI RESEARCH]

[DEFI RESEARCH]https://twitter.com/thiccythot_/status/1589022227437039616

1) What

1) What

https://twitter.com/thiccythot_/status/1663462970746351616i took some of your upnl but you can still close your shorts anon

What are unlocks?

What are unlocks?

Bitcoin correlation to risk (tech) has steadily declined in the past months

Bitcoin correlation to risk (tech) has steadily declined in the past months

one theory is that this restricts the supply on ETH, since it takes 7 days to move the tokens back from the L2 to the L1

one theory is that this restricts the supply on ETH, since it takes 7 days to move the tokens back from the L2 to the L1

First some history

First some history

I just wanted to troll normies for engagement bait

I just wanted to troll normies for engagement baithttps://twitter.com/thiccythot_/status/1656054917490958336