I didn't get a chance to tweet the PCE price & other data on Friday (too busy with carbon taxes!). Sharing data now.

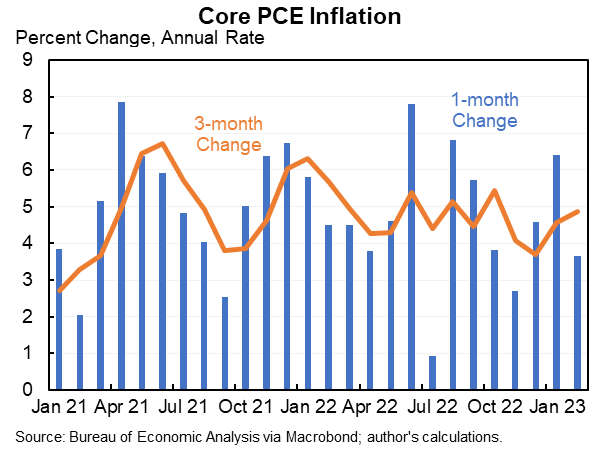

Core PCE inflation came in below expectations and below recent trends.

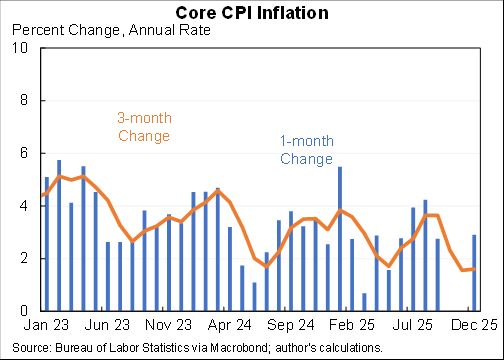

But is volatile, overall has moved sideways.

Underlying inflation remains about 4.5%...

Core PCE inflation came in below expectations and below recent trends.

But is volatile, overall has moved sideways.

Underlying inflation remains about 4.5%...

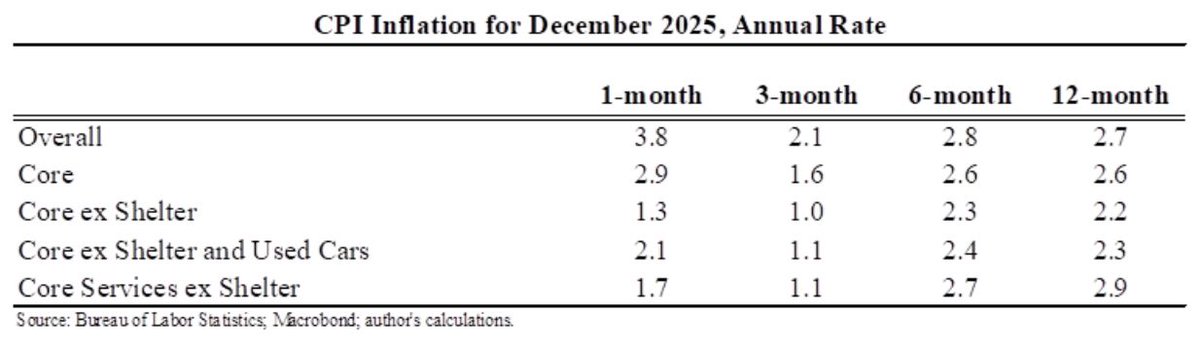

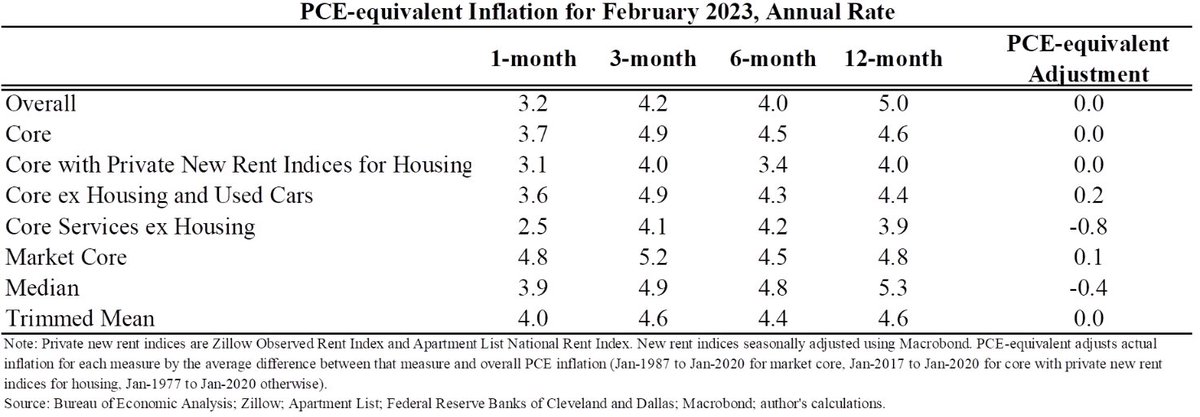

...Here are 8 different measures of inflation for 4 different periods. I'm adjusting to PCE-equivalent (mostly matters for core services ex housing and median which run higher on average).

Ignoring volatile 1 month, these range from 3.4% to 5.3% with a median of 4.5%.

Ignoring volatile 1 month, these range from 3.4% to 5.3% with a median of 4.5%.

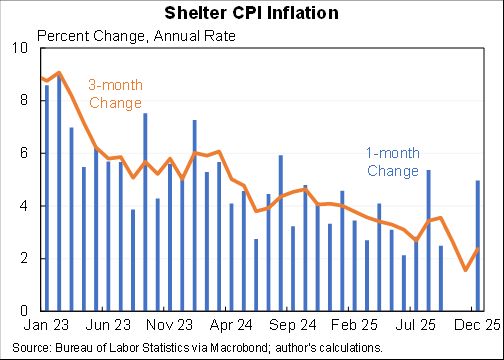

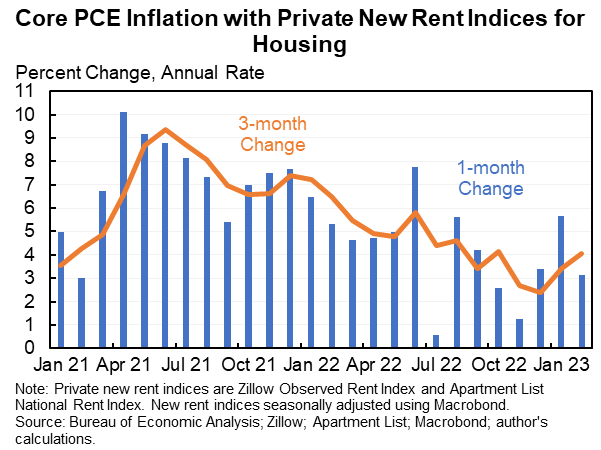

Notably, swapping in indices for new rent for the lagged all rent in the official data is making a smaller difference lately.

The 3-month annualized inflation rate with new rent indices is 4.0%, only slightly below the 4.2% for official core.

The 3-month annualized inflation rate with new rent indices is 4.0%, only slightly below the 4.2% for official core.

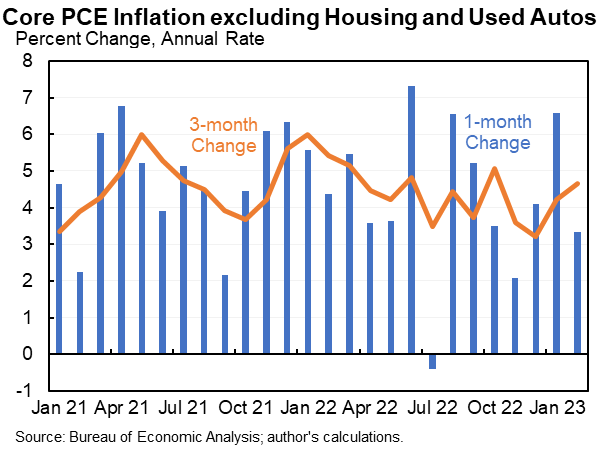

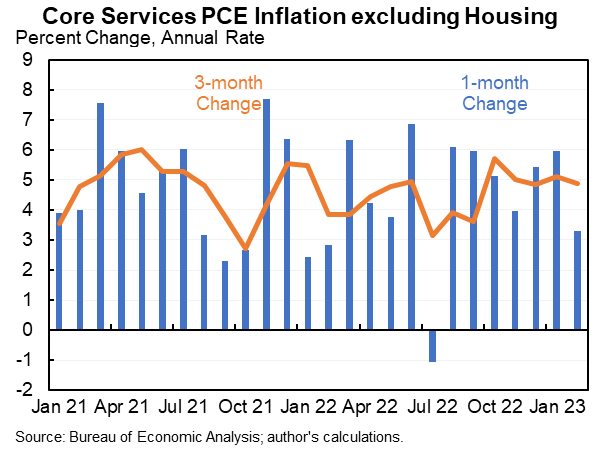

An alternative way to handle housing is simply to exclude it. This reproduces the "supercore" concept by excluding housing and used cars. Like core it has also moved sideways--and is consistent with inflation in the mid-4's.

This is the measure the Fed has been focused on, which is core services excluding housing. Like most everything else it improved in February, but like most everything else smoothed over longer periods it has been moving sideways--and is consistent with 4%+ inflation.

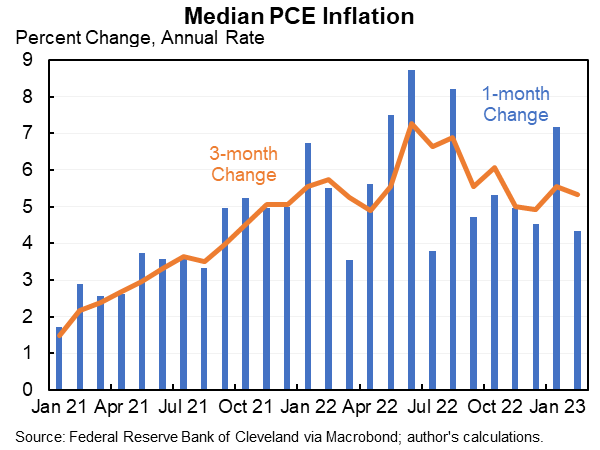

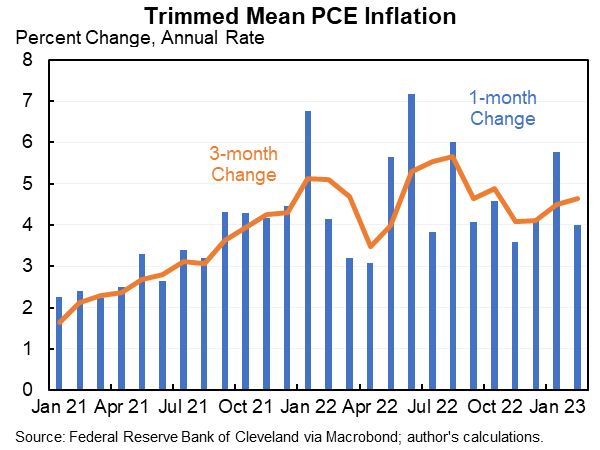

A lot of good empirical reasons to believe the median or trimmed mean are the best measures of core inflation, is telling us more like high 4s than low 4s.

Overall, the PCE price data tell a consistent story (more consistent than the story from the CPI, because housing matters less in the PCE).

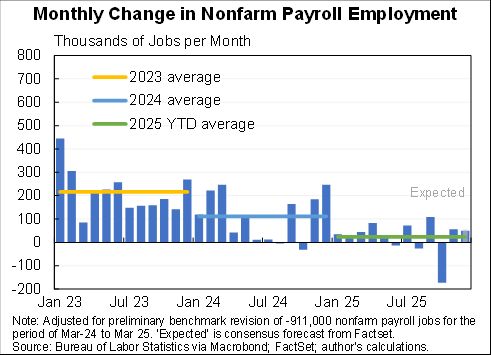

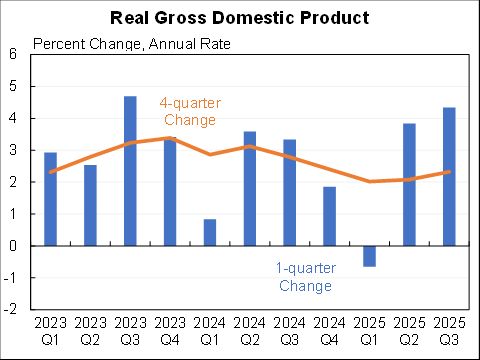

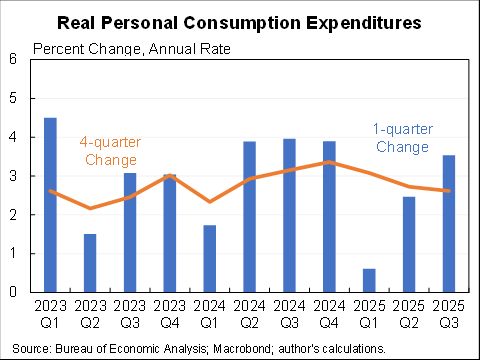

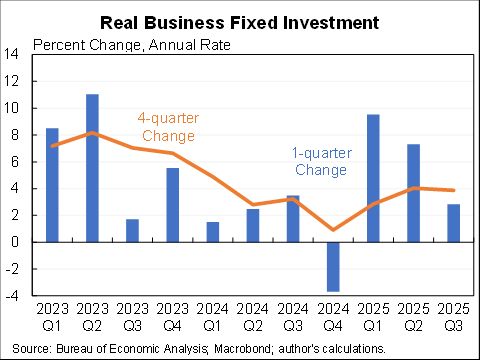

No big reason in the price data itself to expect that to change--but external data on growth and wages suggest some possibility of slowing.

No big reason in the price data itself to expect that to change--but external data on growth and wages suggest some possibility of slowing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh