I had $200,000+ in Bitget and it got stolen.

The worst part is that they're not responding to me, instead, they're spreading lies about me: (🧵)

#BitgetExposed

The worst part is that they're not responding to me, instead, they're spreading lies about me: (🧵)

#BitgetExposed

Here's what happened:👇

I moved $REELT & $MOVR worth over 200,000 #USDT in @bitgetglobal, they instantly froze the funds & stopped the trading declaring it as a specious activity.

The next day, the trading started & Bitget sold coins worth millions.

I moved $REELT & $MOVR worth over 200,000 #USDT in @bitgetglobal, they instantly froze the funds & stopped the trading declaring it as a specious activity.

The next day, the trading started & Bitget sold coins worth millions.

Not only me, but more than 300+ people have complained to me about this scam.

They are also not able to withdraw their funds.

And also aren't getting any response from the team.

They are also not able to withdraw their funds.

And also aren't getting any response from the team.

I tried contacting the team but didn't get any response.

Every time I or someone else tweet something about them, a Bot is replying within seconds.

Strange! They spent millions collaborating with Messi but can't hire a chat assistant to solve the queries.

Every time I or someone else tweet something about them, a Bot is replying within seconds.

Strange! They spent millions collaborating with Messi but can't hire a chat assistant to solve the queries.

Why Bitget is the next FTX ⁉️👇

• The first & biggest reason is that being a CEX holding user funds - they don't have a founder!

No one knows about the founder of Bitget.

(@GracyBitget is just a fake face for hire, the same way they hired Messi)

• They've no office address.

• The first & biggest reason is that being a CEX holding user funds - they don't have a founder!

No one knows about the founder of Bitget.

(@GracyBitget is just a fake face for hire, the same way they hired Messi)

• They've no office address.

They're Chinese scammers operating from a fake shell company in Africa.

• Bitget's terms of service clearly outline, any funds on their platform are their funds, not of the users.

So, they can legally freeze and take your funds.

• Bitget's terms of service clearly outline, any funds on their platform are their funds, not of the users.

So, they can legally freeze and take your funds.

Now you can understand why a Chinese company had to use a shell company in Africa!

• Almost 50% of reserves are in their token $BGB.

(Last time FTX was in a similar situation before it went down!)

Source: coinmarketcap.com/exchanges/bitg…

• Almost 50% of reserves are in their token $BGB.

(Last time FTX was in a similar situation before it went down!)

Source: coinmarketcap.com/exchanges/bitg…

Recently, Bitget got exploited & funds of more than $8M was lost.

But as it's a CEX, not a DEX, there's no chance of getting hacked.

It clearly shows that it was done internally only to steal $8M from the community.

financialexpress.com/blockchain/hac…

But as it's a CEX, not a DEX, there's no chance of getting hacked.

It clearly shows that it was done internally only to steal $8M from the community.

financialexpress.com/blockchain/hac…

They are fully reliant on heavy marketing & paid promotions.

But they hardly have any organic support.

Most of their followers are fake & bots.

Do you know who else was spending heavily on marketing?

- FTX!!

But they hardly have any organic support.

Most of their followers are fake & bots.

Do you know who else was spending heavily on marketing?

- FTX!!

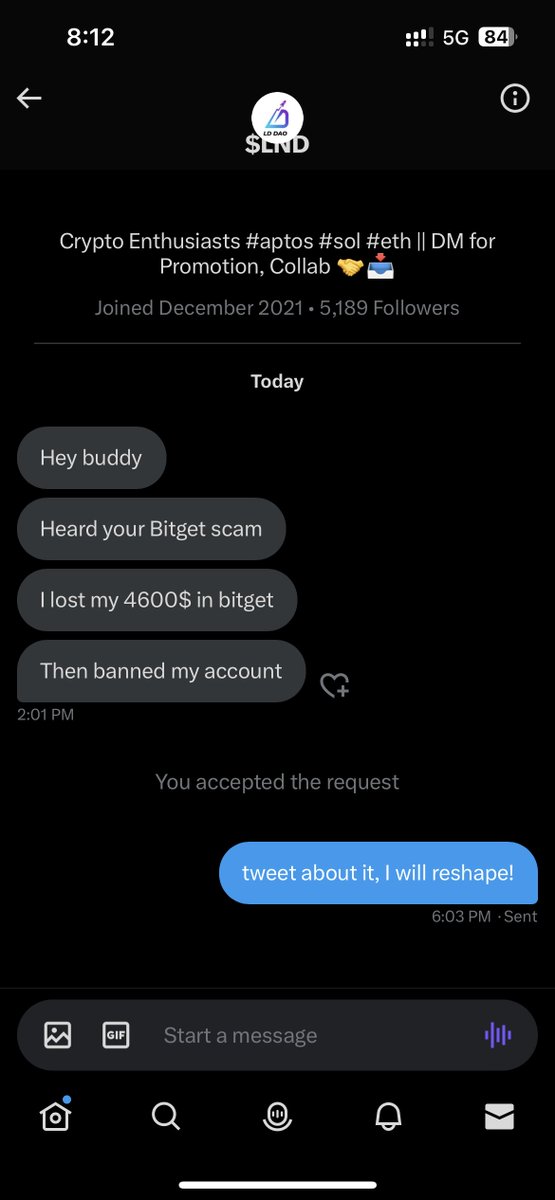

Instead of clarifying the matter directly with me, they are paying big influencers & accounts to defame me for dumping the tokens.

Here's the proof👇

Here's the proof👇

Last year, I alerted you all about FTX but most of you didn't believe me.

Even I had my funds worth more than $2M lost in FTX.

Even I had my funds worth more than $2M lost in FTX.

https://twitter.com/evanluthra/status/1605550469883244544

Some influencers like:

@scottmelker

@CryptoPointHi

@ZakaWaqar

And even, Messi ( @TeamMessi ) is promoting this scam.

Are you guys aware of these scam activities by your sponsor Bitget?

Do you have any responses on how to protect the community?

@scottmelker

@CryptoPointHi

@ZakaWaqar

And even, Messi ( @TeamMessi ) is promoting this scam.

Are you guys aware of these scam activities by your sponsor Bitget?

Do you have any responses on how to protect the community?

This is not something happening for the first time, Bitget has been scamming projects for a long time.

https://twitter.com/FWCOMMUNITY_Q2T/status/1556038950032113664?s=20

Thanks for reading it till here!

Two quick favors:

• Like this thread and mention 3 crypto influencers below👇

• Retweet this thread to spread awareness and save others.

Two quick favors:

• Like this thread and mention 3 crypto influencers below👇

• Retweet this thread to spread awareness and save others.

https://twitter.com/EvanLuthra/status/1643184070224953346

I've invited Bitget to come to a live space with me but they've refused.

Also, I've talked to the employees of Bitget, who have confirmed the scam that's going on.

I'm trying my best to convince them to speak up publically & expose them.

Hopefully, they will do it very soon.

Also, I've talked to the employees of Bitget, who have confirmed the scam that's going on.

I'm trying my best to convince them to speak up publically & expose them.

Hopefully, they will do it very soon.

Some of the people I'm tagging for help:

• @Alex__Belov

• @cobie

• @TheMoonCarl

• @sumitkapoor16

• @MMCrypto

• @cryptoamanclub

• @pushpendrakum

• @Davincij15

• @CryptoDaku_

• @talkwthme

• @open4profit

• @ImZiaulHaque

• @thisisksa

• @spideycyp_155

•… twitter.com/i/web/status/1…

• @Alex__Belov

• @cobie

• @TheMoonCarl

• @sumitkapoor16

• @MMCrypto

• @cryptoamanclub

• @pushpendrakum

• @Davincij15

• @CryptoDaku_

• @talkwthme

• @open4profit

• @ImZiaulHaque

• @thisisksa

• @spideycyp_155

•… twitter.com/i/web/status/1…

I strongly believe @bitgetglobal is the next FTX.

If you want to be safe, shift to DEX or use a trusted exchange who have founders like @cz_binance.

Remember, "Not your keys, not your crypto"

Stay safe & spread awareness about the #BitgetScam.

If you want to be safe, shift to DEX or use a trusted exchange who have founders like @cz_binance.

Remember, "Not your keys, not your crypto"

Stay safe & spread awareness about the #BitgetScam.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter