Honestly Wouldn't be shocked to see #0x0 do a minimal 20-30x + in price from here

Short to Mid term on top of giving non diluted yield rewards paid in $Eth

If you don't know what @0x0_Audits is.

Then this 🧵 should help.

Short to Mid term on top of giving non diluted yield rewards paid in $Eth

If you don't know what @0x0_Audits is.

Then this 🧵 should help.

2/

This Thread will focus more on the value Proposition of the token.

S/O to @CryptoHunterGon, I would've totally missed this one if i wasnt following him.

This Thread will focus more on the value Proposition of the token.

S/O to @CryptoHunterGon, I would've totally missed this one if i wasnt following him.

3/

One of the first questions I personally ask myself when speculating on a project is

How does buying / holding this token make me and others rich.

If that question cant be simply answered, then I move on.

#0x0 has the right ingredients imo to meet that basic requirement.

One of the first questions I personally ask myself when speculating on a project is

How does buying / holding this token make me and others rich.

If that question cant be simply answered, then I move on.

#0x0 has the right ingredients imo to meet that basic requirement.

4/

lets cover what is #0x0 and current products that are live

@0x0_Audits has a range of products with a key focuses on Privacy and Security

#0x0 has an AI-powered Solidity Smart Contract Auditor

that uses machine learning to analyze code for vulnerabilities, errors, and issues.

lets cover what is #0x0 and current products that are live

@0x0_Audits has a range of products with a key focuses on Privacy and Security

#0x0 has an AI-powered Solidity Smart Contract Auditor

that uses machine learning to analyze code for vulnerabilities, errors, and issues.

4/

The AI Auditor generates comprehensive reports that details any issues found, including a description of the problem, the location of the problem in the code, and suggestions for how to fix it.

Using Machine learning this will only get better.

The AI Auditor generates comprehensive reports that details any issues found, including a description of the problem, the location of the problem in the code, and suggestions for how to fix it.

Using Machine learning this will only get better.

5/

This product alone is great to use to verify if contracts are safe before jumping into a new project.

You can verify and look for vulnerabilities yourself vs waiting on the current process today.

You can try it yourself here --> auditor.0x0.ai

This product alone is great to use to verify if contracts are safe before jumping into a new project.

You can verify and look for vulnerabilities yourself vs waiting on the current process today.

You can try it yourself here --> auditor.0x0.ai

6/

Mixer & Flash Loan Protocol

Mixer

A non-traceable privacy ERC-20 transactions mixer is a decentralized platform that provides secure and anonymous transaction mixing. It uses smart contract technology to preserve the privacy of the source and destination of transactions...

Mixer & Flash Loan Protocol

Mixer

A non-traceable privacy ERC-20 transactions mixer is a decentralized platform that provides secure and anonymous transaction mixing. It uses smart contract technology to preserve the privacy of the source and destination of transactions...

7/

...making them untraceable

One of the big issues that is constantly ignored in crypto imo is basic privacy,

Having the ability to use a Mixer so others can't follow your transactions is huge win imo.

...making them untraceable

One of the big issues that is constantly ignored in crypto imo is basic privacy,

Having the ability to use a Mixer so others can't follow your transactions is huge win imo.

8/

It's not uncommon for others to have their wallets track, especially if they have a following or consider a whale, and people to mess up their trades or even get rekt by apeing in or following what they see the wallet they're tracking is doing. Giving the ability to maintain..

It's not uncommon for others to have their wallets track, especially if they have a following or consider a whale, and people to mess up their trades or even get rekt by apeing in or following what they see the wallet they're tracking is doing. Giving the ability to maintain..

9/

..privacy is a much needed product that should be regularly used in this space imo

Flash Loan Protocol

Additionally, it utilizes a flash-loan feature to generate fees that are distributed to $0x0 token holders. Ideal for users who place a high value on privacy and security.

..privacy is a much needed product that should be regularly used in this space imo

Flash Loan Protocol

Additionally, it utilizes a flash-loan feature to generate fees that are distributed to $0x0 token holders. Ideal for users who place a high value on privacy and security.

10/

Taken from their TG

When Someone deposits for ex, $Eth into the Mixer Dapp, Someone else can loan that $Eth in the meantime and quickly return it

Taken from their TG

When Someone deposits for ex, $Eth into the Mixer Dapp, Someone else can loan that $Eth in the meantime and quickly return it

11/

EX:

Borrow 1 $Weth

Buy 1000 #0X0 in UNI v2 for $WETH

Sell 1000 #0x0 in Uni v3 for 1.1 $WETH

Repay loan 1 $Wetth + 0.009 Fees

Profit = 0.091

If you can't pay back the loan in 1 tx, it won't go through.

It's all done in 1 tx.

EX:

Borrow 1 $Weth

Buy 1000 #0X0 in UNI v2 for $WETH

Sell 1000 #0x0 in Uni v3 for 1.1 $WETH

Repay loan 1 $Wetth + 0.009 Fees

Profit = 0.091

If you can't pay back the loan in 1 tx, it won't go through.

It's all done in 1 tx.

12/

The fees collected from this will also be re-distributed to #0X0 holders.

This also maximizes the value and fees that can be generated to earn non-diluted yield rewards paid in $ETH.

The fees collected from this will also be re-distributed to #0X0 holders.

This also maximizes the value and fees that can be generated to earn non-diluted yield rewards paid in $ETH.

13/

Mixer & Flash Loan Protocol has Already has been Audited,

Audit can be found here ---> app.solidproof.io/projects/0x0fa…

Mixer & Flash Loan Protocol can be found here --? mixer.0x0.ai

Mixer & Flash Loan Protocol has Already has been Audited,

Audit can be found here ---> app.solidproof.io/projects/0x0fa…

Mixer & Flash Loan Protocol can be found here --? mixer.0x0.ai

15/

This is what I strongly believe will sky rocket the token price along with earning non diluted rewards

Rewards will be claimable via Dashboard (currently being built), No staking or locking up tokens required.

This is what I strongly believe will sky rocket the token price along with earning non diluted rewards

Rewards will be claimable via Dashboard (currently being built), No staking or locking up tokens required.

16/

Going to go over the features of the Privacy Dex first then focus on the rewards based on what we know right now.

Going to go over the features of the Privacy Dex first then focus on the rewards based on what we know right now.

17/

#0X0 Privacy Dex is the next to be released along with a Dashboard to be able to Claim $Eth rewards that's generated without needing

to lock up or stake your tokens Simply buy #0X0 & automatically start generating non diluting yield from fees associated with all #0X0 Products

#0X0 Privacy Dex is the next to be released along with a Dashboard to be able to Claim $Eth rewards that's generated without needing

to lock up or stake your tokens Simply buy #0X0 & automatically start generating non diluting yield from fees associated with all #0X0 Products

18/

Privacy Dex will start for ERC20 tokens,

A Dex aggregator, such as 1inch will be integrated into #0X0 Platform instead of solely using Uniswap V2.

Privacy Dex will start for ERC20 tokens,

A Dex aggregator, such as 1inch will be integrated into #0X0 Platform instead of solely using Uniswap V2.

19/

The integration offers two key benefits

1. Ensures that users receive the best possible price for their value of their investment

2. Access to not only Uniswap v2 but also other #Ethereum - based Dexs, including:

Uniswapv3

SushiSwap

Curve

ShibaSwap

PancakeSwap

The integration offers two key benefits

1. Ensures that users receive the best possible price for their value of their investment

2. Access to not only Uniswap v2 but also other #Ethereum - based Dexs, including:

Uniswapv3

SushiSwap

Curve

ShibaSwap

PancakeSwap

20/

The expansion of the scope of possible trades and increased liquidity enhances the overall experience

At that point, why use anything else imo

The expansion of the scope of possible trades and increased liquidity enhances the overall experience

At that point, why use anything else imo

21/

Non Diluted ETH Rewards

Finally, were here. Why imo #0X0 token price will be mismatched and the rewards will cause

a massive markup in #0X0 price

Non Diluted ETH Rewards

Finally, were here. Why imo #0X0 token price will be mismatched and the rewards will cause

a massive markup in #0X0 price

22/

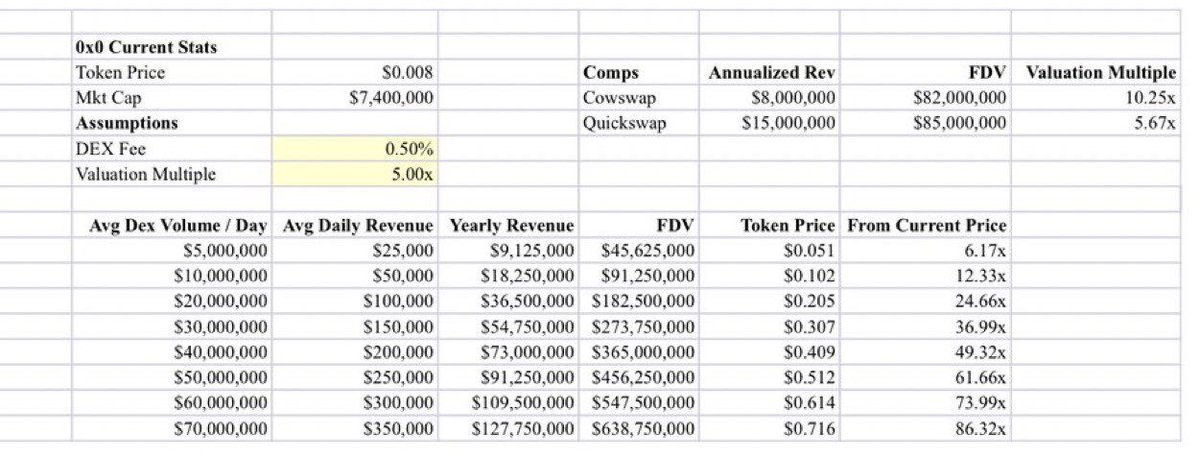

Sheet taken from @infinitybanyan (recommend to follow him btw)

Now to be realistic, the dex is not live yet, so we won't know exactly the amount of fees that are generated right now,

but we can look at ideal volume and go from there to give ourselves an idea on potential

Sheet taken from @infinitybanyan (recommend to follow him btw)

Now to be realistic, the dex is not live yet, so we won't know exactly the amount of fees that are generated right now,

but we can look at ideal volume and go from there to give ourselves an idea on potential

23/

I believe the DEX fees will charge 1% and will charge 0.50% if you hold 1Million #0X0 Tokens as the sheet shows

#0X0 Total Supply is 891.36M tokens with Almost 11% of Supply burnt from buybacks and burns so far.

I believe the DEX fees will charge 1% and will charge 0.50% if you hold 1Million #0X0 Tokens as the sheet shows

#0X0 Total Supply is 891.36M tokens with Almost 11% of Supply burnt from buybacks and burns so far.

24/

but if we assume total supply and holding 1M Tokens (currently 8-$9k worth)

and meet in the middle of fees (holding 1M #0X0 vs Not holding) from Volume just from the Privacy Dex..

but if we assume total supply and holding 1M Tokens (currently 8-$9k worth)

and meet in the middle of fees (holding 1M #0X0 vs Not holding) from Volume just from the Privacy Dex..

Rest of the thread

https://twitter.com/Teaching_Crypto/status/1643498365068427264?t=atYCNG3njF-44fIDJKvA8A&s=19

A few points to clear up

You will get rewards on any amount of #0x0 you hold

No staking or lockup is required

Basically earn as soon as you buy & can claim from a dashboard that's being built right now.

You will get rewards on any amount of #0x0 you hold

No staking or lockup is required

Basically earn as soon as you buy & can claim from a dashboard that's being built right now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter