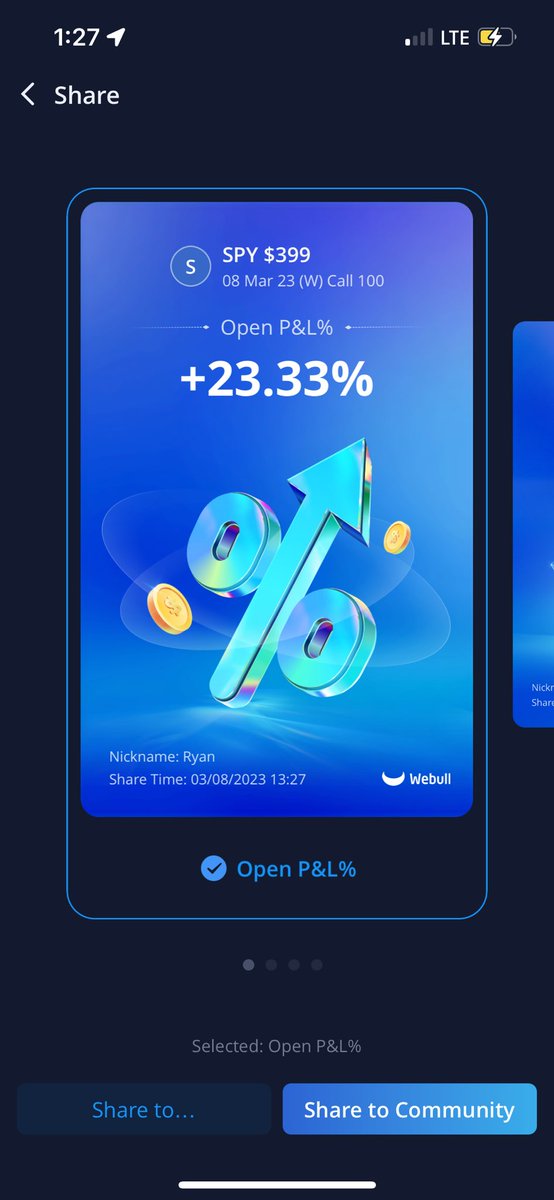

This is my signature model that is the main reasoning behind my 100% win rate my last 11 trades💎

Go backtest this in the charts #ICT

Go backtest this in the charts #ICT

This will be the highest probability with equal lows or high formed during market hours as the draw

we never closed below the bottom fvg so only one available was top one

Yes this is the 2022 model except I emphasize using the EQH/EQL as target, and I emphasize a break below a bullish fvg or strong close above bearish fvg and then use as inverse

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter