This week, Jamie Dimon published a massive 16,000-word $JPM Letter to Shareholders, sharing his views on topics such as inflation, fiscal policy, AI, and interest rates.

Here are 15 Key Highlights from the letter 📄🧵

1. Are we moving from a virtuous cycle to a vicious cycle?

Here are 15 Key Highlights from the letter 📄🧵

1. Are we moving from a virtuous cycle to a vicious cycle?

"Until the collapse of $SIVB, the current economy was performing adequately"

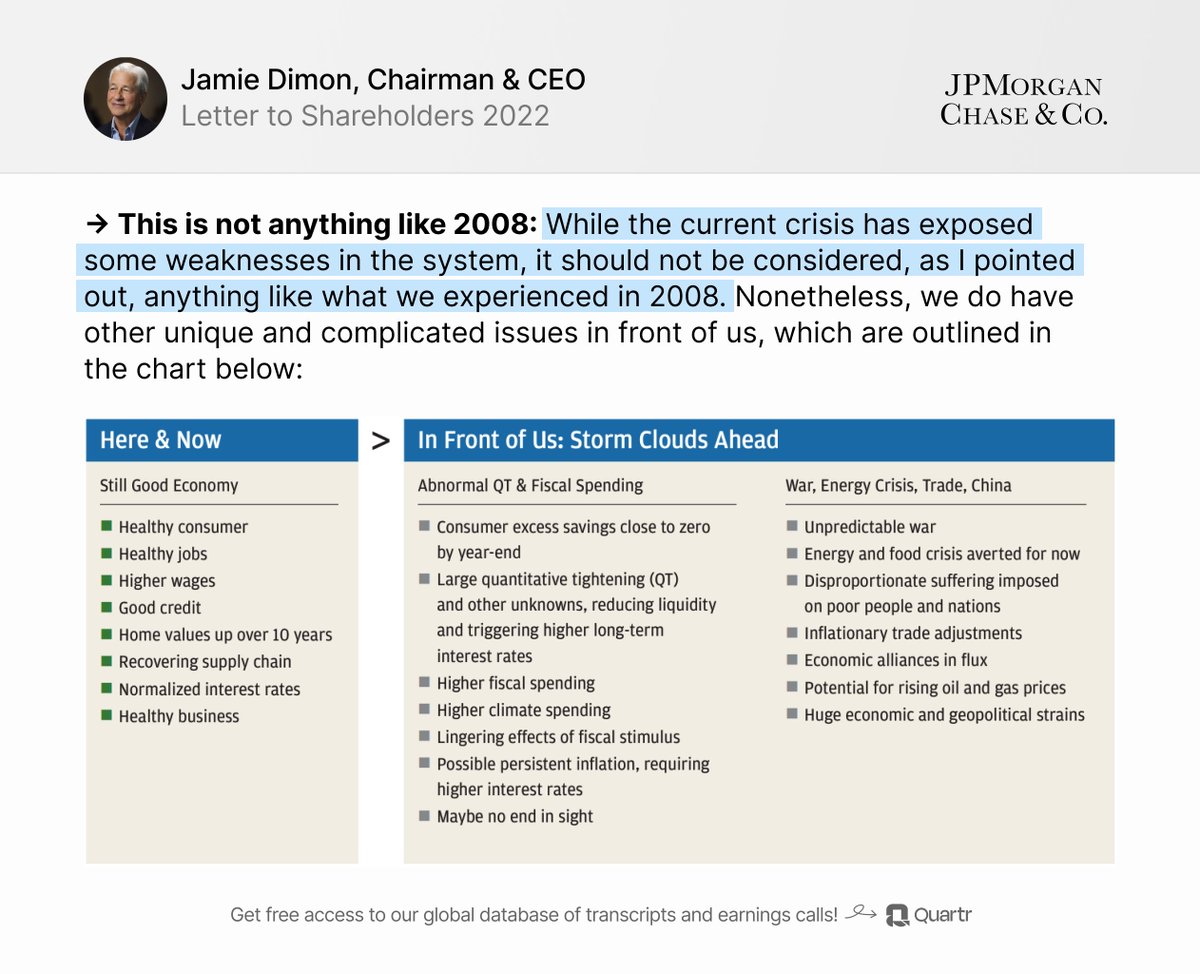

2. On the current economic environment:

2. On the current economic environment:

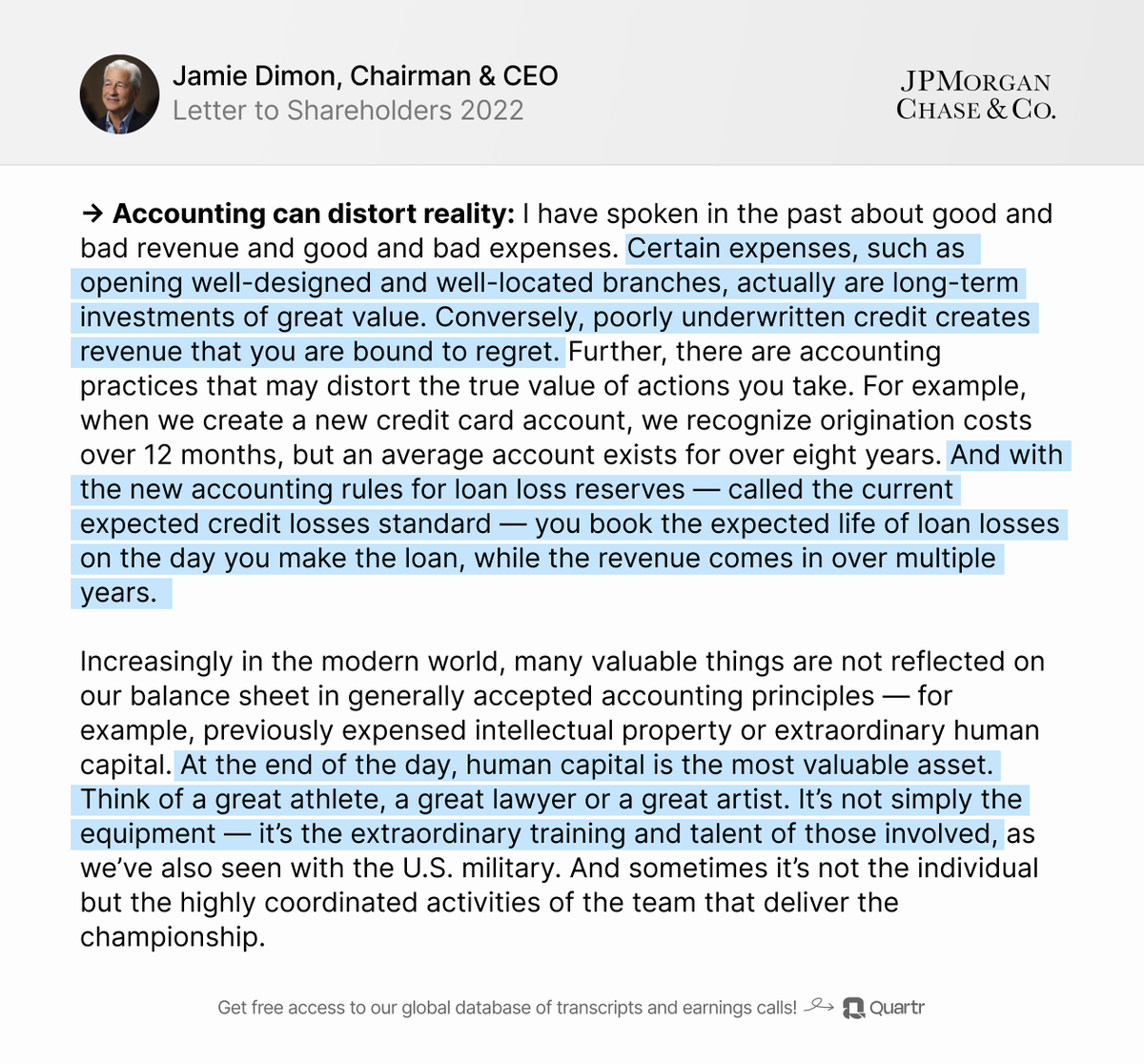

"There are accounting practices that may distort the true value of actions you take"

11. On the distortions that accounting can cause, and about the value of human skill:

11. On the distortions that accounting can cause, and about the value of human skill:

• • •

Missing some Tweet in this thread? You can try to

force a refresh