The term sacrifice is a universal concept.

Anyone that does a sacrifice gets a reward. Note Anyone.

For instance, you sacrifice eating sweets or cholesterol-filled tasty fries to gain a healthy lifestyle

#ChurchofMoney

Anyone that does a sacrifice gets a reward. Note Anyone.

For instance, you sacrifice eating sweets or cholesterol-filled tasty fries to gain a healthy lifestyle

#ChurchofMoney

The law of sacrifice is also progressive, the more you sacrifice, the more you get.

Messi sacrificed his youthful years kicking a football around, he got better, now he is a world champion.

Same with doctors, they sacrifice partying to read, then get a "Dr." and earn big bucks

Messi sacrificed his youthful years kicking a football around, he got better, now he is a world champion.

Same with doctors, they sacrifice partying to read, then get a "Dr." and earn big bucks

Sacrifice is universal, it works on good and bad

In 2 Kings 3 vs 27, we read about a King of Moab who was about to be overrun and defeated in battle, he takes that which is dearest to him, his oldest son, and sacrifices him, the Israelites withdrew from the battle.

In 2 Kings 3 vs 27, we read about a King of Moab who was about to be overrun and defeated in battle, he takes that which is dearest to him, his oldest son, and sacrifices him, the Israelites withdrew from the battle.

Easter sees another sacrifice. Jesus, God's own son is sacrificed on the cross. He dies, and He rises. He gains followers

One Man dying on Golgota returns 2.2b followers, that's a 219,999,999,900% return on "sowed capital"

Probably the highest return on any investment ever!

One Man dying on Golgota returns 2.2b followers, that's a 219,999,999,900% return on "sowed capital"

Probably the highest return on any investment ever!

Thus we have two principles

1. If you sacrifice something dear to you, your time for instance, you gain something of greater value.

2. The more you sacrifice, the greater your odds of victory.

#ChurchofMoney

1. If you sacrifice something dear to you, your time for instance, you gain something of greater value.

2. The more you sacrifice, the greater your odds of victory.

#ChurchofMoney

If I sacrifice my current consumption by sowing (investing) my income, I gain a return, all things being equal.

I however must sow in fertile fields, without thorns, then water my field continuously to get a return. (another sermon)

I however must sow in fertile fields, without thorns, then water my field continuously to get a return. (another sermon)

The more I sacrifice my free time to work, the more I earn.

The more I earn, The more I can sow.

The more I sacrifice consumption to get more seeds to sow, the more I can reap in future.

Work (earn) does not make me rich, the returns from my sacrificial sowing makes me rich

The more I earn, The more I can sow.

The more I sacrifice consumption to get more seeds to sow, the more I can reap in future.

Work (earn) does not make me rich, the returns from my sacrificial sowing makes me rich

This means that debt, which is frontloaded consumption or the opposite of sowing and reaping is a worry.

The Aramic word for debt "Khoba" is also sin.

With debt, you are reaping before sowing....not bad if you turn around and invest what you reaped.

The Aramic word for debt "Khoba" is also sin.

With debt, you are reaping before sowing....not bad if you turn around and invest what you reaped.

Investing needs the sacrifice current consumption.

Current income, not consumed must be sowed so it rises and gains more in the future.

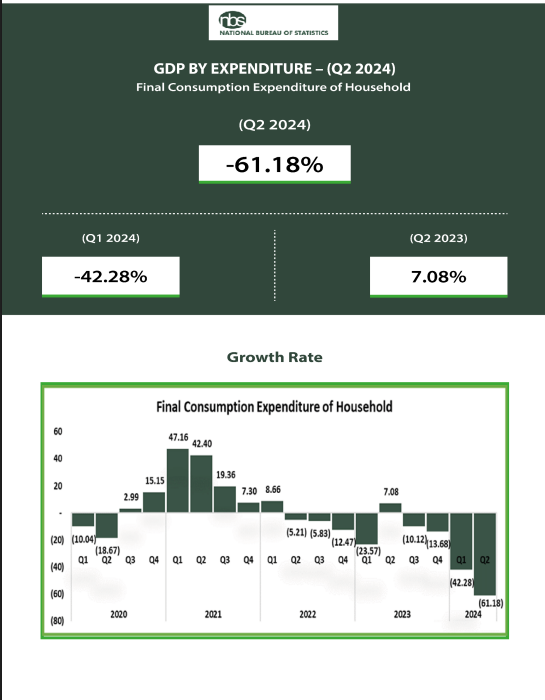

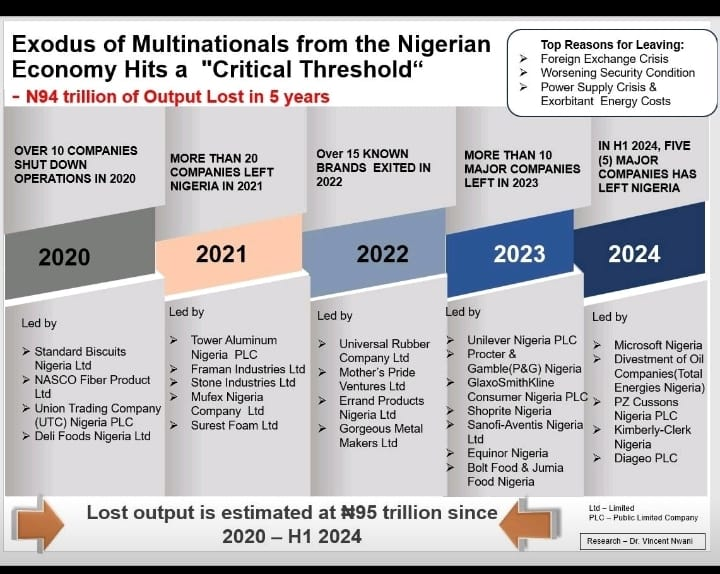

But watch out for inflation, it stalks around seeking who's returns to devour.

One day we should talk about inflation.

#ChurchofMoney

Current income, not consumed must be sowed so it rises and gains more in the future.

But watch out for inflation, it stalks around seeking who's returns to devour.

One day we should talk about inflation.

#ChurchofMoney

• • •

Missing some Tweet in this thread? You can try to

force a refresh