You take a LONG trade at open

Price moved upside, & you made some profits

After some time, the price started to come down

Now you don't know whether it is a TEMPORARY PULLBACK or a COMPLETE REVERSAL

5 Effective Ways to Know about it!

(1/N)

Thread 🧵🧵

#trading #StockMarket

Price moved upside, & you made some profits

After some time, the price started to come down

Now you don't know whether it is a TEMPORARY PULLBACK or a COMPLETE REVERSAL

5 Effective Ways to Know about it!

(1/N)

Thread 🧵🧵

#trading #StockMarket

#1 Look at Open Action

Open action (9.15-9.45) plays a crucial role in the day.

The presence of strong buyers indicates it is just a pullback.

The absence of strong buyers indicates a high possibility of reversal!

(2/N)

Open action (9.15-9.45) plays a crucial role in the day.

The presence of strong buyers indicates it is just a pullback.

The absence of strong buyers indicates a high possibility of reversal!

(2/N)

#2 Look at the Last 2 Days' Price Action

The last 2-3 days' market sentiment plays a crucial role in the current day.

If it is positive, then there is a high possibility that the price is just showing a temporary pullback (and not a complete reversal).

(3/N)

The last 2-3 days' market sentiment plays a crucial role in the current day.

If it is positive, then there is a high possibility that the price is just showing a temporary pullback (and not a complete reversal).

(3/N)

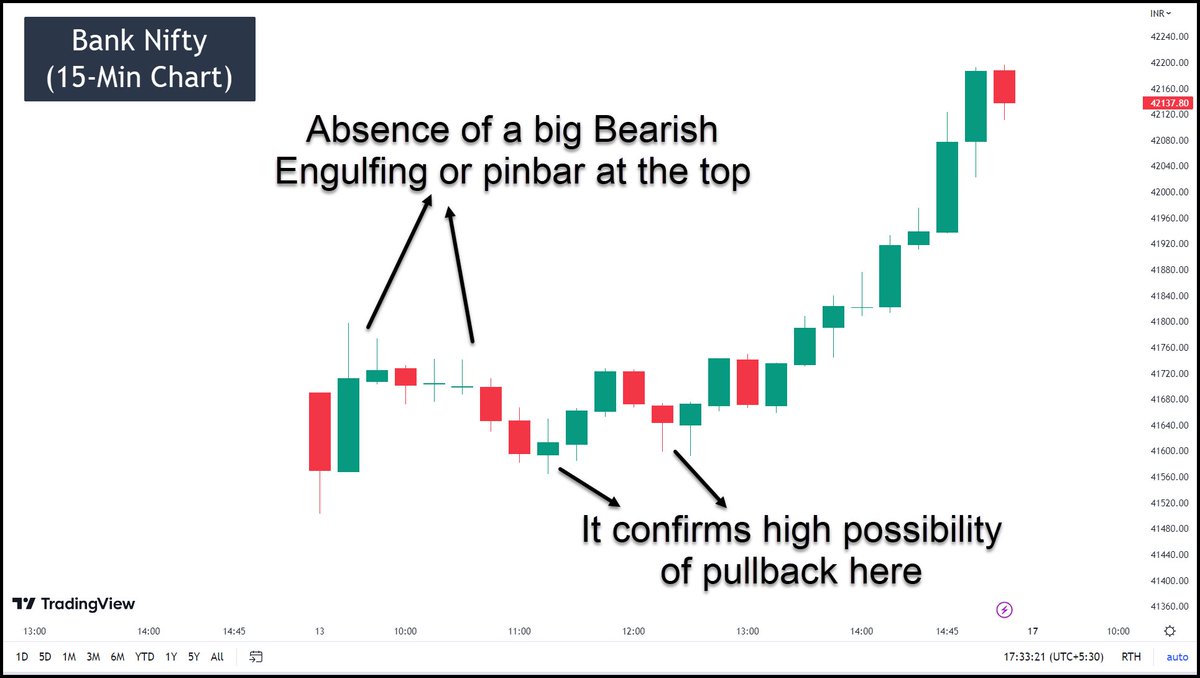

#3 Look at the Price Action at the Top!

Usually, the price forms a "big Bearish Engulfing" or a "big pinbar" at the top before reversing.

The absence of such a candlestick pattern indicates it is just a pullback!

(4/N)

Usually, the price forms a "big Bearish Engulfing" or a "big pinbar" at the top before reversing.

The absence of such a candlestick pattern indicates it is just a pullback!

(4/N)

#4 Look at VWAP

On most trading days, VWAP acts as Support or Resistance.

If the price is taking support at VWAP, then it means a high possibility of temporary pullback (and not complete reversal)

(5/N)

On most trading days, VWAP acts as Support or Resistance.

If the price is taking support at VWAP, then it means a high possibility of temporary pullback (and not complete reversal)

(5/N)

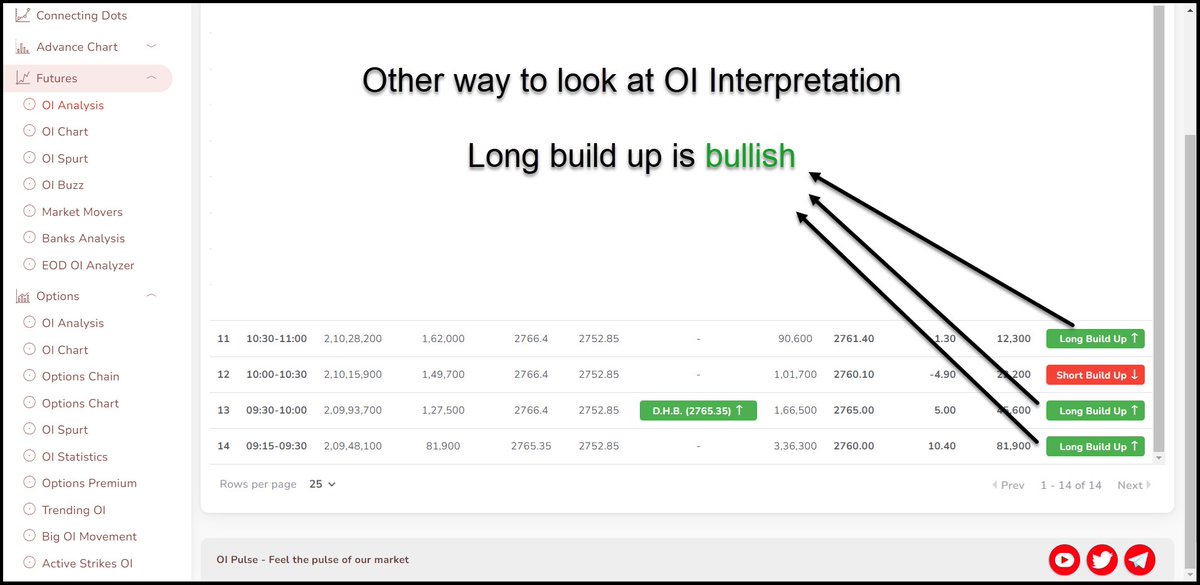

#5 Look at Open Interest (OI)

OI is the number of open contracts in a particular security.

If the OI data is bullish till that point, then it is just a temporary pullback.

Read this article to know more about OI

profiletraders.in/post/the-power…

(6/N)

OI is the number of open contracts in a particular security.

If the OI data is bullish till that point, then it is just a temporary pullback.

Read this article to know more about OI

profiletraders.in/post/the-power…

(6/N)

If you like this useful information, please #retweet and share it with your friends

Follow me

@indraziths

You can also check my online course about Price Action Trading

stockmarketcourses.in/courses/Price-…

Follow me

@indraziths

You can also check my online course about Price Action Trading

stockmarketcourses.in/courses/Price-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter