A few books to study the subject:

1. "The Little Book That Still Beats the Market" by Joel Greenblatt

2. "The Most Important Thing: Uncommon Sense for the Thoughtful Investor" by Howard Marks

3. "The Intelligent Investor" by Benjamin Graham

4. „Thinking, Fast and Slow“ by… twitter.com/i/web/status/1…

1. "The Little Book That Still Beats the Market" by Joel Greenblatt

2. "The Most Important Thing: Uncommon Sense for the Thoughtful Investor" by Howard Marks

3. "The Intelligent Investor" by Benjamin Graham

4. „Thinking, Fast and Slow“ by… twitter.com/i/web/status/1…

To make the point clearer:

"In the short term, the market is a voting machine, but in the long term, it is a weighing machine."

- Warren Buffett

"The idea of excessive stock market competition destroying the pricing mechanism has some validity, but it’s not a total disaster.… twitter.com/i/web/status/1…

"In the short term, the market is a voting machine, but in the long term, it is a weighing machine."

- Warren Buffett

"The idea of excessive stock market competition destroying the pricing mechanism has some validity, but it’s not a total disaster.… twitter.com/i/web/status/1…

The point I am making is that the companies with the safest earnings predictability are the ones with the highest moat or competitive advantage.

These will oscillate between over and undervalued around their Earnings per share trend.

These will oscillate between over and undervalued around their Earnings per share trend.

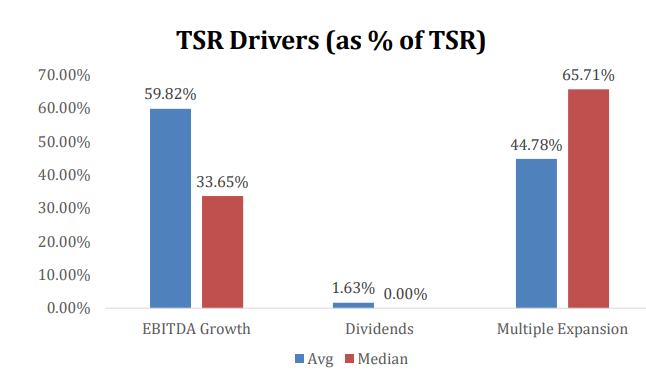

Overperformers capture the company growth which is reflected by the EPS growth long term as well as the mispricing to intrinsic value.

If a company grows eps at 15% and a short term issue gives you a 35% discount your 10y gain equals 18.5%/y only by going back to equilibrium.

If a company grows eps at 15% and a short term issue gives you a 35% discount your 10y gain equals 18.5%/y only by going back to equilibrium.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter