On Apr 15th, @HundredFinance was exploited for over $7M on #Optimism.

Hundred Finance was also a victim of a reentrancy attack on Mar 2022.

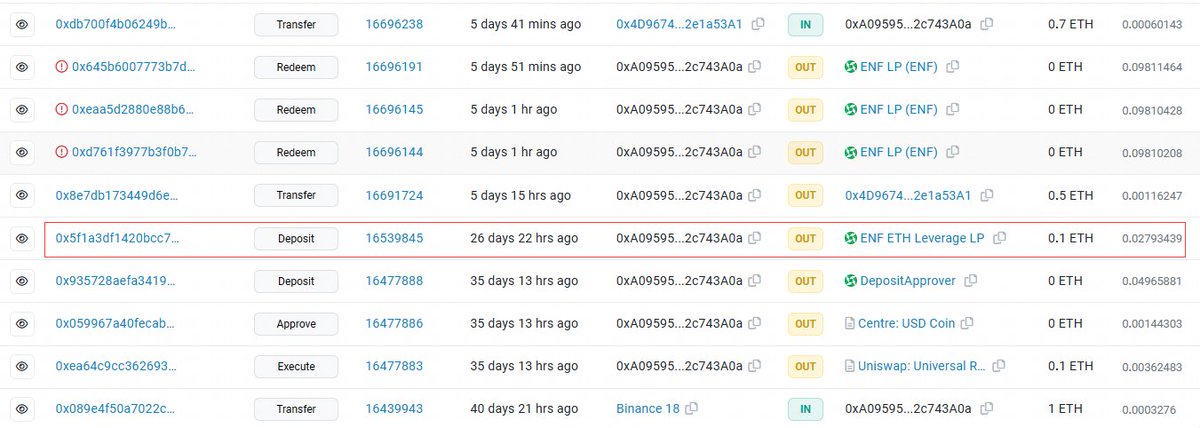

Txs:

0x15096dc6a59cff26e0bd22eaf7e3a60125dcec687580383488b7b5dd2aceea93

0x6e9ebcdebbabda04fa9f2e3bc21ea8b2e4fb4bf4f4670cb8483e2f0b2604f451

Hundred Finance was also a victim of a reentrancy attack on Mar 2022.

Txs:

0x15096dc6a59cff26e0bd22eaf7e3a60125dcec687580383488b7b5dd2aceea93

0x6e9ebcdebbabda04fa9f2e3bc21ea8b2e4fb4bf4f4670cb8483e2f0b2604f451

2/ The root cause is that the attacker can manipulate the exchangeRate by donating a large amount of WBTC to the hWBTC contract.

In the getAccountSnapshot function, the value of exchangeRateMantissa relies on the amount of WBTC in the contract.

In the getAccountSnapshot function, the value of exchangeRateMantissa relies on the amount of WBTC in the contract.

3/ The attacker flashloaned 500 $WBTC, then called the redeem function to redeem the previously staked 0.3 WBTC.

Next, the attack contract 1 sent 500.3 WBTC to attack contract 2. Contract 2 used 4 BTC to mint 200 hWBTC. The redeem function was then called to redeem the 4 BTC.

Next, the attack contract 1 sent 500.3 WBTC to attack contract 2. Contract 2 used 4 BTC to mint 200 hWBTC. The redeem function was then called to redeem the 4 BTC.

4/ Here the attacker can redeem the 4 WBTC previously staked with less than 200 hWBTC. At this point the attacker had a very small amount of hWBTC left on contract 2.

5/ Attack contract 2 then sent 500.3 WBTC to the hWBTC contract and borrowed 1021.91 ETH via the remaining 2 hWBTCs.

Finally the attack contract 2 repaid the previous debt by using 1 hWBTC, and withdrew 500.3 WBTC from the contract.

Finally the attack contract 2 repaid the previous debt by using 1 hWBTC, and withdrew 500.3 WBTC from the contract.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter