US national debt just hit a record $31.5 trillion, up over $8 trillion since 2020.

Total federal debt per household is now $240,000.

We now have a higher Debt/GDP ratio than post-World War 2, at 120%.

Here are some important facts about US national debt.

(a thread)

1/7

Total federal debt per household is now $240,000.

We now have a higher Debt/GDP ratio than post-World War 2, at 120%.

Here are some important facts about US national debt.

(a thread)

1/7

US national debt is now over 120% of GDP, which was $26.1 trillion in the fourth quarter of 2022.

In 2020, the Debt/GDP ratio hit a record 135% as the government passed over $4 trillion in stimulus.

By comparison, Debt/GDP after WW2 hit 114%.

The US has a TON of debt.

2/7

In 2020, the Debt/GDP ratio hit a record 135% as the government passed over $4 trillion in stimulus.

By comparison, Debt/GDP after WW2 hit 114%.

The US has a TON of debt.

2/7

21.8% of the public debt, or $6.9 trillion, is owned by the federal government itself.

This includes Medicare, specialized funds and retirement programs.

9.2% of US debt belongs to the Social Security program.

A program that may run out of money holds ~10% of our debt.

3/7

This includes Medicare, specialized funds and retirement programs.

9.2% of US debt belongs to the Social Security program.

A program that may run out of money holds ~10% of our debt.

3/7

Today, the Federal Reserve System is the largest holder of US debt.

After their massive balance sheet expansion during the pandemic, the Fed now owns ~20% of US debt.

At its peak in April 2022, the Fed held more than $6.25 trillion in US debt.

This was a historic move.

4/7

After their massive balance sheet expansion during the pandemic, the Fed now owns ~20% of US debt.

At its peak in April 2022, the Fed held more than $6.25 trillion in US debt.

This was a historic move.

4/7

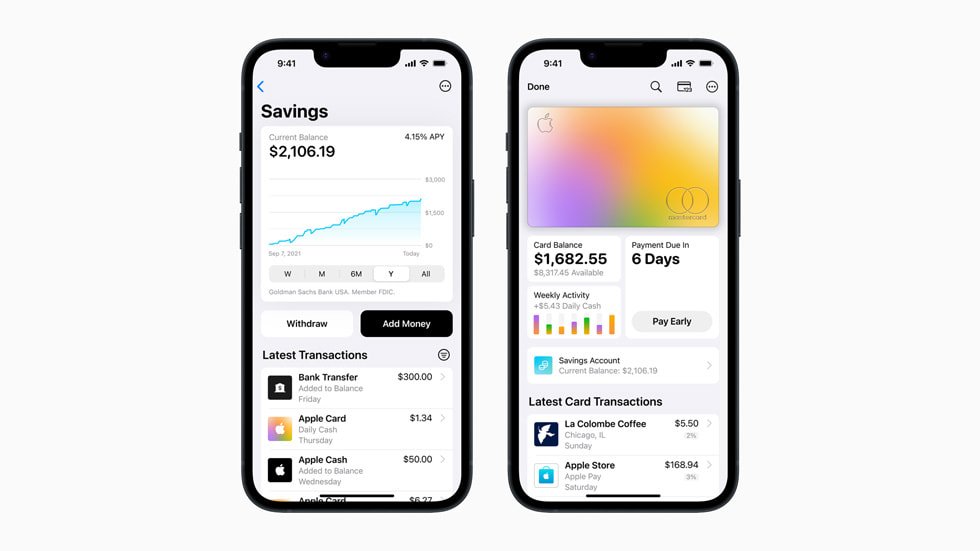

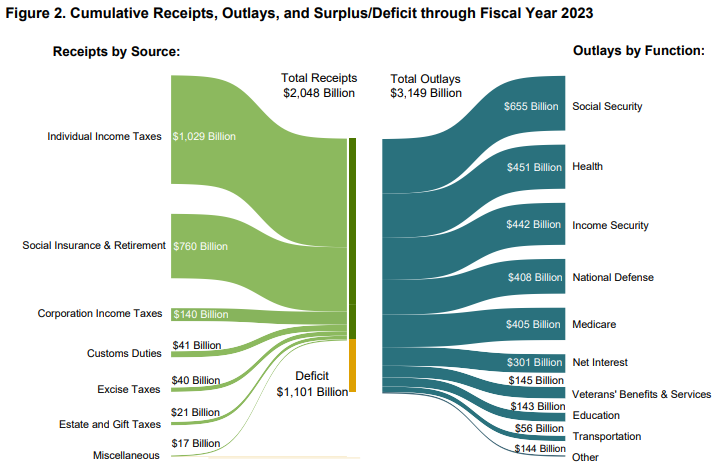

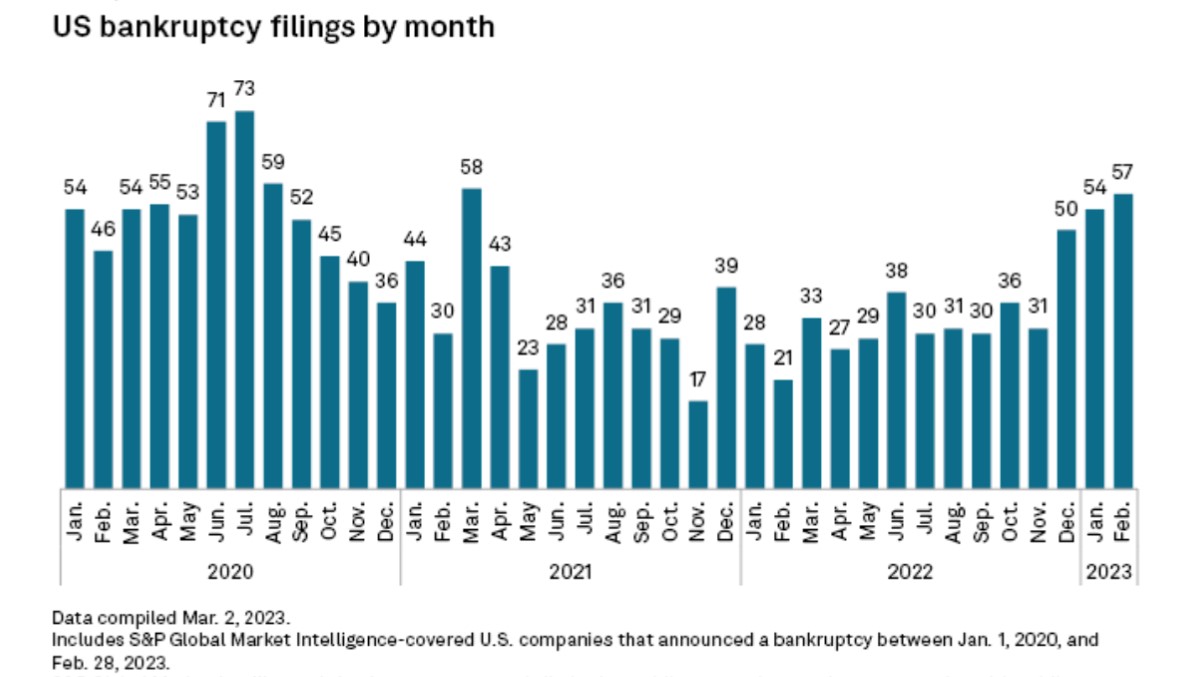

Meanwhile, servicing US debt is one of the government's biggest expenses.

Net interest payments on the debt are estimated to total $396 billion this fiscal year, or 6.8% of all federal outlays.

Interest expense since 2010 has totaled over $3 trillion.

5/7

Net interest payments on the debt are estimated to total $396 billion this fiscal year, or 6.8% of all federal outlays.

Interest expense since 2010 has totaled over $3 trillion.

5/7

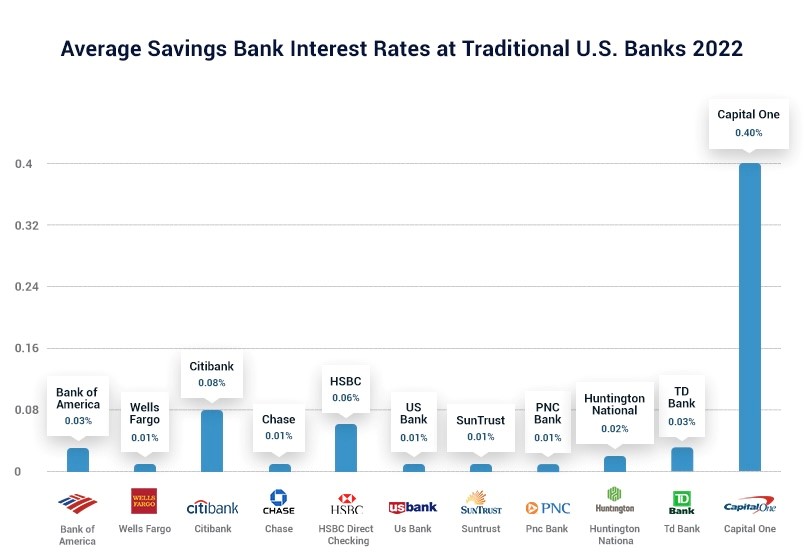

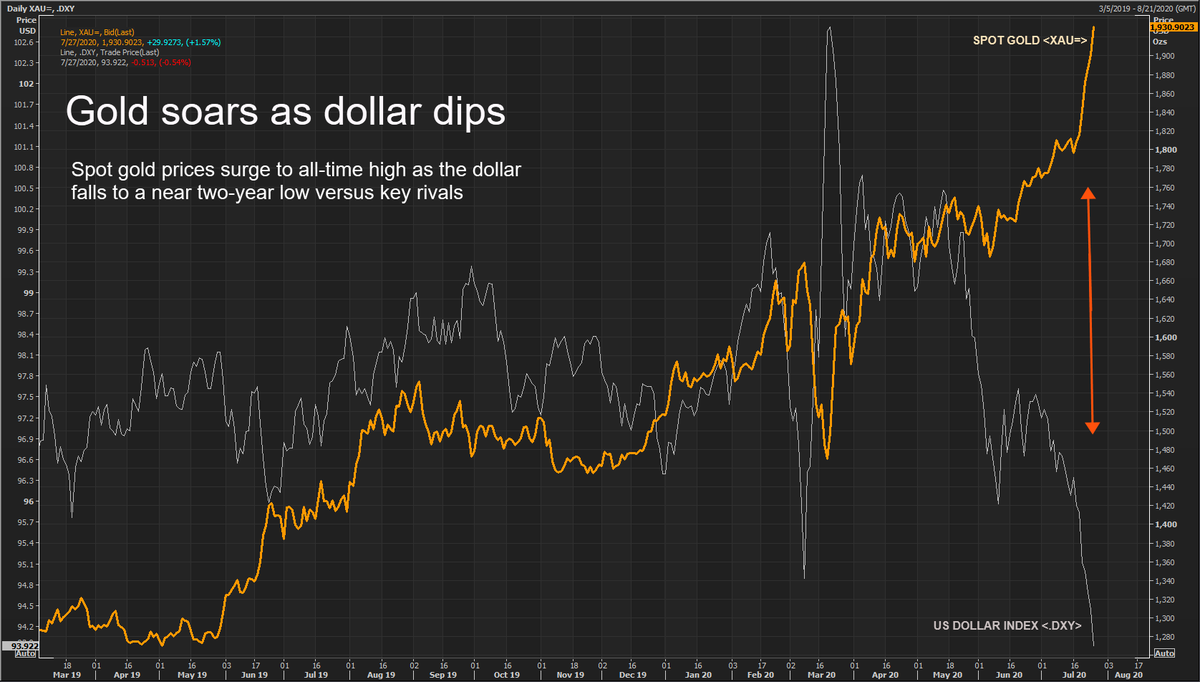

Despite record high interest, rates on US debt are still at historic lows.

While this seems like good news, rates are rising as the Fed attempts to cool inflation.

Currently, rates on US debt are at ~2%, while in the 1990s, it was ~9%.

Interest expense is rising quickly.

6/7

While this seems like good news, rates are rising as the Fed attempts to cool inflation.

Currently, rates on US debt are at ~2%, while in the 1990s, it was ~9%.

Interest expense is rising quickly.

6/7

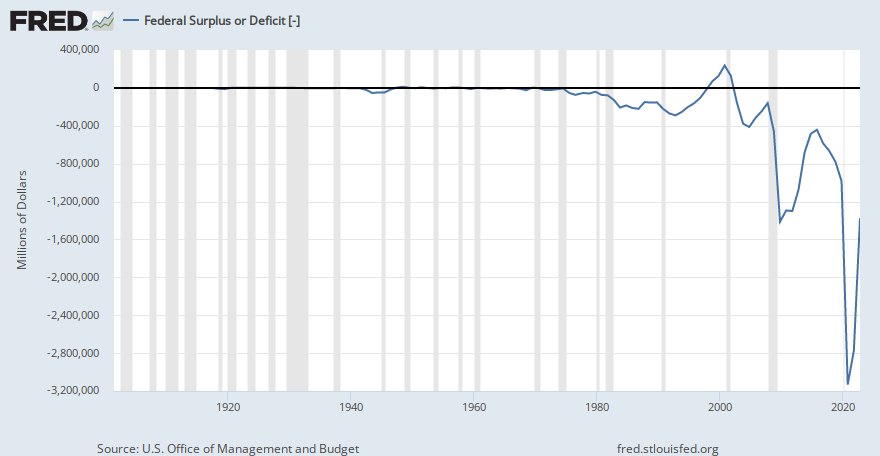

The US deficit is on track to hit $3 trillion by 2033 while Debt/GDP will hit 200% by 2046.

According to the US Treasury, “the rise in Debt/GDP indicates current fiscal policy is unsustainable.”

The debt crisis is here.

Follow us @KobeissiLetter for more as this develops.

7/7

According to the US Treasury, “the rise in Debt/GDP indicates current fiscal policy is unsustainable.”

The debt crisis is here.

Follow us @KobeissiLetter for more as this develops.

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter