Now it is confirmed that PLN23-060 is the best hole to date. A peak of 65.2% is the highest so far. 14.5m interval averaging 9.4% U3O8 is the best interval so far. $FUU #uranium

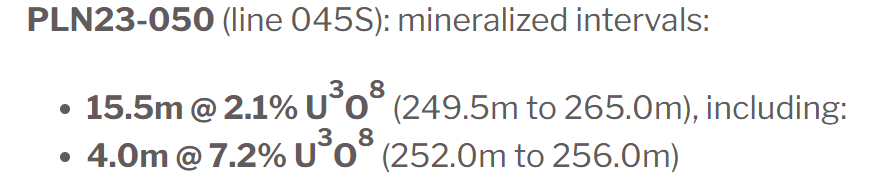

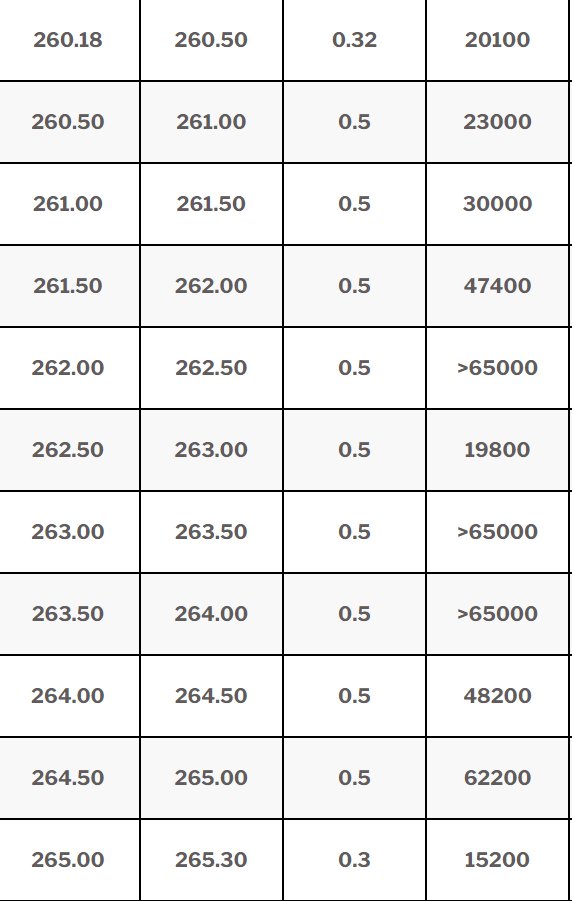

Some other great interceptions as well, on line 30S and 45S, showing we have a continous ultra-high grade core: $FUU #uranium

And remember that assays for the following holes are still pending, hole 59 with the widest interval to date, hole 61 in class with the discovery hole and hole 62 with 1m off-scale: #uranium $FUU

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter