Trading the wrong strategy is a recipe for losing money.

Pick the right strategy for the market.

Use the Hurst exponent to help.

Here’s how with Python:

Pick the right strategy for the market.

Use the Hurst exponent to help.

Here’s how with Python:

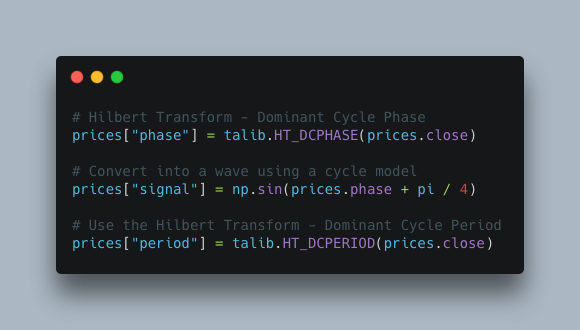

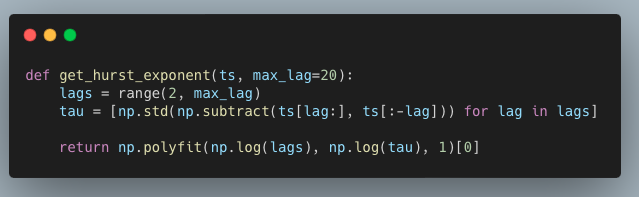

Calculate the Hurst exponent.

If it’s confusing, check out the recent newsletter for details (link at the bottom).

If it’s confusing, check out the recent newsletter for details (link at the bottom).

Use the Hurst exponent to help you pick the right trading strategy.

I break down all the details in a recent newsletter issue:

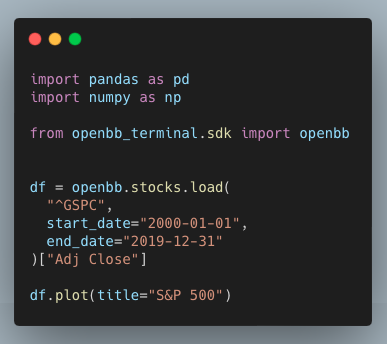

• Get data

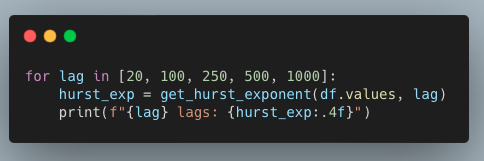

• Calculate Hurst

• Identify the market

Get it here:

pyquantnews.com/how-to-pick-th…

I break down all the details in a recent newsletter issue:

• Get data

• Calculate Hurst

• Identify the market

Get it here:

pyquantnews.com/how-to-pick-th…

The FREE 7-day masterclass that will get you up and running with Python for quant finance.

Here's what you get:

• Working code to trade with Python

• Frameworks to get you started TODAY

• Trading strategy formation framework

7 days. Big results.

pythonforquantfinancemasterclass.com

Here's what you get:

• Working code to trade with Python

• Frameworks to get you started TODAY

• Trading strategy formation framework

7 days. Big results.

pythonforquantfinancemasterclass.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter