Frederick Herzberg's research published(1968) revealed that achievement and recognition for achievement are the primary internal motivators.

A new study found out that even small wins or progress in meaningful work can greatly impact emotions, motivation, and performance

A new study found out that even small wins or progress in meaningful work can greatly impact emotions, motivation, and performance

Analyzing anonymous diary entries from hundreds of people and thousands of workdays, the study concluded that making progress in meaningful work, even through small wins, can significantly impact emotions, motivation, and performance.

In trading an investing, create 2 systems.

The results and the process.

The results:

The growth month by month, year by year and decade by decade will reflect your growth over time which is part of the small wins within the overall journey.

The results and the process.

The results:

The growth month by month, year by year and decade by decade will reflect your growth over time which is part of the small wins within the overall journey.

This growth, over time will push you to trust yourself, give you a loop of motivation and overall will make the journey and your life more enjoyable.

Despite the long term positive expectancy both in growth and emotional satisfaction, it is not what will get you there.

Despite the long term positive expectancy both in growth and emotional satisfaction, it is not what will get you there.

I want you to truly dissect the process from the results.

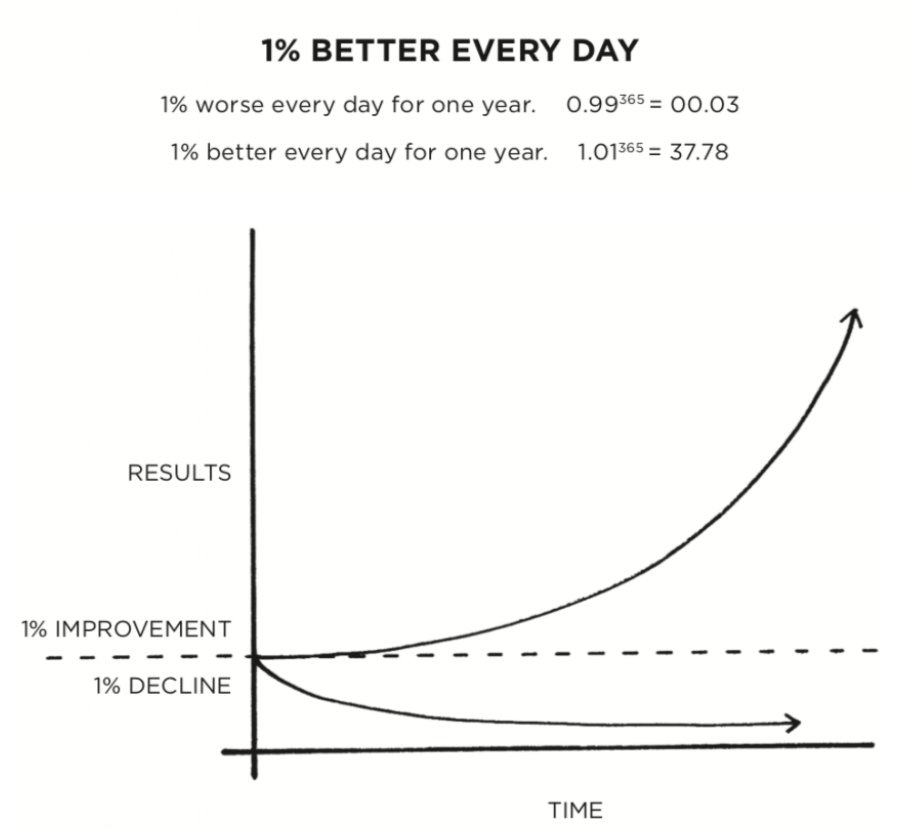

The overall result results from your daily process.

The process is what allows for the overall feedback loop to be enjoyable.

The overall result results from your daily process.

The process is what allows for the overall feedback loop to be enjoyable.

It is extremely important to have a quantifiable, objective and easy growth process to allow you to push through the learning curve your path entails.

Within the process I want you build clear checklist type items to materialize the growth.

For example:

•Prep each morning with checking boxes, which form an opp score

•Look through the dilution and if it fits your minimum criteria(for small caps)

•Formulate execution plan

For example:

•Prep each morning with checking boxes, which form an opp score

•Look through the dilution and if it fits your minimum criteria(for small caps)

•Formulate execution plan

3. Review the execution after the market close and once again use buckets:

Copy chart to review

Followed plan?

Executional performance?

Emotional control?

What you did well

What you did wrong

How can you fix mistakes

New Strategy findings

Copy chart to review

Followed plan?

Executional performance?

Emotional control?

What you did well

What you did wrong

How can you fix mistakes

New Strategy findings

Formulate an overall process, both longer term and day by day to quantify and feel the progress.

It is your job to create this structure, it will keep you grounded, objective and will allow you to harvest new motivation and energy.

Make your life a continuous growth process.

It is your job to create this structure, it will keep you grounded, objective and will allow you to harvest new motivation and energy.

Make your life a continuous growth process.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter