A short thread : How companies artificially boost ROE and ROCE

Recently, few companies claimed that they have superior return ratios (ROCE and ROE) compared to peers...which catches attention of most of the investors/analyst. 1/5

Recently, few companies claimed that they have superior return ratios (ROCE and ROE) compared to peers...which catches attention of most of the investors/analyst. 1/5

However, these companies have not generated enough cumulative FCF in last 10 years (adjusted for the acquisition). Still ROCE and ROE looks better.. why?

2/5

2/5

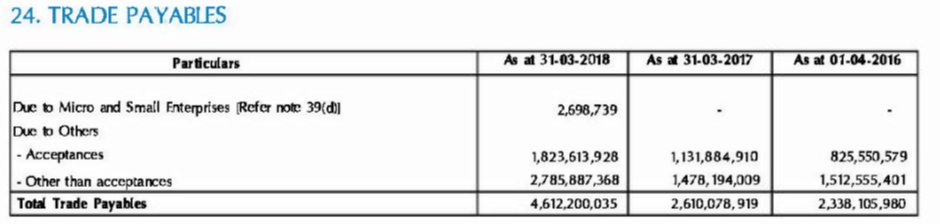

Under the guise of Ind-AS, companies restate acquisition done in the past and instead of recognizing goodwill, they create "Negative Capital Reserve"/ "Negative non-controlling interest reserve etc, which artificially erode the networth and so boost ROCE and ROE. 3/5

2. Example:

Some companies have restated the useful life of assets under the guise of Ind-AS convergence, which resulted into drastic dip depreciation, and so inflating EBIT and ROCE.

Some companies have restated the useful life of assets under the guise of Ind-AS convergence, which resulted into drastic dip depreciation, and so inflating EBIT and ROCE.

Example 3: Some companies do not recognise intangible assets in the books towards software development and expense it in the year of incurring.

These are few ways to artificially boost ROCE and ROE and when compared with peers, these companies looks better which is just an eye wash.. investors should be careful while investing in such companies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter