This will take 8 minutes to learn so be ready.

8 set-ups for beginner and intermediate $SPY

Included charts & when to take enter the trade 👇

8 set-ups for beginner and intermediate $SPY

Included charts & when to take enter the trade 👇

Double Bottom

• Wait for the low of the day to be been created

• Then wait for the same low of day to be retested

• Watch sellers to decrease while buyers jump into buy

• Wait for the low of the day to be been created

• Then wait for the same low of day to be retested

• Watch sellers to decrease while buyers jump into buy

VWAP Breakout on a Red Day

• The $SPY is trading weak or on a down day

• In the morning the VWAP acts as resistance

• After 2pm watch for the VWAP to break for a good entry

• Watch for volume to come into this breakout

• The $SPY is trading weak or on a down day

• In the morning the VWAP acts as resistance

• After 2pm watch for the VWAP to break for a good entry

• Watch for volume to come into this breakout

9:30am VWAP Entry

• The market opens and consolidates

• The sell off is weak and you can tell on the low volume

• As soon as buyers start to break above the VWAP then you can take your entry

• This one is best to watch on 5 min time frame and requires more practice to do

• The market opens and consolidates

• The sell off is weak and you can tell on the low volume

• As soon as buyers start to break above the VWAP then you can take your entry

• This one is best to watch on 5 min time frame and requires more practice to do

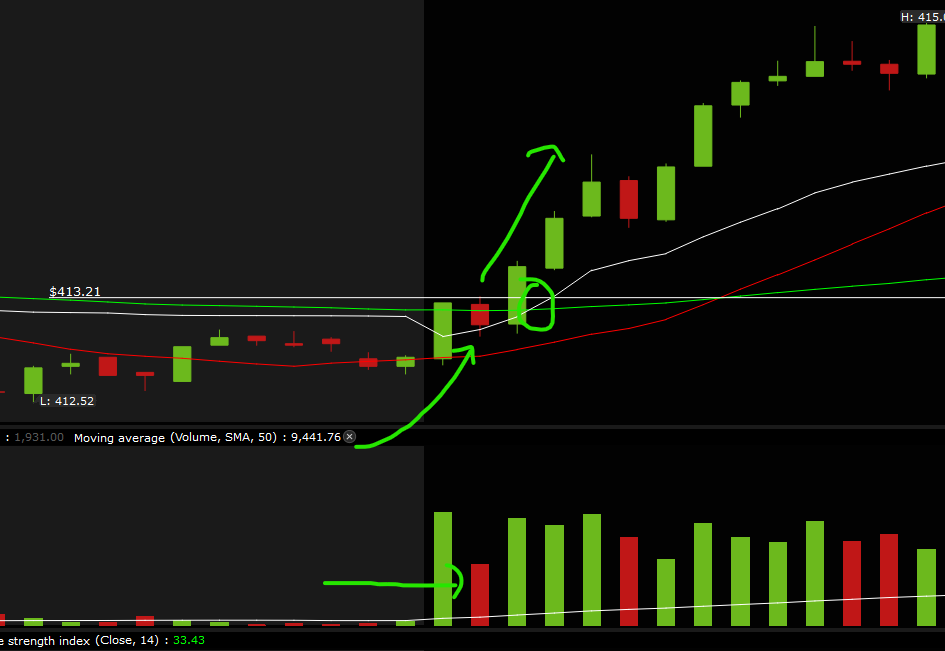

Trend break with Volume confirmation

• The more times a trend has been tested the bigger breakout

• Watch for volume to come in to confirm buyers are stepping into market

• This one requires patience and watching closely for buyers to break trend

• The more times a trend has been tested the bigger breakout

• Watch for volume to come in to confirm buyers are stepping into market

• This one requires patience and watching closely for buyers to break trend

Opening Range Breakdown

• Market opens wait for a clear range to be formed both the top and bottom.

• As soon as the bottom or low of day is broken then you can take entry

• The big confirmation is watching the selling pressure start to increase into the support level

• Market opens wait for a clear range to be formed both the top and bottom.

• As soon as the bottom or low of day is broken then you can take entry

• The big confirmation is watching the selling pressure start to increase into the support level

Opening Range Breakout

• Market opens wait for a clear range to be formed both the top and bottom.

• As soon as the resistance or high of day is broken then you can take entry

• The big confirmation is watching the buying pressure start to increase towards the resistance

• Market opens wait for a clear range to be formed both the top and bottom.

• As soon as the resistance or high of day is broken then you can take entry

• The big confirmation is watching the buying pressure start to increase towards the resistance

To be part of my risk management series where I review how to protect your capital and price targets

1) Follow me @SuperLuckeee

2) Retweet & LIKE 💕this thread

1) Follow me @SuperLuckeee

2) Retweet & LIKE 💕this thread

Bearish Divergence

• If the price keeps going up you can see ahead of time that is getting weak

• Watch the RSI to go down or the opposite direction showing momentum is slowing

• This means a reversal is coming most likely

• If the price keeps going up you can see ahead of time that is getting weak

• Watch the RSI to go down or the opposite direction showing momentum is slowing

• This means a reversal is coming most likely

$SPY times

• The best times to trade $SPY is from 930am - 11am

• The best time to watch for big reversals happen after 2pm

• Strong moves at close happen after 3:30pm

• Volume starts to pick up from 3:00 to 4:00pm

• The best times to trade $SPY is from 930am - 11am

• The best time to watch for big reversals happen after 2pm

• Strong moves at close happen after 3:30pm

• Volume starts to pick up from 3:00 to 4:00pm

If this was helpful for you! Please share this content with others

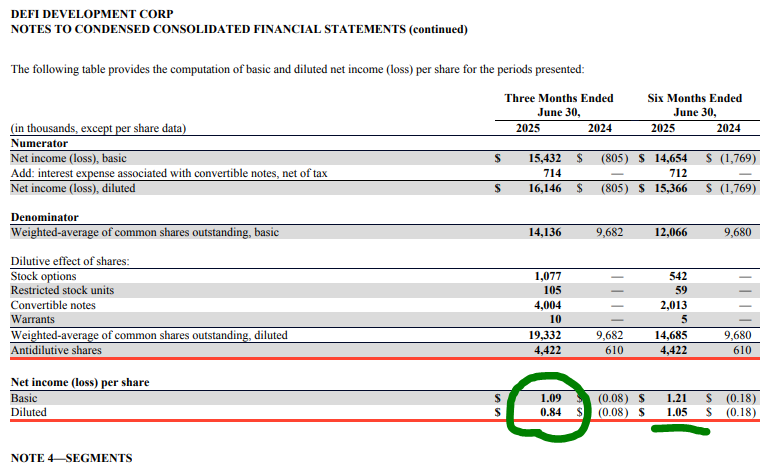

• If you want to be part of our next threads where we break down the financial analysis and earnings

comment "educate" then we will make a thread for it.

• If you want to be part of our next threads where we break down the financial analysis and earnings

comment "educate" then we will make a thread for it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh