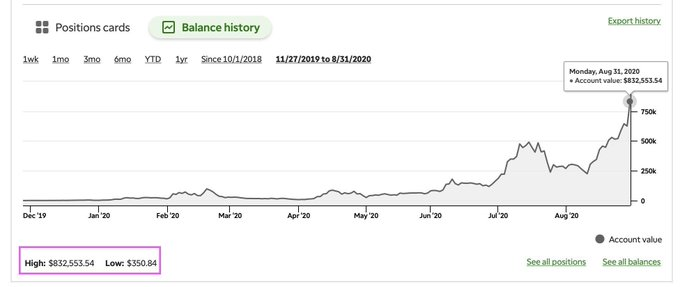

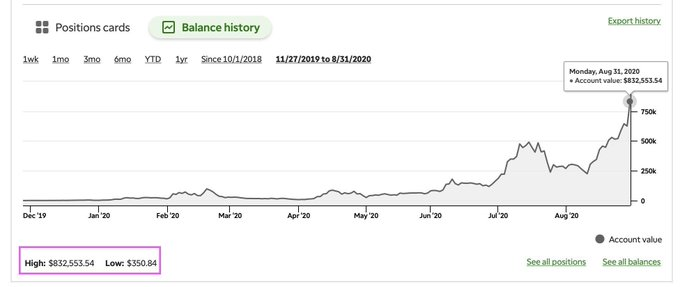

• 14 yrs day-trading & swing trading • God is Love💚 • Trade live and grow with us $350 to $17 million👇 follow us on Youtube: superluckeee_trading

12 subscribers

How to get URL link on X (Twitter) App

1. Core Business & Fundamentals

1. Core Business & Fundamentals

PROMPT 1 – The Undervaluation Screener

PROMPT 1 – The Undervaluation Screener

The gov. is looking to open again in Nov. If this happens we'll have economic data. JPOW will most likely cut in December. This is extremely bullish for the market.

The gov. is looking to open again in Nov. If this happens we'll have economic data. JPOW will most likely cut in December. This is extremely bullish for the market.https://x.com/RyanDetrick/status/1982809227748864222

1 year ago, I alerted IONQ when it was less then $7 ran towards $80+

1 year ago, I alerted IONQ when it was less then $7 ran towards $80+https://x.com/e_tgal/status/1966977824327430442

SPY has spiked 40% from $481 to $667. It is due for a pull back. Big possibility it sells off 5%-10% in October then rallies up for year-end to target $675-$700.

SPY has spiked 40% from $481 to $667. It is due for a pull back. Big possibility it sells off 5%-10% in October then rallies up for year-end to target $675-$700.https://x.com/RyanDetrick/status/1971230391563690141

Disclaimer: Investing involves significant risk. You can lose most or all of your capital before ever seeing gains.

Disclaimer: Investing involves significant risk. You can lose most or all of your capital before ever seeing gains.

Make sure to follow @itsmichaelluu who exactly predicted SPY would hit $650 in August 1 month ahead of time:

Make sure to follow @itsmichaelluu who exactly predicted SPY would hit $650 in August 1 month ahead of time: https://x.com/SuperLuckeee/status/1953518940132446590

These 5 SPY set-ups are good in bull market for 2025. Here's the criteria (bookmark or write it down)

These 5 SPY set-ups are good in bull market for 2025. Here's the criteria (bookmark or write it down)

Make sure you follow @itsmichaelluu for simple but powerful analysis always right before the breakout happens:

Make sure you follow @itsmichaelluu for simple but powerful analysis always right before the breakout happens:https://x.com/SuperLuckeee/status/1953116281344811393

2025 is a massive SWING trading bull market.

2025 is a massive SWING trading bull market.

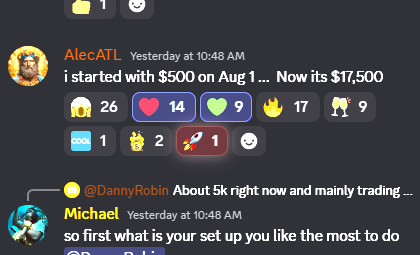

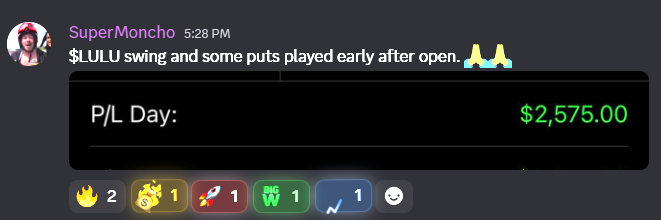

Make sure to follow my trading partner @itsmichaelluu for swing trading alerts for smaller accounts.

Make sure to follow my trading partner @itsmichaelluu for swing trading alerts for smaller accounts.https://x.com/SuperLuckeee/status/1952747057854255273

Make sure to follow my trading partner @itsmichaelluu if you're struggling and want more FREE trading-alerts like these:

Make sure to follow my trading partner @itsmichaelluu if you're struggling and want more FREE trading-alerts like these:https://x.com/SuperLuckeee/status/1952747057854255273

1. Earnings will kick off and I expect it will do better then expected for most companies actually. I'd start trimming positions so to keep a healthy cash position.

1. Earnings will kick off and I expect it will do better then expected for most companies actually. I'd start trimming positions so to keep a healthy cash position.

The best way to trade SPY for the rest of the year is to BUY THE DIPS. The key is to add at major areas of support for SPY so close to $610 and $600.

The best way to trade SPY for the rest of the year is to BUY THE DIPS. The key is to add at major areas of support for SPY so close to $610 and $600.

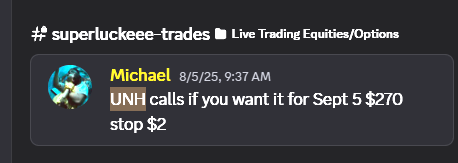

This is actual call out at 9:41am EST after I saw weakness on TSLA chart on the 5min and 1HR time frame.

This is actual call out at 9:41am EST after I saw weakness on TSLA chart on the 5min and 1HR time frame.

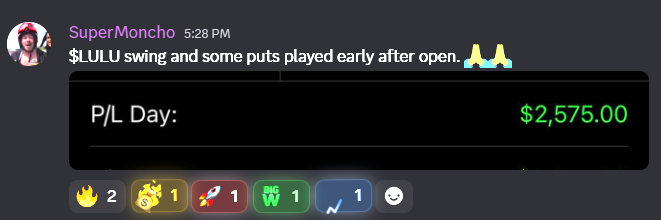

Follow @PhilipSoungCho if you're struggling to be a profitable trader. Its easy to double your trading account in a week with this easy set-up you can learn in 1 hour:

Follow @PhilipSoungCho if you're struggling to be a profitable trader. Its easy to double your trading account in a week with this easy set-up you can learn in 1 hour:https://x.com/PhilipSoungCho/status/1936058622347558962

First, you don't have to take too many trades especially if you work full-time.

First, you don't have to take too many trades especially if you work full-time.

Follow @PhilipSoungCho if you're struggling to grow your account and is not consistent.

Follow @PhilipSoungCho if you're struggling to grow your account and is not consistent. https://x.com/PhilipSoungCho/status/1933657818994819447

4 items to memorize:

4 items to memorize:

Bookmark and STUDY this cheatsheet for REVERSAL patterns for candlesticks. This is all you will need to memorize:

Bookmark and STUDY this cheatsheet for REVERSAL patterns for candlesticks. This is all you will need to memorize: