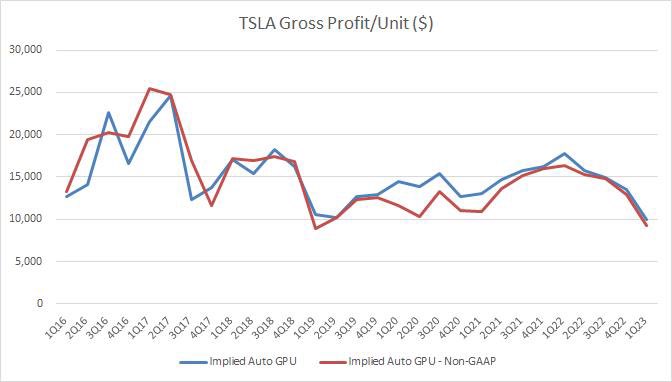

And with gross and operating margins higher than $TSLA, Mercedes doesn’t seem to be “disrupted”, does it? #ProfitableDinosaur

(5) So can we dispense with this silly narrative that $TSLA price cuts are only hurting the legacy automotive OEM’s, please? At their current 9% operating margin, any further Tesla price cuts will also disrupt…Tesla.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter