Sanctions were supposed to deny Russia's ability to finance the war. But sanctions were delayed and it didn't happen. Now sanctions are finally starting to bite. At the end of 2022 liquid reserves were slightly above 1 month of import. More facts: 1/

Before the invasion, Russia's reserves were $634B. Sanctions immobilize about $313B. This leaves Russia with $146B in gold and about $107B in FX assets (largely yuan). 2/

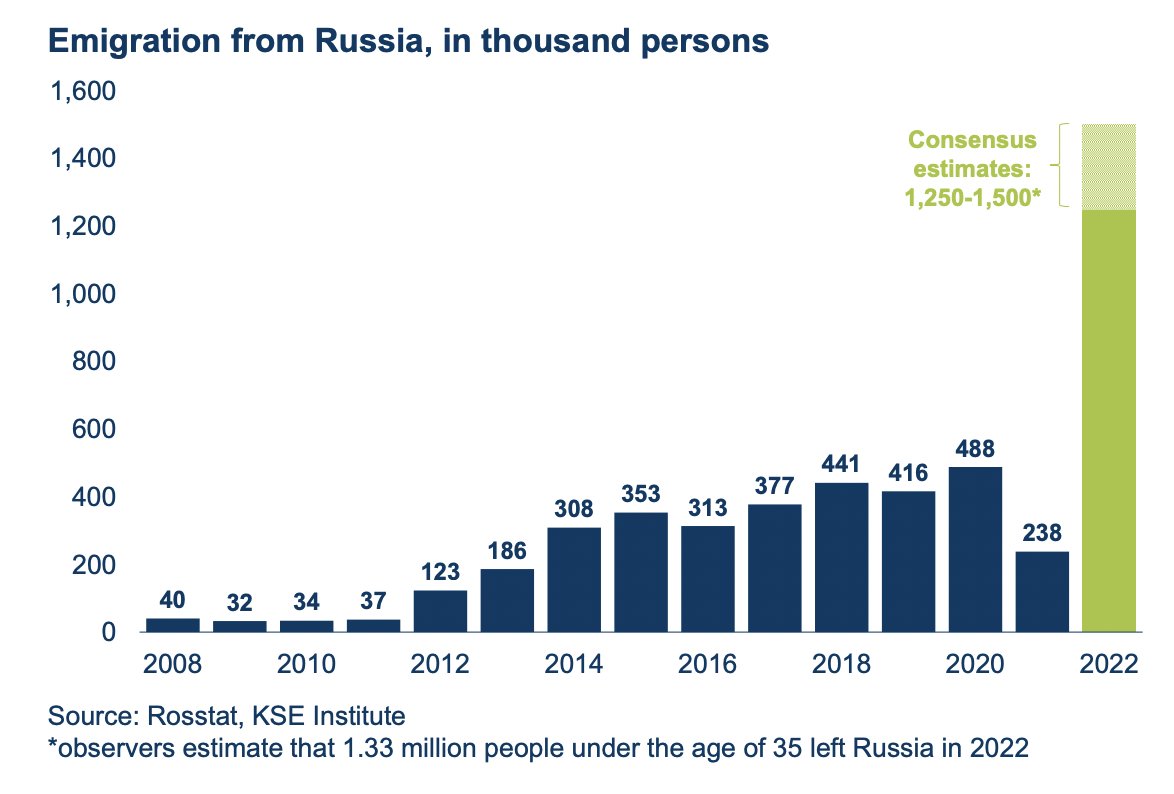

Russia’s economy faces an extended period of stagnation. There was essentially 0 productivity growth post-2014; now it will turn negative due to sanctions and war. Russian economy will further suffer due to emigration and brain drain. 3/

Russia reports a record deficit of 2.4T rubles in 2023Q1 - 82% of the full-year budget target. December had a record single-month deficit of more than 4T rubles. Key drivers are revenue underperformance, notably oil and gas, and elevated expenditures due to the war. 4/

Oil and gas revenues for January-March are 45% below their level the last year. Russia is increasing its tax on oil. However, this is estimated to bring about 600B - not even close to cover Ts in lost revenues. 5/

EU embargoes on crude oil (Dec. 5, 2022) and oil products (Feb. 5, 2023) were delayed. But now together with Europe’s exit from Russian gas, over 50% pre-invasion exports are sanctioned. The sanction gaps are East Asian democracies as well as China, India, and Turkey. 6/

Russia was able to redirect crude oil to China, India, and Turkey. The exclusion of shipping services from the EU embargo allowed to keep Russian oil on the market. But Russia has had to accept heavy discounts. 7/

Sanctions succeeded in maintaining oil market stability while reducing Russian export earnings. Global oil prices have returned to pre-full-scale invasion levels. Russia’s inability to find alternative buyers for its gas decreased gas production. 8/

High prices and redirection to alternative buyers supported Russian exports. But total exports have weakened since 2022Q4 as energy prices moderated and additional sanctions took effect. In imports, Russia has not been able to replace EU and US trade. 9/

KSE Institute expects significant declines in oil and gas export volumes (-12.9%, -27.9%) as well as prices (-32.6%, -49.4%) in 2023. 10/

KSE Institute projects that lower export volumes and prices will cut oil and gas earnings in half this year (41% for oil, 64% for gas). The current account surplus will narrow to $63 billion. This is a problem because Russian budget assumes $123 billion surplus. 11/

Sanctions are working. Slowly but surely. Let's add more. You can read the entire KSE Institute sanction chartbook and suggestions for further sanctions here kse.ua/wp-content/upl…

Thank you @KSE_Institute

@Nataliia_Shapo

@ben_hilgenstock @elinaribakova @JPavytska

12/12

Thank you @KSE_Institute

@Nataliia_Shapo

@ben_hilgenstock @elinaribakova @JPavytska

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh