WHAT'S BAKED IN?

A common mistake that I made early in my career as a fundamental equity analyst was "first order thinking" - reflexively seeing something good as good and something bad as bad.

After being repeatedly pushed by my PM with the question, "that's great, but is it

A common mistake that I made early in my career as a fundamental equity analyst was "first order thinking" - reflexively seeing something good as good and something bad as bad.

After being repeatedly pushed by my PM with the question, "that's great, but is it

already baked into the cake?", I came to understand the importance of assessing market embedded expectations.

When I was first asked this "cake" question, I honestly looked back at my PM dumbfounded, not knowing how to answer.

Today, I view the ability to assess market embedded

When I was first asked this "cake" question, I honestly looked back at my PM dumbfounded, not knowing how to answer.

Today, I view the ability to assess market embedded

expectations as one of most critical tools in the analyst toolkit, yet one of the least discussed topics in the analyst skillset conversation.

We discuss this topic in great depth in the Fundamental Edge Analyst Academy and I thought it would be helpful to share

We discuss this topic in great depth in the Fundamental Edge Analyst Academy and I thought it would be helpful to share

a framework I like to use called MIC: Market view, Internal view, Convergence.

MIC is a simple framework to remind that analyst that the the market price of a stock reflects collective expectations, and large deviations in the price reflect a revision of those expectations.

MIC is a simple framework to remind that analyst that the the market price of a stock reflects collective expectations, and large deviations in the price reflect a revision of those expectations.

Let me walk you through the process.

1) MARKET VIEW (cake picture included...). I personally like to start with the "what does the market believe here" mindset, as the outcome of that analysis sets the bar that I need to hop over.

1) MARKET VIEW (cake picture included...). I personally like to start with the "what does the market believe here" mindset, as the outcome of that analysis sets the bar that I need to hop over.

If the market believes this company is a 10% grower and so do it, where's the alpha?

There is no expectations gap and thus no alpha load.

How do I recommend going about the "what's baked in the cake" question?

1) I like the "if it's in the press, it's in the price" framework

There is no expectations gap and thus no alpha load.

How do I recommend going about the "what's baked in the cake" question?

1) I like the "if it's in the press, it's in the price" framework

as a default starting point.

It's not 1957 and you aren't Warren Buffett...you can't crack a 10-K, read a data point and generate alpha. The bar to justify a compelling idea is high, and should include some sort of differential view on the key drivers.

It's not 1957 and you aren't Warren Buffett...you can't crack a 10-K, read a data point and generate alpha. The bar to justify a compelling idea is high, and should include some sort of differential view on the key drivers.

My *general* framework is that the key disclosures in the public arena are baked into the price.

Management commentary, guidance, sell-side commentary - this should be baked into the price.

Management commentary, guidance, sell-side commentary - this should be baked into the price.

I remember a merger arb friend joking "by the time Jefferies writes about this spread, the trade is done".

By the time you are reading about a fundamental outcome in the Wall Street Journal, it's likely in the price.

That raises the bar for the fundamental analyst either to

By the time you are reading about a fundamental outcome in the Wall Street Journal, it's likely in the price.

That raises the bar for the fundamental analyst either to

uncover fresh insights about the key drivers of the company (in an ethical way) that are not widely disseminated, or to interpret the information differently and come to a differential conclusion.

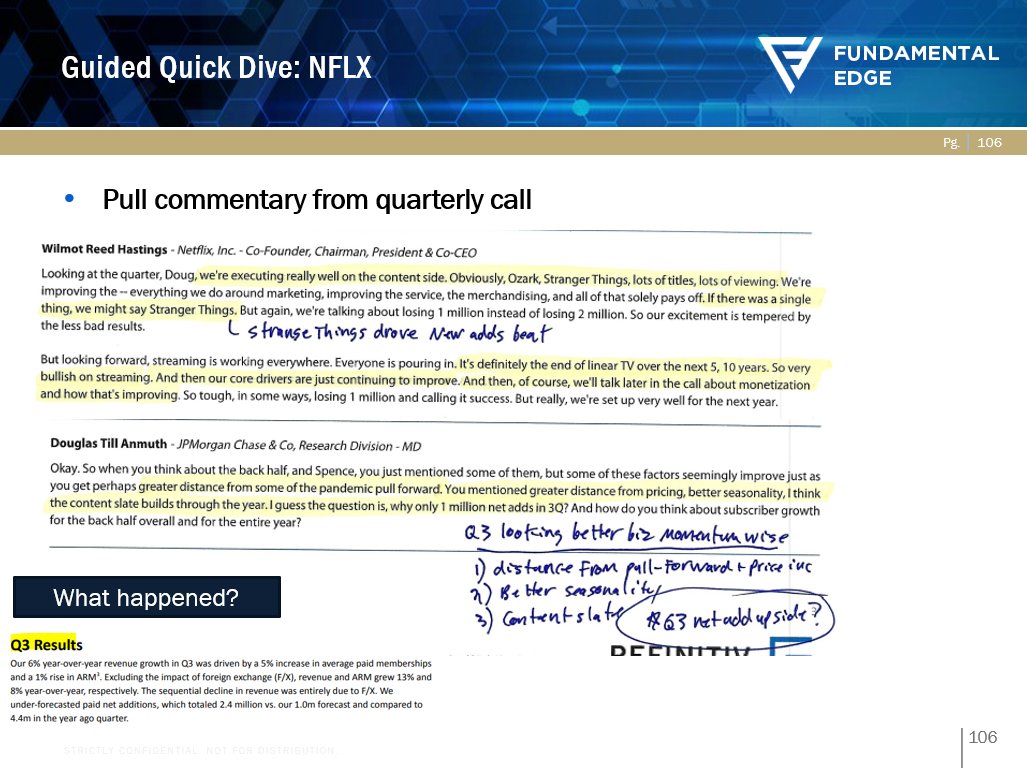

Qualitatively, this "what's baked in" should be an exhaustive narrative analysis of

Qualitatively, this "what's baked in" should be an exhaustive narrative analysis of

management transcripts & sell-side research.

Next, quantitative tools are helpful. Building a reverse DCF sensitized to three key drivers is my favorite approach here combined with a typical analysis of historical absolute, historical S&P relative and historical peer-relative

Next, quantitative tools are helpful. Building a reverse DCF sensitized to three key drivers is my favorite approach here combined with a typical analysis of historical absolute, historical S&P relative and historical peer-relative

multiples. Is a stock at a peak multiple relative to history & relative to peers? Well, that tells you a lot about the embedded expectations.

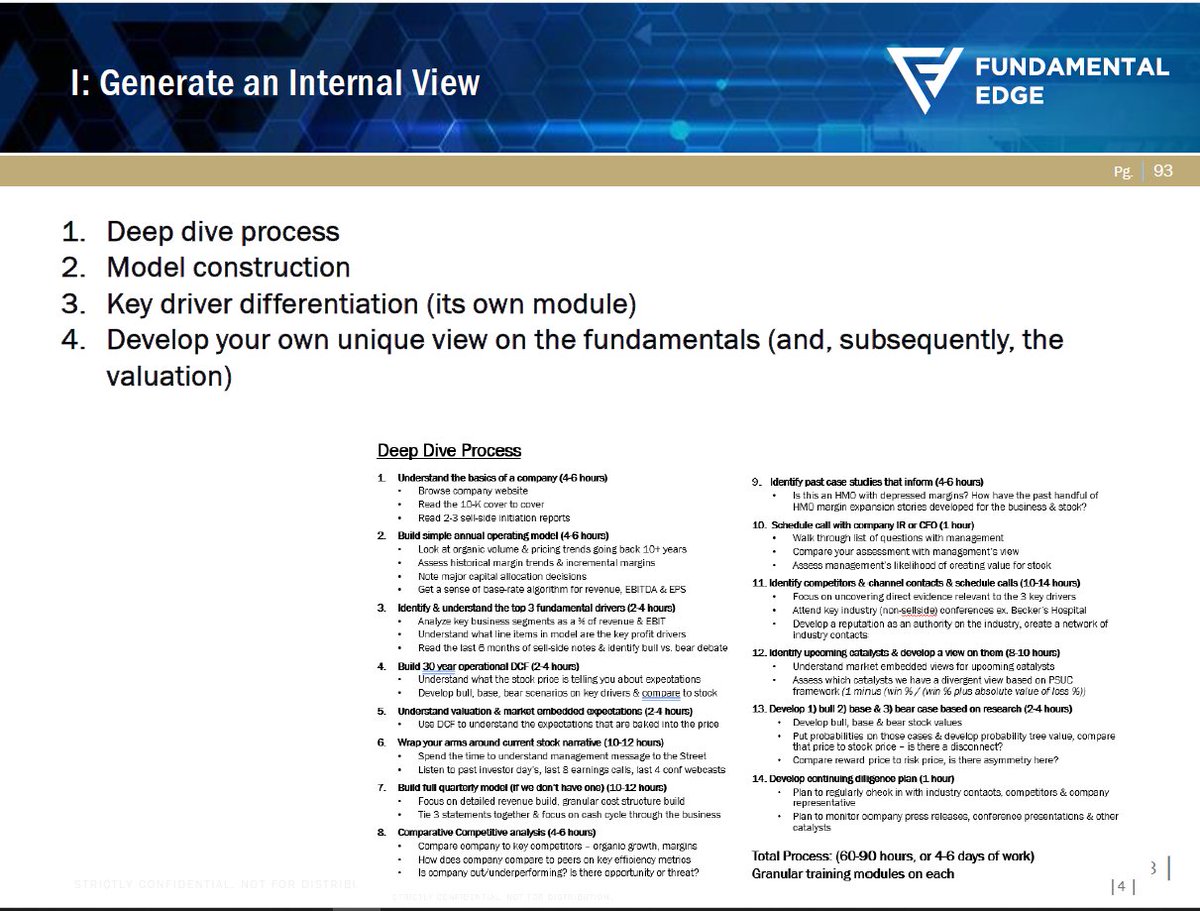

2) INTERNAL VIEW. Once you have approximately assessed the market view (there is a lot of finger in the air in this process), then

2) INTERNAL VIEW. Once you have approximately assessed the market view (there is a lot of finger in the air in this process), then

the process becomes developing your own internal view. On the institutional level, this is done via an exhaustive deep dive focused on the three key drivers of the business. The analyst is looking for a "variant perception" or expectations gap - a conclusion that differs from

the market implied expectation.

3) CONVERGENCE. The MIC process, and stock picking in general, can be quite hubristic. In picking a stock with an eye towards alpha generation you are saying "the market is wrong and I am right".

3) CONVERGENCE. The MIC process, and stock picking in general, can be quite hubristic. In picking a stock with an eye towards alpha generation you are saying "the market is wrong and I am right".

A PM I used to work with always said "valuation is a point of view" and I've come to see the wisdom in that statement.

Valuation is not a fixed concept, but a point of view on future fundamentals (decades, not years).

As the market "changes its mind" on the fundamental outlook

Valuation is not a fixed concept, but a point of view on future fundamentals (decades, not years).

As the market "changes its mind" on the fundamental outlook

and *hopefully* comes around to your outlook, the Market view Converges to your Internal view and that price movement is the source of your alpha generation.

The best traders/investors have a repeatable process to correctly anticipating that convergence.

HOPE THAT IS HELPFUL!

The best traders/investors have a repeatable process to correctly anticipating that convergence.

HOPE THAT IS HELPFUL!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter