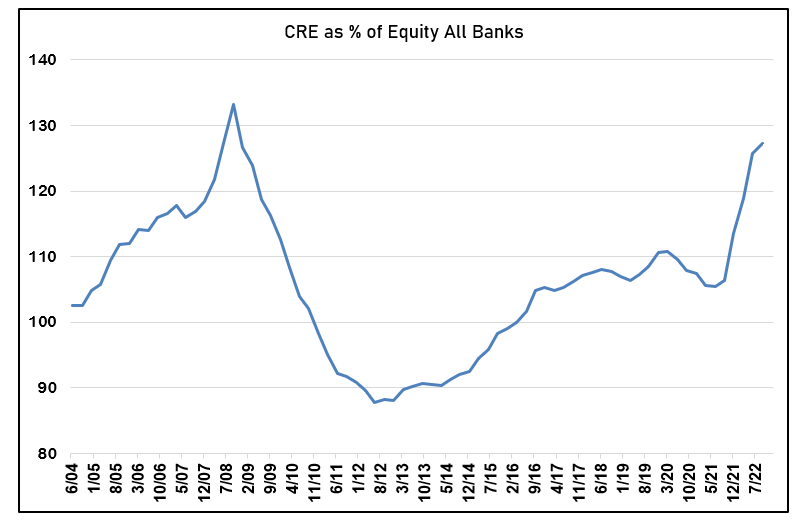

Banks & CRE. Classically the largest source of bank failures. Now there is a lot of concern about how this plays out this time. Let's look at some cursory considerations. CRE as % of assets. Low for big banks, not so much for small ones.

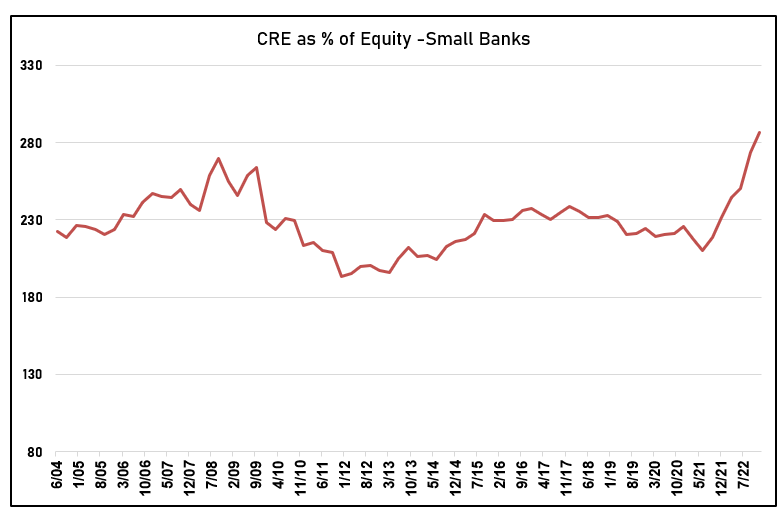

Small banks live off CRE cause they struggle with efficiency, economy of scale, & alternative product lines. Generally your small banks have a slightly better ROA and loan yield also from taking the added risk

But it is really somewhat irrelevant what the percentage of assets is. In fact that chart way understates the CRE importance cause loan assets have been drowned out by cash and securities growing on the balance sheet as a result of fiscal stimulus and deposit growth

You will not that % of equity is the highs or new highs in small banks. Which, if you work in this biz, is no surprise at all. There was a deficit of multifamily supply following GFC, and the boom was primed by low vacancy. As you well know the entire biz is very rate sensitive

Here is the thing to keep in mind those percentages of equity are aggregate averages from Fred and FDIC stats. Presumably those are close to median, which means you have a whole lot of riskier banks in the mix. What amount of those does it take to cause systemic risk?

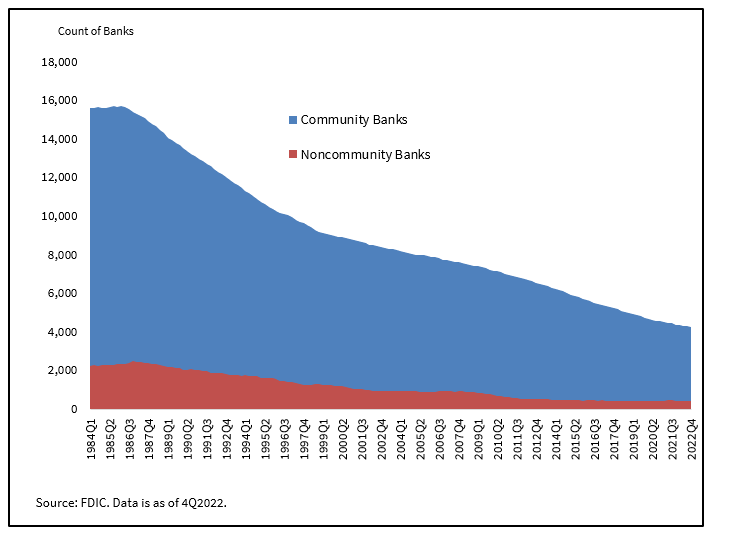

And small banks matter. Partly cause there is so darn many of them. Even if they held a relatively smaller size of deposits and assets, that's a lot of potential disruption and market fear lying in wait.

But... Things are not so dire. There is some risk that recent loans, which are speculative (under construction) on expected rents or vacancies. And on those who floated their loans, but by large the legacy or older vintage which makes up the bulk of it is far less risky.

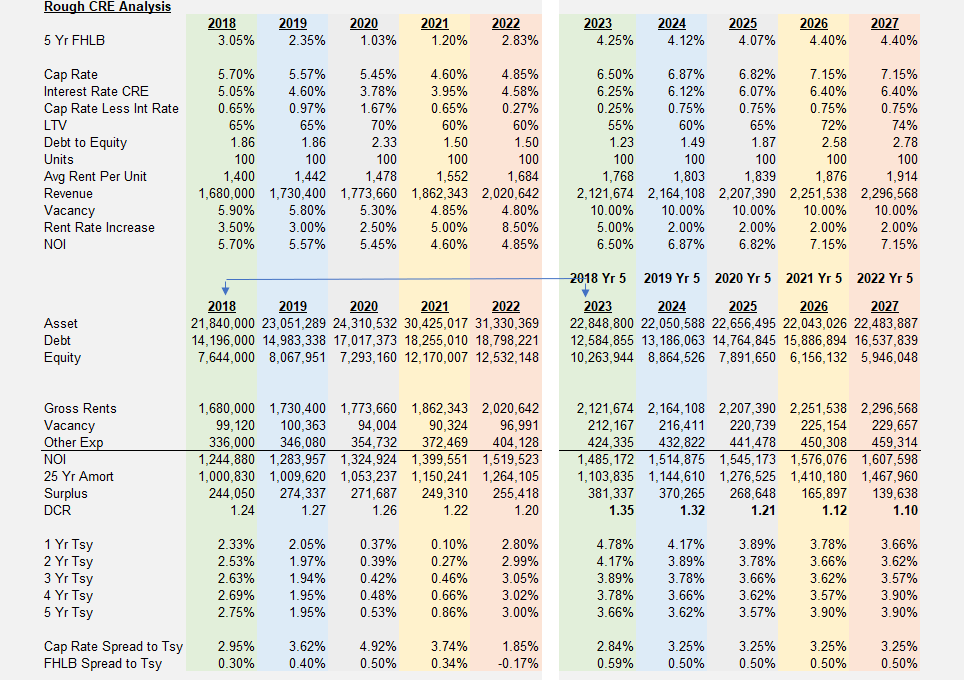

Here's why. Consider a walk forward from 2018. We take then avg rents, cap rates (NOI), LTVs and financing costs, & DCRs (debt coverage ratios i.e. Min cash flow req. Most have 5 to 10 yr rate fixed debt. So the big boom in rents? That increases their coverage & free cash flow!

That's important! If they locked the largest component of their expense structure & yet revenue floats upward w CPI they've greater coverage & equity now than 5 years ago. So the vintage coming due now is roughly from 5 years ago & they look quite good, even if cap rate is higher

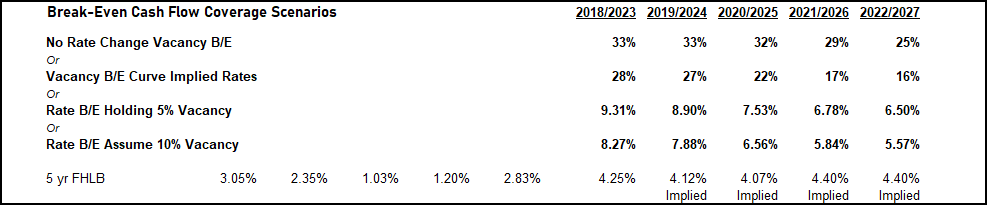

Below is some scenario analysis where we take each years' vintage conditions (assuming 100 unit apt) & then carry it forward to the rate adjust year in 5 yrs. So 2018/2023, 2019/2024 and so on. What we see if that "IF" there was a rate reprice issue it is in 2026-2027

That's largely because even though values may be down (for the 2021 and 2022 vintage), there is little reason to re-appraise and do an equity call unless coverage, debt servicing ability is threatened. Their real risk is not yet.

So the question you have to ask about 2021 and 2022 is whether you believe rates only move higher from here & are higher at 2026-2027, & do you think rents will be flat, fall or vacancy greatly jump?

So let's try some break evens. We can see here that holding a 5% vacancy is very unlikely to generate any issues until maybe 2026, and we have to double vacancy to historical max to get an lt meaningful risk. And still rates have to be 1-2.5% higher in the 5 yr.

But let's keep something in mind. These are the average. If we threatened this is would be catastrophe level. It only takes some segment of the market or banks to have issues to cause great economic turmoil and this analysis can't cover that, we simply don't have the data

And that we could have big problems lies more in the tail of distribution of risk, not the middle as we have shown. So we can't know with any certainty here.

Here is what I think: 1) bank NIM gets hit, hard to keep up with labor & deposit costs on cheap locked loans 2) defaults do go up & greater reserves are reported 3) vacancy increases 4) transaction volume slows cause it takes more equity to do deals (when cap rate & ln rate close

Essentially credit is restricted which leads to Fed rate reduction ultimately. Then we can start over. Not seeing a catastrophe though. But losses and defaults will rise as we move through the vintage at higher rates & higher vacancy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter