The Day After Bankruptcy, La Fin:

On Mar 30th, Bed Bath files $300m ATM offering to be completed Apr 26th or face bankruptcy. The funds would close the ABL w JP Morgan 3 years before maturity. Any acquisition requires JPM approval, except in chapter 11 proceedings. #BBBY

On Mar 30th, Bed Bath files $300m ATM offering to be completed Apr 26th or face bankruptcy. The funds would close the ABL w JP Morgan 3 years before maturity. Any acquisition requires JPM approval, except in chapter 11 proceedings. #BBBY

The $300m ATM offering Mar 30th states,

"Upon filing our annual report Form 10-K, which is due by April 26th, 2023, we will lose S-3 eligibility and therefore we expect all sales made pursuant to the sales agreement will cease by April 26th, 2023...

"Upon filing our annual report Form 10-K, which is due by April 26th, 2023, we will lose S-3 eligibility and therefore we expect all sales made pursuant to the sales agreement will cease by April 26th, 2023...

…If we do not receive the proceeds from the offering of securities covered by this prospectus supplement, we expect that we will likely file for bankruptcy protection."

The company enters into a waiver and amendment to the Credit Agreement w JP Morgan on Mar 30th, telling us, "the total revolving commitment was decreased from $565 million to $300 million,"

indicating this ATM would effectively close the ABL revolving commitments from JP Morgan.

indicating this ATM would effectively close the ABL revolving commitments from JP Morgan.

From the company's S-1 filing,

"We are required to use the net proceeds from sales of our common stock to BRPC II to repay outstanding revolving loans under the ABL facility."

"We are required to use the net proceeds from sales of our common stock to BRPC II to repay outstanding revolving loans under the ABL facility."

"In the event that we fail to obtain all of the anticipated proceeds under the ATM Agreement and therefore fail to meet the requirement of the Amended Credit Agreement, we expect that we will likely file for bankruptcy protection."

Note: "The ABL Facility and FILO Facility mature on August 9, 2026 and August 31, 2027 respectively, unless required to mature earlier pursuant to the terms of the Amendment."

Why is Bed Bath required to close a loan more than 3 years before maturity? Genuine question.

Why is Bed Bath required to close a loan more than 3 years before maturity? Genuine question.

And so we conclude this Bed Bath & Beyond daily series with the same question we first started: What is JP Morgan Chase Doing?

It appears JP Morgan is responsible for the company's active dilution in April and eventual voluntary bankruptcy proceedings.

It appears JP Morgan is responsible for the company's active dilution in April and eventual voluntary bankruptcy proceedings.

https://twitter.com/pirateportfo/status/1643211914640773120?s=20

They certainly didn't require an ATM offering in January when the company ~actually~ defaulted. What exactly changed since then?

Disclaimer: I am an Architect with no experience in corporate transactions or finance. My interpretations may be wildly incorrect. My research is not peer-reviewed. This investment involves significant risk and I hold a position because I have an enormous risk tolerance. 🏴☠️

An easy study of the company's shares available proves quickly proves the ATM offering is unfeasible, as the $$ proceeds will not reach $300m in funds necessary,

311m new shares (739m on 4/24 vs. 428m on 3/27) x $0.40 (avg. stock price) = $125 million proceeds

311m new shares (739m on 4/24 vs. 428m on 3/27) x $0.40 (avg. stock price) = $125 million proceeds

To overcome this, Bed Bath can perform a R/S to increase the stock price and available shares to sell, albeit, at incredible dilution to shareholders.

Notably, Bed Bath first filed for a R/S on Mar 17th, 2 weeks even before the ATM offering, record date for voting was Mar 27th.

Notably, Bed Bath first filed for a R/S on Mar 17th, 2 weeks even before the ATM offering, record date for voting was Mar 27th.

However, the company chooses to schedule a vote for May 9th, weeks after an Apr 26th deadline to complete the $300m ATM offering.

This suggests Bed Bath was unserious about conducting a R/S vote and completing the ATM offering. Predictably, the company then announces Chapter 11.

This suggests Bed Bath was unserious about conducting a R/S vote and completing the ATM offering. Predictably, the company then announces Chapter 11.

Published in Business Credit (June, 2013),

"Very often buyers interested in purchasing distressed companies or assets prefer to do so in the Chapter 11 context, since Chapter 11 transactions can bind dissatisfied creditors who do not expressly consent to the transaction."

"Very often buyers interested in purchasing distressed companies or assets prefer to do so in the Chapter 11 context, since Chapter 11 transactions can bind dissatisfied creditors who do not expressly consent to the transaction."

It's possible JP Morgan did not give permission for a buyout transaction and Chapter 11 proceedings are necessary to circumvent their approval.

The ABL agreement from Aug 2021 has Negative Covenants requiring permissions from JP Morgan.

Source: bedbathandbeyond.gcs-web.com/node/15201/htm…

The ABL agreement from Aug 2021 has Negative Covenants requiring permissions from JP Morgan.

Source: bedbathandbeyond.gcs-web.com/node/15201/htm…

Which brings me to my most likely conclusion.

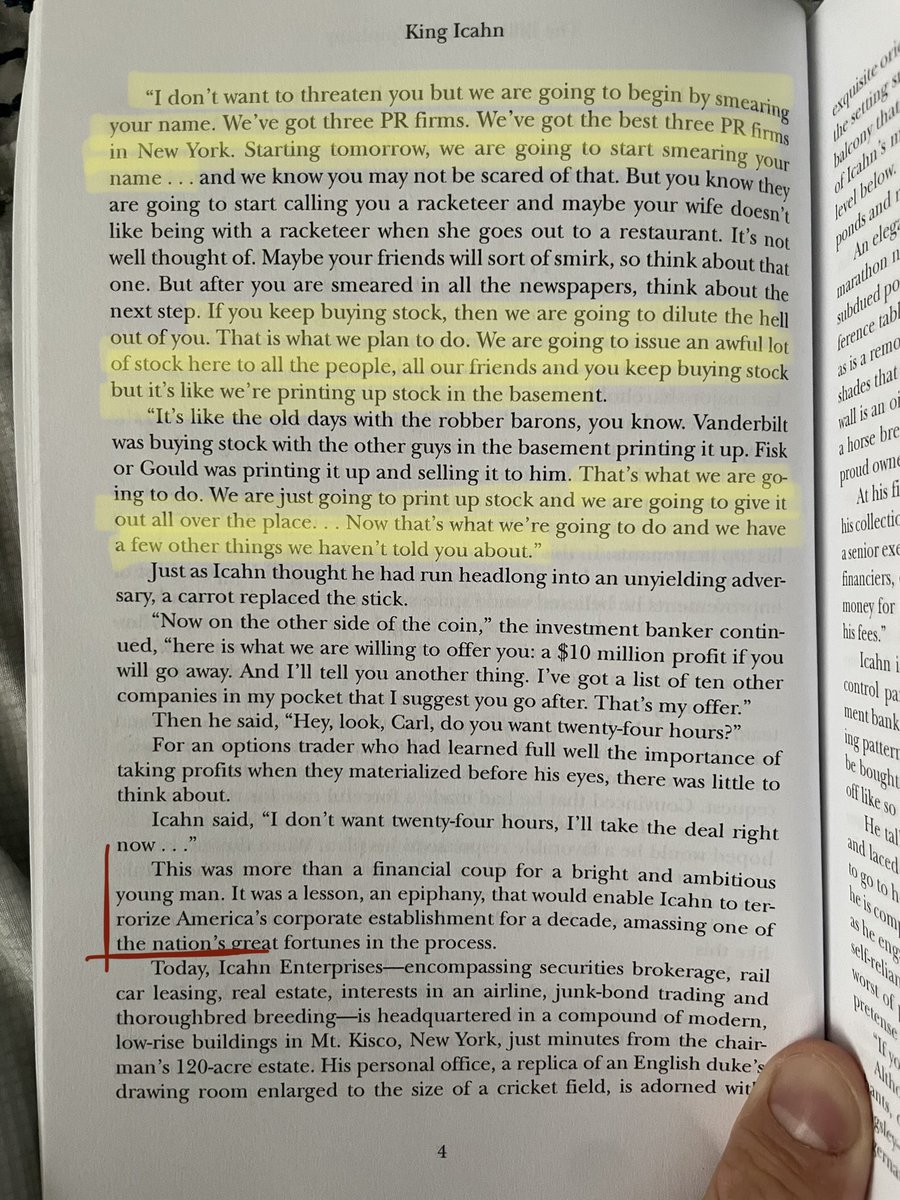

Bed Bath & Beyond entered chapter 11 fully prepared for acquisition. The company now belongs to those who hold its debt, of which I expect @Carl_C_Icahn to soon reveal himself as the significant owner of the company's bonds.

Bed Bath & Beyond entered chapter 11 fully prepared for acquisition. The company now belongs to those who hold its debt, of which I expect @Carl_C_Icahn to soon reveal himself as the significant owner of the company's bonds.

This investment has always been buyout or bust, but the evidence of a buyout has been mounting to date, from the executive hires, debt exchange offering, financial consultants, and securities offerings, all the way to FTC concessions and circumventing JPM approval.

I have certainly enjoyed this crash course in corporate finance and transactions but like the rest of you, I'm ready for this final chapter to unfold. It's time to finish this damn book.

Best of luck this week to all the Corporate Raiders out there. #BBBY

Best of luck this week to all the Corporate Raiders out there. #BBBY

• • •

Missing some Tweet in this thread? You can try to

force a refresh