We're in the early innings of a metals and mining super cycle.

It's important to develop the analysis/valuation tools now to capture tomorrow's opportunities.

Here's a thread on everything you need to know about Valuing Metals and Mining Companies.

Let's get after it ...

It's important to develop the analysis/valuation tools now to capture tomorrow's opportunities.

Here's a thread on everything you need to know about Valuing Metals and Mining Companies.

Let's get after it ...

1/ Motivation For Learning

There are a few reasons to learn about valuing mining companies.

First, not all mines are created equal. And not all valuation tools are created equal.

A DCF or earnings-based model doesn't work for exploration companies.

You need the right tools!

There are a few reasons to learn about valuing mining companies.

First, not all mines are created equal. And not all valuation tools are created equal.

A DCF or earnings-based model doesn't work for exploration companies.

You need the right tools!

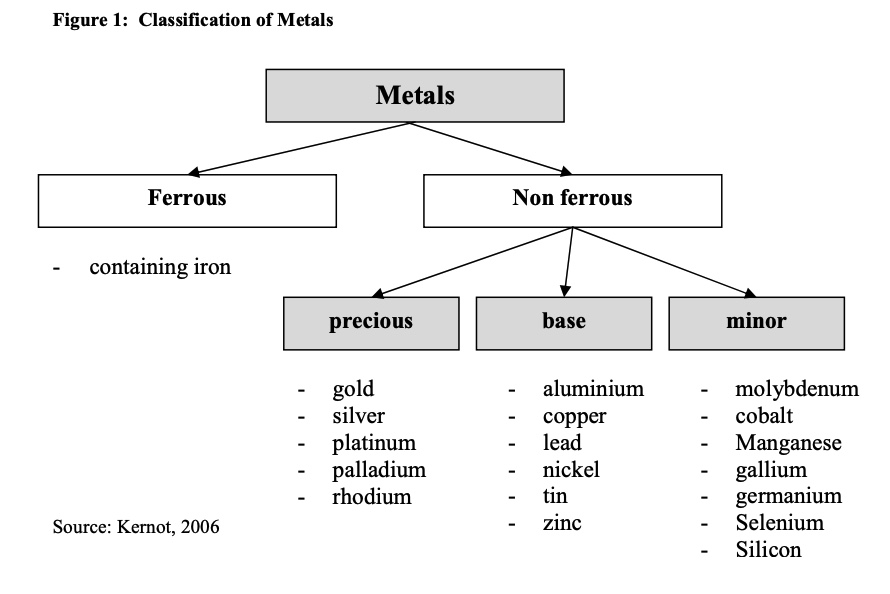

2/ Metal Classification

Before we can value mining projects, we must understand metallurgy.

There are two main metal classes:

• Ferrous: Containing iron

• Non-ferrous: Precious, base, and minor

Industrial metals influenced by supply/demand.

Precious driven by sentiment.

Before we can value mining projects, we must understand metallurgy.

There are two main metal classes:

• Ferrous: Containing iron

• Non-ferrous: Precious, base, and minor

Industrial metals influenced by supply/demand.

Precious driven by sentiment.

3/ Metals-Specific Valuation Factors

M&M stocks are driven by two cycles: Commodity prices & Economic growth

Valuation greatly depends on where we are in the cycle. You get premium multiples during booms, and bankrupt valuations during bottoms.

There are other factors too ...

M&M stocks are driven by two cycles: Commodity prices & Economic growth

Valuation greatly depends on where we are in the cycle. You get premium multiples during booms, and bankrupt valuations during bottoms.

There are other factors too ...

A) Volatility

Miners also experience far greater price volatility than manufacturers or services.

This means more volatile revenues, profits, and cash flows.

Which means a lower market valuation (investors want predictability!).

Miners also experience far greater price volatility than manufacturers or services.

This means more volatile revenues, profits, and cash flows.

Which means a lower market valuation (investors want predictability!).

B) High Fixed Cost

Mining companies need large upfront investments in exploration, equipment, and infrastructure to develop a producing asset.

They must pay these costs regardless of where we are in the cycle because it's expensive to shutdown/reopen.

EBIT can swing wildly.

Mining companies need large upfront investments in exploration, equipment, and infrastructure to develop a producing asset.

They must pay these costs regardless of where we are in the cycle because it's expensive to shutdown/reopen.

EBIT can swing wildly.

C) Long Lead Times

A new mine takes 10-20 years from discovery to production.

This opens mining companies to time-sensitive risks in the underlying commodity.

What happens when you greenlight a mine at $4/lb copper and coper falls to $3/lb by the time its online?

Very tough!

A new mine takes 10-20 years from discovery to production.

This opens mining companies to time-sensitive risks in the underlying commodity.

What happens when you greenlight a mine at $4/lb copper and coper falls to $3/lb by the time its online?

Very tough!

D) Scarcity

We only have so much copper, gold, silver, and graphite to mine on this planet.

That means mining is a finite business with a real end-of-life date.

Companies can delay this by increasing reserve replacement, buying other producers, or mining for new minerals.

We only have so much copper, gold, silver, and graphite to mine on this planet.

That means mining is a finite business with a real end-of-life date.

Companies can delay this by increasing reserve replacement, buying other producers, or mining for new minerals.

E) Other Risks

• Financing risk: Dilutive equity or high-cost debt?

• Permitting Risk: Feasibility

• Geology Risk: Low grades

• Metallurgy Risk: Recoverable quantity

• Country Risk: Politics, taxes, geographic risks, stability, etc.

Country-specific risk premiums 👇

• Financing risk: Dilutive equity or high-cost debt?

• Permitting Risk: Feasibility

• Geology Risk: Low grades

• Metallurgy Risk: Recoverable quantity

• Country Risk: Politics, taxes, geographic risks, stability, etc.

Country-specific risk premiums 👇

4/ Three Mining Categories

There are three main mining company categories:

• Exploration: Don't know if a deposit exists

• Development: Deposit exists, but hasn't been financed or constructed

• Producing: Miner is extracting and selling ore from deposit

There are three main mining company categories:

• Exploration: Don't know if a deposit exists

• Development: Deposit exists, but hasn't been financed or constructed

• Producing: Miner is extracting and selling ore from deposit

5/ Matching Valuation With Category

There are three main valuation methods for mining companies:

• Income/Cash Flow: Earnings-based or DCF model

• Market: Peer transactions

• Cost: Historical cost for asset

Here's a great graphic on which method to use for each category!

There are three main valuation methods for mining companies:

• Income/Cash Flow: Earnings-based or DCF model

• Market: Peer transactions

• Cost: Historical cost for asset

Here's a great graphic on which method to use for each category!

6/ Inferred, Indicated, and Measured Resources

You'll see mining companies boast about their inferred, indicated, and measured minerals.

Don't let it intimidate you.

Inferred: 10%+ chance its there

Indicated: 50%+ chance its there

Measured: 90%+ chance its there

You'll see mining companies boast about their inferred, indicated, and measured minerals.

Don't let it intimidate you.

Inferred: 10%+ chance its there

Indicated: 50%+ chance its there

Measured: 90%+ chance its there

7/ The Appraised (or Cost) Method

The Appraised (Cost) Approach is best for higher-risk exploration companies as they don't have mineral or cash flow.

Value = Sum of all meaningful past exploration expenses and warranted future costs.

I.e., how much to recreate exploration?

The Appraised (Cost) Approach is best for higher-risk exploration companies as they don't have mineral or cash flow.

Value = Sum of all meaningful past exploration expenses and warranted future costs.

I.e., how much to recreate exploration?

8/ Comparable Transactions (Market) Valuation

Comp valuation is great when there isn't enough information to perform an NPV calculation.

There are many ways to compare various mining projects/companies:

• Geological resource

• Mineral resreve

• EBIT/EBITDA

See below.

Comp valuation is great when there isn't enough information to perform an NPV calculation.

There are many ways to compare various mining projects/companies:

• Geological resource

• Mineral resreve

• EBIT/EBITDA

See below.

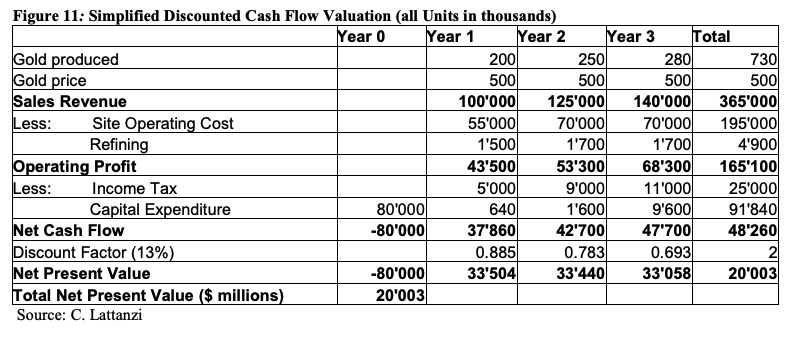

9/ Discounted Cash Flow (DCF) Method

The most important factors in DCF are:

• Discount Rate

• Long-term Commodity Price Assumption

Other factors include:

• Tonnage and grade

• Revenue

• Production costs

Let's break down the DCF into its individual factors ...

The most important factors in DCF are:

• Discount Rate

• Long-term Commodity Price Assumption

Other factors include:

• Tonnage and grade

• Revenue

• Production costs

Let's break down the DCF into its individual factors ...

10/ DCF Factor: Discount Rates

I don't want to spend a bunch of time on discount rates, because it's very simple.

There are three inputs:

• Risk-free rate

• Mining project risk

• Country risk

Combine all three risks to get your discount rate.

See below example.

I don't want to spend a bunch of time on discount rates, because it's very simple.

There are three inputs:

• Risk-free rate

• Mining project risk

• Country risk

Combine all three risks to get your discount rate.

See below example.

11/ DCF Factor: Mineable Reserves

Ore reserve is the fundamental asset which underpins the value of any mining project.

Ore reserve is a function of grades and tonnage.

Lower grades and higher waste tonnage increases costs and reduces revenues, which reduces mine's value.

Ore reserve is the fundamental asset which underpins the value of any mining project.

Ore reserve is a function of grades and tonnage.

Lower grades and higher waste tonnage increases costs and reduces revenues, which reduces mine's value.

12/ DCF Factor: Revenue

Revenue calculation is simple:

Annual tonnage of ore mined and processed * rate of production * metallurgical recovery of salable commodity * price of commodity.

Focus on these three main drivers and ignore the rest for understanding revenues.

Revenue calculation is simple:

Annual tonnage of ore mined and processed * rate of production * metallurgical recovery of salable commodity * price of commodity.

Focus on these three main drivers and ignore the rest for understanding revenues.

13/ DCF Factor: Production Cost

There are three main types of costs in mining operations:

• Operating costs: On-site and off-site

• Capital Expenditures: Development, construction, engineering, inventories, WC, replacement

• Royalties & Taxes: Financing & gov't tax

There are three main types of costs in mining operations:

• Operating costs: On-site and off-site

• Capital Expenditures: Development, construction, engineering, inventories, WC, replacement

• Royalties & Taxes: Financing & gov't tax

14/ Original Resource

Big thanks to Basinvest and Svetlana Baurens for creating this amazing PDF resource.

I highly encourage you to read the entire thing yourself. It will equip you to capture the next great metals & mining investment.

Link here: thaurfin.com/Valuation_of_M…

Big thanks to Basinvest and Svetlana Baurens for creating this amazing PDF resource.

I highly encourage you to read the entire thing yourself. It will equip you to capture the next great metals & mining investment.

Link here: thaurfin.com/Valuation_of_M…

15/ Conclusion

I hope you enjoyed this thread and learned something new!

If you did, please consider liking, RT, and sharing with friends.

Also, check out what we're doing at Macro Ops if you want to learn more about the coming Commodity Super Cycle.

macro-ops.com/subscribe-news…

I hope you enjoyed this thread and learned something new!

If you did, please consider liking, RT, and sharing with friends.

Also, check out what we're doing at Macro Ops if you want to learn more about the coming Commodity Super Cycle.

macro-ops.com/subscribe-news…

• • •

Missing some Tweet in this thread? You can try to

force a refresh