As many responses are already in the comments and we are past 2k votes, here are my thoughts:

Many mistook the question as the question was about the likelihood of being up after 100 trades, not the final amount.

Monte Carlo simulation and binomial distribution.

Many mistook the question as the question was about the likelihood of being up after 100 trades, not the final amount.

Monte Carlo simulation and binomial distribution.

https://twitter.com/TheShortBear/status/1650904665607880721

A Binomial distribution will only work if the bet size stays stagnant or a $ amount, while the question was formulated with a % betting system.

We will calculate both, but for now the Montecarlo system is the better fit

We will calculate both, but for now the Montecarlo system is the better fit

In order to get a high certainty over the max drawdown, likeliest outcome and best outcome we would need to run all possible outcomes and calculate the certainty levels like 95% between X1 and X2

Using a Monte Carlo system, this is what we get via HowToTrade.com

Using a Monte Carlo system, this is what we get via HowToTrade.com

With 100 trades, the confidence intervals are simply not meaningful enough to calculate.

Truth is when it comes to a % bet method, it is hard to calculate the likelihood to be up after the 100 tries with confidence. The spread simply too high.

A thread:

rb.gy/0h2ve

Truth is when it comes to a % bet method, it is hard to calculate the likelihood to be up after the 100 tries with confidence. The spread simply too high.

A thread:

rb.gy/0h2ve

The confidence level is very important as it will dictate the risk level you truly want to take.

This goes from the exposure to black swans(max amount of following losers) as well as the percentage needed to make back deep pullbacks.

This goes from the exposure to black swans(max amount of following losers) as well as the percentage needed to make back deep pullbacks.

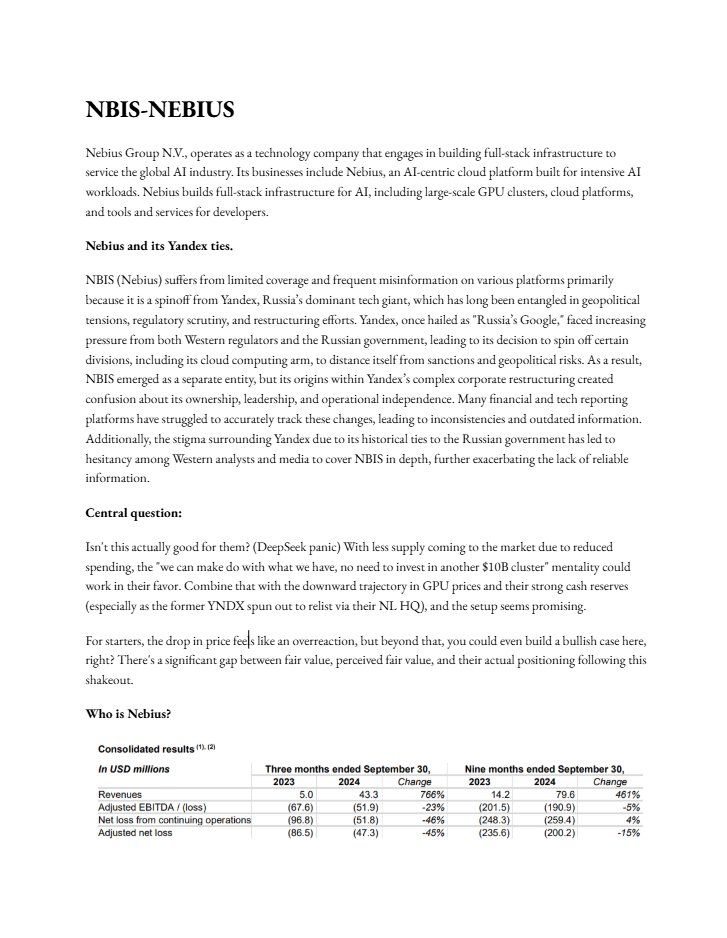

Now to the Binomial distribution:

The binomial distribution can be used in trading strategy calculations to model the probability of a certain number of successful trades out of a fixed number of total trades.

It helps with with the confidence level!

The binomial distribution can be used in trading strategy calculations to model the probability of a certain number of successful trades out of a fixed number of total trades.

It helps with with the confidence level!

The Binomial distribution

How can we calculate it?

n = number of trials (here 100 trades)

k = number of successes (winning trades)

p = probability of success on a single instance

How can we calculate it?

n = number of trials (here 100 trades)

k = number of successes (winning trades)

p = probability of success on a single instance

I personally use a python package to help me calculate it through the package scipy.stats with jupyter notebook.

How do you read a Binomial distribution?

For our example:

x-axis: possible number of successes

y-axis: probability of each possible number of successes.

Each value represents the probability of having that many successes in the given number of trades.

For our example:

x-axis: possible number of successes

y-axis: probability of each possible number of successes.

Each value represents the probability of having that many successes in the given number of trades.

The question was difficult because the % to the account approach is different than a fixed amount and that is where most failed.

Chatgpt and alike failed to understand the shifting nature of the betting size. A binomial dist. only works with the same betting size each time.

Chatgpt and alike failed to understand the shifting nature of the betting size. A binomial dist. only works with the same betting size each time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh